Another layer of the corporate veil has been lifted. The Treasury Laws Amendment (Combating Illegal Phoenixing) Act 2019 (the Act), which received Royal Assent on 17 February 2020 as Act No. 6 of 2020, extends the director penalty regime in Div 269 in Schedule 1 to the TAA to make the directors of a company personally liable for the company’s unpaid GST, luxury car tax (LCT) and wine equalisation tax (WET) in some circumstances.

The Act also extends the estimates regime in Div 268 of Schedule 1 to the TAA so that the Commissioner can collect estimates of GST, LCT and WET (which are jointly administered). The estimate liability is distinct from the underlying liability of the taxpayer to pay the actual liability. Division 268 enables the Commissioner to estimate unpaid amounts of certain liabilities, and to recover the amount of those estimates.

Before the recent changes were enacted, Divs 268 and 269 only applied to Pay As You Go (PAYG) withholding and superannuation guarantee charge (SGC) liabilities.

The changes implemented by the Act will apply in relation to:

that start on or after 1 April 2020.

The changes apply prospectively in relation to assessed liabilities that arise in relation to tax periods commencing on or after 1 April 2020. They may also apply retrospectively to a previous tax period where, on or after 1 April 2020, the Commissioner makes a Div 268 estimate of a net amount relating to that previous tax period (to the extent that the net amount has not been assessed).

The Explanatory Memorandum to the Act explains that a common characteristic of illegal phoenix activity is the stripping and transfer of assets from one company to another entity, carried out with the intention of defeating the interests of the first company’s creditors — including and usually the ATO — in that company’s assets. When an excess of input tax credits claimed is discovered, the Commissioner must amend the relevant GST assessment and pursue the excess as a debt (s. 35-5(2) of the GST Act). The collection of this debt may be obstructed by illegal phoenix activity. The amendments made by the Act implements one of the measures to combat illegal phoenix activity that were announced in the 2018–19 Federal Budget.

All legislative references are to Schedule 1 to the TAA unless otherwise stated. For convenience, net amounts, estimates of net amounts, and GST instalments will be collectively referred to as ‘GST liabilities’ in this article unless context requires otherwise.

An entity’s liability to pay GST, or its entitlement to a refund, is linked to its ‘assessed net amount’ for a tax period (see Divs 33 and 35 of the GST Act). An entity’s net amount for a tax period is equal to the amount of GST imposed on its taxable supplies less its input tax credits, after adjustments. A net amount includes any applicable LCT and WET amounts (s. 17-5(2) of the GST Act). Certain small businesses and not-for-profit entities may elect to pay GST by instalments, which are subtracted from the entity’s net amount for the tax period.

The entity is liable to pay a net amount to the ATO when the net amount is assessed (under the self-assessment system, this is when the entity lodges its activity statement for a tax period).

Under the director penalty regime, directors who fail to discharge their duty to ensure the company pays its tax liabilities become personally liable for a penalty equal to the company’s unpaid liability.

The director penalty regime was first introduced in 1993 (in former Div 9 of Part VI of the ITAA 1936) to assist the Commissioner with recovering unpaid PAYG withholding liabilities; it was rewritten into Div 269 of Schedule 1 to the TAA in 2010. The rules were subsequently extended on 29 June 2012 by the Tax Laws Amendment (2012 Measures No. 2) Act 2012 to cover a company’s unpaid SGC for quarters ending on or after 30 June 2012.

Company directors have a statutory obligation to ensure that the company:

Specifically, s. 269-10 obliges a director of a company to ensure that it complies with the following:

| A company registered under the CA that… | Must pay to the Commissioner by the due day… |

has a PAYG withholding obligation in respect of:

|

the amount that is calculated in accordance with:

|

| has an SG shortfall for a quarter (i.e. ending on 31 March, 30 June, 30 September or 31 December) | the SGC for the quarter in accordance with the SGA Act |

| is given notice of an estimate under Div 268 in relation to a PAYG withholding or SGC amount | the amount of the estimate |

has a GST, LCT or WET liability at the end of a tax period  |

the assessed net amount (GST, LCT, WET) for the tax period in accordance with the GST Act |

has a liability for a GST instalment for a quarter  |

the GST instalment for the quarter in accordance with the GST Act |

is given notice of an estimate under Div 268 in relation to an assessed net amount for GST, WET or LCT (same as for PAYG withholding and SGC)  |

