[lwptoc]

The ATO has subsequently advised that for the JobKeeper fortnights starting 28 September 2020 and 12 October 2020 only, employers will have until 31 October 2020 to meet the wage condition for all employees included in the JobKeeper scheme.

On 15 September 2020, the Treasurer registered a Legislative Instrument titled the Coronavirus Economic Response Package (Payments and Benefits) Amendment Rules (No. 8) 2020 (the Amendment Rules No. 8), accompanied by an Explanatory Statement, which amends the Legislative Instrument titled the Coronavirus Economic Response Package (Payments and Benefits) Rules 2020.

The Amendment Rules No. 8 give effect to the following changes to the JobKeeper Scheme which were announced on 21 July 2020 and 7 August 2020, being the introduction of:

Note – Recent developments

Note – Recent developments

This article provides an overview of the key changes to the JobKeeper Payment scheme introduced by the Amendment Rules No. 8.

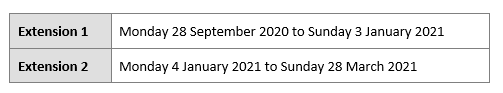

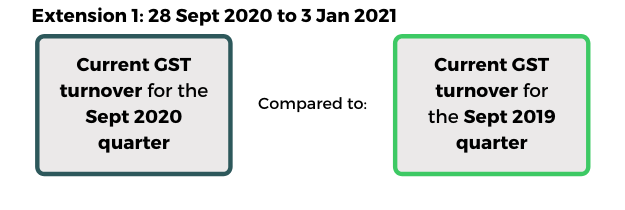

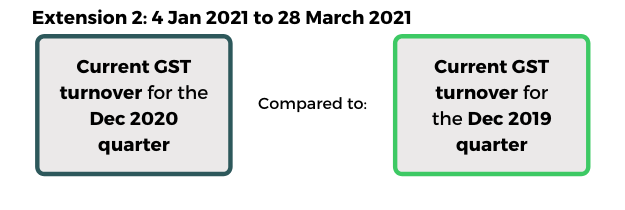

There will be two extensions to the JobKeeper scheme — which was previously legislated to end on Sunday 27 September 2020 — as follows:

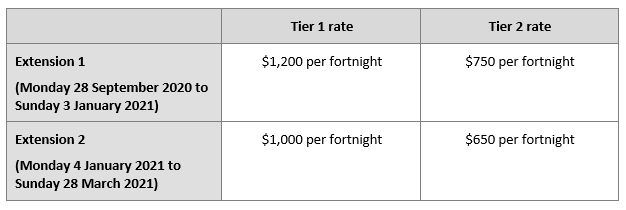

From 28 September 2020, the payment rate will be split into a Tier 1 rate (i.e. the higher rate) and a Tier 2 rate (i.e. the lower rate). Further, both Tier 1 and Tier 2 payment rates will be reduced in two tranches as follows:

The payment rates apply to all individuals eligible for JobKeeper payments — i.e. eligible employees, eligible business participants and eligible religious practitioners.

![]() Note:

Note:

In this article, a reference to an eligible employee includes a reference to an eligible business participant and an eligible religious practitioner unless stated otherwise. Similarly, a reference to an eligible employer includes a reference to an eligible business (of which the individual is a business participant) and a registered religious institution unless stated otherwise.

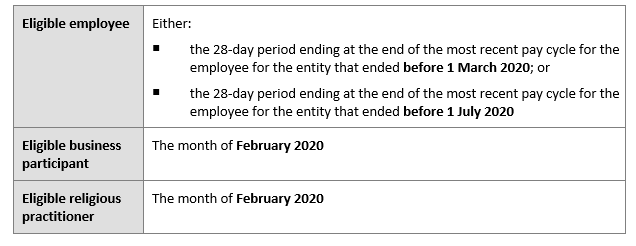

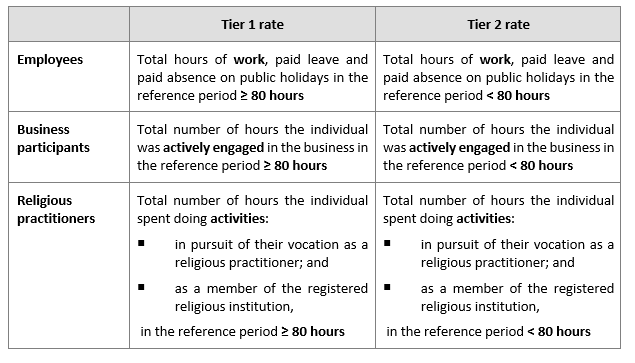

The two-tier payment system will apply to each employee based on their total working hours in the applicable ‘reference period’.

The reference period for an individual is determined as follows:

The Commissioner may determine that an alternative reference period applies to a specified class of individuals where he considers that the relevant reference period set out above may not be suitable.

The payment tiers will apply as follows:

![]() Notes

Notes

The employer must:

From 28 September business will need to apply a new actual decline in turnover test in addition to the existing decline in turnover test.

The new ‘actual decline in turnover test’ will operate as follows:

![]() Implications

Implications

Key differences to the existing decline in turnover test include that:

The Commissioner may determine that certain supplies or classes of supplies are to be treated as being wholly or partly made at a particular time.

The Explanatory Statement notes that it is expected the Commissioner will determine that most or all supplies will be treated as being made at a time in the period to which they are attributable for GST reporting purposes — i.e. it is likely that businesses will generally be able to assess eligibility based on details reported in their Business Activity Statement (BAS).

At the time of writing, the ATO has not released details of whether and how the Commissioner will exercise his discretionary powers under the Amendment Rules No. 8 or how it intends to administer aspects of the extensions.

The ATO will update its JobKeeper Payment webpages (QC 62125) when more information becomes available. TaxBanter will communicate key developments through our social media channels and through this blog. You can subscribe for updates at the bottom of this page, and follow us on LinkedIn so you don’t miss out!

Upcoming webinar

Upcoming webinar

Interested in learning more about the JobKeeper extensions? Join two of our Senior Tax trainers on Wednesday, 16 September. We’ll cover:

You can learn more about JobKeeper Extended here or through the link below.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.