[lwptoc]

Before the COVID-19 pandemic significantly changed international travel, Australians moved overseas every year for a wide variety of reasons, such as career, business, study, family and travel. Pre-pandemic, government estimates were that there was around one million Australians living and working overseas at a given time. Australian Bureau of Statistics data show that in 2018–19, approximately 128,800 Australian citizens and permanent residents (and 190,600 temporary visa holders) moved overseas to live.

While not always the case, many of these outbound Australians become non-residents for Australian tax purposes and retain Australian sources of income — such as rental properties, businesses and investments in Australian entities — after they leave Australia.

Every year, these expatriates seek the services of Australian tax accountants, lawyers and other advisers to provide advice in relation to their tax residency, their Australian and foreign tax obligations in relation to their income and assets, and to assist with fulfilling their Australian tax compliance obligations such as tax returns and activity statements.

In addition there are also foreign nationals who have never been Australian tax residents who also seek the services of Australian advisers in relation to their Australian investments or business income (whether existing or proposed).

The Australian advisers need to consider whether they are liable for GST in relation to the fees received for these services provided to overseas clients — that is, whether the supply of the service is a taxable supply.

Note:

Note:

An entity makes a taxable supply if it meets all the conditions in s. 9-5 of the GST Act — including that the supply is ‘connected with the indirect tax zone’. The indirect tax zone broadly means Australia, subject to certain exclusions. This article refers to the indirect tax zone as ‘Australia’.

In deciding whether GST is payable on particular tax services provided to overseas clients, firstly the general rules in the GST Act about the export of services need to be considered.

The policy underlying GST is that it is intended to be a tax on consumption in Australia; and therefore, goods and services which are not consumed in Australia should not be subject to GST.

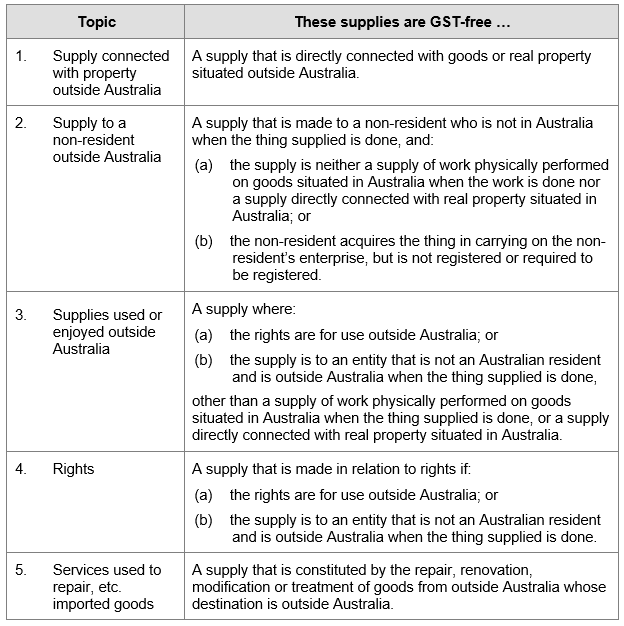

One of the requirements of a taxable supply in s. 9-5 is that it cannot be a GST-free supply. Section 38-190(1) of the GST Act sets out a table of items of various circumstances in which the export of services and intangibles is GST-free:

There are exceptions to the GST-free treatment:

Note:

Note:

Input taxed supplies relating to real property are supplies of residential rent (Subdiv 40-B), and sale of residential premises and supplies of residential premises by way of long-term lease (Subdiv 40-C).

In determining whether a supply of tax services is subject to GST, the facts and issues that an adviser will need to consider include whether:

A number of substantial ATO rulings set out the Commissioner’s interpretation of the GST law which are relevant to the question at hand — i.e. whether the particular supply of tax services is a GST-free supply. If the answer is no, then the supply is a taxable supply as long as the other requirements of s. 9-5 are satisfied.

