[lwptoc]

Editor’s note: This blog article was updated on 27 August 2021 to include the ATO’s Tax Help Program – for more details, see below.

Forms and instructions 2021

The ATO has now released its Tax Time 2021 stationery.

Tax Time 2021 publications will be available here as they are released.

The key publications are here:

The ATO has also prepared a suite of Tax Time Toolkits which provide information for various occupations.

Tax Time 2021 timelines

The ATO will start full processing of 2020–21 tax returns on 7 July 2021 and expects to start paying refunds from 16 July 2021.

The ATO aims to finalise most electronically lodged 2021 returns within 12 business days.

The ATO has not yet updated its lodgment program due dates on its website for 2021 tax return obligations. The lodgment due dates for clients’ 2021 tax returns will be available in Online services for agents by the end of July. Generally, agent-lodged returns for 30 June balancers are due by 15 May of the following year (i.e. 15 May 2022), with an agent extension to 5 June, unless the lodgment program requires earlier lodgment. Where the client has one or more prior year tax returns overdue as at 30 June 2021, their 2021 return due date will be 31 October 2021.

Key changes affecting 2021 tax returns

Individuals

Stage 2 of the Personal Income Tax Plan (tax cuts)

- Upper threshold of the 19 per cent tax bracket raised from $37,000 to $45,000.

- Upper threshold of the 32.5 per cent tax bracket was raised from $90,000 to $120,000.

Optional shortcut method for calculating working from home deductions

- 80 cents per hour to cover all working from home expenses.

- Cannot claim any other expenses for working from home.

Low income tax offset

- Maximum low income tax offset increased to $700 from 1 July 2020 (brought forward from 1 July 2022).

CGT discount for affordable housing

- Resident individuals who provide affordable rental housing to people earning low to moderate income, from 1 January 2018 for an aggregated to three years, can claim an additional affordable housing capital gains discount of up to 10 per cent.

Early access to superannuation — not assessable income

- Eligible individuals could withdraw between $1,000 and $10,000 from their superannuation between 1 July 2020 and 31 December 2020.

- Not assessable income.

The ATO’s Tax Help program for individual self-lodgers

The ATO offers a free Tax Help program from July until 31 October 2021 through which volunteers help eligibile individuals to lodge their tax returns online. The program is available to individuals whose income is $60,000 or less, who did not:

- work as a contractor;

- note — new ‘gig economy’ workers who may be reporting that income for the first time may be classified as employees or contractors depending on their circumstances and they may need to seek professional advice in this regard;

- run a business, including as a sole trader;

- have partnership or trust matters;

- sell shares or an investment property;

- own a rental property;

- have a CGT event happen during the year;

- receive royalties;

- receive trust distributions, other than from a managed fund; or

- receive foreign income, that is not a foreign pension or annuity.

Taxpayers whose tax affairs include one or more of these matters that are ineligible for the Tax Help program should consider seeking assistance from a registered tax agent in lodging their return.

The program is currently experiencing a downturn in part attributable to COVID-19 restrictions affecting taxpayers’ ability to attend face to face sessions at Tax Help centres across Australia. Tax Help is also available online or by phone.

Businesses

Cash flow boost credits

- Eligible businesses received between $20,000 and $100,000 in cash flow boost amounts upon lodging their activity statements.

- Non-assessable non-exempt income.

JobKeeper Payments — assessable income

- Eligible employers received a wage subsidy per fortnight per eligible employee (the payment rate changed over time) until the scheme ceased on 28 March 2021.

- Assessable income.

- Overpaid JobKeeper payments which have been repaid are not assessable.

