Editor’s note: On Thursday, 2 April, we conducted a webinar, hosted by Senior Tax Trainer Robyn Jacobson, on the implications of this package. Click here for more information and to register for a copy of the recording.

The Coronavirus (COVID-19) pandemic is having a devastating impact on global economies, and the daily work and personal routines of hundreds of millions of people around the world have been disrupted in unprecedented ways. Increasingly, communities, towns, cities and countries are going into lockdown to prevent the spread of the virus to those most vulnerable.

Governments around the world are scrambling to prevent the collapse of their economies as the global population struggles to keep up with the misinformation and constant developments, announcements and advice.

The Australian Government has made a series of announcements, including an increase in the debt ceiling from $600 billion to $850 billion to ensure it has the capacity to deal with the ongoing economic impact of the Coronavirus.

On 12 March 2020, the Federal Government announced a $17.6 billion economic stimulus package (the First Stimulus Package) to help businesses, employees and households deal with the significant economic challenges posed by the worldwide spread of the Coronavirus. On 22 March 2020, the Federal Government announced a second economic stimulus package worth $66.1 billion (the Second Stimulus Package).

In releasing the Second Stimulus Package, the Prime Minster, Scott Morrison, stated:

While the full economic effects from the virus remain uncertain, the outlook has deteriorated since the Government’s initial Economic Response announced on 12 March 2020. The spread of the virus worldwide has broadened and is expected to be more prolonged.

The spread of the virus worldwide has broadened and is expected to be more prolonged … Today we announce a second set of economic responses which, combined with our previous actions, total $189 billion across the forward estimates, representing 9.7 per cent of annual GDP.

The total of $189 billion includes $15 billion from the Government and $90 billion from the Reserve Bank of Australia to deliver easier access to business finance, as well as the First Stimulus Package and the Second Stimulus Package (the Stimulus Package).

The Federal Government’s economic response targets four key areas:

The measures are designed to be:

In addition, the Government has committed an additional $2.4 billion to the health system, and will cover 50 per cent of additional hospital costs incurred by States and Territories related to the diagnosis and treatment of the Coronavirus.

The Government’s announcements have been accompanied by various media releases and Treasury fact sheets which are available here:

Prime Minister’s media release on 12 March 2020

Treasurer’s media release on 12 March 2020

Prime Minister’s media release on 22 March 2020

Treasurer’s media release on 22 March 2020

Treasury fact sheets

![]() Note

Note

All State and Territory Governments and a number of local councils have also announced their own economic packages for their respective jurisdictions (see below for a summary of State and Territory measures).

Parliament was scheduled to sit from 23–26 March 2020, then again from 12 May 2020 when the Government was originally scheduled to release the 2020–21 Federal Budget.

However, the Parliament sat only on Monday 23 March, and cancelled all remaining Autumn and Winter sittings for 2020, including the May Budget. On 20 March 2020, the Prime Minister announced that the Government will defer the 2020–21 Federal Budget to Tuesday 6 October 2020.

The Stimulus Package was passed by Parliament on 23 March 2020, with an amendment by the Senate in relation to the Coronavirus Supplement, and received Royal Assent on 24 March 2020 as Act No. 22 of 2020.

The Treasurer, Josh Frydenberg, described the package as representing ‘the most significant support for the Australian economy and community since the war’.

The package comprises eight bills which are available here:

Coronavirus Economic Response Package Omnibus Bill 2020

Guarantee Of Lending To Small And Medium Enterprises (Coronavirus Economic Response Package) Bill 2020

Australian Business Growth Fund (Coronavirus Economic Response Package) Bill 2020

Assistance For Severely Affected Regions (Special Appropriation) (Coronavirus Economic Response Package) Bill 2020

Structured Finance Support (Coronavirus Economic Response Package) Bill 2020

Appropriation (Coronavirus Economic Response Package) Bill (No. 1) 2019–2020

Appropriation (Coronavirus Economic Response Package) Bill (No. 2) 2019–2020

Boosting Cash Flow For Employers (Coronavirus Economic Response Package) Bill 2020

There is a common Explanatory Memorandum to all of these bills.

In addition, the ATO has published a guide on some of the proposed measures.

