[print-me]

On 5 July 2019, the ATO published a Gazette Notice titled Notice of a Data Matching Program advising that the ATO will acquire overseas movement data from the Department of Home Affairs (DHA) for individuals with an existing Higher Education Loan Program (HELP), Vocational Education and training Student Loan (VSL) and/or Trade Support Loans (TSL) debt. The ATO has published a data matching program protocol which sets out the details of the data matching program.

The new data matching program will be conducted for the 2019–20, 2020–21 and 2021–22 income years. The HELP, VSL and TSL debtor population affected by this data collection is expected to involve approximately three million individuals each financial year. This is an extension of the data matching program, gazetted on 27 September 2017, which is currently being conducted for the 2016–17, 2017–18 and 2018–19 income years.

On 8 July 2019, the ATO issued a media release titled Escape from the country, but not your student loans to alert taxpayers that it will be contacting Australian expatriates to remind them about their outstanding student loan obligations.

![]() Note

Note

HELP was first known as the Higher Education Contribution Scheme (HECS), which was introduced in 1989. The scheme is still commonly referred to as ‘HECS’.

In 2003, there were major reforms to higher education, including significant changes to HECS. These reforms were legislated by the Higher Education Support Act 2003 and came into effect in 2005. Additional loan types were added and the program was renamed the Higher Education Loan Program (HELP). HECS was absorbed into HELP and the scheme is now referred to as HECS–HELP.

Student loans such as HELP, VSL and TSL are income contingent loans because minimum repayments depend on the taxpayer’s income.

The taxpayer is required to make compulsory repayments when their ‘repayment income’ exceeds the minimum repayment threshold for an income year. The repayment thresholds are adjusted annually to reflect changes in average weekly earnings.

Foreign residents are obliged to pay an overseas levy where, broadly, their assessed worldwide income (but not Australian taxable income) exceeds the repayment threshold.

![]() Note

Note

The ATO notes in its media release that, as at 31 January 2019, there were over 3.2 million Australians with outstanding student loan debts, totalling more than $66 billion.

| Income contingent loan | No. of individuals | Amount owed |

| HELP | 2.8 million | $62.9 billion |

| SFSS | 165,409 | $2.1 billion |

| SSL | 161,768 | $406.0 million |

| ABSTUDY SSL | 3,119 | $7.2 million |

| TSL | 88,926 | $631.6 million |

Meaning of ‘repayment income’

A taxpayer’s repayment income is the sum of their:

|

Example — Repayment income |

Christina has a taxable income of $50,420. In her tax return she claims:

Christina’s repayment income is $73,810 ($50,420 + $1,250 + $4,560 + $2,580 + $15,000). Source: ATO fact sheet ‘When you must repay your loan’ (QC 44858) |

Repayment thresholds

From 1 July 2019, the minimum repayment threshold is a repayment income of $45,881 at which the repayment rate is 1 per cent. The compulsory repayment rate increases as repayment income increases. The maximum repayment rate of 10 per cent applies to a repayment income of $134,573 and above.

The repayment thresholds and rates for 2019–20 are set out in the table below.

| Repayment income | Repayment rate | Repayment income | Repayment rate |

| Below $45,881 | Nil | $84,433 – $89,498 | 6.0% |

| $45,881 – $52,973 | 1.0% | $89,499 – $94,868 | 6.5% |

| $52,974 – $56,151 | 2.0% | $94,869 – $100,560 | 7.0% |

| $56,152 – $59,521 | 2.5% | $100,561 – $106,593 | 7.5% |

| $59,522 – $63,092 | 3.0% | $106,594 – $112,989 | 8.0% |

| $63,093 – $66,877 | 3.5% | $112,990 – $119,769 | 8.5% |

| $66,878 – $70,890 | 4.0% | $119,770 – $126,955 | 9.0% |

| $70,891 – $75,144 | 4.5% | $126,956 – $134,572 | 9.5% |

| $75,145 – $79,652 | 5.0% | $134,573 and above | 10% |

| $79,653 – $84,432 | 5.5% |

![]() Website

Website

The repayment thresholds and rates for the 2017–18 to the 2018–19 income years are available on the ATO fact sheet ‘Study and training loan repayment thresholds and rates’ (QC 16176). The repayment thresholds and rates are updated annually.

