[lwptoc]

An employer is subject to the SG charge if it does not make the minimum required amount of SG contributions on behalf of their eligible employees in respect of a quarter.

From 1 July 2021, the minimum SG contributions payable in relation to an employee is 10 per cent of the employee’s ‘ordinary time earnings base’ for the quarter. The ordinary time earnings (OTE) base for a quarter comprises the employee’s OTE and the amount of OTE which is salary sacrificed into superannuation for the quarter.

The SG contributions are due by the 28th day after the end of each quarter (i.e. 28 January, 28 April, 28 July and 28 October).

To the extent that the employer does not pay the required SG contributions on time, the employer is subject to SG charge for the quarter, which is the sum of:

An individual SG shortfall for an employee for a quarter is their ‘salary and wages base’ × 10%. An employee’s ‘salary and wages base’ for a quarter comprises their salary and wages and the amount of salary and wages which is salary sacrificed into superannuation for the quarter.

The employer is required to pay the SG charge and lodge an SG charge statement by the due date for each quarter, which is the 28th day of the second month after the end of the quarter (i.e. 28 February, 28 May, 28 August and 28 November).

In certain circumstances, the employer may choose to treat a late payment of SG contributions as follows:

If the SG charge remains unpaid after its due date, general interest charge is payable on the shortfall amount.

In addition to SG charge, the ‘Part 7 penalty’ may also be payable where the employer fails to lodge an SG charge statement or to provide information upon a request (e.g. during an audit). The penalty is imposed under Part 7 of the Superannuation Guarantee (Assessment) Act 1992 (the SGA Act).

The maximum penalty is an additional SG charge equal to 200 per cent of the SG charge amount (with a minimum of $20). For example, if an employer’s SG charge for a quarter is $10,000, the Part 7 penalty may be as high as $20,000 — for a maximum payable of $30,000.

The Commissioner has the discretion to remit the penalty in part or in full.

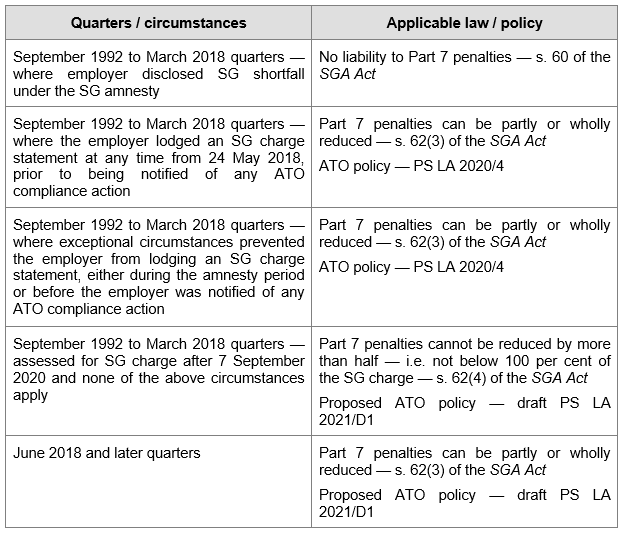

The laws and ATO policies relating to the remission of the penalty differs depending on the quarter involved and whether the employer had voluntarily disclosed SG shortfall in a relevant historical quarter under the SG amnesty.

The following table sets out the legislation and ATO policy which apply to particular SG quarters and employer’s circumstances.

Practice Statement Law Administration PS LA 2020/4 (the Practice Statement) sets out the Commissioner’s decision-making principles for the remission of the Part 7 penalty in respect of quarters that were subject to the SG amnesty, i.e. quarters ending on 31 March 2018 and earlier.

For subsequent quarters, PS LA 2021/D1 (the draft Practice Statement — see below) will apply once finalised. Once the draft Practice Statement is finalised, the Practice Statement will be withdrawn.

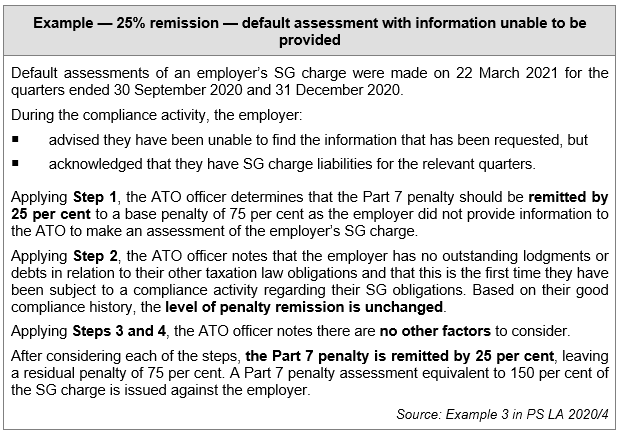

The four-step penalty remission process that applies to quarters ending on 31 March 2018 and earlier is explained in detail in Appendix 1 of the Practice Statement and includes:

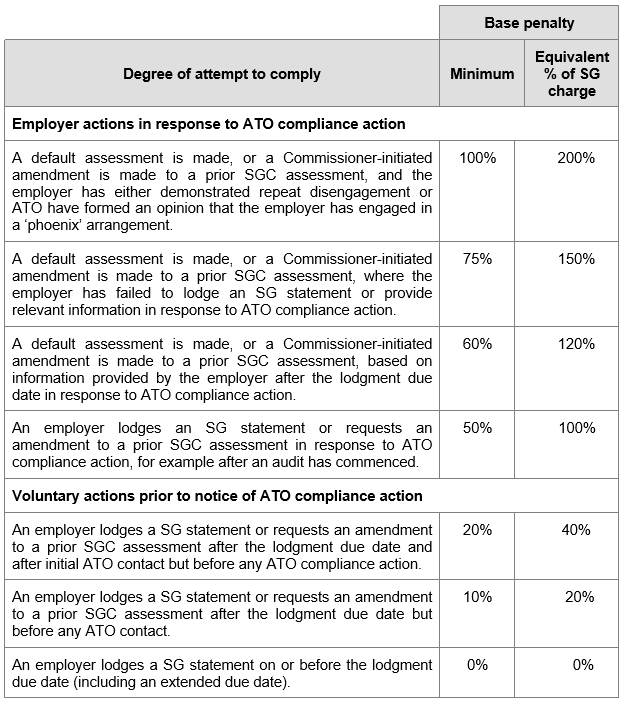

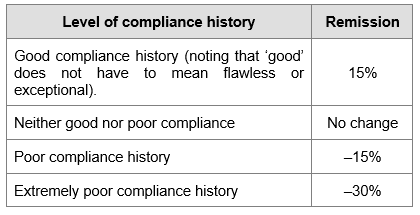

ATO officers are required to assess the employer behaviours that led to an SG Charge assessment as detailed in the table below to determine the base penalty amount.

ATO officers are required to treat an employer’s making initial contact with the ATO to disclose that they have identified SG shortfalls and to advise that they will lodge an SG statement after discussing the relevant matters, in the same way as a lodgment prior to any ATO contact.

ATO officers are instructed to consider the employer’s compliance history for both SG obligations and other taxation laws for the three-year period leading up to the earlier of the day before:

An employer’s SG compliance history is to be given more weight than their compliance history for other taxation laws and ATO officers are required to focus on:

A previous SG assessment resulting from ATO compliance action will reflect a poorer compliance history than an SG assessment that came via a voluntary disclosure.

Where compliance history is good the penalty should remain at the base penalty level in step 1.

ATO officers are required to consider other relevant facts and circumstances of the employer that have not been considered in the first two steps.

Where exceptional circumstances prevented an employer from lodging an SG statement it may be appropriate to remit the penalty below the base penalty level set in Step 1.

While it is not possible to set precise rules for what constitutes exceptional circumstances, the core idea of exceptional circumstances is that there is something unusual to take the case out of the ordinary course. It is a very high threshold.

The exceptional circumstances must have been more than preventing an employer from meeting the due date to make SG contributions. The exceptional circumstances must have prevented the employer from lodging their SG statement.

The penalty relief arrangements that apply for historical quarters is materially the same as the proposed arrangements in the draft Practice Statement — see below.

The draft Practice Statement sets out proposed guidelines to ATO officers about the factors to consider when making a decision on the remission, in whole or part, of the Part 7 penalty where an employer fails to lodge an SG statement by the lodgment due date.

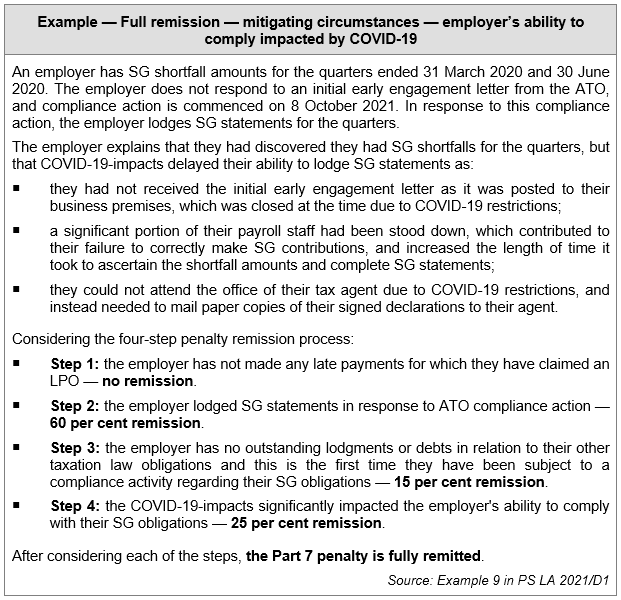

The draft Practice Statement sets out a four-step process — designed to ensure that employers in like circumstances receive like treatment — that ATO officers should follow in making a decision on remission, in whole or part, of the Part 7 penalty.

