[print-me]

After a long period of uncertainty, and in the midst of the recent Liberal Party leadership spill, the Senate on 23 August 2018 unexpectedly passed without amendment the Treasury Laws Amendment (Enterprise Tax Plan Base Rate Entities) Bill 2018 (‘the BRE Act’). The Bill was enacted on 31 August 2018.

The measures in the BRE Act — which take effect from 1 July 2017 — aim to improve the law by setting a ‘bright line’ test to determine which companies are eligible for the lower tax rate.

Our Banter blog on the changes to the Base rate entity rules (written in November 2017 when the BRE Act was still a Bill) details the new measures. But the long period that it remained before the Parliament (from 18 October 2017 to 23 August 2018) — together with further draft guidance from the ATO — has caused extensive confusion about the status of the measures, their start date, how to complete 2018 company tax returns and at what rate companies should be franking their distributions.

This Blog examines the effect of the new measures now that the dust has finally started to settle. But a question remains: do we finally have certainty on the tax law regarding which companies are entitled to the lower tax rate?

![]() Note

Note

This article does not consider the measures contained in the Treasury Laws Amendment (Enterprise Tax Plan No. 2) Bill 2017 which proposed to extend the corporate tax cuts to companies with an aggregated turnover of $50 million or more from 1 July 2019. This Bill was defeated in the Senate on 22 August 2018, and the Government has stated that it will not be taking this policy to the next election.

What is the new law?

The core purpose of the BRE Act is to ensure that ‘passive investment companies’ cannot access the lower tax rate in an income year; instead, they will be taxed at 30 per cent. As a fair corollary, these companies can frank distributions made in the following year at 30 per cent.

The Government’s term ‘passive investment company’ referred to in its Media release of 4 July 2017 does not appear in the BRE Act but the concept is represented by a ‘bright line’ test. This test deems a company to be ‘passive’ for a particular income year if more than 80 per cent of its assessable income comprises specific types of ‘passive’ income. The ‘bright line’ test has no regard for actual activity, intention, assets or profitability. Further, the Commissioner of Taxation has no discretion to grant an exception.

The new measures have retrospective effect from 1 July 2017 (or the first day of a company’s 2017–18 income year if the company is a substituted accounting period taxpayer).

The definition of ‘base rate entity’ from 1 July 2017

Previously legislated definition of ‘base rate entity’

The Treasury Laws Amendment (Enterprise Tax Plan) Act 2017 (enacted on 19 May 2017) introduced the concept of Base rate entity (BRE) and inserted s. 23AA into the Income Tax Rates Act 1986 (the ITR Act).

Former s. 23AA of the ITR Act provided that a company is a BRE for an income year if:

![]() Note

Note

The meaning of ‘aggregated turnover’ is defined in s. 328-115 of the ITAA 1997 to be the total of the ‘annual turnovers’ of the taxpayer and any entity that is connected with (as defined in s. 328-125), or is an affiliate of (as defined in s. 328-130), the taxpayer at any time during the income year.

‘Annual turnover’ is defined in s. 328-120 to be the total ordinary income that the entity derives in the income year in the ordinary course of carrying on a business.

It excludes amounts:

Adjustments are also made where the business is carried on for part of an income year only.

The ATO’s draft ruling TR 2017/D7 explains when a company carries on a business within the meaning of former s. 23AA of the ITR Act. This crucial ruling, albeit in draft, takes a very broad position of what constitutes ‘carrying on a business’ by a company, and contains examples whose tax outcomes have surprised many readers of the ruling.

![]() Important

Important

Now that a company no longer has to ‘carry on a business’ to be a BRE, the question is: what is the purpose now of TR 2017/D7? It is not directly relevant to s. 23AA (although it may still be indirectly relevant because the meaning of ‘aggregated turnover’ is based on ‘ordinary income that the entity derives … in the ordinary course of carrying on a business’).

Further, the ATO has indicated that TR 2017/D7, when finalised, will also more broadly to SBEs which, under s. 328-110, are required to carry on a business.