the amount of the estimate (same as for PAYG withholding and SGC) |

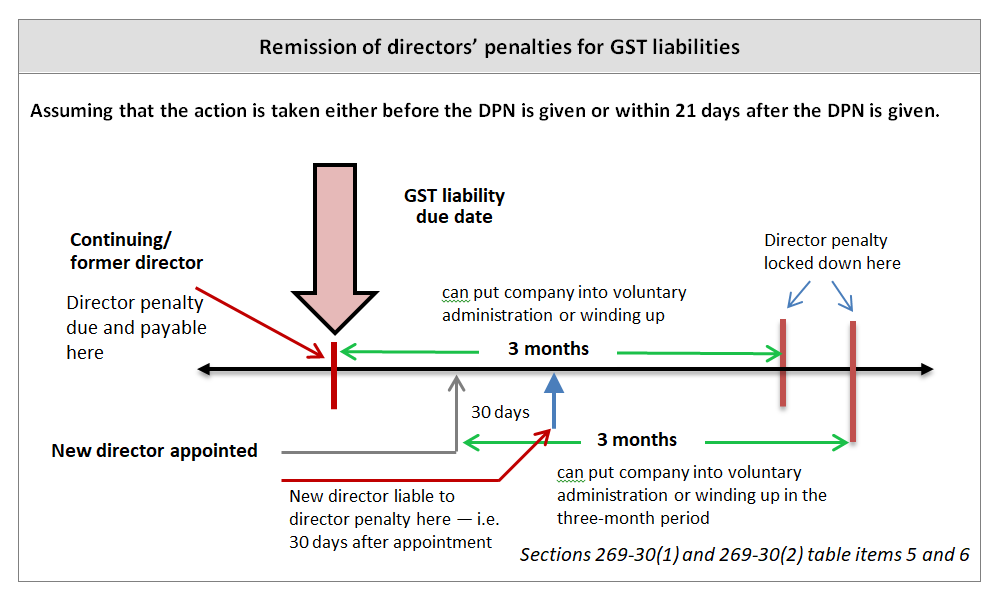

The director’s obligation commences on the day the relevant tax period ends and continues to be under this obligation until the company either:

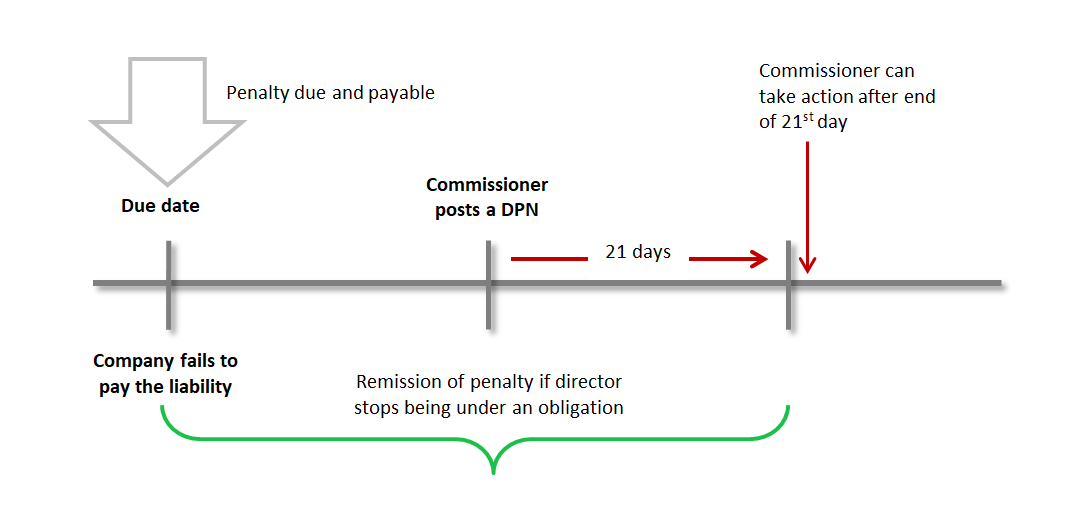

A director is liable to pay a penalty to the Commissioner at the end of the due day of the liability. The amount of the penalty is equal to the unpaid amount of the company’s liability under its obligations (e.g. the assessed or estimated net amount or GST instalment).

However, the Commissioner may not commence recovery proceedings until the end of 21 days after he has given written notice of the penalty. The notice is called a Director Penalty Notice (DPN). The Commissioner is taken to give written notice of the penalty at the time that he leaves it or posts it and not when it is delivered.