The Commissioner’s views include the following:

There is no apportionment available under s. 38-190(2A) — relating to a supply covered by any of items 2 to 4 if the acquisition relates (whether directly or indirectly, or wholly or partly) to the making of a wholly or partly input taxed supply of real property situated in Australia. Even if the acquisition of tax services partly relates to the making of supplies that are input taxed supplies of real property, the supply will not be GST-free. For example, if where tax return preparation services relate to income returned from other sources such as employment, or advice includes other matters such as share investments. The supply by the Australian accountant to the non-resident will be wholly taxable if the requirements of s. 9-5 are met.

![]() Implications

Implications

In practice an Australian accountant may make:

The GST status of the supply/ies may differ depending on the subjects of the services, and the Australian adviser should consider the GST implications in the course of entering into an engagement agreement with a client located outside Australia.

Lucy, a UK resident, engaged Paul, a lawyer in Australia, to advise about potential income tax and land tax liabilities arising from her ownership of a commercial rental property in Australia. Lucy is in the UK when Paul prepares the advice.

The supply is GST-free under item 2. The supply of advice is not directly connected with real property situated in Australia. Instead, it is directly connected with the application of Australian tax laws. It is only indirectly connected with real property in Australia.

Source: Based on Example 18 in GSTR 2003/7

Note:

Note:

A supply covered by item 2 is not GST-free if the acquisition of the supply related (whether directly or indirectly, and wholly or partly) to the making of a supply of real property situated in Australia that would be — wholly or partly — input taxed as residential rent (Subdiv 40-B) or residential premises (Subdiv 40-C) — s. 38-190(2A).

John is a non-resident who lives outside Australia. He owns a two-storey rental property in Australia. The ground floor is leased as a shop — i.e. commercial premises — and the top floor is leased as residential premises.

John engages an Australian tax agent to prepare his tax return. John is not in Australia when the services are performed.

John’s acquisition of the tax return preparation services is related to the making of a supply of real property situated in Australia, as the services are performed to return income, deductions or other matters in respect of that property. However, it is only indirectly related to his Australian real property.

Accordingly, the supply of the tax return preparation services satisfies the requirements of item 2.

However, as the acquisition of the services relates to the making of a supply of real property that is partly input taxed under Subdiv 40-B — i.e. the top floor residential premises — s. 38-190(2A) negates the GST-free status of the entire supply. The supply will be taxable if the other taxable supply requirements are met.

John may be entitled to an input tax credit to the extent that the acquisition of the tax return preparation services relates to the leasing of the commercial premises and is a creditable acquisition.

Source: Based on Example 2 in GSTD 2007/3

Jamie, an Australian resident, owns real property in the UK.

Jamie engages Terry, an accountant in Australia, to provide advice on the UK and Australian CGT implications if he sells his UK property.

Jamie is in Australia when Terry prepares the advice.

Terry’s supply of advice is not directly connected with Jamie’s property in the UK. It is instead directly connected with the application of the Australian and UK tax laws. Accordingly, Terry’s supply is not GST free. The supply will be taxable if the other taxable supply requirements in s. 9-5 are met.

Source: Based on Example 17 in GSTR 2003/7

Mary, a non-resident, has shares in an Australian company the only assets of which are residential rental apartments in Australia. Mary acquires advice from an Australian accountant about her share investment and withholding tax. The acquisition of advice by Mary does not relate to the making of supplies of real property but relates to the holding of shares by Mary. If the supply of advice by the accountant to Mary is GST-free under item 2, s. 38-190(2A) does not negate the GST-free status of that supply.

Source: Based on Example 4 in GSTD 2007/3

Note:

Note:

The outcome may differ if the company that owns Australian residential rental properties is a non-resident company, and it is the company — and not the shareholder — that seeks the tax advice. The outcome will depend on whether the advice directly relates to the real property or whether it directly relates to something else — for example, the tax implications for its shareholder.

Broadly, imports are subject to GST and exports are GST-free – but is it really that easy?

Join us on 1 June as we delve into GST imports and exports during a 90 minute webinar. We’ll cover:

Particular attention will be paid to the rules relating to supplying services or intangibles to non-residents. We will address the following common questions:

Click below for more info on our upcoming webinar. We hope you join in live – you can also purchase the recording to view at a time convenient to you.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.