Last week the ATO issued TR 2023/4 (Ruling) and PCG 2023/2 (Guideline), which respectively set out the Commissioner’s view on when an individual is an ‘employee’ of an entity for PAYG withholding purposes and compliance approach for businesses that engage workers and classify them as employee or independent contractors.

The Ruling replaces TR 2005/16, which was withdrawn with effect from 15 December 2022 when the draft of the Ruling was issued. The Ruling takes into account developments in case law — most notably the High Court decisions in Construction, Forestry, Maritime, Mining and Energy Union v Personnel Contracting Pty Ltd [2022] HCA 1 and ZG Operations Australia Pty Ltd v Jamsek [2022] HCA 2.

The Ruling only considers the ordinary meaning of an ‘employee’.

The Ruling is a binding ruling only for the purposes of the PAYG withholding rules in s. 12-35 of Schedule 1 to the TAA.

The Ruling applies both before and after its date of issue (6 December 2023).

To the extent that the Ruling aids in understanding the ordinary meaning of an ‘employee’ for the purposes of the superannuation guarantee (SG) rules in s. 12(1) of the SGA Act, it is not binding on the Commissioner. However, if the Commissioner later takes the view that s. 12(1) applies less favourably to the taxpayer than the Ruling indicates, the fact that the taxpayer acted in accordance with the Ruling would be a relevant factor in your favour in the Commissioner’s exercise of any discretion in regard to the imposition of SG penalties. Note that the Commissioner’s view of the extended definition of ‘employee’ for SG purposes is outlined in SGR 2005/1.

The Guideline applies more broadly than the Ruling — it is relevant for a variety of tax and superannuation obligations. That is, the Commissioner’s compliance approach set out in the Guideline applies for both PAYG withholding and SG — including the extended definition of employee for SG purposes (as well as other laws administered by the Commissioner including Single Touch Payroll reporting, FBT etc).

The Guideline applies in respect of the application of the Commissioner’s resources from its date of issue (6 December 2023).

Get our newsletter delivered straight to your inbox – sign up here!

Get our newsletter delivered straight to your inbox – sign up here!

Whether a person is an employee — under the ordinary meaning of the term — of an entity is a question of fact to be determined by reference to an objective assessment of the totality of the relationship between the parties, having regard only to the legal rights and obligations which constitute that relationship.

The task is to construe and characterise the contract at the time of entry into it. Recourse may be had to events, circumstances and things external to the contract which are objective, known to the parties at the time of contracting and assist in identifying the purpose or object of the contract.

It is the legal rights and obligations in the contract alone that are relevant, where the validity of that contract has not been challenged as a sham, nor have the terms of the contract otherwise been varied, waived, discharged or the subject of an estoppel or any equitable, legal or statutory right or remedy.

A contract will be a sham if it is not a legitimate record of the intended legal relationship between two parties, but instead is ‘a mere piece of machinery’ serving some other purpose (often to act as a façade and deliberately obscure the true legal relationship for third parties).

Important

Important

Evidence of how the contract was performed, including subsequent conduct and work practices, cannot be considered for the purpose of determining the nature of the legal relationship between the parties.

Notwithstanding the above, evidence of how a contract was actually performed may be considered to establish the contractual terms or to challenge the validity of a written contract.

A useful approach for establishing whether or not a worker is an employee of an engaging entity when analysing and weighing up each of the indicia of employment identified in the case law is to consider whether the worker is working in the business of the engaging entity, based on the construction of the terms of the contract. However this should not be approached as a ‘checklist’ exercise. Further, The label which parties choose to describe their relationship is not relevant to the characterisation of the relationship.

The case law indicia noted in the Explanation to the Ruling are:

![]() Query — What if the worker has an ABN?

Query — What if the worker has an ABN?

The fact that the worker is conducting their own business, including having an ABN, is not determinative — they may separately be an employee in the business of another entity.

The Guideline will be most relevant for situations where a worker’s correct classification is less obvious. If the arrangement is clearly one of employment or independent contracting, the parties may choose not to rely on the Guideline but self-assess based on their confidence that the correct classification has been applied.

