[lwptoc]

The Treasury Laws Amendment (A Tax Plan for the COVID-19 Economic Recovery) Act 2020 inserted Subdiv 40-BB into the Income Tax (Transitional Provisions) Act 1997 (IT(TP) Act) which sets out rules for a temporary full expensing of depreciating assets (TFEDA). The rules achieve this by providing that, for the purposes of Div 40 of the ITAA 1997 (the capital allowances provisions), the decline in value of a depreciating asset is equal to the asset’s cost.

For those entities using the small business depreciation rules in Subdiv 328-D of the ITAA 1997, full expensing is accessed by way of the removal of the instant asset write-off threshold (previously $150,000) in s. 328-180 which effectively compels all newly acquired assets to be fully expensed. Further, entities that have previously used the small business depreciation rules and have a small business pool balance prior to the introduction of the full expensing rules (or entities that begin to use the rules and allocate existing assets to a small business pool), will have those pool balances written off as a consequence of these amendments.

Taxpayers are eligible for TFEDA if they satisfy the s. 328-110 definition of a small business entity (SBE), assuming that the aggregated turnover threshold of $10 million was instead $5 billion (noting there is also an alternative eligibility test for larger corporate tax entities which is not relevant to this article). Critically, while assets subject to Div 40 can only be fully expensed if they are used for the principal purpose of carrying on a business, SBEs using the small business depreciation rules are eligible for full expensing regardless of whether the asset is used principally in carrying on a business (so long as they meet the usual criteria for Subdiv 328-D treatment).

Any deductions will be limited to the extent the taxpayer uses the asset for a taxable purpose. Relevant to this article, a taxable purpose includes a purpose of producing assessable income — such as business, employment or investment income.

The TFEDA rules apply for eligible expenditure on eligible assets where the taxpayer:

after 7.30pm AEST 6 October 2020 and on or before 30 June 2022.

![]() NOT YET LAW

NOT YET LAW

As part of the 2021–22 Federal Budget, the Government announced that it will extend the temporary full expensing measure for 12 months until 30 June 2023. All other elements of the incentive will remain unchanged. At time of writing, the amending legislation has not been introduced into Parliament.

Given the broad nature of these rules, many taxpayers will ask the question ‘Can I really write off the entire cost of my car for tax purposes?’

A car is a depreciating asset and accordingly a deduction for its decline in value can be claimed where the car is used for a taxable purpose, i.e. to produce assessable income.

The deduction for decline in value is determined by reference to an asset’s cost and the cost of a car that is principally designed for carrying passengers is reduced to a limit as notified by the Commissioner each year (see s. 40-230). In the 2021–22 income year this limit is $60,733. Importantly, this limit is applied only to the first element of a car’s cost.

Both the non-taxable purpose proportion and the car limit may reduce the amount that is available for a deduction under both the ordinary rules in Div 40 and the small business depreciation rules of Subdiv 328-D.

The starting point for working out if full expensing is available in respect of the cost of a car is to determine which regime applies:

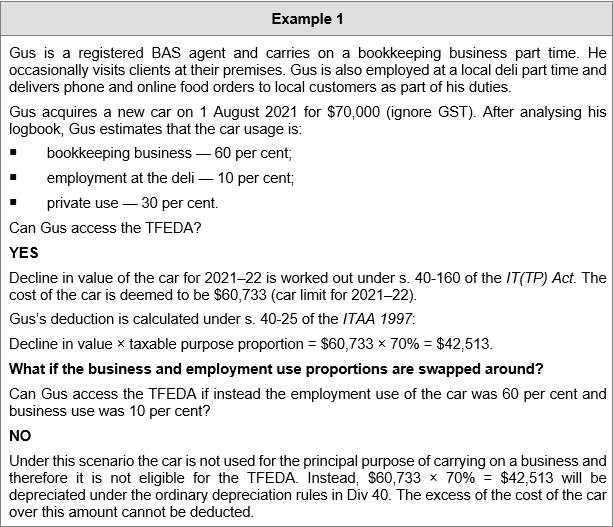

If a taxpayer is using Div 40, then TFEDA will be available if the taxpayer is using the car for the principal purpose of carrying on a business. This means that the taxpayer must use the car in carrying on a business for more than 50 percent of the time. In the case of an individual taxpayer, the car may also be used for the purposes of deriving the taxpayer’s assessable non-business income (employment or investment), but the majority of the use of the car must be in a relevant business.