![]() Note

Note

From 1 July 2019, one set of thresholds and rates apply to all of the income contingent loans. Prior to 1 July 2019, SFSS had its own repayment thresholds and rates.

Repaying the loan

The rules relating to the repayment of HELP debts are set out in Part 4-2 of the Higher Education Support Act 2003 (HESA). Similar provisions exist in other legislation governing the other types of income contingent loans.

Compulsory repayments

Compulsory payments are made through the tax return and are taken into account in working out the taxpayer’s amount of tax payable or refundable.

Hierarchy of compulsory repayment

The hierarchy in which a compulsory repayment is applied is as follows:

![]() Note

Note

The hierarchy changed on 1 July 2019.

![]() Note

Note

Taxpayers working in Australia must advise their employer of their study debt. The employer must withhold and remit additional amounts under the Pay As You Go (PAYG) withholding rules to cover compulsory repayments. For taxpayers within the PAYG instalment system, the ATO takes into account a study debt in working out the PAYG instalment amount and rate.

Voluntary repayments

A taxpayer can make a voluntary repayment at any time. These are in addition to compulsory repayments or the overseas levy. Voluntary repayments are not refundable.

![]() Tip

Tip

If a voluntary repayment is made before 1 June, indexation will be avoided.

Some taxpayers enter into a salary sacrifice arrangement to make voluntary repayments.

Viewing the loan balance

An individual can view their study loan account through their myGov account. The individual can also phone the ATO to request a statement at any time.

Indexation

When the debt is more than 11 months old, the balance is subject to indexation. The indexation is applied on 1 June of each year. The indexation figure is calculated after the March Consumer Price index (CPI) figure is released. For 2019, the indexation rate is 1.8 per cent. The indexation rates for each year is available here.

![]() Note

Note

No interest is charged on study loans.

Death

The unpaid balance of a study loan is cancelled upon the taxpayer’s death. It is the only debt that does not pass to the estate or to another person following death.

When an individual dies, their final tax assessment may include a compulsory repayment. This amount must be paid from the estate. The remainder of the debt is then cancelled. The individual’s legal personal representative and beneficiaries are not liable for the unpaid amount.

ABC News reported on 14 June 2019 that, under a proposal drawn up by federal bureaucrats in 2017, HELP debts ‘would be treated in the same manner as other government debts such as tax debts’ and recovered from deceased estates.

According to ABC News, the policy proposal said:

There are risks associated with the negative reaction from the Australian community to the collection of debt upon death that would otherwise not be payable.

It changes the income-contingent nature of the loan scheme.

Existing debtors took out their loans on the understanding that any unpaid debt would be written off upon death.

Recovering unpaid HELP debts from deceased estates remains a divisive issue in the community, and there is no announced Government position to change the current policy.

Bankruptcy

Study loan accounts are not provable (i.e. where the creditor is entitled to receive a share of the bankrupt’s estate) under s. 82(3AB) of the Bankruptcy Act 1986. Accordingly, an individual who has been declared bankrupt remains liable for the study debts.

Deferring repayments

A taxpayer may apply to:

This may be appropriate where:

Repayment by overseas debtors

Individuals who study in Australia, incur a study loan and then move overseas to work, and may not have sufficient repayment income to make compulsory repayments (even though they are earning income overseas). This is because the foreign income of a foreign resident is generally not included in taxable income in Australia.

The Education Legislation Amendment (Overseas Debt Recovery) Act 2015 — which received Royal Assent as Act No. 154 of 2015 (the Act) — created an overseas payment obligation to recover HELP and TSL debts from Australians living overseas. The Act amended the HESA. The rules only apply to foreign residents (s. 154-16(a)).

![]() Note

Note

The legislative references in this article are to the HESA unless otherwise specified. The HESA applies to HELP debts. The Act made equivalent amendments to the Trade Support Loans Act 2014 in respect of an overseas payment obligation for TSL debts.

(Note: The VSL scheme — which is also subject to the data matching program — commenced on 1 January 2017.)

The new reporting rules

From 1 January 2016, taxpayers with HELP and TSL debts who move overseas for six months or more must notify the ATO.

