Written by: Letty Chen | Senior Tax Writer

On 6 August 2024, the Tax Practitioners Board (TPB) issued two exposure draft Information Sheets setting out the TPB’s proposed guidance in relation to three of the eight new obligations for registered agents under the Code of Professional Conduct in the Tax Agent Services Act 2009 (TASA).

The Ministerial Determination introducing the new obligations was registered on 2 July 2024, with a commencement date of 1 August 2024. On 31 July, the Assistant Treasurer announced transitional arrangements which generally postpone the new obligations until 1 January 2025 for larger firms (more than 100 employees) and 1 July 2025 for smaller practices (100 or fewer employees).

Refer to our recent Banter Blog articles for more information on the new obligations:

New Code obligations for tax agents

TPB’s transitional approach for new Code obligations starting 1 August

Last minute reprieve for tax agents — Code changes postponed

These articles summarise the requirements of the Determination and guidance provided in the Explanatory Statement to the Determination — these will not be reproduced in the present article.

The draft guidance

The exposure draft Information Sheets are:

TPB(I) D54/2024 False or misleading statements to the TPB or Commissioner

TPB(I) D55/2024 Managing conflicts of interest and maintaining confidentiality in dealings with government

There are a number of consultation questions for each draft Information Sheet. The closing date for submissions is 3 September 2024. The TPB anticipates releasing final guidance in late September.

This article will focus on TPB(I) D55/2024 in relation to conflicts of interest and confidentiality in government dealings.

Refer to our other article First tranche of draft TPB guidance on new obligations — false or misleading statements for a summary of TPB(I) D54/2024.

Draft guidance in relation to managing conflicts of interest (government agencies)

The obligation

Section 20 of the Determination requires registered tax practitioners, in relation to any activities they undertake for an Australian government agency in a professional capacity, to:

- take reasonable steps to identify and document any material conflict of interest (real or apparent) in connection with an activity undertaken for the agency

- disclose the details of any material conflict of interest (real or apparent) that arises in connection with an activity undertaken for the agency to the agency as soon as the registered tax practitioner becomes aware of the conflict

- take reasonable steps to manage, mitigate, and where appropriate and possible avoid, any material conflict of interest (real or apparent) that arises in connection with an activity undertaken for the agency (except to the extent that the agency has expressly agreed otherwise).

A breach of this obligation may result in the TPB imposing one or more sanctions.

Activities undertaken for an Australian government agency in the registered tax practitioner’s professional capacity

An ‘Australian government agency’ is defined as the Commonwealth, a State or a Territory, or an authority of the Commonwealth, or of a State or a Territory.

The scope of ‘professional capacity’ includes activities that are and are not tax agent services. This includes providing any advice, assistance, or feedback to the government, whether paid or otherwise. It does not extend to activities that are of a personal nature.

These activities may be undertaken through either a formal engagement (such as through a procurement process, or a confidential consultation process) or an informal engagement (which may include internal meetings and discussions, or informal consultation processes).

Conflict of interest

A conflict of interest is where a registered tax practitioner has a personal interest or has a duty to another person which is in conflict with the duty owed to the government agency.

A conflict of interest may be direct or indirect, and real or apparent (or perceived). Also, it can arise before the registered tax practitioner accepts an engagement or at any time during the engagement.

Whether a conflict of interest is ‘material’ will depend on the facts and circumstances and whether a reasonable person, having the knowledge, skill and experience of a registered tax practitioner, would expect it to be of substantial import, effect or consequence to the other entity. Relevant facts and circumstances may include:

- the information known to the practitioner about the activities

- the consequences for the government agency if the practitioner’s personal interest is such that it could give rise to a real or apparent conflict of interest that could affect their ability to discharge their duties and/or obligations to the government agency.

A material conflict of interest may arise in circumstances that include where a practitioner:

- is engaged by a government agency to consult on proposed government law reform that may result in a potential or perceived benefit or gain to the practitioner and/or their clients

- may benefit or gain financially from their engagement with the government agency directly or indirectly (a benefit to the practitioner, their employer, client and/or other associate)

- misuses confidential information which may result in a potential or perceived benefit or gain to the practitioner

- interferes in government decision making which may result in a potential or perceived benefit or gain to the practitioner.

What are ‘reasonable steps to identify and document any material conflict of interest’?