Whilst to access TFEDA the car must be used principally in a business, the deduction is still based on total taxable use, as s. 40-160 of the IT(TP) Act simply states that the decline in value of the asset is its cost. Section 40-25 of the ITAA 1997 then provides that a deduction is available for an asset’s decline in value after reducing it by the proportion of its use that was not for a taxable purpose.

Additionally, as s 40-160 of the IT(TP) Act provides that the decline in value of the asset is its cost, the rules regarding the car cost limit also apply.

The result is that, provided the car is principally used in carrying on a business, TFEDA will allow a deduction for the car’s cost, limited to the car limit, based on the taxable purpose use of the car.

The choice to use the TFEDA however is optional under Div 40 on an asset by asset basis.

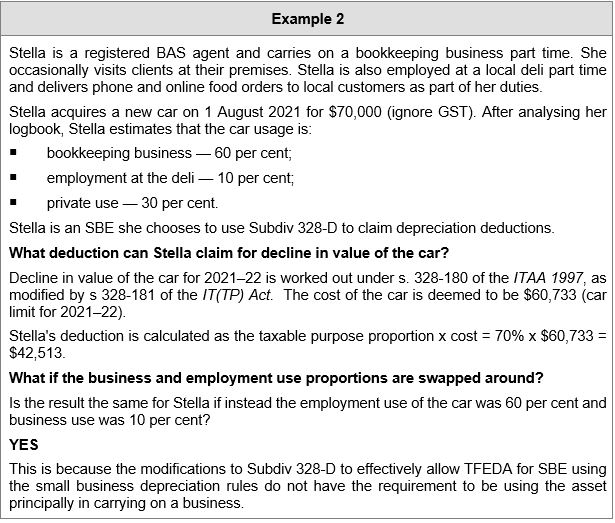

Where a taxpayer is an SBE and chooses to use the small business depreciation rules, Subdiv 328-D allows an immediate deduction for the taxable purpose proportion of the cost of any asset, where the cost (before the reduction for non-taxable use) is less than the relevant threshold (see s. 328-180). However, as a result of the TFEDA changes to Div 40, transitional rules in s. 328-181 of the IT(TP) Act remove the threshold completely. Consequently the taxable purpose proportion of an asset’s cost is immediately deductible, subject to the car limit and any non-taxable use.

These rules apply automatically, therefore an SBE using the small business depreciation rules cannot opt out of full expensing.

The choice to use the small business depreciation rules obliges the SBE to use Subdiv 328-D for all the depreciating assets that it holds — subject to certain exceptions (see for example s. 328-175). This means that SBEs that are individuals who earn non-business income (e.g. salary and wages, or investment income) must apply the Subdiv 328-D pooling rules to eligible assets used in earning that income.

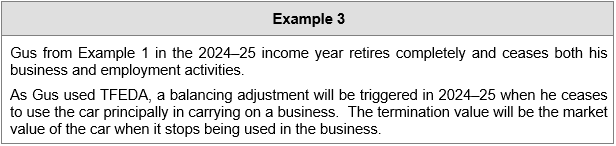

Usually the mechanism to adjust for any private use in a later year is to reduce that year’s claim for decline in value to the extent the asset has been used other than for a taxable purpose (s. 40-25(2)). Where an asset has been fully expensed, however, there is no decline in value in a later year and therefore nothing to adjust. To circumvent this, s. 40-185 of the IT(TP) Act triggers a balancing adjustment specifically when the asset ceases to be used primarily for carrying on a business i.e. the asset is applied for private use. Importantly this balancing adjustment arises where:

… it becomes not reasonable to conclude that you will use the asset principally in Australia for the principal purpose of carrying on a business …

The balancing adjustment is only triggered by a change in use that results in the asset not being used for the principal purposes of carrying on a business (e.g. a change in business use from 70 per cent to 60 per cent will not trigger this balancing adjustment, but a change from 60 per cent to 20 per cent would do so).

