On 8 December 2022, the ATO released its long anticipated final guidance on s. 100A of the ITAA 1936.

TR 2022/4 titled Income tax: s. 100A reimbursement agreements (the Ruling) sets out the Commissioner’s view in respect of the application of s. 100A.

PCG 2022/2 titled Section 100A reimbursement agreements — ATO compliance approach (the Guideline) sets out the ATO’s compliance approach, including how the ATO will assess the taxpayer’s risk level. Both documents contain a number of practical examples.

Together the Ruling and the Guideline are referred to as the finalised guidance.

The finalised guidance was previously issued in draft in February 2022 as TR 2022/D1 and PCG 2022/D1 respectively, and differs from the drafts in a number of respects. Broadly, these include:

A Compendium accompanies each of the Ruling and the Guideline, setting out the Commissioner’s responses to comments received during consultation, including changes reflected in the finalised guidance — refer to TR 2022/4EC and PCG 2022/2EC.

The ATO has updated its website guidance on s. 100A titled Trust taxation — reimbursement agreement (QC 41167) to reflect the finalised guidance.

The finalised guidance will apply both before and after its date of issue (8 December 2022).

In relation to entitlements arising before 1 July 2022, note that:

Section 100A of the ITAA 1936 is an anti-avoidance provision which, subject to the ordinary dealing exception, applies in cases in which a beneficiary has become presently entitled to trust income where it has been agreed that another person will benefit, and that agreement is made by any of its parties with a purpose that some person will pay less or no income tax as a result.

Broadly, the effect where s. 100A applies — i.e. where a beneficiary’s present entitlement arises from a reimbursement agreement — is that:

Note: There are two Federal Court decisions which concern s. 100A that are currently subject to appeal in the Full Federal Court. Those decisions are Guardian AIT Pty Ltd ATF Australian Investment Trust v FCT [2021] FCA 1619 (Guardian) and BBlood Enterprises Pty Ltd v FCT [2022] FCA 1112 (BBlood). The Ruling refers to these cases.

Note: There are two Federal Court decisions which concern s. 100A that are currently subject to appeal in the Full Federal Court. Those decisions are Guardian AIT Pty Ltd ATF Australian Investment Trust v FCT [2021] FCA 1619 (Guardian) and BBlood Enterprises Pty Ltd v FCT [2022] FCA 1112 (BBlood). The Ruling refers to these cases.

In the ATO’s view, there is no reimbursement agreement and s. 100A will not apply to a beneficiary’s present entitlement to trust income where any of the following apply:

(a) The beneficiary is under 18 years of age or otherwise under a legal disability.

(b) Only the beneficiary benefits from their trust entitlement and no one else benefits from the beneficiary’s share of trust net income and trust capital gains.

(c) There was no agreement, arrangement or understanding to provide a benefit to someone other than the beneficiary at the time the beneficiary became presently entitled.

There must be a present entitlement, or deemed present entitlement, of a beneficiary (other than a beneficiary under a legal disability) to a share of trust income, which has arisen out of, in connection with or as a result of a reimbursement agreement (being an agreement, understanding or arrangement that has the three qualities described in requirements 2, 3 and 4 below).

‘Agreement’ is defined widely to include arrangements and understandings whether formal, informal, express or implied. An agreement can include a single step or a series of steps or transactions.

The agreement must provide for the payment of money or transfer of property to, or provision of services or other benefits for, a person other than that beneficiary.

One or more of the parties to the agreement must have entered into it for a purpose (which need not be a sole, dominant or continuing purpose) of securing that a person would be liable to pay less tax in an income year than they otherwise would have been liable to pay.