The Treasury heeded the tax community’s concern over the inherent uncertainty of the requirement to ‘carry on a business’ to access the lower tax rate. In response, the BRE Act removes that uncertainty — by repealing the requirement in its entirety from the definition of a BRE. Instead, the ‘carrying on a business’ test has now been replaced with a passive income test.

New definition of ‘base rate entity’

The BRE Act amends the meaning of a BRE from 1 July 2017 so that, under the new law, a company is a BRE under s. 23AA of the ITR Act if it satisfies two requirements:

Under new s. 23AB of the ITR Act, the following types of income are BREPI:

![]() Note

Note

The ATO has issued a draft Law Companion Ruling LCR 2018/D7 which explains the meaning of these terms.

Implications of the new passive income (BREPI) test

The following table sets out some of the key points in relation to the new BREPI test.

| Issue | Discussion |

| Do grouping rules apply? | No grouping rules apply for the BREPI test — the company’s BREPI and assessable income are measured on a standalone basis. Amounts derived by connected entities and affiliates are not taken into account.

In contrast, when determining whether the company’s aggregated turnover exceeds the threshold, grouping rules apply — that is, the annual turnovers of entities that are connected with, or are affiliates of, the company are aggregated with the company’s annual turnover. |

| Which year? | When working out a company’s aggregated turnover:

|

| What income is included? | ‘Aggregated turnover’ includes only ordinary income derived in the ordinary course of carrying on a business, with certain adjustments.

‘Assessable income’ is the company’s gross assessable income and includes both ordinary income and statutory income. ‘BREPI’ comprises the seven categories of passive income listed above (see s. 23AB of the ITR Act). |

| Non-portfolio dividends: para. (a) | The ATO has confirmed in draft Law Companion Ruling LCR 2018/D7 that a trust cannot receive a non-portfolio dividend. This is because the definition of a non-portfolio dividend in s. 317 of the ITAA 1936 requires a company to have a voting interest in another company of at least 10 per cent.

This means that where the shares in a company are held by a trust, which distributes the dividend income to a corporate beneficiary (CorpBen) (assume CorpBen has no other income), the income will be taxed in the hands of CorpBen at the rate of 30 per cent, because its income will be passive in nature. |

| Interest: para. (d) | Interest is not treated as BREPI if it is derived by:

All other interest income, including that received on overdue debtors, loan accounts, bank accounts, term deposits etc. is treated as BREPI. It does not matter if the interest is derived in the ordinary course of business. |

| Royalties: para. (d) | ‘Royalties’ has the meaning given by s. 6(1) of the ITAA 1936 which extends the ordinary meaning of royalties to include specified payments, such as the right to use industrial, commercial or scientific equipment.

Certain licence fees can constitute royalties, so it will be important to correctly characterise the nature of these payments. See the following ATO rulings for further guidance on the meaning of royalties: |

| Rent: para. (d) | ‘Rent’ means the consideration payable by a tenant to a landlord for the exclusive possession and use of land or premises.

As rent takes its ordinary meaning, there are no statutory income tax law exceptions that apply in contrast to the definition for interest (or payments in the nature of interest). The Commissioner’s view and examples on when consideration paid for the use of land or premises will be rent for this purpose are set out in TD 2006/78. All rental income is taken to be BREPI. There is no carve-out for companies that derive rental income in the course of carrying on a business of renting properties. This is similar to the active asset test in s. 152-40(4)(e) of the ITAA 1997 which prevents assets whose main use is to derive rent from being an active asset. Reimbursement of outgoings Reimbursement by tenants of outgoings incurred by landlords would generally not be considered rent, so it will be important to correctly characterise the nature of payments received from tenants as rent (which constitutes BREPI) or reimbursement of outgoings so that the BREPI of the company can be correctly calculated. Regard should also be had to the Retail Leases Act 2003 (Vic) (at least in Victoria) or the applicable interstate equivalent in relation to restrictions which may apply to landlords seeking reimbursement from their retail lease tenants of certain outgoings. |

| Net capital gains: para. (f) | Net capital gains (after applying capital losses and the small business concessions: see below), are included as BREPI, regardless of whether the asset giving rise to the capital gain was an active asset or used in carrying on a business. |

