Written by: Letty Chen | Senior Tax Writer

On 6 August 2024, the Tax Practitioners Board (TPB) issued two exposure draft Information Sheets setting out the TPB’s proposed guidance in relation to three of the eight new obligations for registered agents under the Code of Professional Conduct in the Tax Agent Services Act 2009 (TASA).

The Ministerial Determination introducing the new obligations was registered on 2 July 2024, with a commencement date of 1 August 2024. On 31 July, the Assistant Treasurer announced transitional arrangements which generally postpone the new obligations until 1 January 2025 for larger firms (more than 100 employees) and 1 July 2025 for smaller practices (100 or fewer employees).

Refer to our recent Banter Blog articles for more information on the new obligations:

New Code obligations for tax agents

TPB’s transitional approach for new Code obligations starting 1 August

Last minute reprieve for tax agents — Code changes postponed

These articles summarise the requirements of the Determination and guidance provided in the Explanatory Statement to the Determination — these will not be reproduced in the present article.

The exposure draft Information Sheets are:

TPB(I) D54/2024 False or misleading statements to the TPB or Commissioner

There are a number of consultation questions for each draft Information Sheet. The closing date for submissions is 3 September 2024. The TPB anticipates releasing final guidance in late September.

This article will focus on TPB(I) D54/2024 — in relation to false or misleading statements.

Refer to our other article First tranche of draft TPB guidance on new obligations — conflicts of interest and confidentiality for a summary of TPB(I) D55/2024.

Section 15(1) of the Determination provides that registered tax practitioners must not:

that the registered tax practitioner knows, or ought reasonably to know:

in their capacity as a registered tax practitioner or in any other capacity.

Subject to the transitional arrangements, these obligations only apply to statements made on or after 1 August 2024.

A breach of the Code — including this obligation — may result in the TPB imposing one or more sanctions. Further, civil and criminal liabilities may apply for making false or misleading statements.

A ‘statement’ is anything that is disclosed for a purpose connected with a taxation law orally or in writing. A statement includes any taxation document, an activity statement, an amendment request and a registration/application form. It also includes a statement made by omission i.e. a failure to include material informaion.

A form that is lodged is not of the statement that is prepared or made. The statement is the information at the individual labels, fields or questions, schedules or annexures. This means more than one statement can be prepared for, or made on, a form.

The ‘someone else’ who makes or prepares a statement includes individuals working under the practitioner’s supervision and control, another registered tax practitioner, a client, employee or any other person.

The phrase ‘know or ought reasonably to know’ has two elements: actual knowledge and constructive knowledge.

A practitioner must therefore take reasonable steps and make reasonable enquiries to ensure that a statement is not false, incorrect, or misleading in a material particular.

The relevant factors in determining whether a practitioner ought reasonably to know that a statement is false, incorrect or misleading will generally be consistent with the principles in the Code item relating to taking reasonable care to ascertain a client’s state of affairs.

The extent to which a practitioner should make reasonable enquiries or take reasonable steps to substantiate information will be proportionate to the materiality of the matter, having regard to the circumstances, including:

Generally speaking, a material particular is something that is likely to be relevant to an entity’s obligations or entitlements under the TASA or taxation law.

Materiality is determined at the time the statement is made — a statement cannot be made material because of subsequent events.. However, should materiality be made known because of a subsequent event practitioners are required to correct the false or misleading statement.

While the obligation does not require practitioners to take action in relation to a statement that was not false, incorrect or misleading at time it was made, but subsequently becomes so because of some later event, practitioners must ensure that subsequent statements made to the TPB or Commissioner are not false, incorrect or misleading in a material particular, and must comply with all other obligations under the TASA, e.g. the requirement to notify the TPB about changes in circumstances and breach reporting.

Correcting information also displays the goodwill of the practitioner and may be factored into any potential sanctions pursued by the TPB for breach of the Code.

The practitioner must take reasonable steps to advise the maker of the statement that the statement should be corrected. The TPB recommends that the practitioner confirms the advice provided in writing.

Practitioners should advise the maker of the statement that the statement should be corrected as soon as possible. There may be legal time limits that apply to making corrections.

Practitioners may also wish to advise the maker of the statement that should they not correct it within a reasonable period, the practitioner will be required to notify the TPB or Commissioner that the statement is false, incorrect or misleading. The TPB recommends that the practitioner should also advise the maker of the statement the timeframe the practitioner considers to be reasonable for the statement to be corrected, having regard to a range of factors, e.g.:

This obligation will apply regardless of whether a client or former client permits or consents to the practitioner notifying the TPB or Commissioner.