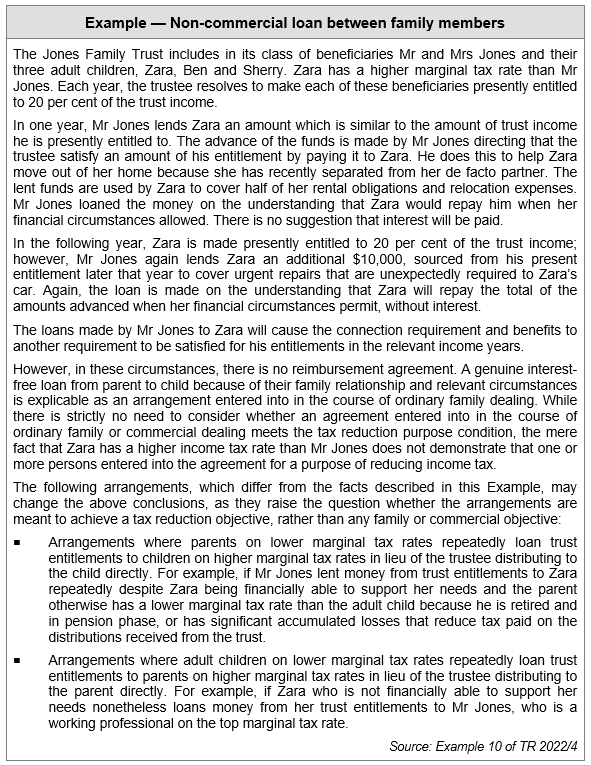

Agreements entered into in the course of ordinary family or commercial dealing are not reimbursement agreements for the purposes of s. 100A. This ‘ordinary dealing’ test is an objective test applied, at least principally, from the perspective of the persons whose purposes are relevant to the operation of s. 100A.

It is the whole dealing in the course of which the agreement is entered into which must have the quality of ‘ordinary family or commercial dealing’.

To test whether there is ordinary family or commercial dealing, consider all relevant circumstances, including what is sought to be achieved by the dealing (in particular, whether it is explained by the family or commercial objectives it will achieve) and whether the steps that comprise the dealing will likely achieve those objectives.

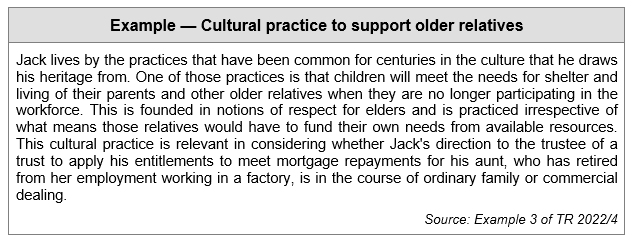

Factors relevant to whether a dealing is ‘ordinary family or commercial dealing’ can include family living arrangements, financial dependence on one another, cultural traditions, and financing arrangements.

‘Family’ takes its ordinary meaning— i.e. a relationship of natural persons based on birth or affinity, and may often involve co-residence. The exception does not apply just because all parties to an agreement are family members.

Features indicating that a dealing may not be ordinary family or commercial dealing include:

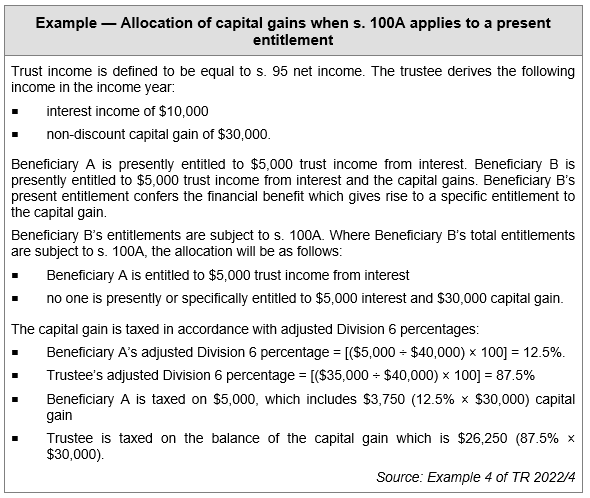

Section 100A disregards a beneficiary’s entitlement to the extent that it arises out of a reimbursement agreement. This means that the net income that would otherwise have been assessed to the beneficiary (or trustee on their behalf) is instead assessed to the trustee at the top marginal tax rate.

There is comparable treatment for a reimbursement agreement that involves franked distributions or capital gains.

