Our Banter blog on the changes to the Base rate entity rules in November 2017 detailed the measures contained in the Treasury Laws Amendment (Enterprise Tax Plan Base Rate Entities) Bill 2017 (‘the Bill’) which propose to improve the current law by setting a ‘bright line’ test to determine which companies are eligible for the lower tax rate.

Clarity on these measures continues to elude tax practitioners and there is now increased confusion because the Bill was not passed by the Senate before it adjourned for the Winter recess on 28 June 2018. The 2018 tax compliance season is now formally underway, yet the measures which are proposed to start on 1 July 2017 remain unenacted … at least until Monday 13 August 2018, when Parliament returns for the Spring Parliamentary sittings. However, there is no assurance that the Bill will be passed by the Senate even in August; it may be many more months before we have certainty on the tax law regarding which companies are entitled to the lower tax rate.

This raises a profound question: on what basis should 2018 company tax returns be completed?

![]() Note

Note

This discussion does not consider the measures contained in the Treasury Laws Amendment (Enterprise Tax Plan No. 2) Bill 2017 which proposes to extend the corporate tax cuts to companies with an aggregated turnover of $50 million or more from 1 July 2019. This Bill remains before the Senate.

On 25 July 2018, the ATO released draft practical compliance guideline PCG 2018/D5 which provides guidance on the ATO’s compliance and administrative approach for companies that have faced practical difficulties and uncertainty in determining their tax rate for the 2015–16 and 2016–17 income years. This will be discussed in our next Banter Blog.

The ATO provides the following guidance (QC 48880) on its administrative treatment for companies completing 2018 tax returns:

In the event that the Treasury Laws Amendment (Enterprise Tax Plan Base Rate Entities) Bill 2017 … does not pass, the existing law will continue to apply, as described below.

Companies should prepare their 2017–18 income tax returns under the existing law. To qualify for the lower 27.5% tax rate in the 2017–18 income year, a company must meet the existing base rate entity definition which requires them to:

- have an aggregated turnover of less than $25 million, and

- be carrying on a business.

If there are changes to this law (as proposed in the Treasury Laws Amendment (Enterprise Tax Plan Base Rate Entities) Bill 2017), companies may need to amend their 2017–18 company tax returns.

The ATO also provides the following guidance (QC 56206) on completing 2018 company tax returns:

Proposed law changes affecting eligibility for the lower company tax rate have not yet passed.

This means the lower 27.5% tax rate continues to apply to your clients who are base rate entities as defined under the current law.

A company was a base rate entity for the 2017–18 income year if it:

- carried on a business

- had an aggregated turnover of less than $25 million.

When completing your eligible clients’ 2018 company tax returns, you must:

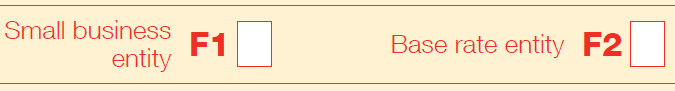

- select label F2 Base rate entity at item 3 Status of company

- use the lower 27.5% tax rate on their calculation statement at label T1 Tax on taxable or net income.

The tax rate is 30% for companies that are not base rate entities.

Explanation for determining the correct tax rate

In the 2015–16 and 2016–17 income years, a company was eligible for the lower corporate tax rate (28.5 per cent in 2015–16 and 27.5 per cent in 2016–17) if the company was a small business entity (SBE) as defined in s. 328-110 of the ITAA 1997.

This broadly requires the company to:

![]() Note

Note

Aggregated turnover means total ordinary income that the company derives in the income year in the ordinary course of carrying on a business (‘annual turnover’) and includes the annual turnover of affiliates and entities connected with the company, but excludes:

The Treasury Laws Amendment (Enterprise Tax Plan) Act 2017 (enacted on 19 May 2017) introduced the concept of the Base rate entity (BRE), contained in s. 23AA of the Income Tax Rates Act 1986 (ITR Act).

Under s. 23AA of the ITR Act, a company is a BRE for an income year if:

![]() Note

Note

The aggregated turnover threshold for BREs increased to $50 million from 1 July 2018.

![]() Important

Important

The ATO has issued a draft ruling, TR 2017/D7, which explains when a company carries on a business within the meaning of s. 23AA of the ITR Act (i.e. one of the current conditions to be a BRE). This crucial ruling, albeit in draft, takes a very broad position of what constitutes ‘carrying on a business’ by a company, and is therefore very relevant to the completion of 2018 company tax returns.

For reasons which were articulated in a previous Banter blog, the Government announced during 2017 that it would amend the existing law to clarify that a company will not qualify for the lower corporate tax rate if at least 80 per cent of its income is of a passive nature.

The Bill was introduced into Parliament on 18 October 2017 and proposes to amend s. 23AA of the ITR Act to replace the ‘carries on a business’ condition to be a BRE with a new passive income test.

Under the proposed test, a company will be a BRE if — in addition to satisfying the aggregated turnover test — its Base rate entity passive income (defined in proposed s. 23AB of the ITR Act) does not exceed 80 per cent of its assessable income.

This Bill remains unenacted despite its proposed start date of 1 July 2017. The ATO’s advice (see above) is to apply the existing law when completing 2018 company tax returns, which means that the lower tax rate of 27.5 per cent continues to apply to those companies which are BREs as defined under the current law.