Companies

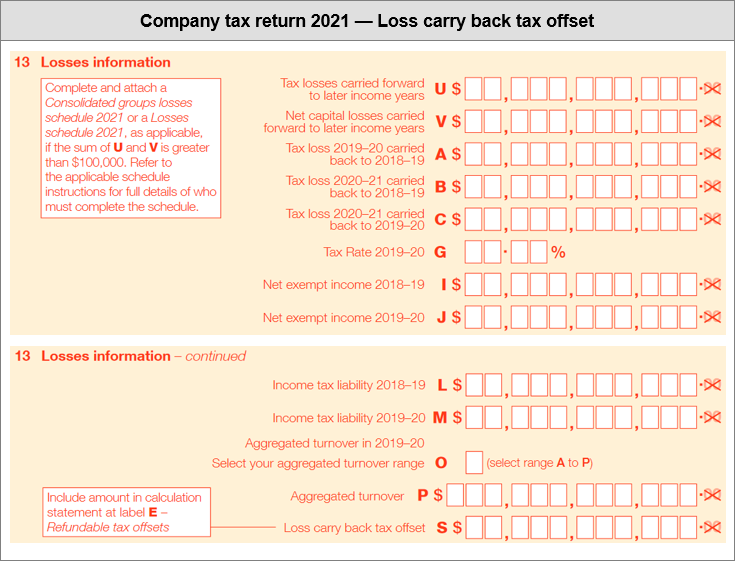

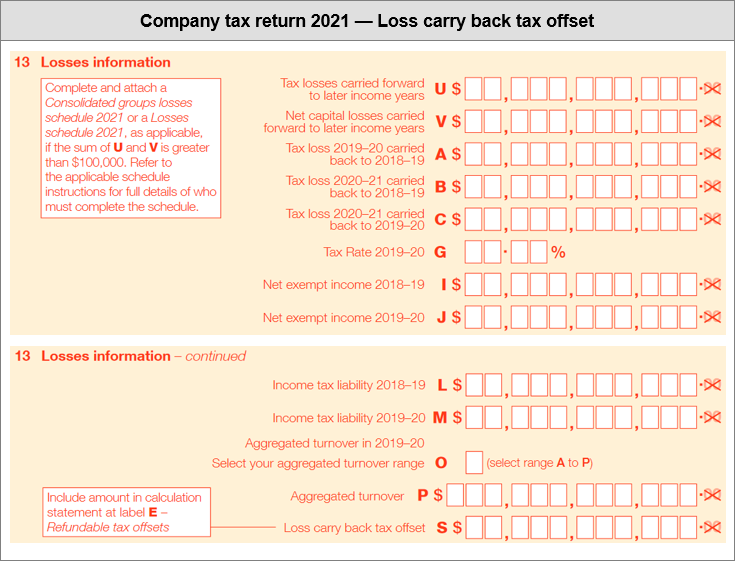

Loss carry back tax offset

- Eligible companies can carry back losses as far back as 2019 for a refundable tax offset.

Corporate tax rate for base rate entities

Small businesses

Uncapped instant asset write-off

- $150,000 threshold up until 7.30 pm AEDT on 6 October 2020; uncapped from that time.

Write-off of closing pool balance

- Entire closing balance of the general small business pool as at 30 June 2021.

Backing business investment

- Can claim 57.5 per cent of the cost of eligible assets in the first year the asset is added to the pool.

Turnover threshold increased from $10 million to $50 million from 1 July 2020 for certain concessions.

- Immediate deduction for professional expenses for start-ups, including professional, legal and accounting advice, and government fees and charges.

- Immediate deduction for prepaid expenses which cover a period of 12 months or less that ends in the next income year.

Capital allowances (other than simplified depreciation)

Temporary full expensing of depreciating assets

- Eligible businesses can deduct the full business portion of the cost of eligible new depreciating assets first held, and first used or installed ready for use for a taxable purpose, between 7.30 pm AEDT on 6 October 2020 to 30 June 2022.

Enhanced instant asset write off

- Eligible businesses other than SBEs can immediately deduct the taxable proportion of the cost of eligible depreciating assets up to a threshold of $150,000.

Backing business investment

- Eligible businesses can claim a deduction of 50 per cent of the cost of an eligible depreciating asset.