Relevant factors in determining whether a practitioner has taken reasonable steps may include the following:

- the size of the tax practitioner entity

- the type of work undertaken by the tax practitioner

- the client base of the tax practitioner

- the likelihood of conflicts of interest arising

- the sensitive nature of the activities undertaken for the government agency

- any possible adverse consequences for the government agency should a conflict of interest arise

- whether the registered tax practitioner has provided training to staff on identifying, disclosing and documenting conflicts of interest

- whether the registered tax practitioner has established procedures for the disclosure and record-keeping of potential conflicts of interest

- whether the registered tax practitioner has established procedures for identifying and documenting conflicts of interest.

Disclose details of any material conflict of interest as soon as you become aware of the conflict

The obligation is not limited to a practitioner disclosing information about their own material conflicts of interest. It extends to any material conflict of interest of any employee, associate, contractor or other relevant entity that the practitioner is aware of.

Details to disclose to the government agency may include the following:

- the nature of the conflict

- the extent of the conflict

- what interest, association or incentive gives rise to the conflict

- the identity of the registered tax practitioners or others related to the conflict and the extent to which they have been involved in the services provided to the government agency

- when the conflict was first identified

- how the advice or services provided to the government agency might have been different had there not been a conflict of interest

- any benefit, financial or otherwise, obtained due to the conflict of interest

- whether any actions have been taken or are proposed to avoid the conflict or to mitigate any damage arising from the conflict.

Where a practitioner is unsure as to whether a conflict of interest arises or whether the conflict is material or not, they should err on the side of caution and disclose the details of the potential conflict of interest.

Managing and mitigating a conflict of interest

Reasonable steps to manage and mitigate a conflict of interest may require a practitioner to:

- assess and evaluate the conflict of interest

- implement appropriate mechanisms to manage or control the impact of the conflict of interest on the practitioner’s advice or decisions, or the decisions of the government agency

- implement appropriate mechanisms to mitigate the conflict of interest.

Examples of reasonable steps include the following:

- enforcing procedures for managing, mitigating, and avoiding conflicts of interest

- allocating staff to projects in a way that manages or avoids potential conflicts of interest

- having internal governance policies in relation to conflicts of interest that include consequences for failing to comply with those procedures

- maintaining a conflict of interest register and information handling procedures that utilise technology to limit information access to those with a legitimate need to know.

Additional techniques may include:

- placing a positive onus on employees or anyone else providing relevant services on behalf of the practitioner to declare conflicts of interest

- developing a register of private interests

- reviewing conflict of interest declarations periodically

- relevant training

- seeking advice from an independent third party, which may include legal advice.

In some cases, conflicts will be unmanageable and the only way to adequately manage the conflict is for the practitioner to decline the engagement. Otherwise, the continued engagement by the government agency of the practitioner will be at the discretion of the agency.

