Written by: Letty Chen | Senior Tax Writer

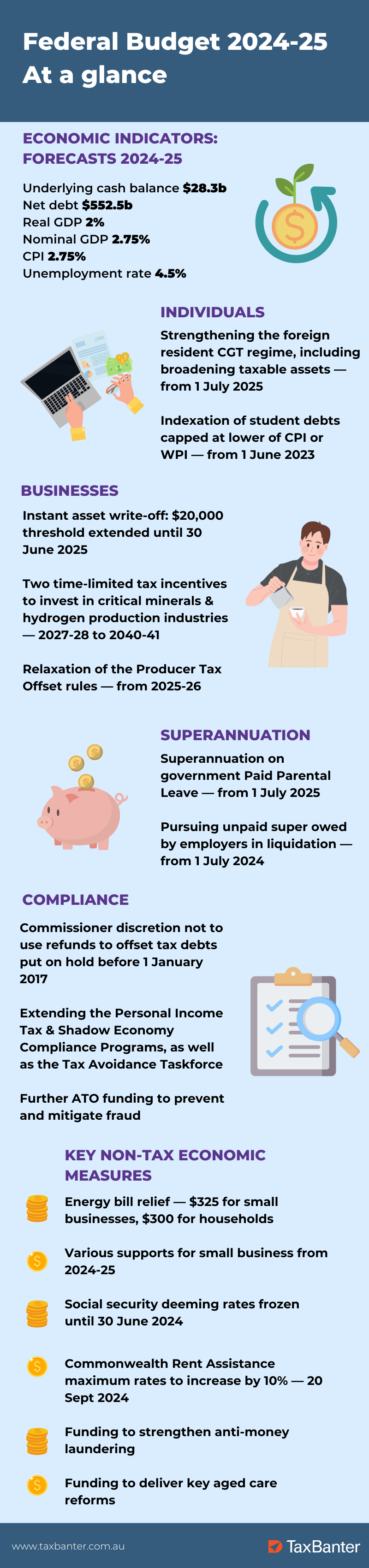

In its 2024–25 Federal Budget handed down on 14 May 2024, the Government announced that it will extend the $20,000 instant asset write-off threshold for one year until 30 June 2025.

While the measure is described as an ‘extension’, it is worth noting that – as at 17 May – the currently legislated threshold for 1 July 2023 to 30 June 2024 is $1,000! The Government has previously proposed a $20,000 threshold for 2023–24 which it intends to enact.

What is the instant asset write-off for small businesses? The provisions in Subdiv 328-D of the ITAA 1997 allow an eligible small business entity (SBE) taxpayer (annual turnover of less than $10 million) to bring forward 100 per cent of the depreciation deduction of the cost of an eligible asset to the current income year rather than writing it off over multiple years.

The standard and legislated threshold is $1,000 — that is, eligible assets with a cost of less than $1,000 may be fully depreciated in the year in which the taxpayer starts to use the asset, or have it installed ready for use, for a taxable purpose.

To encourage business investment and spending, since 2015 the Government has progressively and temporarily increased the threshold to various higher thresholds, cumulating in an ‘uncapped’ measure (i.e. all eligible assets regardless of cost could be immediately written off) from 6 October 2020 to 30 June 2023. Between 2 April 2019 and 30 June 2023, medium sized entities (turnover $10 million to less than $50 million) and large businesses (turnover $50 million to less than $500 million) also had access to some form of an instant asset write-off at thresholds of $30,000, $150,000 or uncapped at various times (legislated outside of the Subdiv 328-D small business rules).

All of these temporary expansions to the write-off ended on 30 June 2023. From 1 July 2023, the threshold for SBEs reverted to $1,000. Medium and large businesses no longer had access to an immediate deduction. At time of writing this is the current status as legislated.

In last year’s Federal Budget, the Government announced that it would temporarily increase the threshold to $20,000 (from $1,000) from 1 July 2023 to 30 June 2024.

Legislation to give effect to this change has not passed Parliament. Indeed, on 27 March the Treasury Laws Amendment (Support for Small Business and Charities and Other Measures) Bill 2023 was amended by the Senate to increase the $20,000 threshold to $30,000 and to extend the measure to medium entities with turnover of $10 million to less than $50 million, and returned to the House of Representatives for consideration. On the morning after the Budget, 15 May, the House disagreed to the Senate amendments and the Bill — with the original $20,000 threshold — was returned to the Senate. The next day,16 May, the Senate rejected the Bill again and insisted on its proposed amendments.

So, in summary:

This current state of play creates uncertainty for businesses planning the timing of their capital expenditures in the lead-up to 30 June 2024.

![]() Note:

Note:

The House of Representatives will return on 28 to 30 May. There are more sitting days for both Houses of Parliament in June. This article will be updated for any legislative developments since the time of writing.

Assume that Parliament enacts the Government’s proposals of a temporary $20,000 threshold for both 2023–24 and 2024–25 — that is, the instant asset write-off threshold is uncapped for 2022–23, then $20,000 for 2023–24 and 2024–25, then reverts to $1,000 from 2025–26.

![]() Note:

Note:

If a $30,000 threshold is legislated for 2023–24 and $20,000 for 2024–25, the below analysis still stands except for the higher threshold for the current year. If the extension to medium sized entities is also enacted, then based on previous similar temporary extensions, most likely it will take the form of a modification of the general capital allowances rules in Div 40 of the ITAA 1997.

An SBE will be able to deduct the taxable purpose proportion of the cost of the asset in 2023–24 or 2024–25 if:

If the SBE holds the asset by 30 June 2025 but has not yet started to use the asset, or have it installed ready for use, for a taxable purpose by that date, it will not have access to the $20,000 threshold. Similarly, if the taxpayer was not an SBE in the year it started to hold the asset but becomes an SBE when it begins to use the asset, it will not be eligible for the immediate deduction.

An immediate deduction will also be available for the second element of the cost — of less than $20,000 — for an asset where the first element of the cost has been immediately written off.

The lock-out rule applies to SBEs that are eligible for but choose to opt out of Subdiv 328-D. under the default arrangements, the taxpayer cannot again apply the provisions for a period of five income years after the first later year in which the taxpayer could have made the choice.

However, under transitional rules enacted with the temproary threshold increases, SBEs are currently not required to apply the lock-out rule to income years that end on or after 12 May 2015 but on or before 30 June 2023. Assuming the Government’s proposals are enacted, the lock-out rule should be deferred for a further two years until 30 June 2025.

SBEs will be able to opt back into applying Subdiv 328-D to access the threshold during the 2014–15 through to the 2024–25 income years. The lock-out rule will start to apply again from the first income year that ends after 30 June 2025, i.e. from 2025–26.

The lock-out rule will not prevent a taxpayer from opting back into the rules in 2021–22 to 2024–25 if they previously opted out within the last five years.

![]() Implications

Implications

A choice not to use the small business capital allowance rules in the 2024–25 income year will lock them out of the rules until the 2029–30 income year. Accordingly, careful consideration should be given to any choice made in the 2024–25 income year.

Click here to view in full size or to print.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.