From the 2016–17 income year, taxpayers with HELP or TSL debts who are foreign residents will be assessed on their assessed worldwide income — their Australian and foreign sourced income — for the purposes of determining whether they meet the repayment income threshold for compulsory repayments (s. 154-16).

From 1 July 2017, affected overseas taxpayers must use a myGov account to lodge their assessment of assessed worldwide income.

In its media release, the ATO sets out the top five destinations for Australians with income contingent loans:

| Country | Number of Australians |

| 1. United Kingdom | 12,296 |

| 2. United States | 5,569 |

| 3. New Zealand | 2,632 |

| 4. Canada | 2,444 |

| 5. Hong Kong | 2,111 |

Moving overseas — notifying the ATO

If an individual has an intention to reside overseas for 183 days or more in any 12-month period, they must submit an overseas travel notification within seven days of leaving Australia (s. 154-18(1)). The overseas travel notification can be completed through ATO online services via myGov or through a registered tax agent.

The notification requires the following details:

The individual must also continue to update their contact details while overseas, either through ATO online or a registered tax agent. Another notification will need to be lodged if the person returns to Australia or if their residency changes, but not if they only return to Australia for a short period (e.g. for a holiday).

Reporting assessed worldwide income

A taxpayer’s assessed worldwide income is the sum of their repayment income and their foreign resident foreign sourced income (s. 154-17).

Under the law, a foreign resident with a debt must report their assessed worldwide income (s. 154-18(3)).

The ATO only requires the assessed worldwide income to be reported if it exceeds 25 per cent of the minimum repayment threshold.

For the:

The taxpayer can report their assessed worldwide income through ATO online services or through a registered tax agent.

Repayments may be in the form of a compulsory repayment or an overseas levy depending on how the assessed worldwide income is made up.

|

Example — How repayments are calculated |

| In the relevant Australian income year, Emily earns Australian-sourced repayment income as well as foreign resident foreign-sourced income. These two amounts form her total assessed worldwide income.

The total repayment obligation on Emily’s assessed worldwide income is her assessed worldwide income × the applicable repayment rate. As Emily has earned over the minimum repayment rate in Australia, the compulsory repayment component of Emily’s repayment is determined as follows: Repayment income × the applicable repayment rate = compulsory repayment The overseas levy raised on Emily’s assessed worldwide income is calculated as follows: Total repayment obligation − compulsory repayment = Emily’s overseas levy Source: Example from ATO fact sheet ‘Overseas obligations when repaying loans’ (QC 47358) |

Assessed worldwide income assessment methods

A foreign resident may choose one of three income assessment methods to calculate their foreign resident foreign sourced income. These are set out in the Overseas Debtors Repayment Guidelines 2017, registered on 19 July 2018.

Overseas levy

A foreign resident taxpayer is liable to pay an overseas levy that is equal to the difference between:

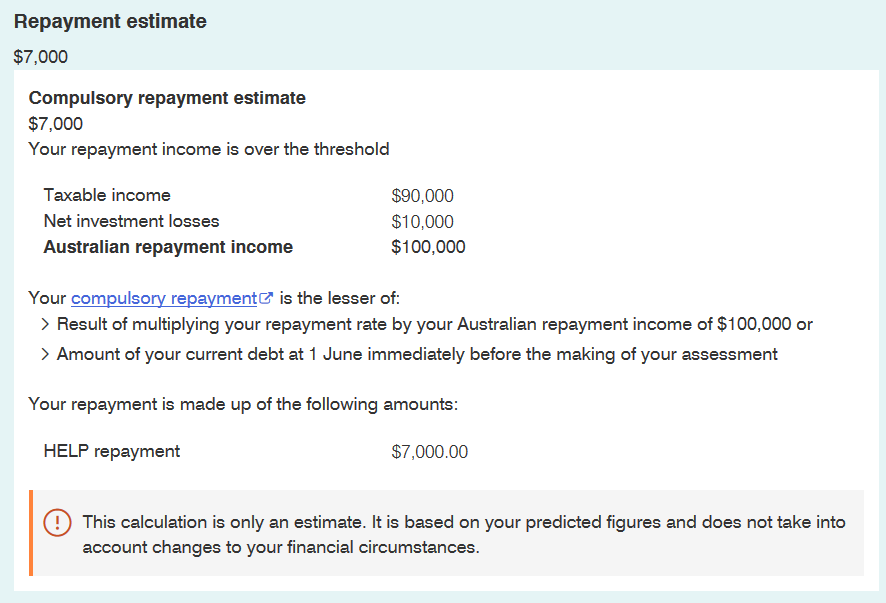

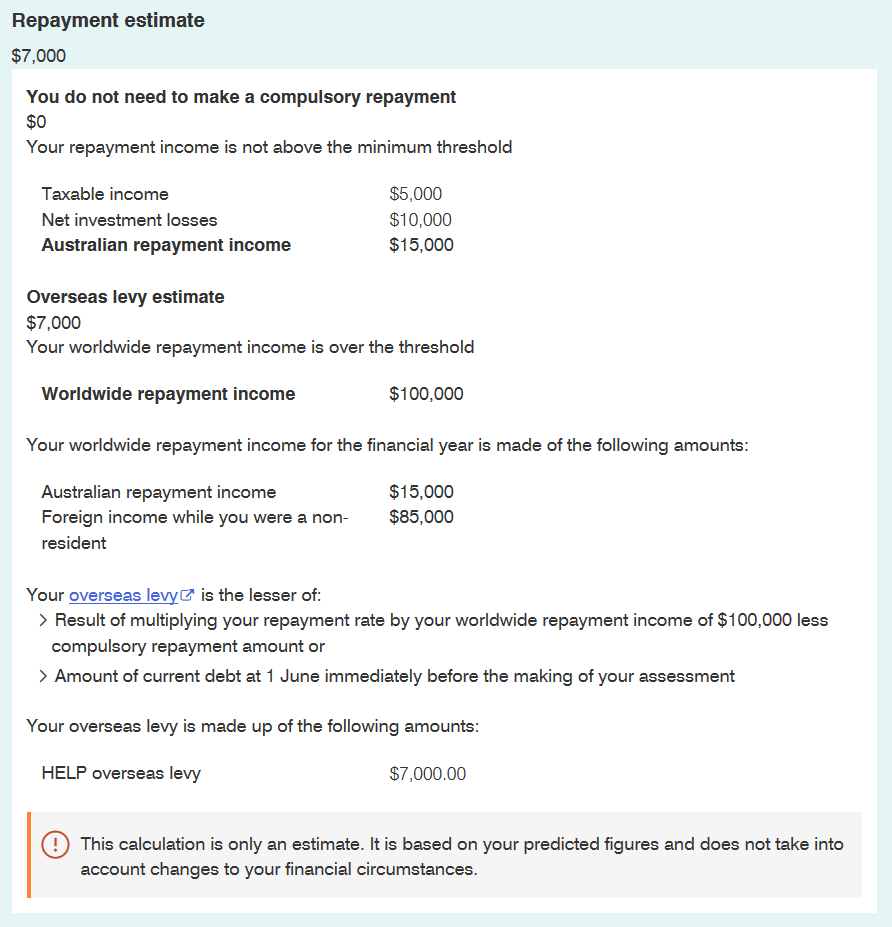

Study and training loan repayment calculator

The ATO has released a Study and training loan repayment calculator to help taxpayers determine the amount of their compulsory repayment or overseas levy.

The calculator can be used for the 2015–16 to the 2019–20 income years. The taxpayer discloses the values for the various elements of repayment income for the relevant income year, and the calculator then works out the estimated minimum repayment.

The following estimate of a compulsory repayment is for the 2018–19 income year for an Australian resident:

The following estimate of the overseas levy is for the 2018–19 income year for a foreign resident. This individual as the same total income as the resident taxpayer above, except that $85,000 is non-assessable foreign income.

The Department of Home Affairs (DHA) will provide overseas movement data for the HELP, VSL and TSL debtor population, including:

The data will be used by the ATO to identify those HELP, VSL or TSL debtors that have left Australia and remain overseas. The ATO will assess their status against ATO records and other data held to identify debtors that may not be meeting their registration, lodgment and/or payment obligations.

The primary use of the data is to support voluntary compliance through successful targeting of communications and provision of self-help information.

In its media release, the ATO indicates that it will be contacting overseas debtors in the coming months.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.