The ATO has released its interim Decision Impact Statement (the interim DIS) in relation to the Tribunal decision in Bendel v FCT [2023] AATA 3074 (Bendel). Bendel concerned whether a private company’s failure to call for payment of entitlements to income of a trust was the provision of ‘financial accommodation’ and, therefore, a loan for Div 7A purposes (s. 109D of the ITAA 1936). The interim DIS sets out the ATO’s administrative treatment pending the outcome of the Commissioner’s appeal against the Tribunal’s decision.

The Primary Issue considered by the Tribunal was whether the Company made a loan — within the meaning of s. 109D(3) — to the Trust during each of the 2014 to 2017 income years on account of the Company’s unpaid present entitlements (UPEs) to trust income of the previous year.

The Tribunal decided that the Company did not make a loan to the trustee of the Trust.

Therefore there was no deemed dividend paid by the Company to the Trust under s. 109D(1).

The Tribunal reasoned that a ‘loan’ did not reach so far as to embrace the rights in equity created when entitlements to trust income (or capital) were created but not satisfied and remained unpaid. The balance of an UPE of a corporate beneficiary, whether held on a separate trust or otherwise, was not a loan to the trustee of the Trust.

On 26 October 2023, the Commissioner lodged a notice of appeal to the Federal Court against the Tribunal’s decision in respect of the Primary Issue.

Until the appeal process is finalised, the Commissioner does not intend to review the current ATO views relating to private company entitlements to trust income. These views are set out in TD 2022/11 Income tax: Division 7A: when will an unpaid present entitlement or amount held on sub-trust become the provision of ‘financial accommodation’?

Note: in addition to the application of s. 109D, the basis on which private company beneficiaries deal with UPEs may have implications under other rules, such as s. 100A.

The interim DIS sets out the ATO’s administrative treatment pending the outcome of the appeal process.

The ATO will administer the law in accordance with the published views in TD 2022/11.

The Commissioner does not propose to finalise objection decisions in relation to past year assessments where the decision turns on whether or not a UPE was a s. 109D(3) loan.

However, if a decision is required to be made (e.g. because a taxpayer gives notice requiring the Commissioner to make an objection decision), any objection decisions made will be based on the ATO’s existing view of the law.

109D(1) Loans treated as dividends in year of making.

A private company is taken to pay a dividend to an entity at the end of one of the private company’s years of income (the current year ) if:

(a) the private company makes a loan to the entity during the current year; and

(b) the loan is not fully repaid before the lodgment day for the current year; and

…

109D(3) What is a loan?

In this Division, loan includes:

(a) an advance of money; and

(b) a provision of credit or any other form of financial accommodation; and

(c) a payment of an amount for, on account of, on behalf of or at the request of, an entity, if there is an express or implied obligation to repay the amount; and

(d) a transaction (whatever its terms or form) which in substance effects a loan of money.

[emphasis added]

TD 2022/11 describes when a private company provides financial accommodation where it is made presently entitled to income of a trust and either:

The phrase ‘financial accommodation’ in s. 109D(3)(b) has a wide meaning. It extends to cases where an entity with a trust entitlement has knowledge of an amount that it can demand and does not call for payment.

A private company beneficiary with a UPE, by arrangement, understanding or acquiescence, consents to the trustee retaining that amount to continue using it for trust purposes if the company:

This constitutes the provision of financial accommodation to the trustee. As a result, the private company beneficiary makes a loan to the trustee under the extended definition of a ‘loan’ in s. 109D(3).

The amount set aside by the trustee ceases to be an asset of the main trust and forms the corpus of the sub-trust (the sub-trust fund). The private company beneficiary has a new right to call for payment of the sub-trust fund and can call the sub-trust to an end. A choice by the private company not to exercise that right does not constitute financial accommodation in favour of the trustee in its capacity as trustee of the sub-trust, because the sub-trust fund is held for the private company beneficiary’s sole benefit.