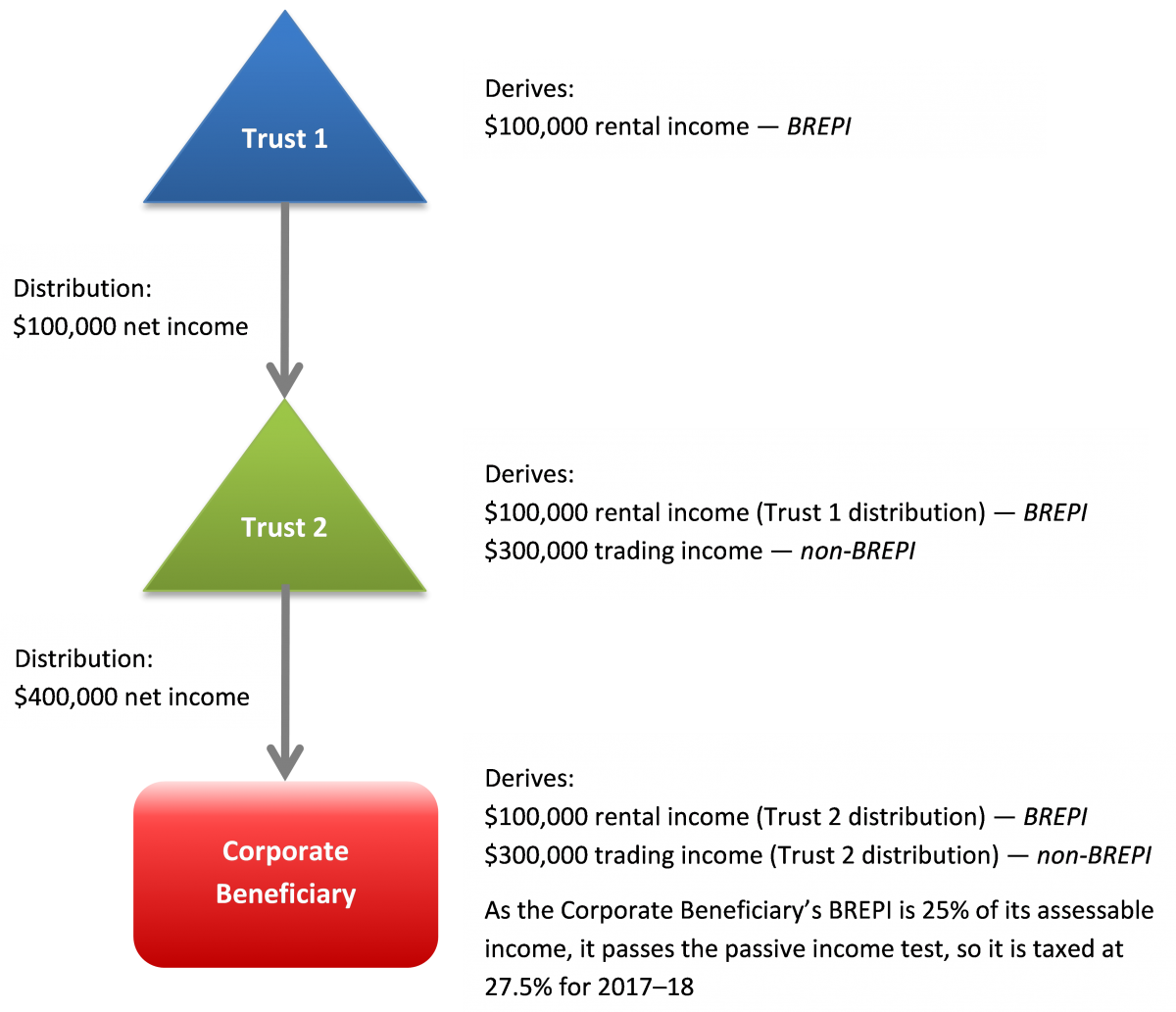

| Distributions from partnerships and trusts: para. (g) | A question often asked is: What tax rate applies to a corporate beneficiary?

This discussion is confined to trust distributions but the principles apply equally to distributions from partnerships. Broadly, the answer lies in the character of income received from the trust. Under the new rules, the character of income derived by a trust flows through the trust for this purpose. So if the distribution from the trust comprises at least 20 per cent business income, then assuming the distribution is the only income of the corporate beneficiary, the company will not have BREPI that is more than 80 per cent of its assessable income, so it will be taxed at 27.5 per cent. However, if the trust distribution instead comprises rent, interest, dividends, royalties, capital gains etc. then the company’s BREPI will exceed 80 per cent of its assessable income, so the company will be taxed at 30 per cent. Under the new BREPI test, a trust distribution received by a corporate beneficiary must be dissected into its:

The BRE Act explicitly clarifies that income will retain its BREPI/non-BREPI character when it flows through a chain of trusts or partnerships. (See the example below) |

| Gross or net income? | Where the BREPI derived directly by a company is:

the gross amount should be included in the BREPI test. However, where the BREPI derived by a company is:

This is because, in the case of capital gains and distributions, it is the net amount that is included in the company’s assessable income, not the gross amount. |

| What tax rate applies if both types of income are derived? | The new BREPI test is one of the two mandatory eligibility requirements for the lower tax rate. The company’s entire taxable income will be taxed at one rate, whether that be 27.5 per cent or 30 per cent. A company will never have its BREPI taxed at 30 per cent and its business income taxed at 27.5 per cent. |

Example:

* ignoring deductions

In this illustration, the corporate beneficiary is taxed at the lower 27.5 per cent tax rate for 2017–18 as it satisfies both of the eligibility criteria to be a BRE:

| BREPI test | BREPI = 25 per cent of the company’s assessable income:

BREPI = $100,000 (i.e. attributable to rental income distributed from Trust 1 via Trust 2) Assessable income = $400,000 (i.e. Trust 2 distribution) The BREPI test is satisfied as 25 per cent is not greater than 80 per cent. |

| Aggregated turnover test | It is assumed that the corporate beneficiary’s aggregated turnover — including the turnovers of any connected entities and affiliates — is less than $25 million in 2017–18. |

Implications

Implications

In relation to trust distributions, the tax law only recognises the streaming of net capital gains and franked distributions to beneficiaries. Other classes of income cannot be separated and distributed to different beneficiaries. However, the manner in which capital gains and franked distributions are distributed to beneficiaries may affect whether a corporate beneficiary satisfies the new 80 per cent passive income test.

Further, the corporate beneficiary will need to trace up through a chain of one or more interposed partnerships or trust estates to determine the extent to which the distribution is attributable or not to BREPI. We have suggested to the ATO that new labels which identify the amount of BREPI included in a partnership or trust distribution should be included in tax returns so that the ultimate corporate beneficiary can calculate its BREPI as a proportion of its total assessable income for an income year. However, there are no such labels in the 2018 tax returns.

New label on 2018 company tax return

2017 company tax return form

In the 2017 company return form, label F1 determined the tax rate that applied to the company’s taxable income in the calculation statement. If the company was an SBE in 2016–17 (based on the company carrying on a business and having an aggregated turnover in 2015–16 or 2016–17 of less than $10 million), label F1 should have been marked × — this would calculate the tax at the rate of 27.5 per cent.

If label F1 was left blank, the tax rate was 30 per cent.

2018 company tax return form

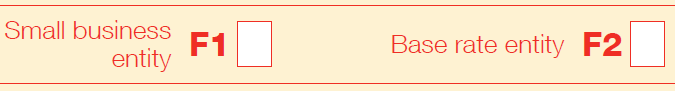

The 2018 company return form contains a new label: F2.

Label F1 should still be marked × if the company is an SBE in 2017–18 (which enables it to access a range of small business tax concessions such as the instant asset write off for assets that cost less than $20,000).

However, label F1 no longer determines the company’s tax rate. This is determined by label F2 which should be marked × if the company is a BRE under s. 23AA of the ITR Act. This will calculate the tax at the rate of 27.5 per cent. If label F2 is left blank, the tax rate will calculate at 30 per cent.