![]() Reference

Reference

Treasury fact sheet — Cash flow assistance for businesses

The Cash flow assistance for employers measures will assist businesses to manage cash flow challenges and help them to retain their employees. The support will be available in two forms:

This measure is estimated to cost $31.9 billion over the forward estimates period, and benefit around 690,000 businesses employing 7.8 million people.

Small- and medium-sized businesses that employ people, and have an aggregated annual turnover of less than $50 million (based on the prior year turnover) will be eligible. Aggregated annual turnover is defined in s. 328-115 of the ITAA 1997 and means the ordinary income derived by the taxpayer, the taxpayer’s affiliates and entities connected with the taxpayer in the ordinary course of carrying on a business.

The amount of the payment received will be equal to 50 per cent of the PAYG withheld from salary and wages up to a maximum of $25,000. Where the employer pays salary and wages but is not required to withhold tax (e.g. where all of the employees earn below the tax-free threshold of $18,200), the employer will still receive a minimum payment of $2,000.

The Government announced that this measure would be enhanced by increasing the amount of the payment received (“the first boost”) so that it will be equal to 100 per cent of the PAYG withheld from salary and wages up to a maximum of $50,000. The minimum payment will be $10,000.

The Government announced that an additional payment (“the second boost”) is also being introduced for tax periods from July to September 2020. The second boost will be equal to the total of all payments received under the first boost. This means that eligible employers will receive at least $20,000 up to a total of $100,000 under both payments. To qualify for the second boost, the entity must continue to be active into 2020–21 (i.e. lodging activity statements).

The payments will also be extended to include not-for-profit entities, including charities.

The payments will only be available to ‘active eligible employers established prior to 12 March 2020’.

This means an entity will be eligible if it satisfies the following requirements:

However, charities that are registered with the Australian Charities and Not-for-profits Commission (ACNC) will be eligible regardless of when they were registered, subject to meeting other eligibility criteria (this recognises that new charities may be established in response to the Coronavirus pandemic).

The tax boost payments will be tax-free and automatically calculated by the ATO; no new registrations or new forms will be required.

The payments will be delivered by the ATO as an automatic credit in the activity statement system from 28 April 2020 upon employers lodging eligible upcoming activity statements. The minimum payment of $10,000 will be applied to the entity’s first lodgment. Where the entity is in a refund position, the ATO will deliver the refund within 14 days.

If an employer receives a payment to which it was not entitled, it is obliged to repay that amount. General interest charge will apply.

The first boost will be based on 100 per cent of the PAYG withholding reported at label W2 of the activity statement, up to the limits outlined above.

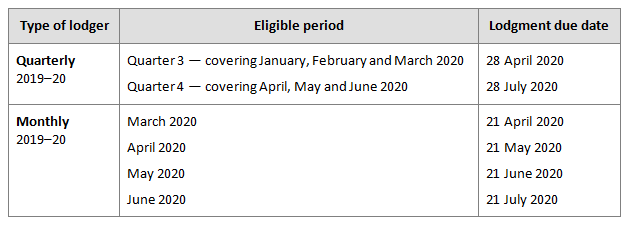

Quarterly lodgers will be eligible to receive:

Monthly lodgers will be eligible to receive:

This may be summarised as follows:

To provide a similar treatment to quarterly lodgers, the first boost for monthly lodgers will be calculated at 300 per cent of the amount reported in the March 2020 activity statement.

![]() Note

Note

This means that the entitlement for March 2020 will be based solely on three times the amount reported in the March 2020 activity statement. It has no regard for what was reported in the January 2020 and February 2020 activity statements. This will advantage some employers while disadvantaging others.

The first boost will be payable (i.e. credited) by the Commissioner following lodgment of the activity statement according to the following rules:

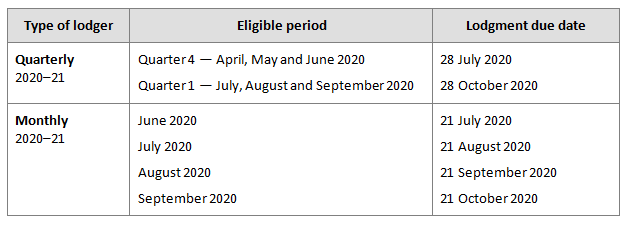

The second boost will be equal to the full amount of the first boost to which the entity was entitled. The second boost is available to all entities that received any amount of the first boost, even if their circumstances have changed, provided the entity lodges an activity statement for the tax periods from June 2020 to September 2020.

