The ATO has recently finalised TR 2024/1 titled Income tax: composite items — identifying the relevant depreciating asset for capital allowances (the Ruling). The Ruling sets out the relevant principles identified by the Commissioner to assist in determining whether a composite asset is just one depreciating asset or a number of separate depreciating assets for tax depreciation (Div 40 of the ITAA 1997) purposes.

The Ruling was originally issued in draft seven years ago as TR 2017/D1 and reissued as an updated draft last year as TR 2023/D2.

A ‘depreciating asset’ is defined in the tax law as ‘an asset with a limited effective life that can reasonably be expected to decline in value over the time it is used’ but does not include land, an item of trading stock, or intangible assets not listed in the legislation.

A composite asset is an asset that is comprised of multiple components that are capable of separate existence.

The question arises as to how to deal with composite assets for the purposes of claiming a depreciation deduction.

The law states that:

… whether or not a particular composite item is a depreciating asset or whether its components are depreciating assets is a question of fact and degree which can only be determined in light of all the circumstances of the case. [Emphasis added.]

The Commissioner’s view is that in order for a component — or more than one component — of a composite item to be considered to be a depreciating asset, the component must be capable of being separately identified and recognised as having commercial and economic value.

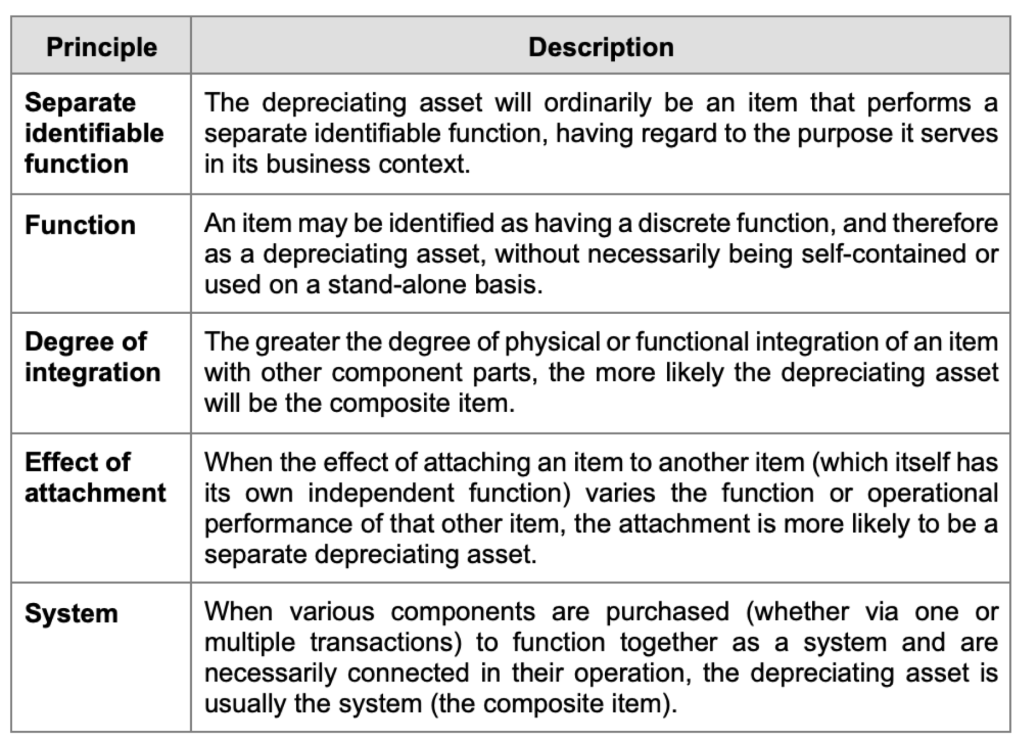

Purpose or ‘functionality’ is generally a useful guide in identifying the depreciating asset and identifies the following main principles that are to be taken into account in determining whether a composite item is a single depreciating asset, or more than one depreciating asset:

The Ruling also considers the following issues:

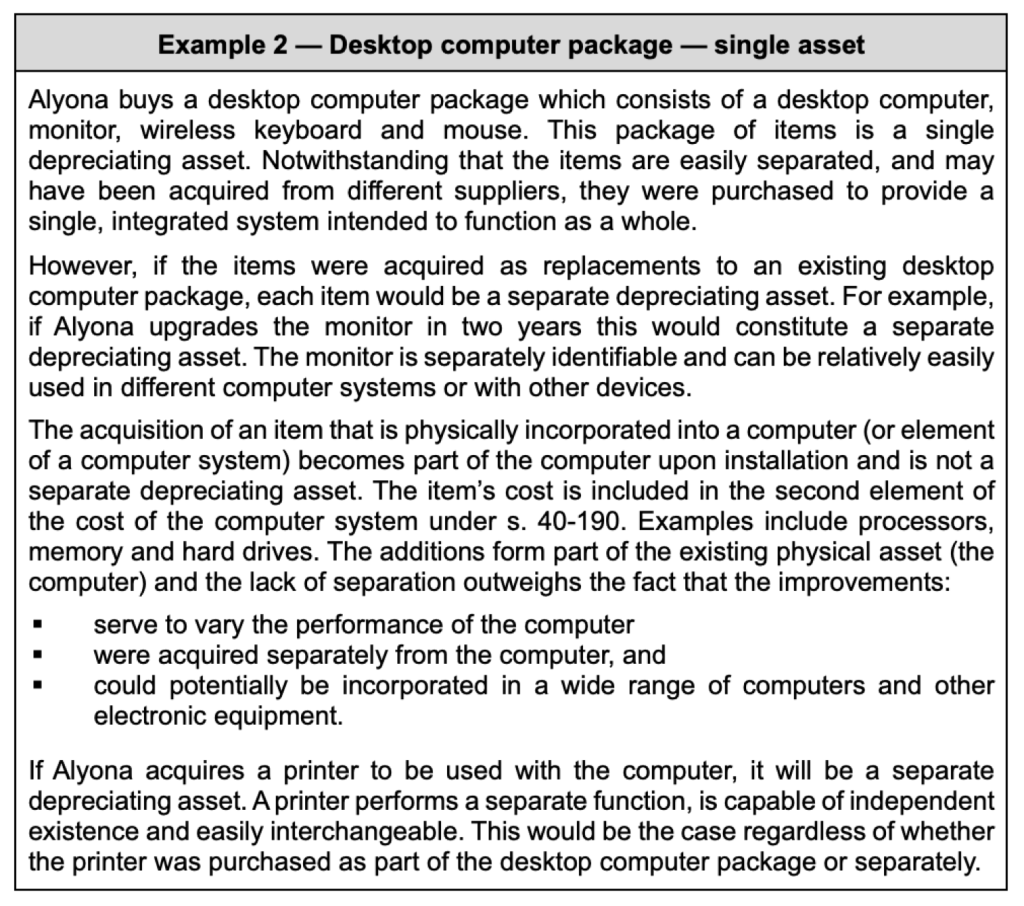

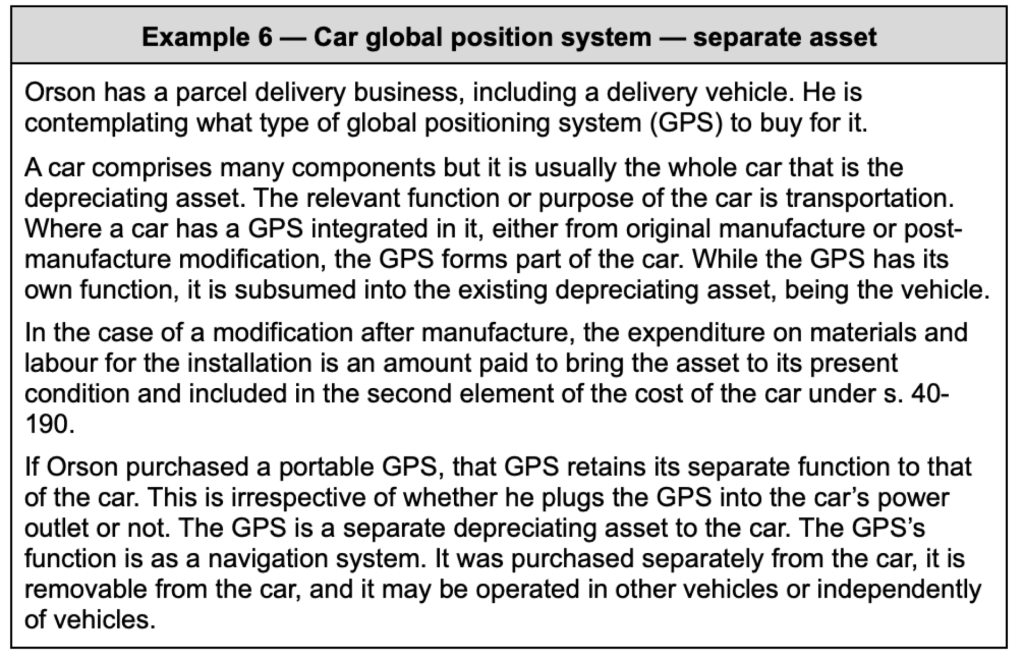

The Ruling contains 14 practical examples, including the following:

The ATO’s guidance on the depreciation of composite assets will be covered in our upcoming Tax Fundamentals workshops.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.