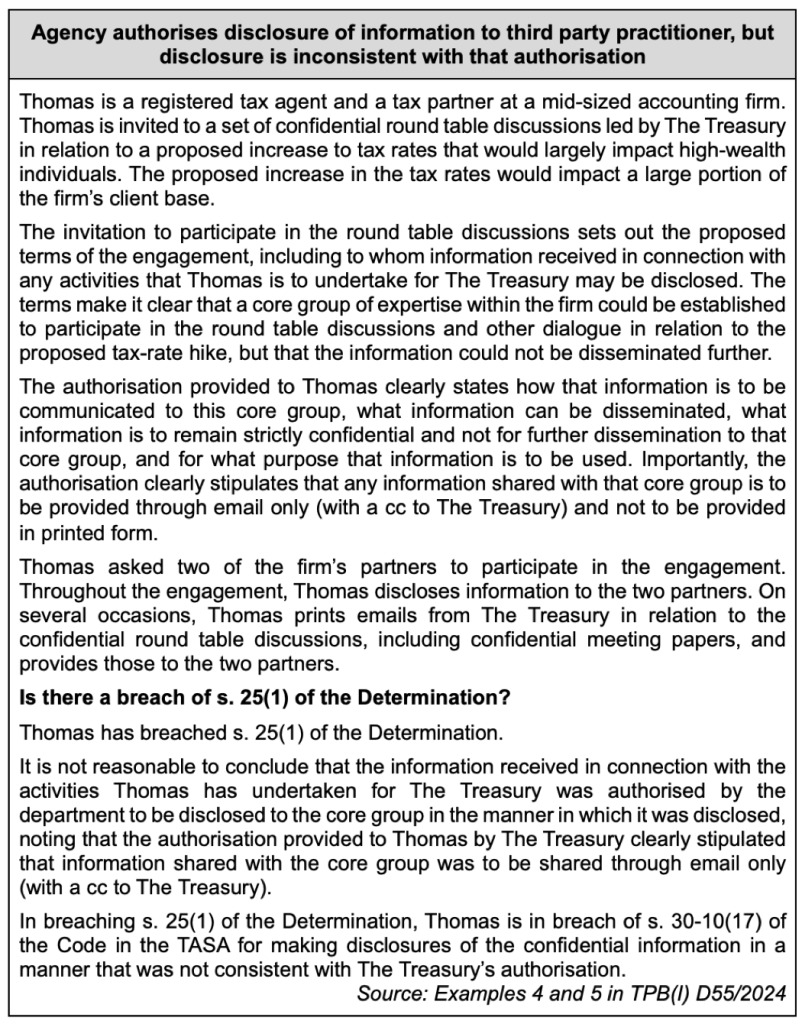

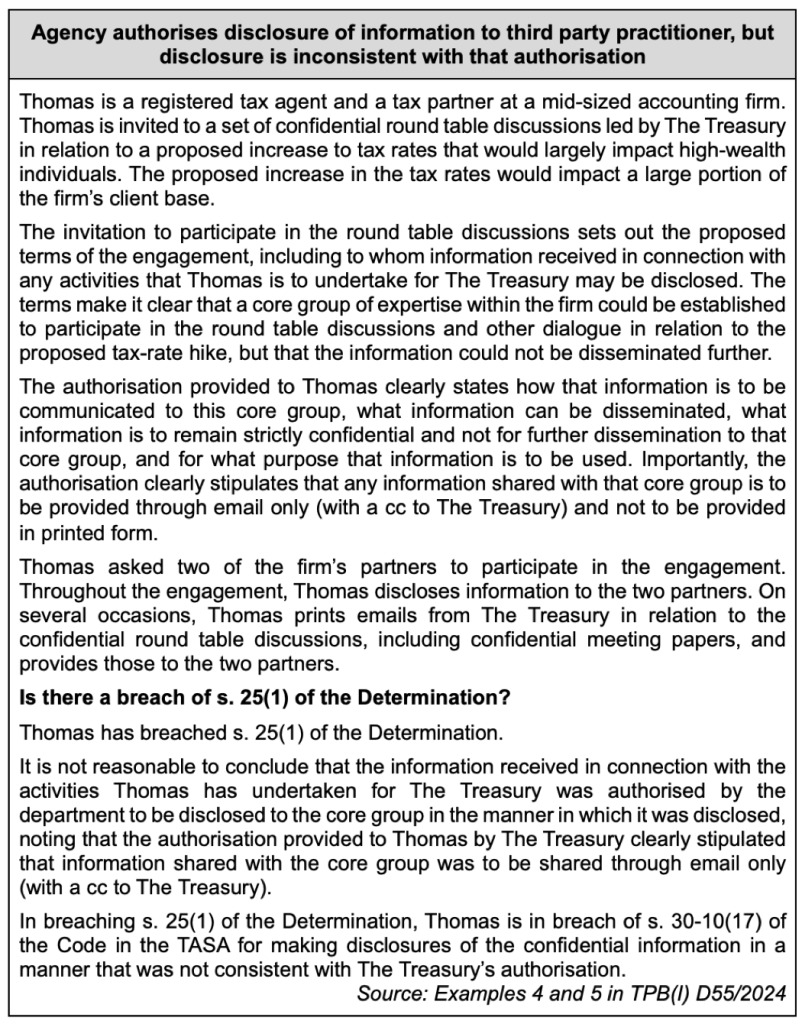

Case studies

There are three case studies in relation to the conflicts of interest Code item, including the following:

Click here for more information.

Draft guidance in relation to confidentiality in dealings with government agencies

The obligation

Section 25 of the Determination gives rise to two obligations in relation to maintaining confidentiality in dealings with Australian government agencies:

- subject to some exceptions, not disclose any information received, directly or indirectly, from an Australian government agency in connection with any activities undertaken for that agency in a registered tax practitioner’s professional capacity

- subject to some exceptions, not use any information received, directly or indirectly, from an Australian government agency in connection with any activities undertaken for that agency in a registered tax practitioner’s professional capacity, for their personal advantage, or for the advantage of an associate, employee, employer or client of the registered tax practitioner.