This may be summarised as follows:

The second boost is not subject to:

While there is no minimum amount or cap on the second boost, it is inherently capped because it is equal to the first boost which will be at least $10,000 and cannot exceed $50,000.

![]() Note

Note

This means that as long as the employer meets the eligibility criteria in 2019–20 and 2020–21, and was entitled to the first boost, they are entitled to the second boost even if their circumstances change (e.g. staffing levels). The amount of the second boost is not based on the amounts of PAYG withholding reported in the June 2020 to September 2020 activity statements — it is equal to the amount of the first boost — but the entity will need to lodge activity statements for the tax periods from June 2020 to September 2020 in order to receive the second boost.

![]() Note

Note

The June 2020 quarterly or monthly activity statement can be used to determine entitlements in both 2019–20 and 2020–21. A note in the legislation states that an entity may be entitled to a payment in 2020–21 for the month of June 2020 or the June quarter and also be entitled to a payment in 2019–20 for the same month or quarter.

For example, a quarterly lodger could receive a first boost payment of $50,000 based on its March 2020 and June 2020 activity statements. It could then be entitled to a second boost payment of a further $50,000 based on the lodgment of its June 2020 activity statement, as well as the tax periods from July 2020 to September 2020.

The second boost will be payable (i.e. credited) by the Commissioner following lodgment of the activity statement according to the following rules:

The first boost will be payable (i.e. credited) by the Commissioner following lodgment of the activity statements as set out in the table above (see First boost — 2019–20).

The second boost is payable only once activity statements for the tax periods from June 2020 to September 2020 are lodged but is not based on the amounts reported in those activity statements. As stated above it is equal to the amount of the first boost.

If the entity is:

Example adapted from Treasury fact sheetSarah owns and runs a building business in South Australia and employs 8 construction workers on average full-time weekly earnings, who each earn $89,730 per year. Sarah reports withholding of $15,008 for her employees on each of her monthly Business Activity Statements (BAS). Under the Government’s changes, Sarah will be eligible to receive the payment on lodgment of her BAS. Sarah’s business receives:

Under the previously announced Boosting Cash Flow for Employers measure, Sarah’s business would have received a maximum payment of $25,000. Under the Government’s enhanced Boosting Cash Flow for Employers measure, Sarah’s business will receive $100,000. |

Issues arising

| Issue | Discussion |

| Sole traders and partnerships | These types of employers will be eligible for PAYG withholding paid in respect of their employees, just like a company or a trust.

However, a sole trader or a partner in a partnership cannot employ themselves, so if the business does not employ anyone in the eligible period, sole traders and partners will not be eligible for the payment in respect of their own drawings from the business. |

| Integrity measures | The eligibility conditions require that the employer must have held an ABN on 12 March 2020 and must have — in practical terms — either lodged a 2019 tax return or an activity statement for a tax period that started on or after 1 July 2018 and ended prior to 12 March 2020. This is an integrity measure which prevents contrived arrangements designed to create entitlement to the payment by creating a new employer entity.

Further, the payment will not be available if the entity (or its associate or agent) has engaged in a scheme for the sole or dominant purpose of seeking to make the entity entitled to the payment or increase the entitlement to the payment. However, there don’t seem to be any provisions which specifically prevent a controller of a family-run business from taking drawings from a company or trust (that existed before 12 March 2020 and meets the conditions above) via a loan account then later recharacterising the drawings as salaries and wages, or directors fees — subject to the restriction outlined in the above paragraph.

The marketing of arrangements designed to generate or increase entitlements to the payment could result in the promoter penalty regime applying which carries significant penalties. |

| Prior year turnover | Eligibility for the payment is based on the entity’s prior year aggregated turnover. The eligibility conditions require that the entity has notified the Commissioner, by 12 March 2020, of an assessable amount for 2018–19, or a taxable supply in a tax period that started on or after 1 July 2018 and ended before 12 March 2020. However, the entity’s aggregated turnover (within the meaning in s. 328-115 of the ITAA 1997) is not disclosed on its tax return or activity statements. We expect that entities will determine their eligibility (i.e. the turnover threshold) under self-assessment. |

| Personal services income | Only withholding payments listed under Subdivs 12-B, 12-C or 12-D in Schedule 1 to the TAA are eligible for this payment. These are payments for work and services, payments for retirement or because of termination of employments, and benefit and compensation payments.

