Written by: Roelof Van Der Merwe | Senior Trainer (Tax)

Background

On 11 December 2024, the ATO released two updates (TD 2024/D3 and TA 2024/2) dealing with the interaction of Division 7A (s.109U of the Income Tax Assessment Act 1936) to private company loans and payments involving guarantees.

Typical financing scenario before s.109U: No deemed dividend

Division 7A can apply when a private company makes a loan/payment to a shareholder/associate. The amount of the Division 7A deemed dividend will be limited to the amount of the distributable surplus (i.e. net assets).

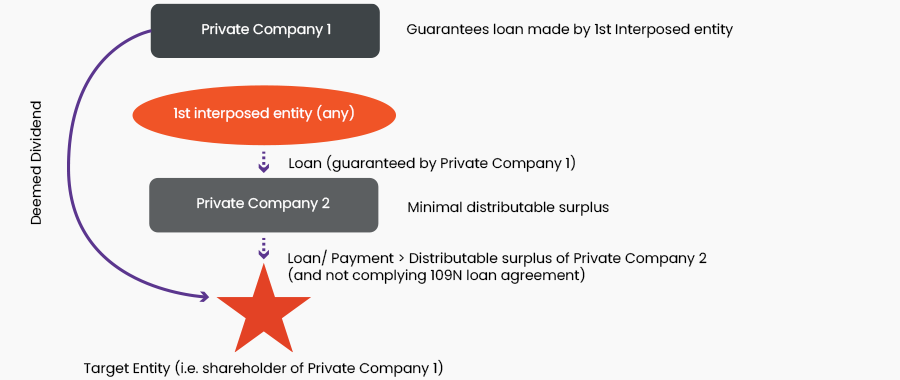

Before s.109U was inserted into Division 7A, a company with a significant distributable surplus (i.e. Private Company 1) that wanted to extract money from Private Company 1 tax-free, could create a new company (i.e. Private Company 2) with no distributable surplus and then get Private Company 2 to make a loan/payment to a shareholder or associate of both Private Company 1 tax-free.

Because Private Company 2 will have zero net assets and will therefore not be able to borrow money from the bank to make such a loan/payment, Private Company 1 will provide security for a loan to Private Company 2.

Typical financing scenario after s.109U: Deemed dividend

Section 109U deems the arrangement described above (and set out in the diagram above) to give rise to a deemed dividend equal to the distributable surplus of Private Company 1 if:

What does this mean for you?

TD 2024/D3 clarifies that for Division 7A to apply, when multiple interposed entities are involved, there is no requirement that the 1st interposed entity (i.e. the entity that provides the finance) must be a private company (e.g. it can be a bank or public company), as long as the entity making the final payment/loan (e.g. Private Company 2 in our example) is a private company.

If there are not multiple interposed entities involved (i.e. the 1st interposed entity makes the loan/payment directly to the target entity), Division 7A will only apply if the 1st interposed entity is a private company.

TA 2024/2 states that if the guarantee provisions are triggered:

Next steps

Consider reviewing all financing arrangements to identify whether guarantees were provided to non-private companies (e.g. banks) to provide loans to private companies.

Our in house training empowers you team and helps them to navigate the many onerous compliance challenges posed by Division 7A and much more.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.