Obligation to not disclose information

‘Information’ refers to the acquiring or deriving of knowledge obtained in connection with the activities undertaken. This information could be acquired either directly or indirectly from the government agency or other sources. Examples include:

- proposed government reform, including potential legislative changes

- information about procurement processes, including tender or pricing information, an agency’s project budget, pre-tender estimates, or evaluation methodologies

- personal information about entities

- cabinet in-confidence documents or market sensitive information.

A third party means any entity other than the practitioner and the government agency and includes:

- an entity to which the practitioner outsources work (e.g. another registered tax practitioner, a legal practitioner, a contractor, or an overseas or offshore entity)

- an entity that maintain offsite data storage systems (including unencrypted ‘cloud storage’).

In what circumstances can a registered tax practitioner disclose information to a third party?

A practitioner may only disclose the information if:

- it is reasonable to conclude that the disclosure was authorised by the agency and the disclosure was done consistently with the agency’s authorisation; or

- there is a legal duty to do so.

Reasonable to conclude further disclosure of information was authorised by the government agency

If a reasonable person, possessing the required knowledge, skill and experience of a registered tax practitioner, objectively determined, would conclude that the further disclosure of the information was authorised by the government agency, this will be sufficient. It is not necessary to determine the question with any certainty. For example, it would be reasonable to conclude that further disclosure of the information was authorised where:

- the further disclosure was expressly authorised by the government agency, either in writing or otherwise (for example, the formal engagement letter included a clause authorising the disclosure of information); or

- authorisation of the further disclosure was implied by the government agency, either in writing or otherwise.

Other relevant factors may include the following:

- comments made by the government agency when providing the information to the registered tax practitioner; or

- the availability of the information provided to the registered tax practitioner from other sources.

The TPB recommends that the practitioner should, prior to any disclosure, clearly inform the agency that there will be such a disclosure and obtain permission.

Legal duty to do so

Examples where a practitioner may have a legal duty to disclose such information to a third party include:

- providing information requested by the TPB in undertaking enquiries about the practitioner’s conduct

- providing information to the TPB under the breach reporting obligations

- providing information to a court or tribunal pursuant to a direction, order, or other court process

- providing information to AUSTRAC in accordance with reporting obligations anti-money laundering laws

- providing information or documents to the ATO pursuant to a s. 353-10 notice

- providing information to an AFS licensee pursuant to the Corporations Act 2001.

A practitioner should consider whether any of the documents may be subject to LPP.

Inadvertent disclosure

The following are some examples of where registered tax practitioners need to be particularly mindful of their obligations:

- leaving information in unsecured locations which may be accessed by third parties

- disposing (such as trading in or selling to a second-hand market) of IT equipment or mobile devices that contain / store data that may be accessible by third parties

- the use of shredding and data disposal services

- the use of external service providers which may include, for example, IT consultants, virtual assistants, and cleaners

- the use of virtual meetings to discuss information when third parties may be in attendance

- the use of public Wi-Fi or unsecure network when providing services for a government agency

- the use of unencrypted cloud storage.

Obligation to not use information for personal advantage

A practitioner may only use information received for their personal advantage, or the advantage of an associate, employee, employer (which may include the recognised professional association of the registered tax practitioner), or client, if:

- it is reasonable to conclude that the information received from the agency was authorised by the agency to be used in a way that may provide for such a personal advantage

- any further use of the information was done consistently with the agency’s authorisation.

The TPB is of the view that a personal advantage refers to interests that involve potential gain, financial or otherwise, for the practitioner. It may be direct or indirect. The mere possibility that the information has the potential to result in a personal advantage is enough to trigger the obligation.

In determining whether it is reasonable to conclude that the agency authorised such use of the information, the following factors may be relevant:

- the use of the information for the personal advantage of the practitioner (or others) was expressly authorised by the government agency; or

- the use of the information for the personal advantage of the practitioner (or others) was implied by the government agency.