If a company or trust derives PSI, and promptly pays a salary or wage to the individual providing the personal services, then the entity would qualify for the payment. Where the income is instead attributed to the individual because the entity does not promptly pay a salary or wage, the employer must report and pay PAYG withholding on the attributed PSI each month or quarter (depending on the amount each year) at labels W1 and W2 on the activity statement. However, the payment will not cover attributed PSI because the PAYG withholding on these amounts are remitted under Div 13 of Schedule 1 to the TAA which is not included in the eligible types of withholding listed above. |

| Do grouping rules apply? | Grouping rules apply when determining the entity’s aggregated turnover under s. 328-115 of the ITAA 1997 because the ordinary income derived by the taxpayer, the taxpayer’s affiliates and entities connected with the taxpayer in the ordinary course of carrying on a business is taken into account in working out whether the $50 million threshold has been exceeded.

However, no grouping rules apply to prevent multiple entities that are commonly controlled — as long as together they are within the $50 million turnover threshold — from each being access the cash flow boost. So, a business that operates various branches around Australia through one legal entity will be entitled to a maximum of $100,000 across 2019–20 and 2020–21. However, a national business run via a group of five entities that each employ staff and lodge activity statements will be able to access a maximum of 5 × $100,000 i.e. $500,000. |

| Contractors | The cash flow boost is available only for entities that make payments of salaries or wages (or similar payments including director’s fees) to employees, and payments to contractors that are subject to voluntary withholding arrangements.

Accordingly, payments to contractors that are not subject to voluntary withholding arrangements are not eligible for the cash flow boost. |

| Implications of the payment being tax-free |

Because the payment is tax-free, it will give rise to unfranked dividends in companies and CGT event E4 will happen for unit trusts where the payment is withdrawn from the company or unit trust in the form of equity (i.e. a dividend or a distribution).

However, a couple of points to note:

|

| Deferred activity statements | One of the ATO’s responses to the recent bushfire crisis is to allow businesses (and individuals and SMSFs) in impacted local government areas until 28 May 2020 to lodge and pay activity statements.

It is unclear how the ATO will reconcile their bushfire response, which allows deferred lodgment, with the Government’s stimulus package, which encourages prompt lodgment to access the relief payment. |

Hopefully the ATO will promptly issue technical and administrative guidance to resolve many or all of these issues.

The second part of the Government’s cash flow assistance for employers to help smaller employers to retain apprentices and trainees is in the form of a wage subsidy. At this stage it is unclear whether the subsidies will be subject to tax in the employers’ hands.

The subsidies will be offered under the Australian Apprenticeships Incentive Program.

This measure is estimated to cost $1.3 billion across 2019–20 and 2020–21 and support up to 70,000 businesses employing around 117,000 apprentices.

Key points:

![]() Reference

Reference

Treasury fact sheet — Delivering support for business investment

The Government proposes to temporarily increase both the asset threshold and the eligibility threshold for the IAWO until 30 June 2020.

Key points:

This measure is estimated to have a net cost of $700 million over the forward estimates period, and will support over 3.5 million businesses (over 99 per cent of all businesses) employing more than 9.7 million employees.

Example 2 adapted from Treasury fact sheetSamantha owns a company, Sam’s Specialty Roasters Pty Ltd, through which she operates a large food processing business in Brisbane. Sam’s Specialty Roasters Pty Ltd has an aggregated annual turnover of $150 million for the 2019–20 income year. On 1 May 2020, Samantha purchases five new conveyor belts for her production facility for $40,000 each, exclusive of GST, for use in her business. Under existing tax arrangements, Sam’s Specialty Roasters Pty Ltd is not eligible for the instant asset write-off and instead would depreciate the conveyor belts using an effective life of 15 years. Choosing to use the diminishing value method, Sam’s Specialty Roasters Pty Ltd would claim a total tax deduction of $4,456 for the 2019–20 income year. Under the new $150,000 instant asset write-off, Sam’s Specialty Roasters Pty Ltd would instead claim an immediate deduction of $200,000 for the purchase of the conveyor belts (i.e. $40,000 for each conveyor) in the 2019–20 income year, $195,544 more than under existing arrangements. At the company tax rate of 30 per cent, Samantha will pay $58,663.20 less tax in 2019–20. |

