The last sitting of Parliament ended on 30 March 2023. It will reconvene next Tuesday 9 May when the Government’s Budget is introduced into the Parliament as a collection of appropriation bills and the Treasurer makes a speech to the House of Representatives at 7.30 pm to introduce the bills.

Both houses of Parliament will sit from Tuesday 9 to Thursday 11 May 2023. Parliament will debate and consider the appropriation bills in the same way as other proposed legislation.

The Government has already announced some tax and superannuation measures which will be included in the Budget — on Monday we will be releasing a Banter Blog article setting out a round-up of the tax and superannuation announcements on the eve of the Budget.

Before Budget night comes around with a swathe of expected and unexpected new measures, now is a good time to take stock of the measures which were announced by the current or previous government.

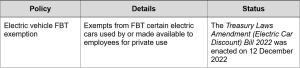

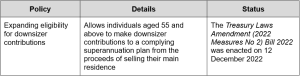

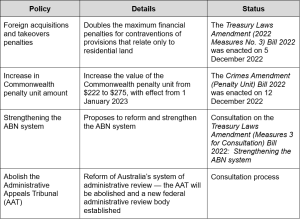

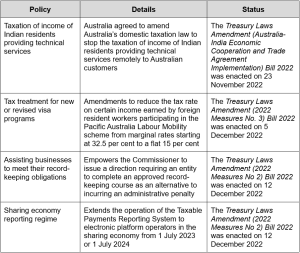

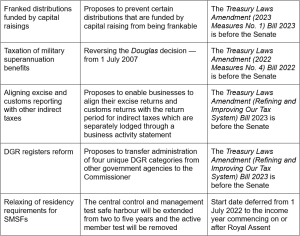

The following tables set out the status of the measures announced by the Government in the October 2022–23 Federal Budget handed down on 25 October 2022.

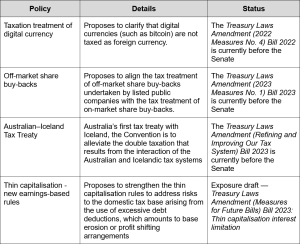

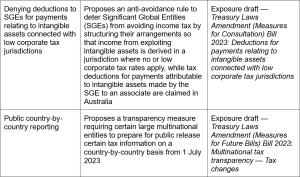

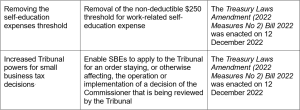

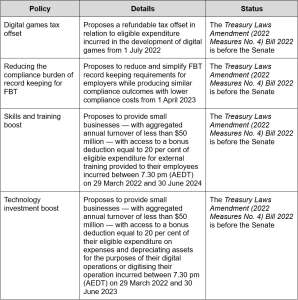

The following is a status update of measures announced by the previous government which had not been enacted by the time the Albanase Government took office.

In the lead-up to Budget night next Tuesday, 9 May, this article is a stocktake of the status of tax and superannuation measures announced by the Albanese Government in their October 2022 Budget and the unenacted measures they inherited from the former Morrison Government.

Want to get free access to our comprehensive Federal Budget summary and Timeline when we release it?

Join our weekly newsletter through this link!

We’ll send everything out first thing on 10 May, leading up to our Budget presentation.

Join us for our annual Federal Government Budget webinar, delivered the morning after the Government hands down the Federal Budget. What changes are in store, and what does it mean for you and your clients?

We’ll review key implications and hold a Q&A session at the conclusion.

This is one of TaxBanter’s most popular sessions; one you don’t want to miss.

All attendees will receive a copy of the recording, along with the slide pack.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.