[lwptoc]

On 6 September 2022 the Government released exposure draft legislation titled Treasury Laws Amendment (Measures for Consultation) Bill 2022: Taxation treatment of digital currency (the draft Bill) which proposes to exclude crypto assets, such as Bitcoin, from being treated as a ‘foreign currency’ for Australian income tax purposes.

In practical terms, the proposed legislative amendments will not change the ATO’s current approach. However it will provide legislative certainty and clarity and reduce the need for taxpayers to rely on their own and the ATO’s application of the existing foreign currency definition to the particular characteristics of a crypto asset.

Consultation feedback is due by 30 September 2022.

The Legislative Assembly of the Republic of El Salvador recognised bitcoin as an unrestricted legal tender by legislative decree which took effect on 7 September 2021. As an unintended consequence of this, there is the potential that bitcoin may be a ‘foreign currency’ for the purposes of the ITAA 1997 due to its status as a legal tender in El Salvador.

This is inconsistent with current policy intent. Bitcoin and other similar digital currencies were never intended to be foreign currencies for Australian income tax purposes.

Without clarification of the tax treatment of bitcoin and digital currencies, there would be uncertainty about the status of these assets for Australian income tax purposes.

See the Government’s media release announcing the proposed amendments on 22 June 2022.

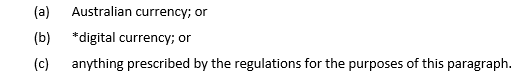

The draft legislation relies on amending the existing definition of digital currency in the GST Act before adopting it as an exclusion from the definition of foreign currency in the ITAA 1997. To achieve this, the draft Bill proposes to:

Implications

Implications

Digital currencies (such as bitcoin) will not be foreign currencies for the purposes of the ITAA 1997, even if they are adopted as a legal tender by a foreign jurisdiction.

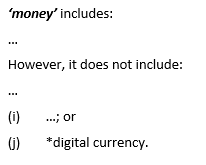

Despite bitcoin being adopted as a legal tender and therefore potentially being considered a currency, it is decentralised, and it is not issued by, or controlled by, any government. In contrast, what are commonly referred to as ‘central bank digital currencies’ are a government-issued digital form of money that will continue to be money, not digital currency.

‘foreign currency’ means a currency other than Australian currency.

foreign currency means a currency other than:

digital currency has the same meaning as in the *GST Act.

(There is no current definition.)

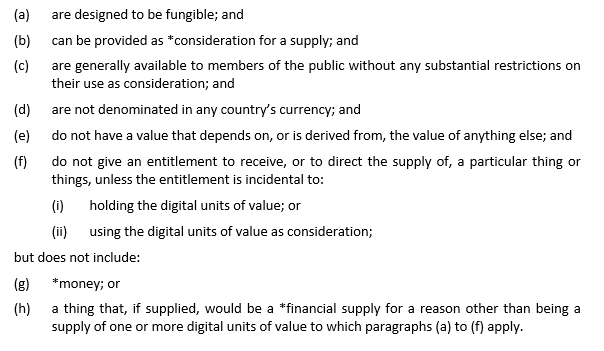

‘digital currency’ means digital units of value that:

(Note: proposed changes are marked in bold.)

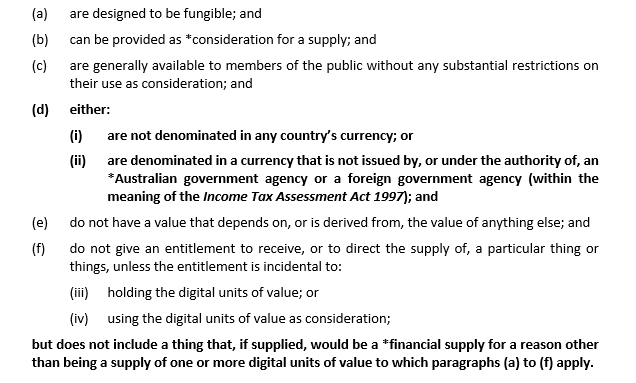

‘digital currency’ means digital units of value that:

Proposed new para. (j)

foreign currency means a currency other than:

The amendments to the definition of ‘foreign currency’ in the ITAA 1997 are proposed to apply in relation to income years that include 1 July 2021 and to subsequent income years.

The purpose of applying the amendments to income years that include 1 July 2021 is to ensure consistent tax outcomes for all taxpayers, including those with substituted accounting periods.

The amendments to the GST Act and GST Regulations are proposed to apply in relation to supplies or payments made on or after 1 July 2021, to align their application with the application of the amendments to the ITAA 1997.

Retrospective application is necessary to clarify that the tax treatment of digital currencies that applied prior to 7 September 2021 (the date at which the El Salvador decree took effect) continues to apply after that date.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.