Under the current law, the $30,000 IAWO is available until 30 June 2020 to businesses with an aggregated turnover of less than $50 million, but split across a number of provisions which are similar but not identical:

Currently, SBEs can acquire the asset from during the period starting at 7:30 pm on 12 May 2015 and ending on 30 June 2020, but the date on which they first used or installed the asset ready for use determines which asset threshold applies (i.e. $20,000, $25,000 or $30,000). In contrast, medium-sized businesses must both acquire and first use or install the asset ready for use during the period starting at 7:30 pm on 2 April 2019 and ending on 30 June 2020.

Medium-sized businesses will only be able to access the increased threshold of $150,000 if they:

For SBEs, the legislative amendment simply increases the threshold in s. 328-180. The effect is that SBEs would be able to access the increased threshold of $150,000 where the asset is acquired between 7:30 pm on 12 May 2015 and 30 June 2020 as long as it is first used or installed between 12 March 2020 and 30 June 2020, thereby providing a more than 5-year window to acquire the asset.

Increasingly, the most frequent question being asked by perhaps wishful taxpayers and practitioners is whether the car limit in s. 40-230 of the ITAA 1997 will apply to assets acquired under the increased threshold of $150,000. The car limit is $57,581 for 2019–20.

The legislation does not suspend or disregard the car limit and there is no exception for cars purchased that exceed $57,581.

A time limited 15-month investment incentive will be introduced which will allow eligible businesses to claim accelerated depreciation deductions on eligible assets.

Key points:

The accelerated depreciation is available to entities with aggregated annual turnover of less than $500 million that do not use the simplified depreciation rules in Subdiv 328-D of the ITAA 1997 (whether because they choose not to or they are ineligible).

For companies that are eligible for the Research and Development Tax Incentive, the amount of the accelerated depreciation deduction will be used for calculating the notional deductions that can be claimed under the incentive.

This measure is likely to be applied to assets that cost more than $150,000 that are not eligible for the new temporary IAWO.

![]() Implications

Implications

An SBE that uses the simplified depreciation rules in Div 328 of the ITAA 1997 may deduct an amount equal to 57.5 per cent of the taxable purpose proportion of the adjusted value of an asset added to the general small business pool in the relevant income year.

Example 1 adapted from the ATO fact sheetJoan and Bruce own a company, NC Transport Solutions Pty Ltd, through which they operate a haulage business on the North Coast of New South Wales. NC Transport Solutions Pty Ltd has an aggregated annual turnover of $8 million for the 2019–20 income year. On 1 May 2020, Joan and Bruce purchase a new truck for $260,000, exclusive of GST, for use in their business. Under past tax arrangements, NC Transport Solutions Pty Ltd would depreciate the truck using their general small business pool. This means that NC Transport Solutions Pty Ltd would deduct 15 per cent of the asset’s value when they added it to the pool, leading to a tax deduction of $39,000 for the 2019–20 income year (assuming there are no other assets in the pool). Under the new accelerated depreciation, NC Transport Solutions Pty Ltd will instead claim a deduction of 57.5% when they add it the pool, leading to a deduction of $149,500 for the 2019–20 income year. |

![]() Reference

Reference

Treasury fact sheet — Early access to superannuation

Eligible individuals will be able to apply to access up to $10,000 of their superannuation before 1 July 2020. They will also be able to access up to a further $10,000 from 1 July 2020 for approximately three months (exact timing will depend on the passage of the relevant legislation).

This measure is expected to have a cost of $1.15 billion over the forward estimates.

An individual will be eligible for early release if they satisfy any one or more of the following requirements:

![]() Note

Note

If a sole trader whose business is affected by COVID-19 does not employ anyone, they cannot access the business cash flow assistance payments (up to $100,000); however they can access this measure which allows them early access to their superannuation.