The Commissioner can give a DPN under s. 269-25 by leaving it at, or posting it to, an address that appears — from information held by ASIC — to be, or to have been the director’s place or residence or business within the last seven days. The Commissioner may also serve a copy of the DPN to the director’s registered tax agent.

Where the company has multiple directors, the director penalties are likely to be ‘parallel liabilities’. The Commissioner has stated in PS LA 2011/18 that he may commence action against any or all of the directors to recover the company’s unpaid amounts. In determining which director(s) to pursue, the Commissioner will have regard to a number of factors, including each director’s capacity to pay and the relative merits of any defences.

New directors that are appointed after the due date of the liability become liable for the penalty if the obligation remains unsatisfied for 30 days after the appointment.

![]() Important

Important

The liability extends to amounts due before the director’s appointment.

There is no provision which relieves a director from their obligation to cause the company to comply with its obligations if they resign as director. A former director remains liable for director penalties equal to the company’s unpaid GST liabilities that fell due either:

Section 269-35 contains the possible defences that a director may claim against the penalty:

The penalty will be remitted if the Commissioner is satisfied that the director’s circumstances meet one of the defences. Further, according to PS LA 2011/8, the Commissioner will not initiate (or continue) court proceedings to recover a penalty if he considers that the director could satisfy the court that they have a valid defence.

![]() Reference

Reference

Refer to MT 2008/1 and MT 2008/2 for the ATO’s view on the meaning of ‘reasonable care’ and ‘reasonably arguable’ respectively.

An amount that is paid or applied towards discharging a liability will reduce each parallel liability by the same amount. That is, where a director pays their penalty, the company’s liability and other directors’ penalties which relate to the same underlying debt will be reduced by the amount paid.

To recover an unpaid penalty, the ATO may issue a garnishee notice to an individual or a business (e.g. a bank) that holds, or may hold, money for the director.

Other recovery measures may include: a departure prohibition order (which prevents the director departing from Australia), a writ/warrant of execution (which authorises the seizure and sale of the director’s assets), and a freezing order (which restrains the director from removing or disposing of assets).

The Commissioner has stated, in PS LA 2011/20, that a payment that is made and readily identified as being in respect of a particular liability of a company that has arisen under a remittance provision will usually be allocated to that liability.

The ATO does not typically provide personalised payment advice forms to a director to whom it issues a DPN. The director must therefore advise the ATO that the payment that the director makes is in relation to a DPN. However, the practice statement notes that the ATO does not have to follow any instruction given by the taxpayer when allocating payments.

If the director is paying the full amount of the DPN, the amount is allocated to reduce the penalty on the director’s account and the corresponding parallel liability on the company account (for example, the relevant PAYG withholding amounts).

If the director’s payment is less than the full amount, the payment will:

A director’s penalty is remitted if the director stops being under the obligation under s. 269-15:

The director stops being under the obligation if they take certain actions. Where these conditions for remission are not satisfied by a specific date, the penalty is then ‘locked down’ and cannot be remitted other than by payment of the debt.

![]() Note

Note

The three-month rule was removed with respect to unpaid SGC liabilities, and estimates of these liabilities, from 1 July 2018, to discourage directors from taking advantage of it by delaying the placing of the company into liquidation or voluntary administration. The three-month period remains applicable to PAYG withholding liabilities and estimates, and now for GST liabilities (and LCT and WET liabilities).

Where the company enters administration or begins to be wound up after the lockdown date, only the amount of the assessed net amount liability that was calculated by reference to information reported to the Commissioner before the end of the three-month period is remitted.

This means that:

Emma and Julie are directors of Swift Supply Pty Ltd.

Swift Supply is required to pay and report GST on a quarterly basis under s. 27-5 of the GST Act. Swift Supply is required to lodge its return for the quarter ending 30 June 2019 by the due date of 28 July 2019 (s. 31-8 of the GST Act).

Swift Supply lodges its return more than three months late on 1 November 2019. The return gives rise to a liability for Swift Supply to pay an assessed net amount of $100,000. The due date for the payment is 28 July 2019 (s. 33-3 of the GST Act).

Emma and Julie are under an obligation to ensure Swift Supply pays the liability, enters administration or begins to be wound up. The obligation begins on the day the tax period ended (30 June 2019).

Julie resigns from Swift Supply on 20 July 2019. This does not affect her obligation in relation to the company’s liability.

