On 3 October 2023 the Government released a package of exposure draft legislation to reduce the tax concessions available to individuals with superannuation balances above $3 million, from 1 July 2025.

The draft legislation released are the Treasury Laws Amendment (Better Targeted Superannuation Concessions) Bill 2023 (the Bill) and the Superannuation (Better Targeted Superannuation Concessions) Imposition Bill 2023 (the Imposition Bill), together with draft explanatory materials.

Consultation closes 18 October 2023.

Under the proposed changes the headline concessional tax rates applying to superannuation earnings on an individual’s total superannuation balance (TSB) exceeding $3 million will be up to 30 per cent, an increase from the current 15 per cent.

This change is expected to apply to around 80,000 individuals, approximately 0.5 per cent of Australians with a superannuation account.

The Bill proposes to insert new Div 296 in the ITAA 1997 which, together with the Imposition Bill, will impose a tax at the rate of 15 per cent for superannuation earnings corresponding to the individual’s TSB that exceeds $3 million for an income year. This is referred to as the ‘Div 296 tax’.

The draft explanatory materials contains 12 practical examples.

The higher 30 per cent rate only applies to ‘taxable superannuation earnings’ which represents the proportion of earnings corresponding to the part of the TSB that exceeds $3 million.

![]() Important

Important

Earnings corresponding to the balance up to $3 million will continue to be taxed at the 15 per cent concessional rate.

Step 1

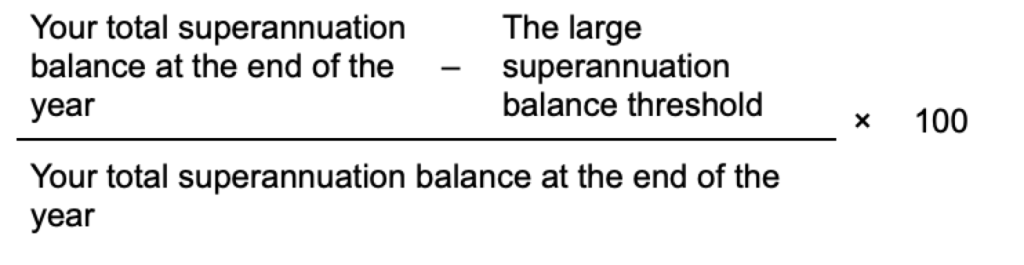

The total amount of taxable superannuation earnings for an income year is worked out by determining the percentage of the TSB at the end of the year that is above the ‘large superannuation balance threshold’ (i.e. $3 million):

(proposed new s. 296-35(2))

Step 2

The result is rounded to two decimal places, rounding up if the third decimal place is 5 or more (proposed new s. 296-35(3)).

Step 3

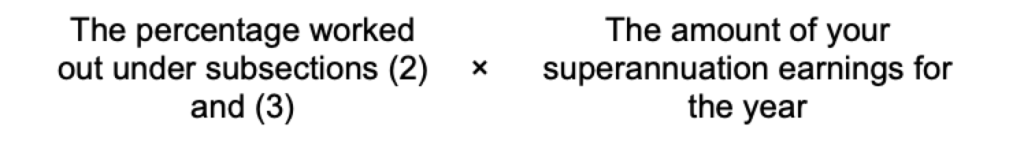

The amount of taxable superannuation earnings equals:

(proposed new s. 296-35(1))

The Bill proposes to amend the law so that all Australian superannuation interests are counted in an individual’s TSB and to introduce a new concept of the ‘total superannuation balance (TSB value). Foreign superannuation interests are excluded as they are not subject to the concessional tax treatment.

The TSB value will be determined by a method or value prescribed in the regulations or otherwise the total amount of the superannuation benefits that would become payable if any individual had the right to cause the superannuation interest to cease at that time and the individual voluntarily causes the superannuation interest to cease, colloquially known as the ‘withdrawal benefit’.

The proposed changes to the TSB remove the link to transfer balance account, thereby aligning the definition of TSB to the annual valuation requirement for certain income streams for the purposes of the Div 296 tax.

![]() Important

Important

These amendments to the TSB apply beyond Division 296 and will applying in working out an individual’s TSB for all other purposes from immediately before 1 July 2025 or on or after 1 July 2025.

For Div 296 purposes, an LRBA amount is to be disregarded to ensure that the tax is only calculated on net assets. There will be no change to how LRBAs are dealt with in the TSB for other purposes.

![]() Note

Note

An individual’s TSB includes all of their superannuation interests and is not a separate figure for each interest — i.e. the $3 million threshold will be applied on a per-individual basis and not on a per-account or per-fund basis.