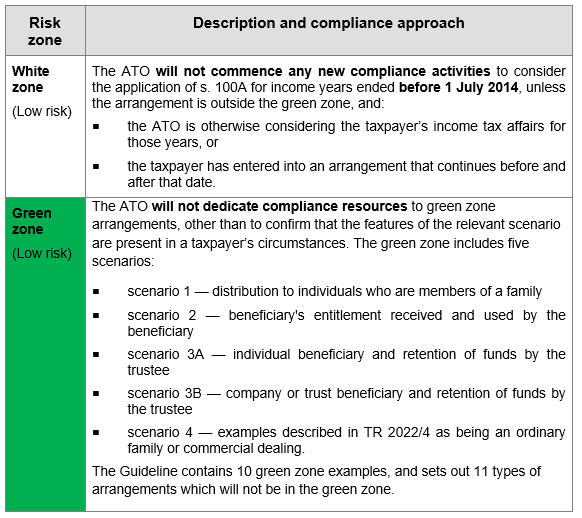

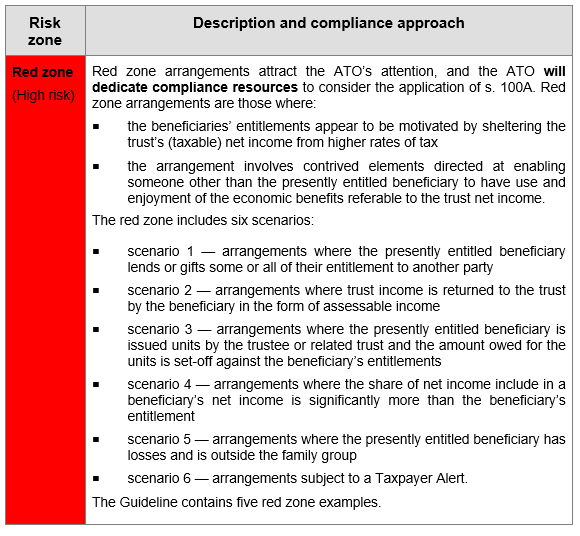

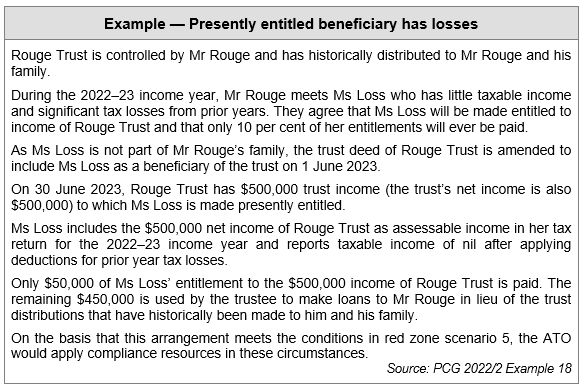

The following table describes the ATO’s compliance approach for arrangements to which s. 100A may apply:

For arrangements not within the white, green or red zones, the following principles may indicate whether the arrangement has a higher risk of the ATO dedicating compliance resources to consider the application of s. 100A:

(a) a benefit is provided to a person other than the beneficiary

(b) the provision of that benefit involves complexity or contrivance

(c) that benefit could have been provided in a more direct manner

(d) the arrangement results in significantly less tax being paid compared to if the benefit had been provided more directly.

While each arrangement depends on its facts, the following documents and records are important and should be kept wherever possible:

The ATO acknowledges that family arrangements are typically conducted with a greater level of informality than dealings between unrelated parties. Nonetheless, contemporaneous records which demonstrate the intended objectives should be kept, e.g. in the form of a file note of a meeting.

Notwithstanding that an arrangement is fully documented, s. 100A may still apply.

Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia. ATO guidance in relation to section 100A will be comprehensively covered in these options.

Our 2023 registrations are now open! Save up to 25% by registering for a full series of your choice (tax workshops or online training). Our early bird pricing is our only annual sale, so get in quick!

Personalised training options

Personalised training optionsWe can also present these Updates at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.