Amounts released from superannuation under this temporary measure will be tax-free and the amount withdrawn will not affect Centrelink or Veterans’ Affairs payments.

Individuals will be able to apply online directly to the ATO through their myGov account (www.my.gov.au) for early release of their superannuation from mid-April 2020. Individuals will need to certify that they meet the above eligibility criteria.

An application for release must be made within six months of the amendments commencing.

It is expected that individuals will self-assess their eligibility and that they will be able to apply through the ATO online services on myGov. An applicant may specify the amount they wish to have released and the superannuation entity from which the amount is to be released.

Once the ATO has processed the application, they will issue the individual with a determination, and provide a copy of this determination to the individual’s superannuation fund, which will advise them to release the superannuation payment. The fund will then make the payment to the individual without them needing to apply to the fund directly. However, to expedite payments, it would be prudent for individuals to immediately ensure that the fund has the correct details, including current bank account details and proof of identity documents.

Separate arrangements will apply for members of self-managed superannuation funds. Further guidance will be available on the ATO website: www.ato.gov.au.

Example 13.2 from the Explanatory MemorandumRachel is a sole trader with a catering business. At the end of July 2020, Rachel seeks to apply for an early release from her superannuation for the 2020–21 financial year. Due to the adverse economic effects of the coronavirus, Rachel’s turnover for July is $5,000 compared to $10,000 on average per month for the second half of 2019. Rachel therefore determines that her turnover has reduced by more than 20 per cent compared to her average turnover over the last six months of 2019. Rachel self-certifies that she is eligible for early release and applies to have $10,000 released from her superannuation. |

![]() Reference

Reference

Treasury fact sheet — Providing support for retirees

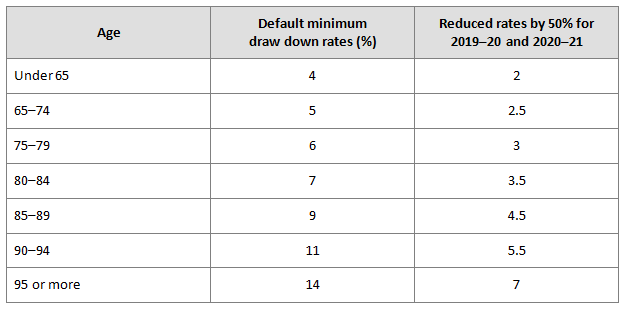

To assist retirees to manage the impact of volatility in financial markets on their retirement savings, the superannuation minimum drawdown requirements will be temporarily reduced.

This measure will have no impact on the underlying cash balance for 2019–20 and a negligible impact in 2020–21.

The Government is temporarily reducing the superannuation minimum drawdown requirements for account-based pensions and similar products by 50 per cent for the 2019–20 and 2020–21 income years. This measure will benefit retirees with account-based pensions and similar products by reducing the need to sell investment assets to fund minimum drawdown requirements.

The reduction applies for 2019–20 and 2020–21.

![]() Historical note

Historical note

The minimum draw down rates were halved from 2008–09 to 2010–11 — following the global financial crisis which similarly affected the investment values of superannuation assets — in response to concerns that investment assets needed to be sold and losses may be realised in a depressed market in order to meet the minimum draw down amount.

The Government is also reducing social security deeming rates in recognition of the impact of the low interest rates on savings. Both the upper and lower social security deeming rates will be reduced by a further 0.25 percentage points in addition to the 0.5 percentage point reduction to both rates announced on 12 March 2020.

As of 1 May 2020, the upper deeming rate will be 2.25 per cent and the lower deeming rate will be 0.25 per cent. The change will benefit around 900,000 income support recipients, including around 565,000 people on the Age Pension who will, on average, receive around $105 more from the Age Pension in the first full year that the reduced rates apply.

The changes will be effective from 1 May 2020.

This measure is expected to have a cost of $876 million over the forward estimates.

