Recent Federal Court and Tribunal decisions have confirmed that the supply of some common supermarket products are wholly taxable. These products are Birds Eye frozen food varieties and Chobani flip yoghurts. The GST law provides that a supply of ‘food’ is GST-free, unless the product supplied is specifically listed as not being GST-free.

Relevantly, food that is ‘marketed as a prepared meal’ and food which is a ‘combination of one or more’ foods listed as being taxable are not eligible for GST-free status. The Court and Tribunal in their respective decisions consider the meaning of those expressions.

![]() Reference:

Reference:

The ATO has an itemised list of major foods and beverages that can be searched to find out their GST status — see the Detailed food list.

Subdivision 38-A of the GST Act provides that a supply of ‘food’ is GST-free. The two pertinent questions are — what is ‘food’ and what are the exceptions to the GST-free status of the supply of food?

The first step is to work out whether the particular item is ‘food’.

The expression food is defined in the legislation as meaning any of the following, or any combination of any of the following:

Food does not include:

The next step is to check whether the supply of the item of food falls within the list of supplies that is not GST-free:

Schedule 1 to the GST Act — food that is not GST-free:

![Gst Free Foods [table For Blog Dec 23] (600 X 1800 Px)](https://taxbanter.com.au/wp-content/uploads/2023/12/GST-free-foods-table-for-blog-Dec-23-600-x-1800-px.png)

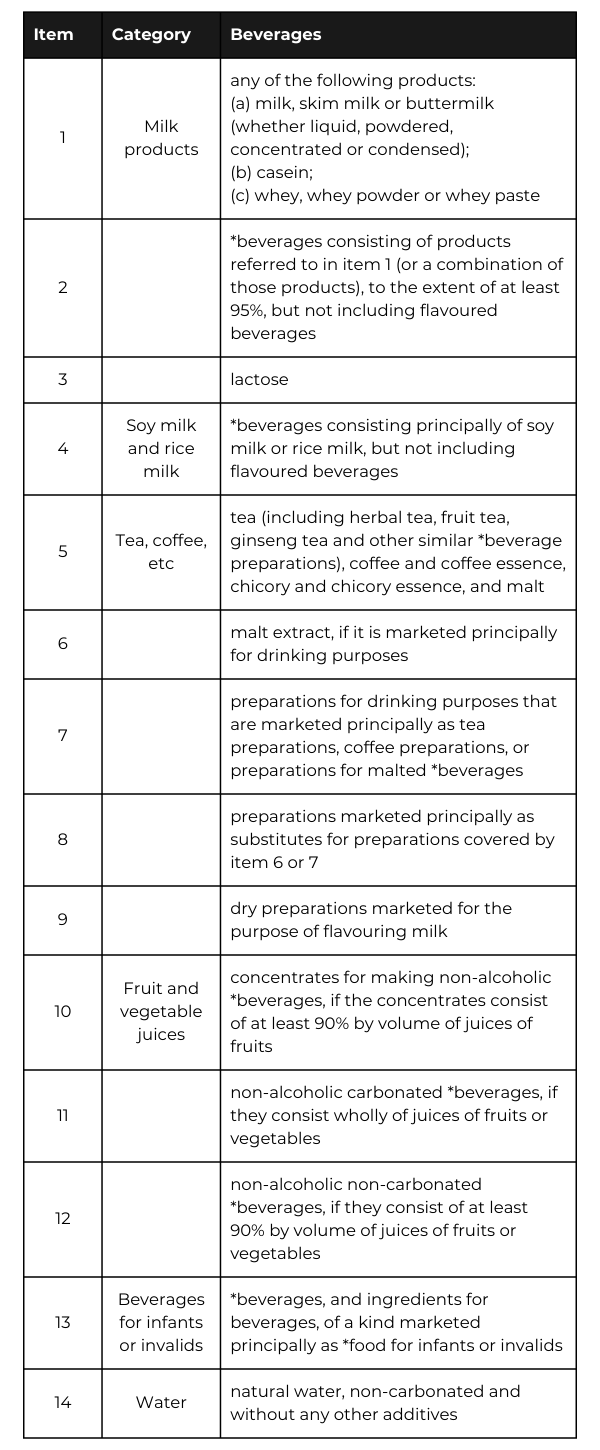

Schedule 2 to the GST Act — beverages that are not GST-free:

See Schedules 1 and 2 for explanatory notes in relation to particular items.

Premises includes:

Where the supply of food is GST-free, a supply of the packaging in which the food is supplied is also GST-free — to the extent that the packaging is necessary and is of a kind in which that kind of food is normally supplied.

Get our newsletter delivered straight to your inbox – sign up here!

Get our newsletter delivered straight to your inbox – sign up here!

Simplot Australia Pty Limited v FCT [2023] FCA 1115

The Taxpayer was the importer and supplier of the following frozen food products (together, the Products):

Whether the Products were excluded from GST-free status under s. 38-3(1)(c) — in particular, whether the Products were ‘food marketed as a prepared meal, but not including soup’ as specified in the table in Schedule 1 to the GST Act.

The Court held that the Products were the kind of food marketed as a prepared meal. Therefore, supplies of the Products were taxable, and not GST-free.

The category is directed not at how the Products are in fact consumed or purchased but whether they are members of a class or genus of foods that are marketed as prepared meals. The characteristic that the foods must have in common is that they are of a type marketed as a prepared meal (to the end consumer.

The term ‘marketed’ looks at the activities of the seller (specifically in communicating or conveying messages to the market for the promotion or sale of the product) and not at how the goods are consumed. Relevant matters include labelling, packaging, display, promotion and advertising.

In considering the meaning of ‘meal’, the Court considered that the statutory context is the identification of a class or category of food, not of an occasion. For food to be of a kind marketed as a prepared meal, it is not necessary it be marketed for consumption as a breakfast, lunch or dinner. The category looks to the content of the food, rather than at the time at which it is taken.

The attributes of a prepared meal, discerned from common experience, include:

The form of packaging is not determinative of the issue of whether a food is of a kind marketed as a prepared meal.

Chobani Pty Ltd and FCT [2023] AATA 1664

The product under consideration was the Chobani Flip Strawberry Shortcake flavoured yoghurt. It comprised strawberry flavoured yoghurt, packaged in the main compartment of a plastic tub and dry inclusions which sat in a separate smaller compartment of the same plastic tub.

The dry ingredients were a blend of cookie pieces and white chocolate chips. The tub had a score line between the two compartments, allowing the consumer to remove the single foil covering and bend the tub to flip the dry inclusions in the smaller compartment into the flavoured yoghurt in the larger one.

The Taxpayer was the manufacturer of the Product.

Whether the Product was excluded from GST-free status under s. 38-3(1)(c) — specifically, whether the Product was a combination of one or more foods specified as not GST-free in Schedule 1.

The Taxpayer had not discharged its burden of proving that the Product was not a food that was a combination of one or more foods at least one of which was biscuit goods or confectionery or food of such a kind. Therefore, supplies of the Product are taxable supplies, and not GST-free.

Having regard to the physical composition and presentation of the Product — how it was marketed, the significance of the dry ingredients to the marketing of the Product and the consumer experience, the overall impression was that the Product was a combination of strawberry‑flavoured yoghurt, cookie pieces and white chocolate chips. The cookie pieces and chocolate chips were not insignificant, remained readily identifiable, and were not subsumed into a separate product.

There was no doubt that chocolate sold for immediate consumption, and not for baking purposes would be confectionery. The chocolate in the Product was included for its sweet creamy flavour and texture, suggesting that it was to be enjoyed as chocolate.

Although the biscuit pieces were not complete cookies or biscuits — they presented as a crumble — they were described in the product specification as ‘baked cookie pieces’. They were not marketed as ingredients to be used to prepare another food but rather as a significant distinguishing feature of a single Product.

The cookie pieces made up 70 per cent of the weight of the dry inclusions, which suggested that the blend consisted principally of cookies or food of that kind, and were therefore biscuit goods. The cookie and chocolate pieces had not lost their separate identity as part of the blend of dry inclusions.

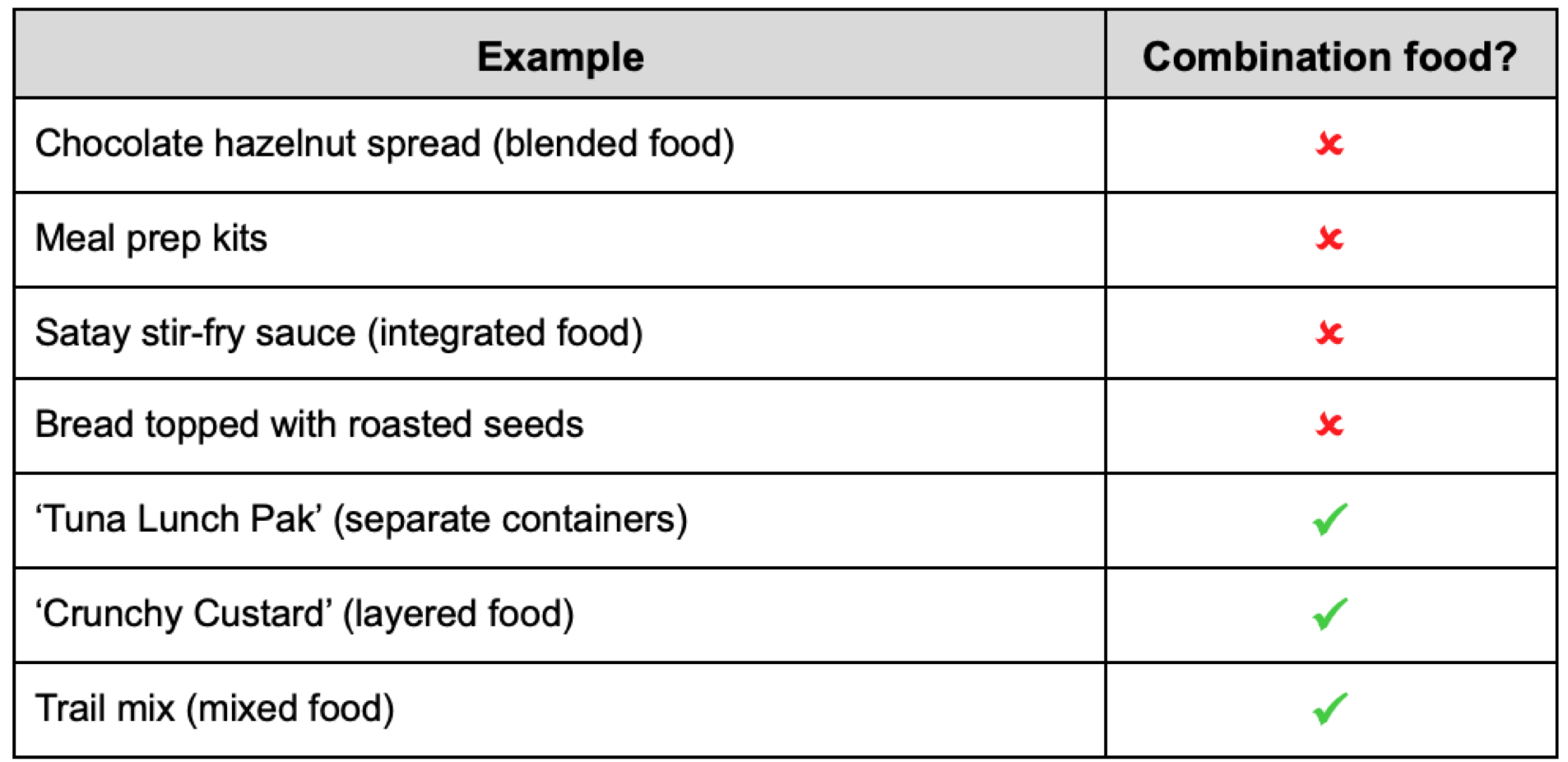

Subsequent to the Tribunal decision in Chobani, the ATO issued draft GSTD 2023/D1 titled Goods and services tax: supplies of combination food which sets out the Commissioner’s preliminary view about the meaning of combination food in s. 38-3(1)(c) of the GST Act.

The exclusion from GST-free treatment includes a product which is a combination of foods, one or more of which is an item contained in the table in Clause 1 of Schedule 1 to the GST Act, i.e. an item excluded from GST-free status.

In Chobani the Tribunal accepted ‘combination’ takes its ordinary meaning, as the product or outcome of joining two or more things together in some way.

The draft Determination sets out the Commissioner’s preliminary view — by reference to the Tribunal’s decision in Chobani — that a supply of a combination food is the supply of a product comprising separately identifiable foods, at least one of which is a taxable food.

The draft Determination sets out the following principles which apply in determining whether there is a supply of a combination food:

The draft Determination contains a number of examples:

![]() Note:

Note:

GSTR 2001/8, which concerns apportioning the consideration for a supply that includes taxable and non-taxable parts, has no application to supplies of combination foods. Combination foods have no non-taxable parts and are always treated as a single taxable thing.

The ATO will issue an addendum to the GST Industry Issue Detailed food list to ensure consistency with the draft Determination — specifically, the GST status of ‘dip (with biscuits, wrapped individually and packaged together)’ will change from mixed supply to taxable supply.

NOW is the time to get organised! We offer online sessions, as well as workshops throughout Australia.

Purchase an entire series of training this December and save 15-25%.

Get our early bird pricing while it lasts.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.