For SG charge assessments made after 7 September 2020, the law generally limits the ability of the ATO to remit Part 7 penalties for historical quarters, i.e. from 1 July 1992 to 31 March 2018.

Where a historical quarter is assessed for SG charge after 7 September 2020, the Part 7 penalty cannot be reduced by more than half — i.e. not below 100 per cent of the SG charge unless:

Exceptional circumstances need to have prevented the employer from lodging the SG statement continuously from the start of the amnesty period (24 May 2018) until the date of lodgment or notification of ATO compliance action (whichever is earlier).

There are no precise rules for what constitutes exceptional circumstances. The core idea is that there is something unusual to take the case out of the ordinary course. It is not enough for the employer to demonstrate exceptional circumstances that prevented them from meeting the due date to make SG contributions, or to make payment of an SG charge liability after disclosing it. The exceptional circumstances must have prevented the employer from lodging their SG statement.

Some factors which may point towards exceptional circumstances include where an employer’s ability to lodge has been directly impacted by a natural disaster or COVID-19; where an employer relied on incorrect ATO advice that they did not have an SG shortfall; or where an employer was suffering from severe illness or other affliction that rendered them incapable of lodging an SG statement.

Some examples of factors that are unlikely to constitute exceptional circumstances on their own are where an employer is facing financial difficulty, did not understand their obligations, made an error in determining their obligations, or claims that they failed to come forward during the amnesty due to a lack of time between the amnesty being legislated and the end of the amnesty.

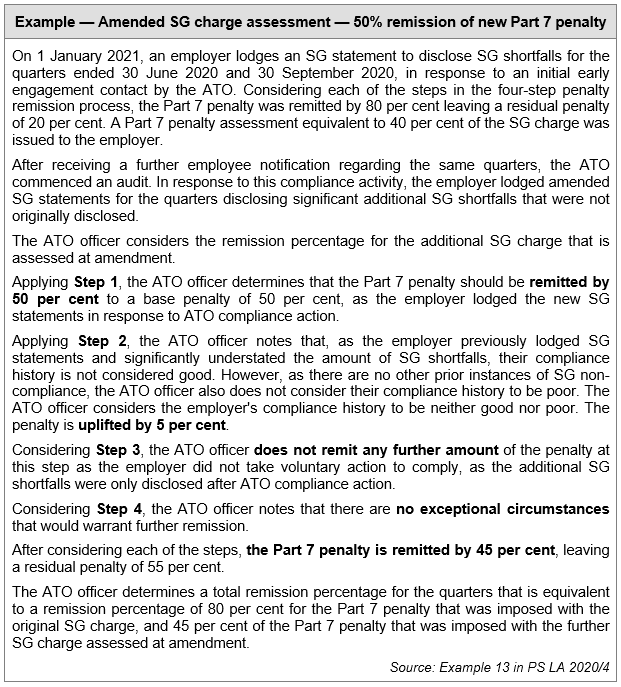

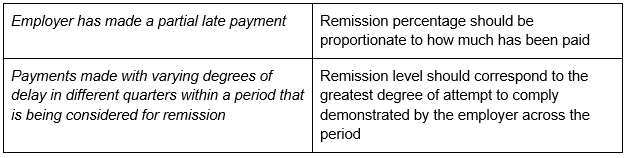

The proposed four-step process is explained in detail in Appendix 1 of the draft Practice Statement and includes the following:

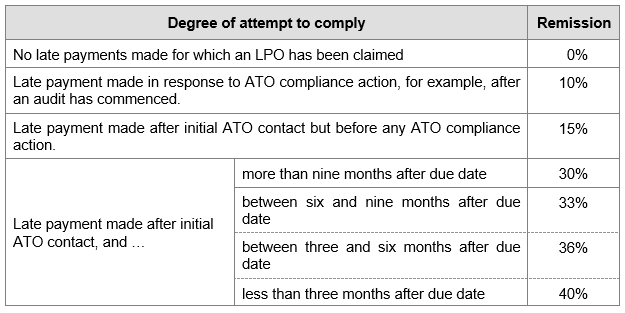

Where an employer has made these late payments, they can claim a LPO when they lodge their SG statement. Although the LPO does not reduce the amount of penalty imposed, some remission is warranted in recognition that the employer has met their employees’ entitlement, albeit late.