Where the balancing adjustment is triggered, the legislation includes the asset’s termination value at the time of the balancing adjustment in taxpayer’s assessable income and also treats that termination value as the asset’s cost going forward. This means that if the asset is partly used for a taxable purpose later, depreciation deductions for decline in value can be claimed from that point. The termination value will be the market value of the asset at the time of the balancing adjustment (s. 40-300(2)) ITAA 1997).

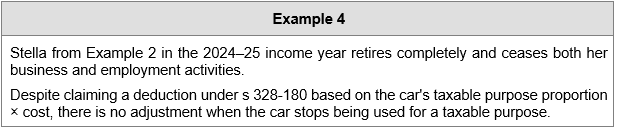

Under the small business depreciation rules, the mechanism for adjusting for private use is in s. 328-225 of the ITAA 1997 and applies only to assets that have been allocated to a small business pool. There is no adjustment for assets that have been fully written off under s. 328-180.

Warning

Warning

Whilst there is no adjustment if the asset is used privately, when the asset is sold the termination value will be assessable based on the taxpayer’s upfront taxable use, see below.

The balancing adjustment is only triggered by a change in use that results in the asset not being used for the principal purposes of carrying on a business (e.g. a change in business use from 70 per cent to 60 per cent will not trigger this balancing adjustment, but a change from 60 per cent to 20 per cent would do so).

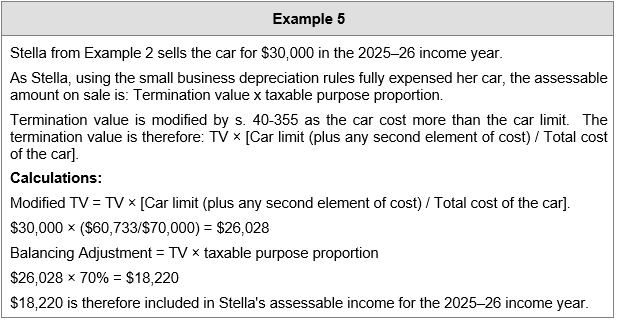

Accordingly, the taxable purpose proportion of the entire termination value (usually the sale proceeds) is assessable. However, a further adjustment to the termination value arises under s. 40-335 of the ITAA 1997 where the car was subject to the car limit. The termination value in this case is adjusted as follows:

TV × [Car limit (plus any second element of cost) / Total cost of the car]

Where there has been a change in use of the asset that was subject to TFEDA such that a balancing adjustment was triggered under s. 40-185 of the IT(TP)A, the asset effectively has its cost reset to market value from that time. Division 40 can then apply as per normal from that point in time where the taxpayer uses any portion of the asset for a taxable purpose. Upon disposal the taxpayer will calculate a balancing adjustment as per normal rules.

Where an immediate deduction was claimed under s. 328-180, upon disposal the taxable purpose proportion of the asset’s termination value will be included in assessable income under s. 328-215(4). Taxable purpose proportion is defined in s. 328-205. With reference to the purpose proportion of the asset’s termination value where a newly acquired asset has not had any adjustments to its taxable use, the legislation states that the taxable purpose proportion will be the amount estimated when the asset was first used or installed ready for use.

Accordingly, regardless of any change in taxable use of the asset, the taxable purpose proportion of the entire termination value (usually the sale proceeds) is assessable to the taxpayer in the year the car is sold. Although, where the car was subject to the car limit, the termination value is also adjusted as set out above.

Need to brush up on this topic a little more? Download our recent Special Topic webinar, Capital allowances revisited. You can check out a full list of our 2021 Special Topics here.

We can also present these Special Topics at your firm (or through a private online session) with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.