However, the situation is different if the private company beneficiary by arrangement, understanding or acquiescence, consents to the sub-trustee allowing those funds to be used by or for the benefit of the private company beneficiary’s shareholder or their associate where:

This constitutes the provision by the private company beneficiary of financial accommodation to the entity using or benefiting from the use of the sub-trust fund under s. 109D(3)(b). As a result, the private company beneficiary makes a loan to the entity using the sub-trust fund under the extended definition of a ‘loan’ in s. 109D(3).

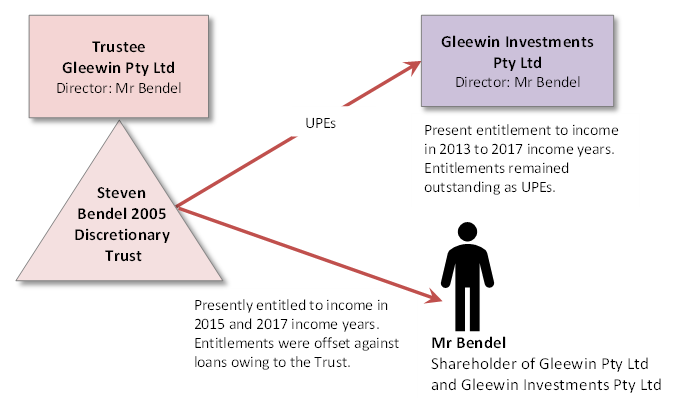

Mr Bendel controlled the Bendel Group of entities, which included the following:

The Commissioner issued amended assessments on the basis that the UPEs to prior year trust income were loans within the meaning of s. 109D(3), made by the Company to the Trust. The loans were taken to be dividends under s. 109D(1).

The Tribunal did not accept the contention (of both parties) that a separate trust arose in any conventional sense that had the effect of discharging or replacing the obligation to pay entitlements to income. The Company’s entitlements to be paid its share of the Trust’s income continued to exist.

The Tribunal found that the balance of the outstanding UPEs, whether held on a separate trust or otherwise, were not loans to the Trustee within the meaning of s. 109D(3).

The Tribunal based this conclusion on the following:

Apart from the Primary Issue, the Tribunal considered three other issues — summary below.

Whether s. 6-25 of the ITAA 1997 prevents a deemed dividend from being included in the Trust’s assessable income or, alternatively, the taxpyaer’s assessable incomes on the basis that the same amount has already been included in assessable income.

Consistent with its conclusion for the Primary Issue, the Tribunal found it unnecessary to decide this issue. Nonetheless, it observed that any deemed dividend would not be the ‘same amount’ as the amount previously included in the Company’s assessable income in respect of the UPE.

Whether the Tribunal will exercise the s. 109RB discretion (subject to the answers to the preceding issues).

The Tribunal found that loans (within the ordinary meaning of that term) of $41,252 and $9,431 had been made by the Company to the Trust. It considered no basis had been advanced for the exercise of the s. 109RB discretion in respect of those amounts.

Under s. 109RB the Commissioner may exercise a discretion to disregard the deemed payment of a dividend or that a deemed dividend may be franked.

Whether penalties have been imposed correctly and, if so, whether the Tribunal will remit them.

Based on the Tribunal’s decision regarding the application of section 109D to the UPEs, this issue was only relevant to the $41,252 and $9,431 ordinary loans. The Tribunal observed that ‘Mr Bendel is a registered tax agent to whom the outcome of retaining amounts belonging to a company should have been obvious’. It considered penalties respect of those amounts should be recalculated at the same rate and not remitted.

Section 100A of the ITAA 1936 applies where:

AND

![]() Note

Note

Section 100A effectively has an unlimited period of review — i.e. the Commissioner has an unlimited period in which to issue an assessment under the provision.

For further guidance on Section 100A, download our recorded session.

Thinking about your 2024 L&D?

NOW is the time to get organised! We offer online sessions, as well as workshops throughout Australia.

Purchase an entire series of training and save 15-25%.

Get our early bird pricing while it lasts.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.