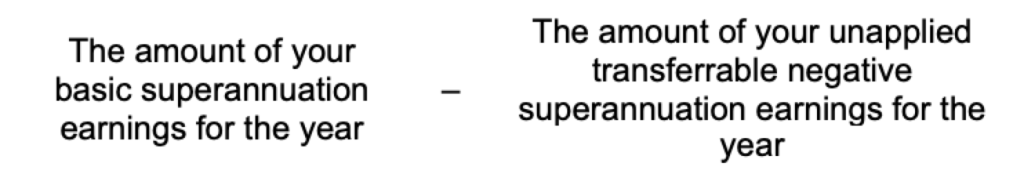

An individual’s superannuation earnings for an income year depends upon whether they have any ‘transferrable negative superannuation earnings’ to apply or not.

An individual will have transferrable negative superannuation earnings for an income year if the amount of basic superannuation earnings are less than nil and the TSB immediately before the start of the year is greater than $3 million.

Where an individual does not have any transferrable negative superannuation earnings, their superannuation earnings will be the amount determined as their ‘basic superannuation earnings’ for the year.

If they do have transferrable negative superannuation earnings, then they will calculate their superannuation earnings under s. 296-110.

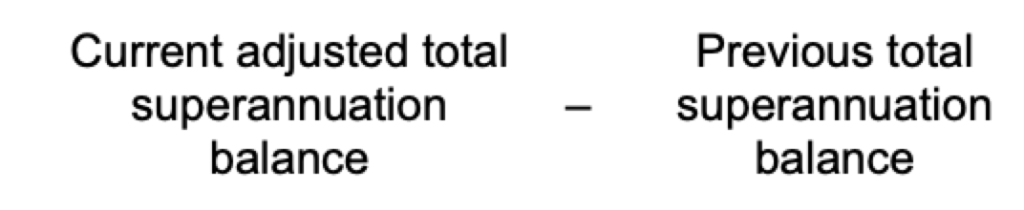

The amount of an individual’s basic superannuation earnings is equal to:

Current adjusted TSB = adjusted TSB at the end of the year

Previous balance = TSB immediately before the start of the year

If either the current adjusted balance or the previous balance is below $3 million, then substitute with $3 million.

The basic superannuation earnings can be a positive or negative amount.

![]() Implications

Implications

The same methodology applies to interests in both APRA funds and SMSFs.

The formula allows losses to be carried forward.

Individuals who drop below the threshold are able to have negative earnings recognised for future years (in the event that their balance increases to exceed the threshold).

The calculation of earnings includes all notional (unrealised) gains and losses (except for the excluded types of earnings listed below).

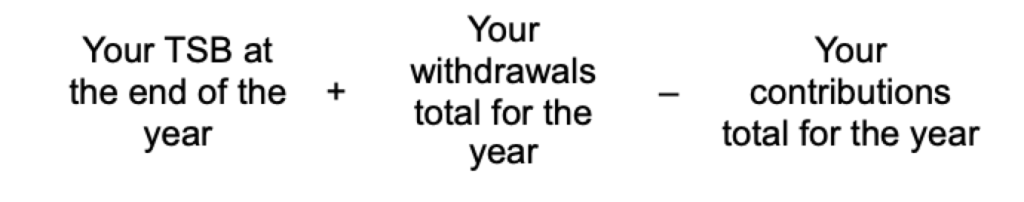

An individual’s adjusted TSB is worked out as follows:

Withdrawals total equals the total of the following amounts paid from the individual’s superannuation interests during the year:

An amount is also included in relation to a first home super saver amount released.

Contributions total equals the total of the following amounts received into the individual’s superannuation plan during the year:

Example — Calculation of Div 296 tax liability (example 1.3 in the draft EM)

Melanie has three superannuation accounts with the following TSB values at 30 June 2025:

Melanie’s TSB captures all her superannuation accounts. Her TSB on 30 June 2025 is $3.7 million.

These superannuation accounts had the following balances at 30 June 2026:

Her TSB on 30 June 2026 is $4.1 million.

In the 2025–26 income year Melanie receives benefit payments of $250,000 from her two pension accounts and makes a $300,000 downsizer contribution.

Melanie’s adjusted TSB at the end of the year is calculated to be $4.05 million by adding her total withdrawals of $250,000 and deducting her total contributions of $300,000 from previous TSB of $4.1 million.

Melanie’s basic superannuation earnings for the 2025–26 income year are calculated as $350,000 by subtracting her previous TSB from her current adjusted TSB ($4.05 million minus $3.7 million).

As Melanie does not have unapplied transferrable negative superannuation earnings, her superannuation earnings for the 2025–26 income year will be her $350,000 in basic superannuation earnings.

As her TSB at the end of the year is greater than the large superannuation balance threshold of $3 million and her superannuation earnings for 2025–26 are greater than nil, Melanie will have taxable superannuation earnings.

The percentage of Melanie’s superannuation earnings above the $3 million threshold is calculated as 26.83 per cent, by calculating the percentage of her TSB at the end of the year over $3 million rounded to 2 decimal places (($4.1 million – $3 million)/$4.1 million).