This step only considers late payments for which an LPO has been claimed in respect of the relevant quarters.

ATO officers, using the following table, should consider further remission based on the employer’s attempt to comply through lodging a SG statement to self-assess their SG Charge liability.

The draft Practice Statement states that where the employer has lodged an SG statement before any ATO contact, or after initial contact but before any compliance action, they will satisfy this requirement and there will be no restriction on remission.

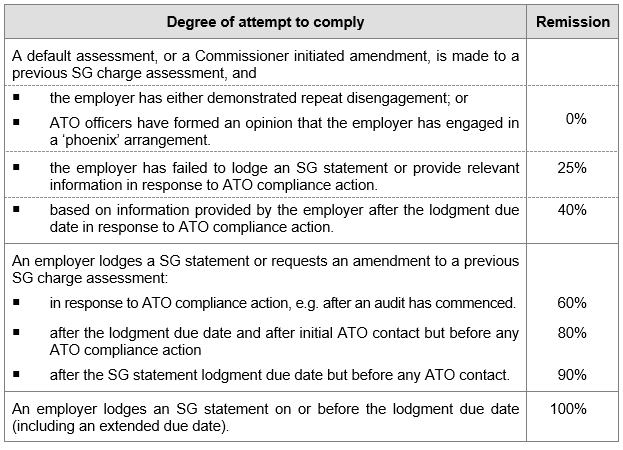

Consider and evaluate the employer’s compliance history for both SG obligations and other taxation laws for the three-year period leading up to the earlier of the day before:

More weight should be given to an employer’s SG compliance history than to their compliance history for other taxation laws and the focus should be on:

A previous SG charge assessment resulting from ATO compliance action will reflect a poorer compliance history than an SG charge assessment that came via a voluntary disclosure.

Depending on an employer’s compliance history, ATO officers may provide additional remission or may reduce the level of remission provided by the other steps in this remission process. Generally, the amount of additional remission or reduced remission should not exceed the amounts in the following table:

All other relevant facts and circumstances should be considered to ensure the resulting Part 7 penalty is appropriate.

Different mitigating facts or circumstances may warrant different levels of further remission, depending on their significance in contributing to the employer’s non-compliance. Where there are multiple mitigating circumstances present, they should each be considered for remission.

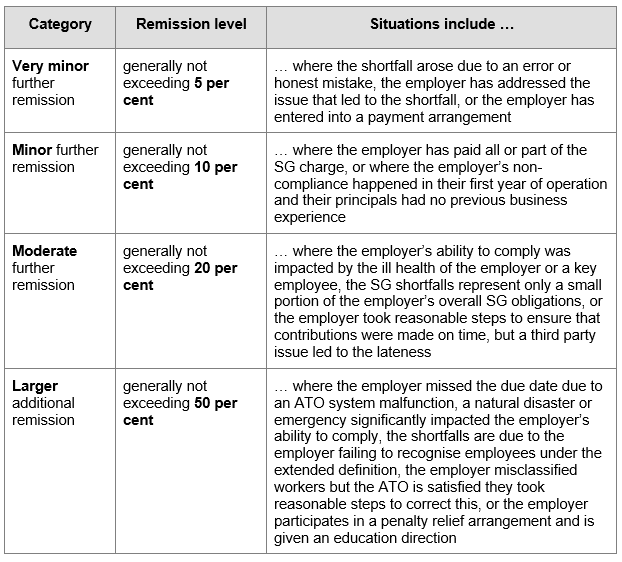

Mitigating facts or circumstances that warrant further remission are in the following categories:

In limited cases, it may be appropriate to provide additional remission to an employer in conjunction with a direction for education — known as a ‘penalty relief’ arrangement. This may be appropriate where education is considered a more effective option to positively influence employer behaviour.

The ‘penalty relief’ arrangement recognises that whilst the ATO expects all employers to meet their SG obligations, an employer may have SG knowledge gaps that led to non-compliance and these can be addressed through education.

Only employers with a turnover of less than $50 million should be considered for a penalty relief arrangement and only if they have not previously been provided with penalty relief and they:

Interested into delving into this a little further? Join our next Special Topic webinar, Superannuation Guarantee post amnesty. Each registrant will receive a copy of the recorded session. You can check out a full list of our 2021 Special Topics here.

We can also present these Special Topics at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.