Practitioners must provide the TPB or the Commissioner with sufficient detail to identify the relevant statement and why they believe it to be false, incorrect or misleading in a material particular. The obligation does not require the practitioner to provide additional information, evidence or details in order for the statement to be corrected.

The notification will not be in contravention of the confidentiality requirements in Code item 6 because registered practitioners have a legal duty to correct such statements.

In some circumstances, the making, preparing or directing, or permitting someone to make or prepare a false, incorrect or misleading statement may give rise to the practitioner having a reasonable belief that they have committed a ‘significant breach’ of the Code, requiring a report to be made to the TPB under the breach reporting requirements which commenced on 1 July 2024.

In considering the appropriate action, the TPB will take into account mitigating circumstances, e.g. compliance with the obligations relating to correcting statements and the breach reporting obligations.

Click here for more information or to register.

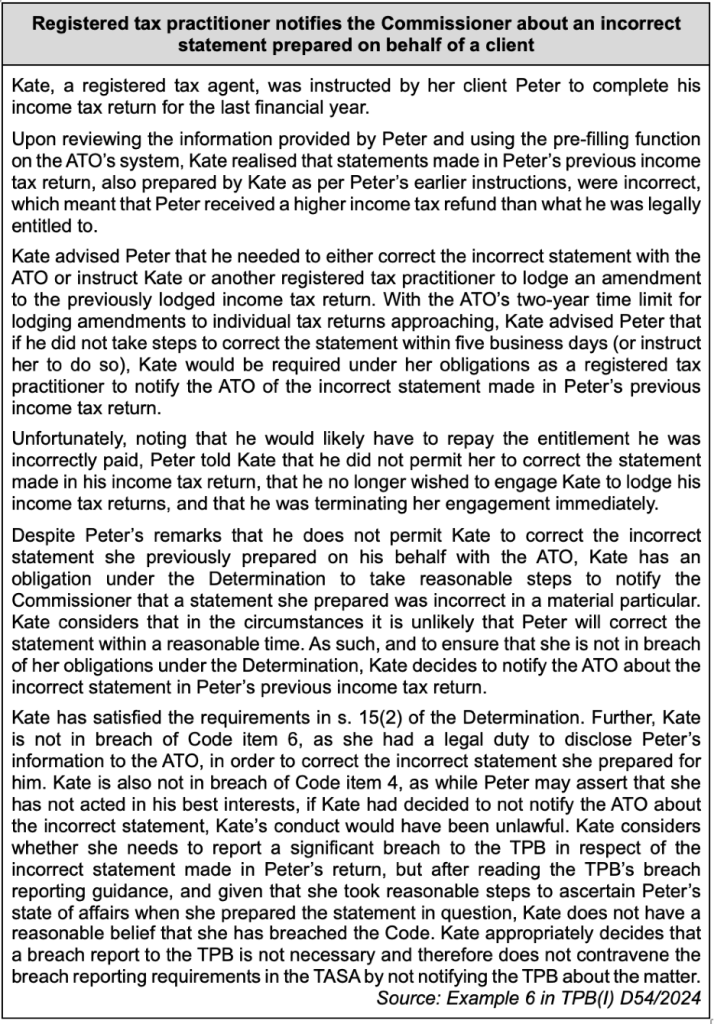

There are six case studies, including the following:

Note: In this example, Kate requested that her client amends his tax return within five business days. From the facts, it is clear Kate chose this timeframe due to the fact that the end of the statutory amendment period for the relevant assessment was approaching. There is currently no definitive guidance as to the number of days which the TPB would consider to be reasonable. However, note that in a recent media interview, the TPB chair Peter de Cure suggested that this may a window of no more than 28 days, though the TPB was also considering a shorter five-day period. We await the final Information Sheet.

Note: In this example, Kate requested that her client amends his tax return within five business days. From the facts, it is clear Kate chose this timeframe due to the fact that the end of the statutory amendment period for the relevant assessment was approaching. There is currently no definitive guidance as to the number of days which the TPB would consider to be reasonable. However, note that in a recent media interview, the TPB chair Peter de Cure suggested that this may a window of no more than 28 days, though the TPB was also considering a shorter five-day period. We await the final Information Sheet.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.