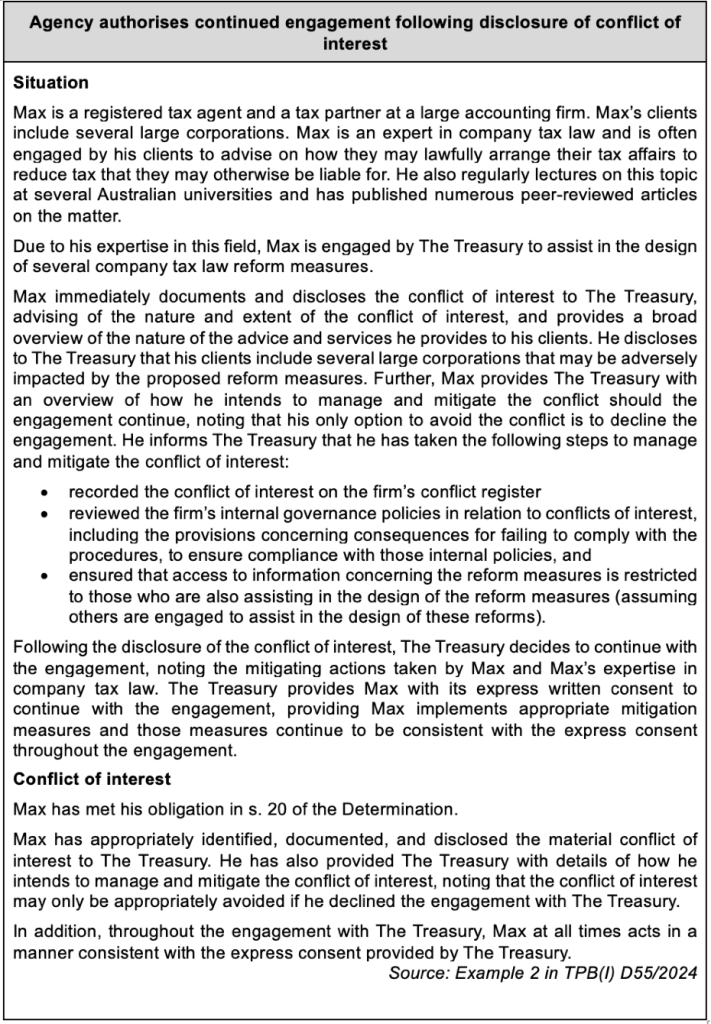

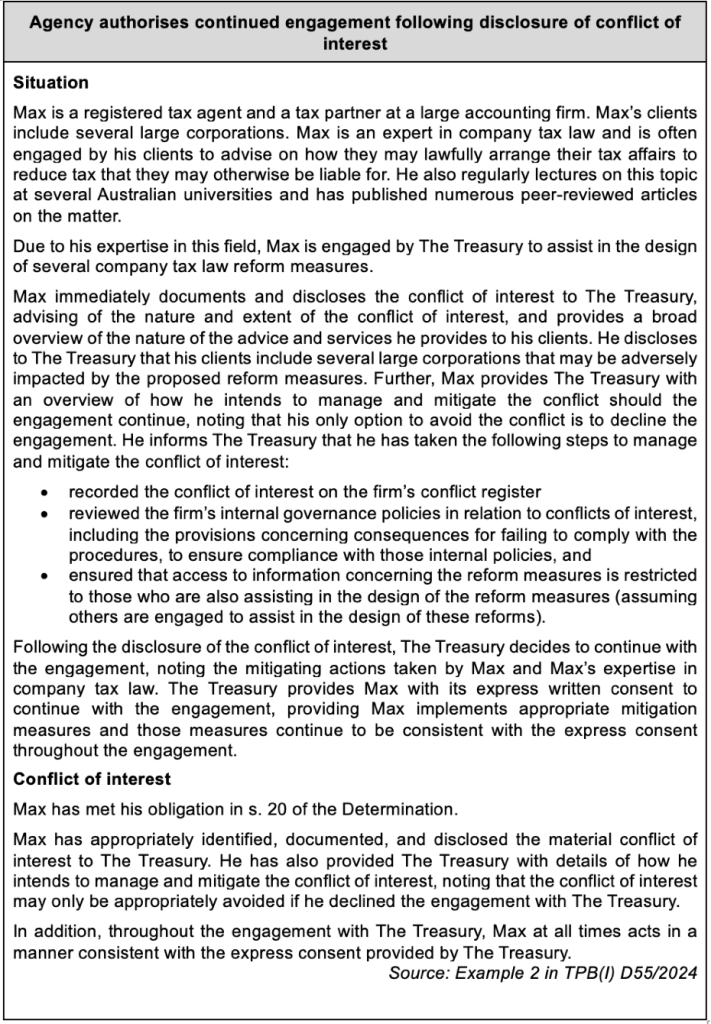

Case studies

There are five case studies in relation to the confidentiality Code item, including the following: