[print-me]

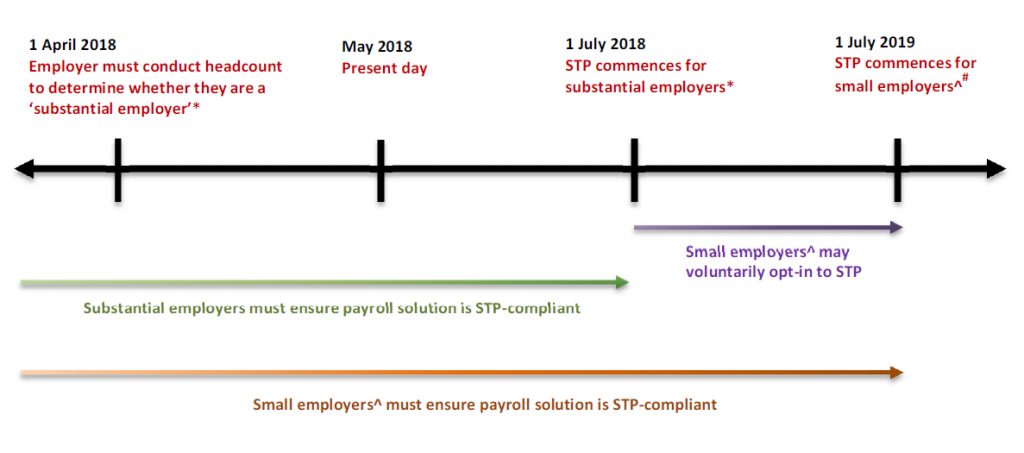

On 1 July 2018 Single Touch Payroll (STP) will commence for ‘substantial employers’ which had at least 20 employees on 1 April 2018.

This article contains some practical action points to take between now and 30 June 2018 so that your clients’ businesses — or your own business — is ready for STP.

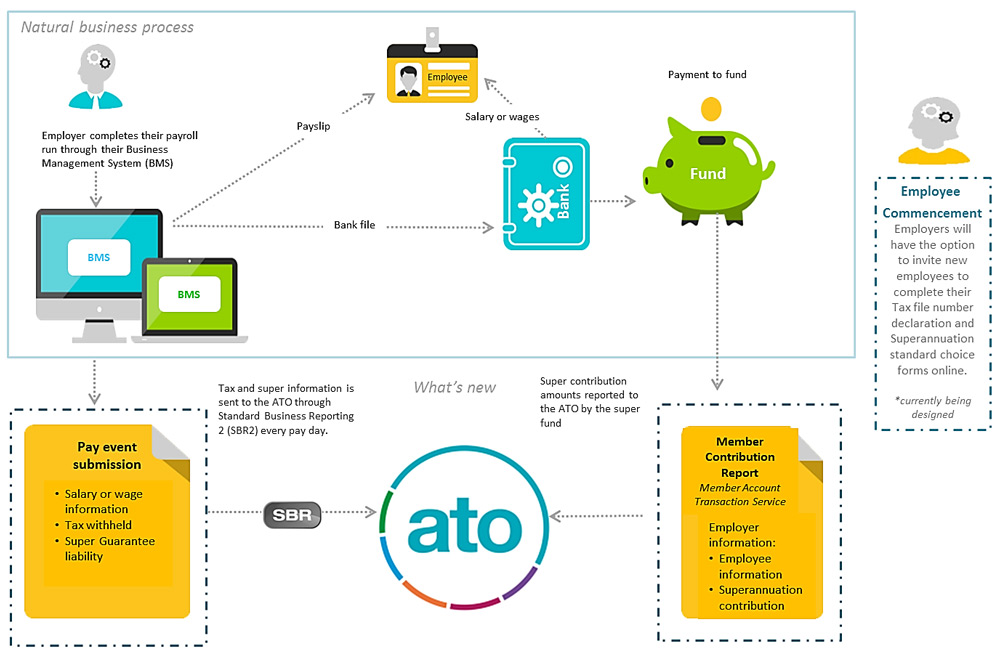

Source: ATO

Employers will use STP-enabled software to electronically report payroll and superannuation liability information to the ATO at the time that employees are paid their salaries, wages, allowances, bonuses etc.

For more information on how STP will operate, refer to:

The ATO ran a STP Employer Engagement event, tailored for employers, which was live streamed on 16 November 2017. The recording and slidepacks are available here.

On Friday 4 May 2018, the ATO hosted a free STP Tax Practitioner Engagement Forum which was live streamed. During this event, ATO and industry representatives provided practical guidance to help tax practitioners and their clients implement STP. The two Q&A expert and small business panels were facilitated by Taxbanter’s own Robyn Jacobson, Senior Tax Trainer. If you were unable to tune in for the live event — or want to see it again! — check this page soon as the ATO will upload videos and slidepacks from the event.

[fusion_table]

| Has an employee headcount as at 1 April 2018 been conducted? | |

|---|---|

| Yes – ensure the supporting documentation is retained with other STP material | |

| No – do it now! Follow the ATO guidelines | |

| Is the headcount 19 or fewer? | |

| Yes – STP is not mandatory, but keep an eye on news updates as there is currently a Bill before Parliament which proposes to make STP compulsory for small employers from 1 July 2019 |

|

| No – consider whether you may be eligible for an exemption or a deferral | |

| The organisation | |

| Appoint one or more staff members as the STP specialist(s) for the organisation | |

| STP specialist(s) to receive in-depth STP training (e.g. from the ATO, Taxbanter or software provider) | |

| Provide tailored training for other staff | |

| Decide whether to use an STP-compliant software package in-house or to outsource STP lodgments to a third party (e.g. payroll service provider, tax agent, BAS agent) | |

| Ensure organisation is up to date with PAYG withholding, SG payments and reporting obligations | |

| Ask all staff to confirm that their personal payroll details are up to date | |

| Backup payroll data in existing payroll software | |

| Process any currently outstanding backpay or payroll adjustments before 1 July 2018 | |

| Decide whether the organisation will voluntarily report reportable fringe benefits amounts and reportable superannuation contributions under STP | |

| Decide whether the organisation will voluntarily issue payment summaries for the year ended 30 June 2019 (to assist employees in transitioning to using ATO Online) | |

| Using an in-house STP-compliant software package (if relevant) | |

| Select a software provider and specific product | |

| Confirm with the software provider that the product has received ATO approval | |

| Check with the software provider whether the product has received a software provider deferral from the ATO — if so, obtain the Deferral Reference Number and new STP start date | |

| Ask for the software provider’s implementation timeline for the chosen product | |

| Organise trial runs, data migration etc. with the software provider | |

| Outsourcing STP lodgments (if relevant) | |

| Select a third party to lodge STP reports | |

| Confirm which software package the third party will use and that the product has been approved by the ATO | |

| Check whether the third party has been granted (or has applied for) a deferral | |

| Confirm scope of services | |

| Ask for the third party’s implementation timeline | |

| Organise trial runs, data transfer etc. with the third party |

[/fusion_table]

Watch the videos and download the slidepacks from the ATO’s STP Tax Practitioner Engagement Forum held on Friday 4 May 2018 here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.