If the Bill is enacted in August, only a minority of 2018 company returns will have been lodged by then, so perhaps it may be still workable for the legislative amendments to apply retrospectively from 1 July 2017. However, if the Bill remains unenacted for the remainder of this year and is not enacted until late this year or even into 2019, it is unreasonable to expect taxpayers to amend tax returns they have already lodged that were based on the existing law at the time. In this case, a revised start date of 1 July 2018 would be appropriate.

This question is not easily answered because, like the company tax rate, the way in which a company’s franking rate is determined changed on 1 July 2016 and is proposed to change again from 1 July 2017.

On 25 July 2018, the ATO released draft practical compliance guideline PCG 2018/D5 which provides guidance on the ATO’s compliance and administrative approach for companies that have faced practical difficulties and uncertainty in determining their franking rate for the 2016–17 and 2017–18 income years. This will be discussed in our next Banter Blog.

Up to and including the 2015–16 income year, a company franked a distribution paid in 2015–16 using the rate of 30 per cent, regardless of whether the company was an SBE (i.e. regardless of whether its corporate tax rate was 28.5 per cent or 30 per cent).

The franking credit attaching to a distribution was calculated as simply:

the amount of the frankable distribution × 30/70

The law changed from 1 July 2016. For distributions paid in the 2016–17 income year, a company’s franking rate is determined based on its corporate tax rate for imputation purposes — which is taken to be the company’s corporate tax rate for that income year, worked out on the assumption that its aggregated turnover for 2016–17 is equal to its aggregated turnover for 2015–16.

Practically, this means that the company will frank a distribution paid in 2016–17 using the rate of:

For distributions paid in the 2017–18 income year, the current law provides that, just like 2016–17, a company’s franking rate is determined based on its corporate tax rate for imputation purposes — which is currently taken to be the company’s corporate tax rate for that income year, worked out on the assumption that its aggregated turnover for 2017–18 is equal to its aggregated turnover for 2016–17.

Practically, this means that the company will frank a distribution paid in 2017–18 using the rate of:

The Bill proposes to change the law again from 1 July 2017.

For distributions paid in the 2017–18 income year, a company’s franking rate is still determined by its corporate tax rate for imputation purposes — which is taken to be the company’s corporate tax rate for that income year, but worked out on the following two assumptions:

Practically, this means that the company will frank a distribution paid in 2017–18 using the rate of 27.5 per cent if:

The company will frank a distribution paid in 2017–18 using the rate of 30 per cent if either or both of the following apply:

New label on 2018 company tax return

In the 2017 company return form, label F1 determined the tax rate that applied to the company’s taxable income in the calculation statement. If the company was an SBE in 2016–17 (based on the company carrying on a business and having an aggregated turnover in 2015–16 or 2016–17 of less than $10 million), label F1 should have been marked × — this would calculate the tax at the rate of 27.5 per cent.

If label F1 was left blank, the tax rate was 30 per cent.

The 2018 company return form contains a new label: F2.

Label F1 should still be marked × if the company is an SBE in 2017–18 (which enables it to access a range of small business tax concessions such as the instant asset write off for assets that cost less than $20,000).

However, label F1 no longer determines the company’s tax rate. This is determined by label F2 which should be marked × if the company is a BRE under existing s. 23AA of the ITR Act. This will calculate the tax at the rate of 27.5 per cent. If label F2 is left blank, the tax rate will calculate at 30 per cent.

![]() Note

Note

It is our understanding that practitioners’ tax return software does not produce a validation error if label F2 is crossed incorrectly. For example, if turnover of $50 million is reported at item 6 (income) and Label F2 is marked ×, the tax will still calculate at the rate of 27.5 per cent, which is clearly incorrect. The taxpayer/agent needs to manually determine whether a company satisfies the conditions to be a BRE under the existing law and correctly indicate this at label F2.

Summary tables — corporate tax rates and franking rates

The corporate tax rates and franking rates are summarised in the tables below.

CURRENT LAW

— Corporate tax rate for 2017–18

— Franking rate for a distribution paid in 2017–18

| Aggregated turnover | Carries on a business in 2017-18 | Does not carry on a business in 2017-18 |

| Less than $25 million in 2017-18 | Tax rate: 27.5% | Tax rate: 30% |

| $25 million or more in 2017-18 | Tax rate: 30% | |

| Less than $25 million in 2016-17 | Franking rate: 27.5% | Franking rate: 30%

(The franking rate of a dormant company is 30%) |

| $25 million or more in 2016-17 | Franking rate: 30% |

* The ATO advises that 2018 company tax returns should be completed based on the current law.

PROPOSED LAW — Corporate tax rate for 2017–18

| Aggregated turnover | BRE passive income for 2017–18 ≤ 80% of assessable income for 2017–18 |

BRE passive income for 2017–18 > 80% of assessable income for 2017–18 |

| Less than $25 million in 2017-18 | Tax rate: 27.5% | Tax rate: 30% |

| $25 million or more in 2017-18 | Tax rate: 30% | Tax Rate: 30% |

PROPOSED LAW — Franking rate for a distribution paid in 2017–18

| Aggregated turnover | BRE passive income for 2016–17 ≤ 80% of assessable income for 2016–17 |

BRE passive income for 2016–17 > 80% of assessable income for 2016–17 |

| Less than $25 million in 2016-17 | Franking rate: 27.5%

(The franking rate of a dormant company is 27.5%) |

Franking rate: 30% |

| Less than $25 million in 2016-17 | Franking rate: 30% | Franking rate: 30% |

Join thousands of savvy Australian tax professionals and get our weekly newsletter.