New disclosures in tax returns

New items in the Company tax return 2021

Item 8 Financial and other information — 3 new labels

- P — Opening franking account balance

- X — Select your aggregated turnover range

- Y — Aggregated turnover

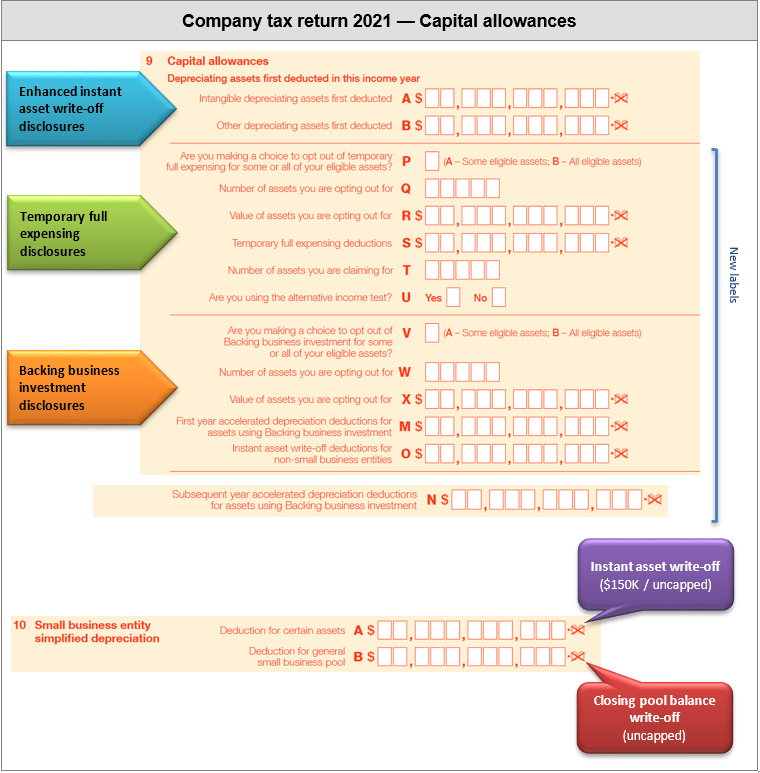

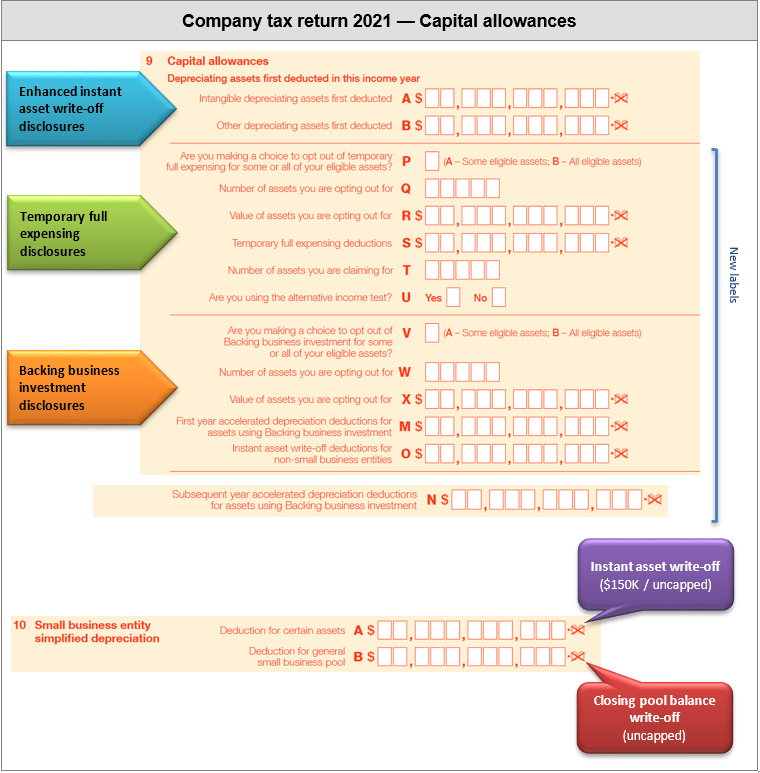

Item 9 Capital allowances — 12 new labels (P to N)

- See the excerpt from the tax return below

Item 13 Losses information — 11 new labels (A to S)

- See the excerpt from the tax return below

New items in the Trust tax return 2021

Item 49 Aggregated turnover

- P — Select your aggregated turnover range

- Q — Aggregated turnover

Item 50 Capital allowances 11 new labels (P to O)

- Similar to the new labels in the Company tax return (see the excerpt below)

New items in the Partnership tax return 2021

Item 48 Aggregated turnover

- U — Select your aggregated turnover range

- V — Aggregated turnover

Item 49 Capital allowances 11 new labels (P to N)

- Similar to the new labels in the Company tax return (see the excerpt below)

Company tax return disclosures for new incentives

For more information about the capital allowances changes which may affect 2021 tax returns and planning for 2022, check out our upcoming presentation, Capital allowances revisited, taking place on 7 July. You can also register for the recording so you can review it at a time convenient to you.

Further info and training

Each month, TaxBanter’s Tax Updates will keep you informed of the latest developments in this space. We present Tax Updates online, in cities across Australia and offer private tailored training sessions to firms of all sizes.

Brush up for the EOFY by training with us! Our next Online Tax Update takes place Tuesday, 6 July. You can register for it here. New clients can take 50% off the session with the code EOFY50.

To learn more about our various training options, click here.