Written by: Letty Chen | Senior Tax Writer

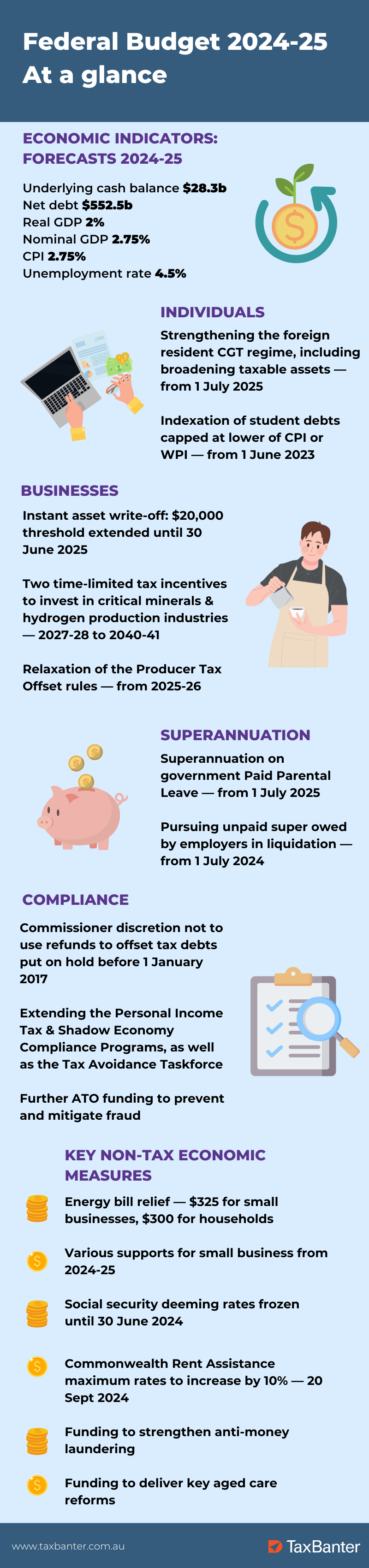

In the 2024–25 Federal Budget, the Government announced that it will make changes to the foreign resident CGT regime to ‘strengthen’ it and provide greater certainty about the operation of the rules. The proposed amendments will apply to CGT events happening on or after 1 July 2025.

The proposed amendments will:

The Government has not released technical details of these propose changes, although the Budget papers indicate the intentions of the amendments:

The measure will ensure that Australia can tax foreign residents on direct and indirect sales of assets with a close economic connection to Australian land, more in line with the tax treatment that already applies to Australian residents. The new ATO notification process will improve oversight and compliance with the foreign resident CGT withholding rules, where a vendor self‑assesses their sale is not taxable real property.

These reforms will also improve certainty for foreign investors by aligning Australia’s tax law for foreign resident capital gains more closely with OECD standards and international best practice.

This article will look at the current rules and where the changes may potentially be implemented.

Australian residents are subject to CGT on all of their CGT assets worldwide unless an exception applies to the asset. Foreign and temporary residents are subject to CGT only on five prescribed categories of CGT assets, which all have some connection to Australia — known as ‘taxable Australian property’ (TAP). More accurately, Div 855 of the ITAA 1997 does not impose a positive taxation obligation in relation to TAP, but rather, the provisions allow the taxpayer to disregard a capital gain or capital loss if the CGT asset is not TAP.

TAP includes:

It appears the Government intends to broaden the types of assets which are TAP. This may take the form of adding one or more new categories, and/or an existing category may be expanded — for example it may be possible that the indirect interest in Australian real property tests are relaxed such that more interests involving land which do not satisfy the current tests (see below) will be treated as TAP. It is clear from the Budget papers that the focus of a potential redefinition of TAP will be direct and indirect interests in Australian land (i.e. not merely shares in Australian companies which do not have Australian real property holdings).

![]() Note: The TAP rules came into effect on 12 December 2006. Previously, foreign residents were subject to CGT on a wider range of CGT assets — which had the ‘necessary connection’ with Australia, including real property and shares or units in Australian entities (with exceptions). Perhaps the Government intends to cast the CGT net back to some or all of the range of assets captured under the former ‘necessary connection’ concept.

Note: The TAP rules came into effect on 12 December 2006. Previously, foreign residents were subject to CGT on a wider range of CGT assets — which had the ‘necessary connection’ with Australia, including real property and shares or units in Australian entities (with exceptions). Perhaps the Government intends to cast the CGT net back to some or all of the range of assets captured under the former ‘necessary connection’ concept.

A taxpayer has an indirect interest in Australian real property if:

A taxpayer’s membership interest in the entity will be an indirect Australian real property interest at a particular time only if it passes the non-portfolio interest test either:

An interest will pass the test at a time if the sum of the ‘direct participation interests’ held by the taxpayer and its associates in the entity at that time is 10 per cent or more.

The taxpayer’s direct participation interest in an entity essentially reflects the taxpayer’s direct control interest in the entity, which is broadly:

While the Budget announcement does not specifically refer to an intention to alter the non-portfolio interest test, it may nevertheless be possible that the Government amends it in the broader aim of capturing more indirect interests in Australian land by, for example, extending the 12 month period or lowering the 10 per cent threshold.

A taxpayer’s membership interest in the entity will be an indirect Australian real property interest at a particular time only if it passes the principal asset test at that time.

The test is passed if the sum of the market value of the entity’s assets that are TARP exceeds the sum of the market value of the entity’s assets that are not TARP.

The Budget papers clearly indicate the Government’s intention that the relative market values of the entity’s TARP and non-TARP assets — and whether the entity’s underlying value is principally derived from Australian real property — will be tested over a 365-day period rather than only at the time of the CGT event (the sale or transfer of the membership interest). This may mitigate the potential to manipulate asset holdings just before a sale of the interests or the unintended effects of market fluctuations.

At present the only targeted reporting regime for foreign residents selling TAP (other than the usual income tax return disclosures pertaining to all CGT events for all taxpayers) is the foreign resident CGT withholding obligation — imposed on the purchaser and not the foreign resident vendor — which applies to disposals of:

The current withholding rate is 12.5 per cent of the first element of cost base in the purchaser’s hands — generally the purchase price (proposed to increase to 15 per cent from 1 January 2025). The purchaser is obliged to remit the withheld amount to the ATO and the vendor may claim it as a credit against their tax liability when they lodge their tax return disclosing the disposal of the asset.

There are circumstances in which the withholding obligation will not apply. Relevant to this Budget announcement, the foreign resident vendor may provide the purchaser with a declaration confirming that the membership interests they are disposing of are not indirect Australian real property interests.

The Budget announcement indicates that the Government will implement a new reporting regime for foreign residents disposing of shares and other membership interests exceeding $20 million in value. Prospective vendors will be required to notify the ATO prior to the transaction being executed. While the Budget papers are silent as to potential details, it is very likely that reportable membership interests will need to be indirect Australian real property interests given that the Budget papers note that the purpose of the proposed obligation is to improve compliance with the foreign resident CGT withholding rules. The ATO would then be able to data match the pre-sale notification with withholding amounts remitted. Given the $20 million threshold, the notification obligation is clearly not intended to affect the vendors of interests in many small businesses.

Click here to view in full size or to print.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.