![]() Reference

Reference

Treasury fact sheet — Payments to support households

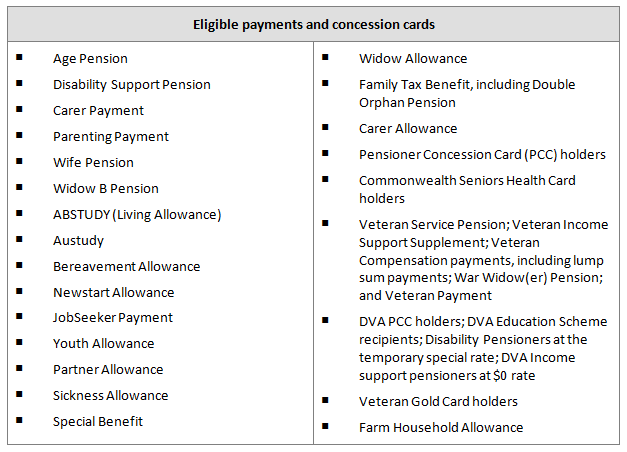

Two separate $750 tax-free payments will be provided to social security, veteran and other income support recipients and eligible concession card holders as follows:

Key points:

An individual will be eligible for the first payment if they:

The first payment will be made to around 6.6 million eligible individuals and will have a budget impact of $4.8 billion.

An individual will be eligible for the second payment if they:

The second payment is expected to be made to around 5 million social security, veteran and other income support recipients and eligible concession card holders and will have a budget impact of $4.0 billion.

![]() Reference

Reference

Treasury fact sheet — Income support for individuals

Eligibility to income support payments will be temporarily expanded, and a new, time-limited Coronavirus supplement will be established.

These measures are expected to cost $14.1 billion.

Key points:

The income support payment categories eligible to receive the Coronavirus supplement are:

For the period of the Coronavirus supplement, there will also be:

![]() Reference

Reference

Treasury fact sheet — Assistance for severely affected regions and sectors

The Government has set aside $1 billion to support regions and communities that have been disproportionately affected by the economic impacts of the Coronavirus, including those heavily reliant on industries such as tourism, agriculture and education.

The $1 billion will be distributed through existing or new mechanisms as soon as practicable.

In addition, the Government will deliver a $715 million assistance package to the airline industry.

The ATO will also provide administrative relief (see below).

![]() Reference

Reference

Treasury fact sheet — Temporary relief for financially distressed businesses

To provide a safety net to otherwise profitable and viable businesses that may temporarily face financial distress, this package of measures will:

![]() Reference

Reference

Treasury fact sheet — Supporting the flow of credit

The Government, the Reserve Bank of Australia and the Australian Prudential Regulation Authority have taken coordinated action to support the flow of credit in the Australian economy, in particular for small and medium enterprises (SMEs).

Under the Coronavirus SME Guarantee Scheme, the Government will provide a guarantee of 50 per cent to lenders to SMEs for new unsecured loans to be used for working capital. The scheme will support up to $40 billion of lending to SMEs.

The Scheme will commence by early April 2020 and be available for new loans made by participating lenders until 30 September 2020.

Key points:

The Treasury advises interested SMEs to approach their financial institution for more information, and that even though the scheme officially commences in April, some lenders may be able to provide credit sooner.

The Coronavirus Business Liaison Unit (the Unit) has been created in Treasury to support confidence, employment and business continuity. The Unit is engaging with peak business and industry groups on systemic issues arising from Coronavirus to ensure these are being brought to the attention of Government. The Unit is also providing up to date information on the Government’s response to COVID-19 and the actions that Government is taking to support business and industry across Australia.

Treasury encourages businesses to contact their relevant industry body to provide feedback.

It is useful to note some other measures which have fixed deadlines, and in respect of which there has been no announcement to date by the Government to soften the impact on those affected.

The impact of COVID-19 is being felt across the economy, including by Australian expatriates who face a looming deadline of 30 June 2020 to enter into contracts to sell their former homes under newly enacted laws. The new measures contain a transitional rule applies which allows taxpayers who held the property just before 7:30 pm on 9 May 2017 to sell the property no later than 30 June 2020.

Some Australian expatriates may be trying to sell their former Australian homes in a chaotic market where:

It is hoped that the Government will consider extending the 30 June 2020 deadline in light of the Coronavirus crisis; however, this could only be a retrospective amendment given that the Parliament is not likely to resume until at least October 2020.

