The 2023 Intergenerational Report provides a 40-year projection of the outlook of the economy and the Government’s budget to 2062–63.

The five major forces that will shape the Australian economy over the coming decades are population ageing, expanded use of digital and data technology, climate change and the net zero transformation, rising demand for care and support services and increased geopolitical risk and fragmentation.

It is projected that the economy will be around two and a half times larger but it will grow at a slower rate than in the past, at an average of 2.2 per cent a year. Real incomes will be around 50 per cent higher.

Australia’s population is projected to grow more slowly at an average of 1.1 per cent per year, compared to 1.4 per cent over the past 40 years. It is projected to reach 40.5 million.

The population will continue to age — the number of people aged 65 and over will more than double and the number aged 85 and over will more than triple, while the number of centenarians will increase six-fold.

As the population continues to age, the overall participation rate is projected to decline from 66.6 per cent to 63.8 per cent.

The gender gap in participation is expected to continue to narrow.

Productivity growth is assumed to grow at 1.2 per cent a year, around the average of the past 20 years.

The ageing population will reinforce the trend towards a services-based economy, with the care and support sector potentially doubling.

Digitalisation will change how we work, raising productivity, improving workplace safety and providing agility.

The net zero transformation will see global demand for some exports decline, while creating new markets and opportunities. Critical minerals could become key exports as the world transitions to net zero. Australia is already the world’s largest producer of lithium, supplying more than half of all global production. Global demand for lithium could be more than eight times higher in 40 years time.

Climate change will have profound impacts on the economy and society. It will affect where and how Australians choose to live and work, food and energy security and our environment.

The five main spending pressures are health, aged care, the NDIS, defence and debt interest payments. They are projected to rise from around one-third to one-half of all government spending.

Total government spending is projected to rise by 3.8 percentage points of GDP, with the ageing population causing around 40 per cent of the increase.

Despite the ageing population, spending on age and service pensions is projected to fall as a share of GDP, with superannuation increasingly funding retirements.

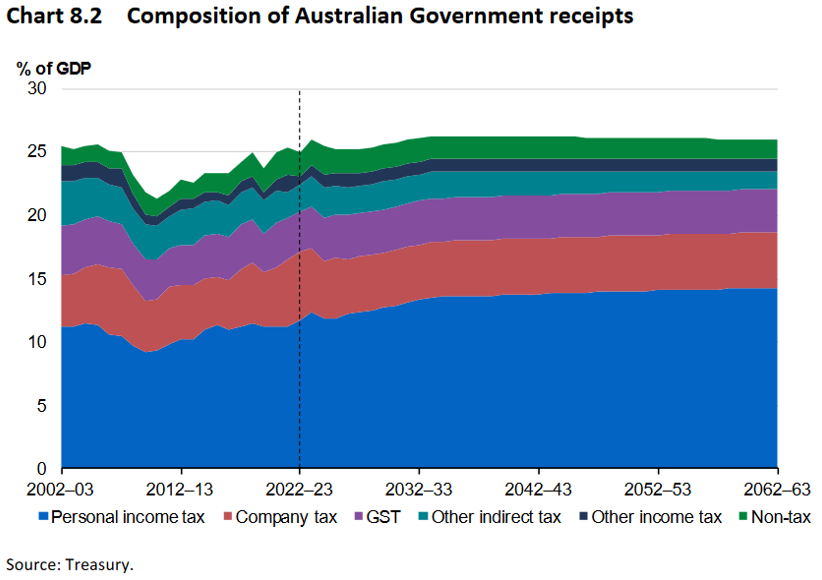

Tax as a share of the economy is assumed to be constant over the long run.

Structural changes to the economy will put pressure on the revenue base. Reliance on the following is expected to decrease:

Non-tax receipts are projected to decline as a share of the economy, reflecting lower earnings from the Australian Government Future Fund as assets are anticipated to be drawn down to fund public superannuation liabilities.

The underlying cash balance was in surplus in 2022–23 for the first time since 2007–08, but projected to return to deficit for the remainder of the projection period, reaching 2.6 per cent of GDP in 2062–63. Gross debt as a share of GDP is projected to decline over the coming decades.

Growing spending pressures are projected to result in deficits remaining, with gross debt projected to reach 32.1 per cent of GDP by 2062–63.

Tax receipts were expected to comprise 92.5 per cent of total receipts in 2022–23 — this is projected to rise to 93.9 per cent by 2062–63.

Tax projections in the Intergenerational Report reflect the assumption that tax as a share of the economy remains constant at 24.4 per cent of GPD — this is a feature of every intergenerational report.