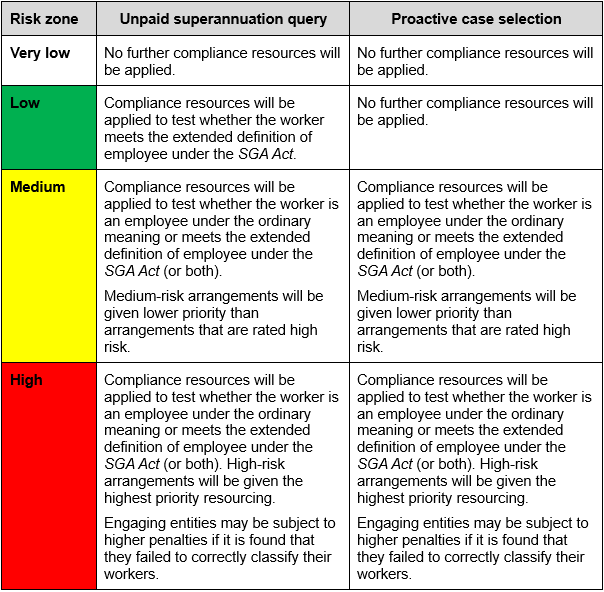

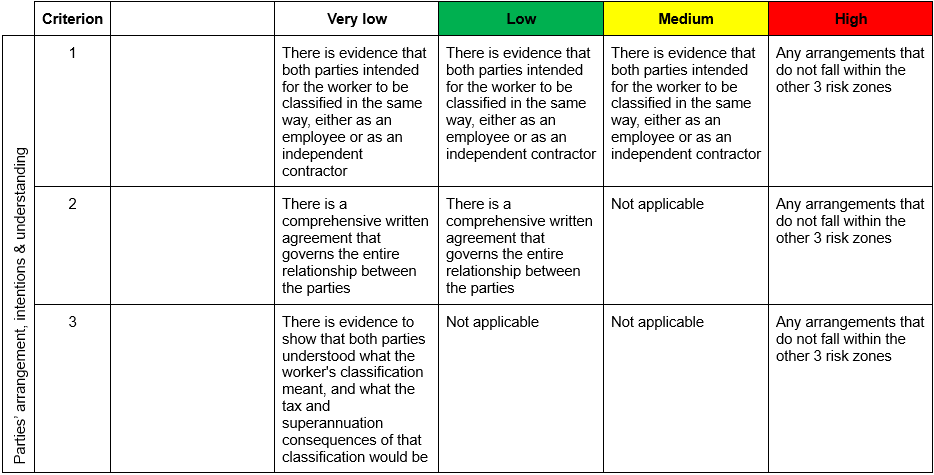

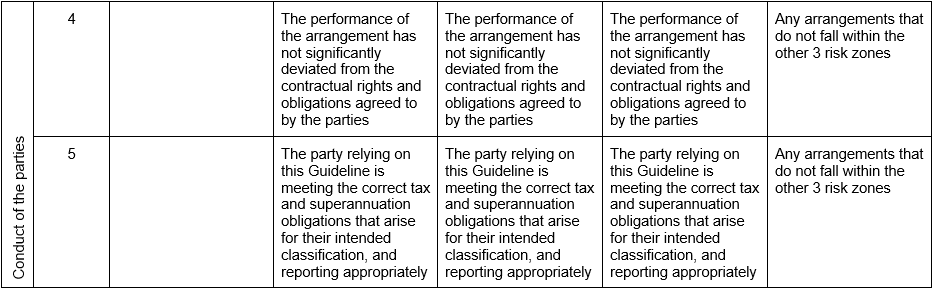

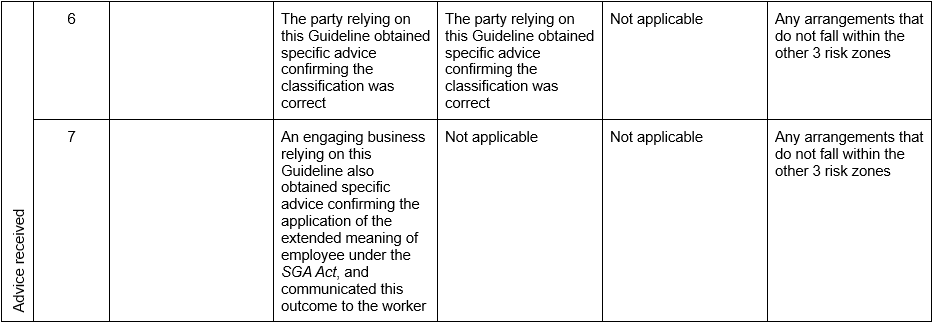

The Guideline outlines the ATO’s risk framework for worker classification arrangements, based on the actions taken by the parties when entering into the arrangement. Parties can self-assess against this risk framework to understand the likelihood of the ATO applying compliance resources to review their arrangement.

A review may be the result of proactive case selection based on particular risk factors and information known to the ATO, or the result of an unpaid superannuation query received from a worker (including where they believe they satisfy the extended definition of employee).

An arrangement can also fall into the very low-risk category if the entity voluntarily meets employer obligations regardless of their view of the worker’s classification.

Where there has been a ‘significant deviation’ of the arrangement, the party will need to reassess their risk rating. This may include:

Refer to the Guideline for six practical examples.

NOW is the time to get organised! We offer online sessions, as well as workshops throughout Australia.

Sessions generally include a tax update, along with a specialty topic.

Purchase an entire series of training this December and save 15-25%.

Get our early bird pricing while it lasts.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.