The superannuation guarantee (SG) regime imposes draconian and immovable penalties on employers who fail to comply with the SG obligations.

The ATO has reminded employers that they still need to meet their ongoing SG obligations. By law, the ATO cannot:

The ATO will implement a number of administrative measures to assist Australians experiencing financial difficulty as a result of the Coronavirus.

![]() Note

Note

The ATO has published a COVID-19 frequently asked questions page which deals with the tax consequences of events and transactions arising from the Coronavirus.

Options available to assist businesses include:

These assistance measures will not be automatically implemented. Affected businesses should contact the ATO on its Emergency Support Infoline on 1800 806 218. The ATO will tailor a support plan for the business’s needs and circumstances.

To make it easier for taxpayers to apply for relief, the ATO plans to increase its presence in significantly affected regions, including additional temporary shopfronts (the first one will be in Cairns) and face-to-face options.

Individual taxpayers who are experiencing difficulties with complying with their tax obligations because of the Coronavirus can:

The Tax Practitioners Board (TPB) is also offering support to registered agents affected by the Coronavirus. For example, an extension of time can be provided to meet registration obligations.

Affected tax practitioners should contact the TPB.

The Governments of most States and Territories have announced economic stimulus and relief packages. The following brief summary focuses on the assistance that is proposed to be available to businesses, in particular payroll tax. The packages also contain measures for households and the health system.

The States and Territories will defer the date of their respective Budgets.

Under the ACT Government’s $137 million economic survival package:

The NSW Government‘s $2.3 billion health and economic package and subsequently announced stage two package include:

The NT Government has announced a $65 million Jobs Rescue and Recovery Plan and an additional $50 million fund to support small business.

The package includes:

The $50 million Small Business Survival Fund will deliver grants to help keep businesses alive, even when they have to shut. The NT Government will release more details.

The Queensland Government’s $4 billion economic relief package includes:

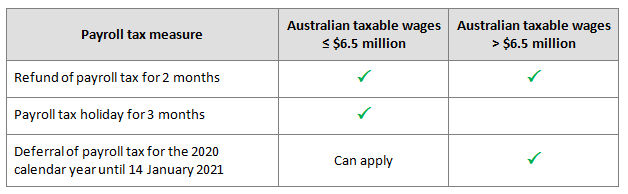

A payroll tax relief package contains the following measures for eligible employer groups:

The South Australian Government’s $350 million stimulus package includes:

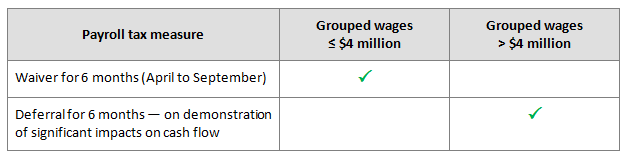

A second $650 million Jobs Rescue Package includes the following $60 million payroll tax relief measures:

The Tasmanian Government’s $420 million stimulus package includes:

The Tasmanian Government will also make one-off payments of $250 to eligible individuals or up to $1,000 to families for those who are required to self-isolate. Eligibility includes those with a Health Care Card or a Pensioners Concession Card and those on low incomes who can demonstrate a need for financial support.

Under the Victorian Government’s $1.7b Economic Survival Package:

The Western Australian Government’s $607 million stimulus package includes $114 million in payroll tax measures to support small businesses:

The Australian Banking Association has announced a Small Business Relief Package. Australian banks will defer loan repayments for impacted small business for six months. The package was developed following discussions with APRA and ASIC to provide the appropriate regulatory treatment and is subject to authorisation by the ACCC.

Further, the Reserve Bank of Australia will provide a three-year funding facility of at least $90 billion to banks at a fixed rate of 0.25 per cent. Additional funding will be available to banks if they increase lending to business, especially to SMEs.

The Commonwealth, the States and Territories and financial institutions are constantly releasing information about proposed relief packages. Check the relevant websites for up to date details.

Refer to this page for the latest Federal Government health news and advice in relation to the Coronavirus. Check State and Territory government websites for up to date information about domestic travel restrictions, school closures and other state based impacts.

Note: On Thursday, 2 April, we will be conducting a webinar, hosted by Senior Tax Trainer Robyn Jacobson, on the implications of this package. Click here for more information and to register.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.