Melanie’s taxable superannuation earnings are calculated as $93,905 by multiplying her superannuation earnings by the percentage of the earnings above the threshold (26.83 per cent × $350,000).

This taxable superannuation earnings amount will be taxable at 15 per cent. Melanie will have a Div 296 tax liability of $14,086 for the 2025-26 income year ($93,905 x 15 per cent).

if an individual has basic superannuation earnings that are less than nil in an income year, they may be carried forward and offset against a Div 296 tax liability in future years:

Example — Transferrable negative superannuation earnings (example 1.6 in the draft EM)

Jamal has a TSB on 30 June 2025 of $3.2 million. Jamal’s TSB is $2.8 million on 30 June 2026.

Jamal’s adjusted TSB at the end of the year is calculated to be $2.8 million, as there are no contributions or withdrawals to his fund in the 2025–26 income year.

As Jamal’s adjusted TSB at the end of the year is less than $3 million, for the basic superannuation earnings calculation the current adjusted TSB will be replaced with a $3 million value to ensure that the earnings calculation only captures the negative earnings for the part of his TSB over $3 million. Jamal’s basic superannuation earnings for the 2025-26 income year are calculated as -$200,000 by subtracting his previous TSB from the threshold of $3 million ($3.0 million – $3.2 million).

As Jamal does not have unapplied transferrable negative superannuation earnings, his superannuation earnings for the 2025–26 income year will be his basic superannuation earnings of -$200,000.

As his TSB at the end of the year is less than the large superannuation balance threshold of $3 million and his superannuation earnings for 2025–26 are less than nil, Jamal will not have taxable superannuation earnings.

However, as Jamal’s TSB immediately before the start of the year is greater than $3m and he has superannuation earnings of less than nil, he will have a transferrable negative superannuation earning of $200,000 for the 2025–26 income year. Superannuation earnings he may incur in future income years will be reduced by this amount.

The proposed law excludes from taxation earnings from superannuation interests in:

However the value of these interests is counted in an individual’s TSB for the purpose of determining if they exceed the $3 million threshold.

Proposed Subdiv 296-E sets out how to determine and individual’s superannuation earnings if they have an interest in an excluded interest at the end of the income year. This only applies if the individual’s basic superannuation earnings are positive. Therefore no positive earnings from excluded interests are taxed but all negative earnings will be captured as transferrable negative superannuation earnings.

Generally, all individuals who have taxable superannuation earnings for an income year are liable to pay the Div 296 tax, with the following exceptions:

Payment of a Div 296 tax is generally due 84 days after the Commissioner gives the individual a notice of assessment for the tax, except for amounts determined to be attributable to a defined benefit interest and thus deferred to a Div 296 tax debt account.

Individuals liable to pay a Division 296 tax will have the option of paying their tax liability either by releasing amounts from one or more of their superannuation interests or by paying the liability from outside of the superannuation system or a combination of the two.

If an individual holds multiple superannuation interests, then they can choose which interest(s) to release the money from.

The Bill proposes to amend the law to allow an individual to make a request for the release of superannuation money if they have received a notice of assessment of a Div 296 tax liability, within 60 days.

Example — Paying a tax liability when there are multiple superannuation interests (example 1.9 in the draft EM)

Sally is 62 and has multiple superannuation interests with the following balances at 30 June 2026:

Sally receives a notice from the ATO outlining calculated superannuation earnings of $550,000 for the 2025-26 income year resulting in Div 296 tax payable of $46,103.

Sally has the choice to pay the tax using amounts held outside superannuation or to release money from one or more of her superannuation interests. Sally elects to pay the amount from her accumulation interest by completing the election form. The ATO requests the release of $46,101 from the superannuation fund where Sally’s accumulation interest is held in an APRA-regulated fund.

The Bill introduces a Div 296 general interest charge. This is worked out by adding three percentage points to the base interest rate for that day and dividing the total by the number of days in the calendar year.

This general interest charge uses the same calculation method as the shortfall interest charge and is applied to any outstanding liabilities which remain unpaid by the due date and are not deferred to a Division 296 debt account. The lower interest charge on unpaid Div 296 liabilities ensures that it allows taxpayers to have a rate of interest charged that are broadly similar to market rates. This means that the rate of interest does not penalise taxpayers in the very rare circumstance that they do not have liquidity within or outside of superannuation to meet the tax liability.

Shortfall interest charge will also apply where an amount of Div 296 tax becomes due and payable because of an amended assessment.

Other key issues covered by the draft legislation include:

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 14 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

![]() Outsource your L&D

Outsource your L&D

We can also present tax updates or specialty topics at your firm or through a private online session, with content tailored to your client base. Call our support team at 0434 067 133 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Email us to have a chat >

Join thousands of savvy Australian tax professionals and get our weekly newsletter.