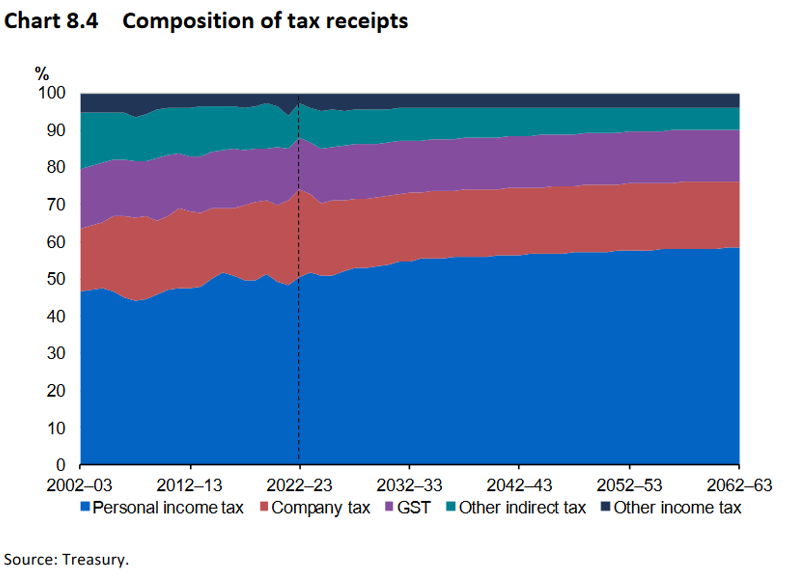

Changing consumer preferences, rapid technological advances, efforts to decarbonise and a more complex global strategic outlook are projected to directly impact the tax system.

In particular:

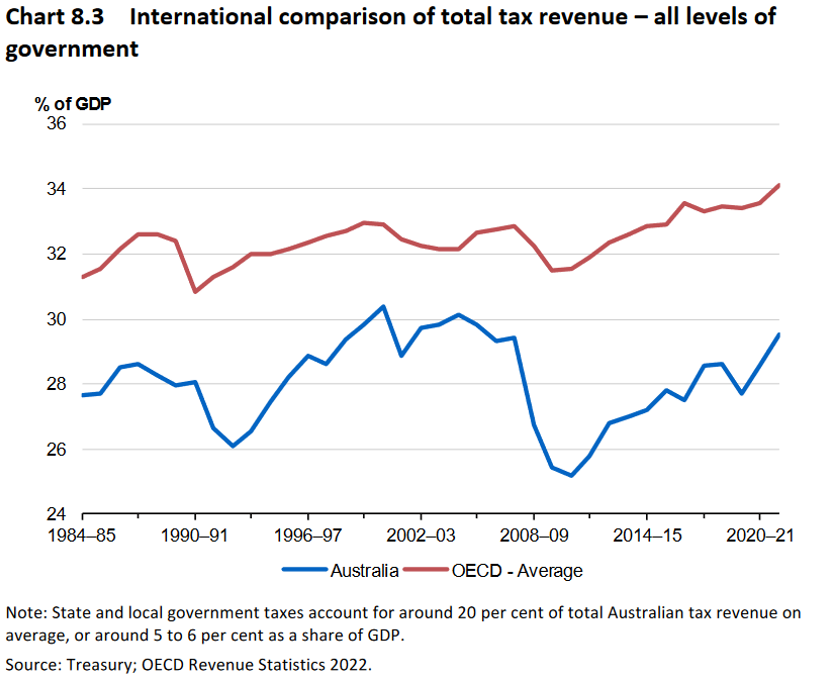

After falling to a recent low of 21.8 per cent of GDP in 2019–20, the tax-to-GDP ration is now forecast to reach 23.9 per cent in 2023–24, and 24.4 per cent in 2033–34.

A significant difference between Australia and most other OECD countries is that Australia’s tax mix does not include social security contributions (similar in many respects to compulsory superannuation contributions).

Personal income tax is projected to increase from 13.5 per cent of GDP in 2033–34 to 14.3 per cent in 2062–63.

Longer-run economic trends will influence the composition of tax receipts. These include increased take up of electric vehicles and reduced smoking rates.

In the absence of policy change, the following changes over the next 40 years are projected:

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 14 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

![]() Outsource your L&D

Outsource your L&D

We can also present tax updates or specialty topics at your firm or through a private online session, with content tailored to your client base. Call our friendly staff on 03 9660 3500 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Email us to have a chat >

Join thousands of savvy Australian tax professionals and get our weekly newsletter.