[lwptoc]

The ATO’s ‘Next 5,000’ tax performance program is designed to give the community confidence that the privately owned and wealthy groups are paying the right amount of tax.

The Next 5,000 program is funded by the Tax Avoidance Taskforce. It began on 1 July 2019. To date it has focused on engaging with clients on a one-to-one basis. This has been generally through streamlined assurance reviews that are based on the ATO’s justified trust methodology.

The program focuses on prevention rather than correction by letting taxpayers know about potential tax risks specific to their business and providing public advice and guidance on relevant issues.

The Next 5,000 program runs for four years from 2019 onwards.

The Findings report for the Next 5,000 program, current at 5 November 2021 and published in early December, gives the ATO’s observations and insights into what it has seen through the program so far. The findings and data in this report are as of 5 November 2021.

If a taxpayer or tax professional operates or represents a Next 5,000 private group, they can use these findings to:

The ATO has reviewed more than 1,800 transactions, activities and events of Next 5,000 private groups that were worth nearly $7 billion, through over 250 streamlined assurance reviews.

The ATO’s key observations are that:

The ATO has confirmed that private groups have correctly reported amounts relating to significant activities, events and transactions totalling nearly $5.8 billion. This amount is made up of:

Common tax issues the ATO has observed include:

Since the program began, the ATO has received over 30 voluntary disclosures from private groups that total over $16.7 million in tax, penalties and interest from streamlined assurance reviews.

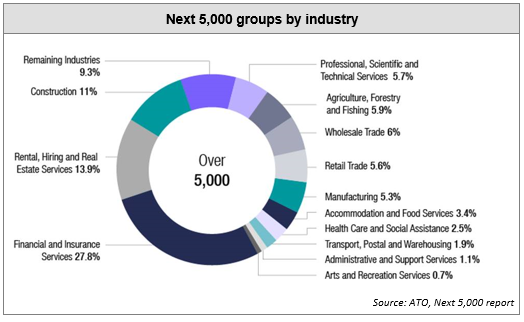

There are about 5,000 private groups in Australia that are part of this program as they have net wealth of over $50 million. These groups hold around $825 billion in wealth and contribute more than $9.8 billion in tax revenue each year.

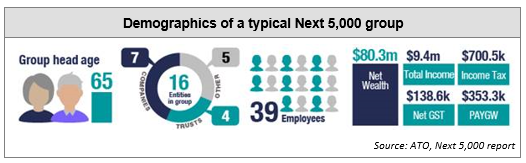

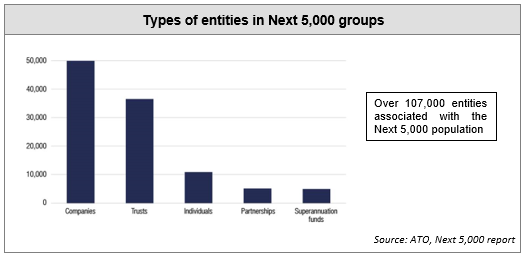

A typical Next 5,000 group can contain up to 16 entities, including a mix of:

Some Next 5,000 groups have philanthropic interests and include an ancillary fund or charity. Approximately 6.3 per cent of Next 5,000 groups have a private ancillary fund.

Most are well established, multigenerational businesses that have been operating for many years. Many are family businesses or closely controlled groups.

The ATO uses data matching and analytic models to identify Australian resident individuals who, together with their associates, control wealth of more than $50 million. The ATO then looks at the whole group of entities.

The Next 5,000 program does not include private groups in the Top 500 private groups tax performance program.

A typical Next 5,000 group includes:

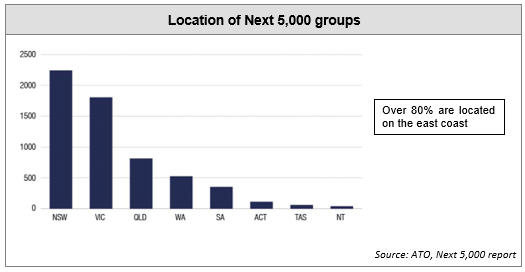

The Next 5,000 population:

The ATO tailors its approach, based on the group’s:

For groups that are large, have complex structures or multiple potential tax issues, the ATO engages with them through streamlined assurance reviews — which are conducted one-to-one with representatives of the group. The ATO aims to complete 800 to 1,000 streamlined assurance reviews each year. They are generally completed over a four-month period.

For other groups, the ATO engages with them through:

The ATO may send the taxpayer information specific to their business risks, or provide certainty on significant commercial deals through early engagement and pre-lodgment agreements.

Where appropriate, audits may be undertaken.

When the ATO identifies issues, it prefers to work with the taxpayer collaboratively rather than resorting to a traditional audit.

Where the ATO is unable to obtain assurance, it may:

This year the ATO:

In relation to TFE and LCB, the ATO may want to:

When reviewing TFE and LCB claims, the ATO may request information outside of the usual two-year time period for streamlined assurance reviews.

The ATO will also undertake a limited number of GST-integrated reviews.

![]() Reference

Reference

Also see the ATO’s guide What attracts our attention.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.