Swift Supply is never in a position to pay the liability. As such, both Emma and Julie were required to place the company into administration or begin winding it up. This does not happen on or before the due date of 28 July 2019 and the director penalties begin to apply from this date.

The Commissioner issues director penalty notices to Emma and Julie on 1 February 2020. The Commissioner may begin recovery proceedings on or after 23 February 2020.

Kerrie is appointed as a director of Swift Supply on 15 November 2019 and is immediately under the obligation to ensure Swift Supply pays the liability, enters administration or is wound-up. The penalty arises for Kerrie after 30 days on 15 December 2019.

The Commissioner also issues a director penalty notice to Kerrie on 1 February 2020.

Emma and Kerrie place Swift Supply into administration on 10 February 2020.

The original directors, Emma and Julie, satisfy the first condition to have their penalties remitted because their obligation is satisfied on 10 February 2020, before the end of the 21-day period on 22 February. However, because Swift Supply entered administration more than three months after the company’s due date of 28 July, the penalty is locked down. The entire amount of the penalty is locked down because the company’s GST return for the June quarter was more than three months late.

As a new director, Kerrie is entitled to a full remission of the penalty because Swift Supply entered administration:

Source: Examples 4.4 and 4.5 in the Explanatory Memorandum

Aaron is the sole director of Tangent Communications Pty Ltd.

Tangent Communications is required to pay and report GST on a quarterly basis under s. 27-5 of the GST Act. Tangent Communications is required to lodge its return for the quarter ending 30 June 2019 by the due date of 28 July 2019 (s. 31-8 of the GST Act).

Tangent Communications lodges its return on 23 July 2019. The return gives rise to a liability for Tangent Communications to pay an assessed net amount of $150,000. The due date for the payment is 28 July 2019 (s. 33-3 of the GST Act).

Aaron is under an obligation to ensure the company pays the liability, enters administration or begins to be wound up. The obligation begins the day the tax period ended (30 June 2019).

Tangent Communications is never in a position to pay the liability. As such, Aaron was required to place the company into administration or begin winding it up. This does not happen on or before the due date of 28 July 2019 and the director penalty begins to apply from this date.

On 1 September 2019, Tangent Communications provides further information to the Commissioner to correct an error in the company’s GST return and requests an amended assessment. The Commissioner agrees to issue an amended assessment to the company. Under this assessment, the company has an assessed net amount of $200,000. This does not affect the due date for the company to pay the amended assessed net amount (28 July 2019).

On 15 January 2020, the Commissioner further amends the company’s assessed net amount for the period ending 30 June 2019, increasing the assessed net amount to $220,000. This does not affect the due date for the company to pay the amended assessed net amount (28 July 2019).

On 1 February 2020, the Commissioner issues a director penalty notice to Aaron for the company’s outstanding $220,000 liability. The Commissioner may begin recovery proceedings on or after 23 February 2020.

Aaron places Tangent Communications into administration on 10 February 2020, before the end of the 21-day period on 22 February.

Because Tangent Communications lodged a timely GST return for the relevant period, the entire penalty is not locked down. However, because the information the company provided to the Commissioner led to an understatement of the company’s assessed net amount, the shortfall amount ($20,000) is locked down. The remaining director penalty amount of $200,000 is remitted.

Source: Example 4.6 in the Explanatory Memorandum

Phoenix companies have received increasing attention from the legislature, the Government, the courts and the media because of their cost to public revenue and the inherent unfairness that the controlling minds are often seen to ‘get away’ with unethical and illegal behaviour due to the protection offered by the corporate veil.

Not all companies that default on tax debts — and not all directors of such companies — engage in illegal activity. Regardless of motivation, the Government has recognised that non-payment of corporate GST liabilities is a serious problem which requires the strong deterrent of personal liability to be imposed on directors.

With the new rules commencing on 1 April 2020, now is the time for directors to ensure their company is complying with, and will comply with, their GST obligations. This includes making sure that activity statements and GST returns are lodged on time, and net amounts and GST instalments are paid promptly. It is also important to ensure that responsible staff members are adequately trained, or that appropriate external advice is sought, to correctly ascertain liabilities and entitlements. If the company has genuine difficulty with meeting lodgment and payment obligations, contacting the ATO to discuss the problem and to negotiate a deferral or payment plan will help ensure that the Commissioner does not issue a DPN.

Directors also need to be up to date with their understanding of their legal and ethical responsibilities and to consider asset protection strategies in structuring their personal affairs.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.