![]() Note

Note

We understand that tax practitioners’ tax return software does not produce a validation error if label F2 is crossed incorrectly. For example, if turnover of $50 million is reported at item 6 (income) and label F2 is marked ×, the tax still calculates at the rate of 27.5 per cent which is clearly incorrect. The taxpayer/agent needs to determine whether a company satisfies the conditions to be a BRE and correctly indicate this at label F2.

Additional assumptions for maximum franking rate calculation

The way in which a company’s maximum franking rate is determined changed on 1 July 2016 and has changed again from 1 July 2017.

Position before 1 July 2016

Up to and including the 2015–16 income year, a company’s maximum franking rate for a franked distribution paid in 2015–16 was 30 per cent, regardless of whether the company was an SBE (i.e. regardless of whether its corporate tax rate was 28.5 per cent or 30 per cent).

The franking credit attaching to a distribution was calculated as simply:

the amount of the frankable distribution × 30/70

Position for 2016–17

The law changed from 1 July 2016. For franked distributions paid in the 2016–17 income year, a company’s maximum franking rate is determined by its corporate tax rate for imputation purposes (CTR for imputation purposes) which is taken to be the company’s corporate tax rate for that income year, worked out on the assumption that its aggregated turnover for 2016–17 is equal to its aggregated turnover for 2015–16.

Practically, this means that the company will frank a distribution paid in 2016–17 using the rate of:

Position from 1 July 2017

The BRE Act changed the law again from 1 July 2017.

For distributions paid in the 2017–18 income year, a company’s maximum franking rate is still determined by its CTR for imputation purposes which is taken to be the company’s corporate tax rate for that income year, but now worked out on the following three assumptions:

Practically, this means that company’s maximum franking rate for a franked distribution paid in 2017–18 is 27.5 per cent if:

The company’s maximum franking rate for a franked distribution paid in 2017–18 is 30 per cent if either or both of the following apply:

ATO compliance and administrative approach

On 25 July 2018, the ATO released draft Practical Compliance Guideline PCG 2018/D5 which provides guidance on the ATO’s compliance and administrative approach for companies that have faced practical difficulties and uncertainty in determining their franking rate for the 2016–17 and 2017–18 income years.

Corporate tax rate for 2015–16 and 2016–17

Given the uncertainty around what constitutes ‘carrying on a business’ prior to the release of TR 2017/D7, the Commissioner will not allocate compliance resources specifically to conduct reviews of whether companies have applied the correct tax rate in the 2015–16 and 2016–17 income years.

Franking rate for 2016–17 and 2017–18

The Commissioner will not impose penalties on the company for giving a member an incorrect distribution statement provided it gives written notice to each of its members clearly showing the correct amount of the franking credit. The notice should be provided in the same way as the distribution statement was provided (this may be electronically by email).

The company can provide this notice to their members without seeking an exercise of the Commissioner’s discretion to allow the distribution statement to be amended (which is ordinarily required).

Summary tables — tax rates and franking rates

The corporate tax rates and franking rates for 2017–18 are summarised in the tables below.

NEW LAW — Corporate tax rate for 2017–18

| Aggregated turnover | BREPI for 2017–18 ≤ 80% of assessable income for 2017–18 | BREPI for 2017–18 > 80% of assessable income for 2017–18 |

| Less than $25 million in 2017–18 | Tax rate: 27.5% | Tax rate: 30% |

| $25 million or more in 2017–18 | Tax rate: 30% | Tax rate: 30% |

NEW LAW — Maximum franking rate for a distribution paid in 2017–18

| Aggregated turnover | BREPI for 2016–17 ≤ 80% of assessable income for 2016–17 | BREPI for 2016–17 > 80% of assessable income for 2016–17 |

| Less than $25 million in 2016–17 | Maximum franking rate: 27.5%

(The maximum franking rate of a dormant company is 27.5%) |

Tax rate: 30% |

| $25 million or more in 2016–17 | Maximum franking rate: 30% | Maximum franking rate: 30% |

Join thousands of savvy Australian tax professionals and get our weekly newsletter.