[print-me]

On 9 May 2017, as part of its 2017–18 Federal Budget, the Government announced that it would remove the ability of foreign residents to access the CGT main residence exemption (MRE) in Subdiv 118-B of the ITAA 1997. On 12 December 2019, the Treasury Laws Amendment (Reducing Pressure on Housing Affordability Measures) Act 2019 was enacted.

The measures apply retrospectively to CGT events happening on or after 7.30 pm (AEST) on 9 May 2017. The changes only affect non-resident individual taxpayers (not residents or temporary residents).

A transitional rule will not deny the MRE to a taxpayer who held the dwelling immediately before that time if:

The transitional rule was designed to allow affected taxpayers until 30 June 2020 to sell their former Australian homes without losing access to the full or partial MRE that they would have been entitled to under the former law.

Nevertheless, there may be foreign resident clients who decide to delay the sale of their property until after 30 June 2020, despite the MRE potentially no longer being available to them. Reasons for such a decision may include the following:

The following case study sets out some key matters to consider, regardless of whether the taxpayer sells their property by 30 June 2020 or after that date.

Sarah is a lawyer. She commenced her career in Melbourne and purchased a townhouse for $620,000 on 1 July 2017 (contract date). Sarah moved into the townhouse in October 2017, shortly after settlement.

In January 2019, Sarah became engaged to a Canadian citizen, Tom, who had been working in Melbourne for several years on secondment from his Canadian employer. Tom was scheduled to return to his employer’s Vancouver office in August 2019. Sarah decided to move to Vancouver with him on a permanent basis.

Sarah secured a permanent role with a law firm in Vancouver commencing in August 2019.

During June and July 2019, Sarah sold or otherwise disposed of her belongings, closed her Australian bank accounts and cancelled local memberships. She accepted a tenant in her townhouse on a 12 month lease commencing on 1 August 2019. At that time, the market value of the townhouse was $760,000. Sarah and Tom flew to Vancouver on 1 August 2019.

Sarah received advice from a registered tax agent that she became a non-resident for Australian tax purposes on 1 August 2019.

Sarah and Tom married in Vancouver in December 2019. They had been living in an inner-city rental apartment since their arrival. They have decided to purchase a suburban family home in Vancouver. To assist in financing this purchase, Sarah disposed of her townhouse for $800,000 on 1 May 2020 (contract date).

What are the relevant tax issues for Sarah to consider for the 2019–20 income year in relation to the disposal?

The first issue that needs to be considered is whether Sarah is a resident or non-resident for Australian tax purposes at the time of the CGT event arising from the sale of the townhouse — i.e. 1 May 2020. In this case, Sarah has been a non-resident since 1 August 2019.

At settlement, 12.5 per cent of the proceeds — $100,000 — have been forwarded to the ATO on Sarah’s behalf under the foreign resident CGT withholding regime.

Once Sarah has completed her Australian income tax return for the year ended 30 June 2020, the withheld amount will be available as a credit towards any tax payable.

Although Sarah disposed of her townhouse prior to 30 June 2020, the transitional rule in relation to the removal of the MRE does not apply. This is because she did not own the townhouse immediately before 7.30 pm (AEST) on 9 May 2017.

Therefore, the new rules apply and she cannot apply the MRE to any portion of the capital gain.

Sarah makes a capital gain of $180,000 on the disposal of her townhouse (proceeds $800,000 less cost base $620,000).

The market value as at 1 August 2019 is not relevant in this calculation. The cost base of the property is not reset to the market value at the time it was first used to produce income because the MRE rules do not apply.

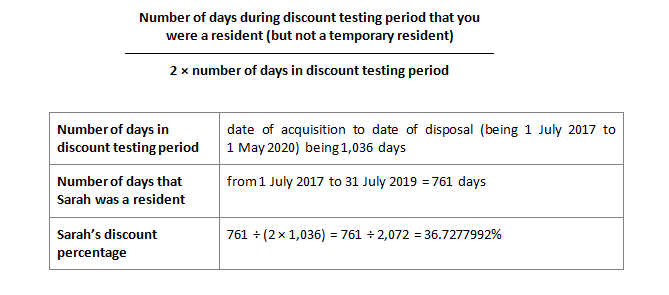

The relevant discount percentage is calculated depending on when the asset was acquired and when the taxpayer became a non-resident. Section 115-115 of the ITAA 1997 provides for three different scenarios where the taxpayer was a foreign resident at the time of the disposal. The formula applicable to Sarah is:

Sarah’s taxable capital gain is therefore $180,000 reduced by 36.7277992 per cent to $113,890.

Sarah is eligible for the discount for the portion of the capital gain that accrued during her 761 days of Australian residency and not eligible for the discount for the portion of the capital gain that accrued during her 275 days of non-residency.

The capital gain of $180,000 × 761 residency days ÷ 1,036 total days = capital gain of $132,220. If the discount of 50 per cent was applied, the taxable discount gain would be $66,110.

However, the part of the capital gain attributable to the 275 non-residency days is not subject to discounting at all. That is, $180,000 × 275 ÷ 1036 days = $47,780.

Therefore, Sarah’s taxable capital gain is $66,110 + $47,780 = $113,890.

![]() Note

Note

The calculation of a taxable capital gain on disposal of a main residence may take into account the overall proportion of the ownership period during which the property was the taxpayer’s main residence, but it does not generally require the gain to be attributed to a specific period of time, with two key exceptions:

If Sarah had owned the townhouse immediately before 7.30 pm (AEST) on 9 May 2017, and the disposal occurred:

The deemed market value cost base (as at 1 August 2019) rule provided in s. 118-192 would also be available but unnecessary in this situation as she had rented out the property for fewer than six years and did not own another property during that time.

Assuming that she did not become a foreign resident until after she acquired the property, the capital gain (reduced by the partial MRE if applicable) would also be eligible for discounting at a rate of less than 50 per cent. The actual discount percentage under s. 115-115 would depend on the date of acquisition and the date that Sarah became a non-resident. For example, if Sarah had acquired the property in May 2015 whilst a resident and then became a non-resident May 2016, she would be entitled to a partial discount for the capital gain attributable to the period of her residency (one year).

![]() Reference

Reference

The ATO has prepared a CGT discount worksheet to assist in calculating the applicable CGT discount for a foreign resident.

The date that Sarah became a foreign resident is relevant because the CGT discount rules for foreign residents changed with effect from 8 May 2012.

Where Sarah became a foreign resident AND acquired the property before 8 May 2012, Sarah may have been eligible to choose to effectively ‘reset’ the cost base of the townhouse to its market value on 8 May 2012 for the purposes of calculating the discount percentage (but not for calculating the gross capital gain). Under this approach, the CGT discount takes into account the capital gain accrued prior to 8 May 2012.

Where Sarah became a foreign resident before 8 May 2012 but did not acquire the townhouse until after that date, she would not have been entitled to any discount percentage at all (assuming she did not resume Australian tax residency at any time before the disposal).

The interaction between the recent changes to the MRE for foreign residents and the CGT discount rules for foreign residents can be explained in detail for current in-house clients as an alternative special topic. Please contact our admin team at enquiries@taxbanter.com.au to change your monthly special topic.

If you’re not a TaxBanter client and you’re interested in this presentation, feel free to email us and our team can send through further information about how our team can tailor this training to your organisation.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.