[lwptoc]

![]() Editor’s notes:

Editor’s notes:

This article was original posted on 22 July 2020 based on the details contained in the Government’s announcement of the extended JobKeeper scheme on 21 July 2020. This article has been subsequently updated to incorporate the changes to the extended scheme announced on 7 August 2020.

The Treasury has updated its fact sheet titled Extension of the JobKeeper Payment (the Fact Sheet) in relation to the extended scheme.

On 14 August 2020, the Treasurer registered the Coronavirus Economic Response Package (Payments and Benefits) Amendment Rules (No. 7) 2020 which changed the employee eligibility reference date from 1 March 2020 to 1 July 2020 with effect from 3 August 2020. This article has not been updated for this development. See our newest update, JobKeeper employee eligibility date changed to 1 July 2020 for an outline of these amendments.

On 21 July 2020, the Government announced that due to the ongoing COVID-19 crisis, the JobKeeper Payment scheme will be extended by six months until 28 March 2021, from the original end date of 27 September 2020. The period of the extended scheme comprises 13 fortnights — i.e. the proposed extension exactly doubles the length of the original scheme. From 28 September 2020:

On 7 August 2020, the Treasurer announced further changes to increase access to the scheme during the proposed extension period (i.e. 28 September 2020 to 28 March 2021), driven by the ongoing crisis and the implementation of Stage 4 business restrictions in Victoria.

Under these revisions, from 28 September 2020, entities will only have to meet the quarterly decline in turnover test for (broadly) the previous quarter instead of multiple quarters as was originally proposed.

Significantly, from Monday 3 August 2020, the employee eligibility test date will move from 1 March 2020 to 1 July 2020. The new reference date will apply for the last four fortnights of the legislated scheme as well as the duration of the proposed extended period. Staff who were hired after 1 March 2020 may now be eligible for JobKeeper.

The Treasurer’s media release also reports the following anticipated consequences of the revisions to the proposed extended scheme:

The proposed changes to the scheme will be brought into legal effect once the Treasurer registers a Legislative Instrument to amend and/or supplement the Legislative Instrument titled the Coronavirus Economic Response Package (Payments and Benefits) Rules 2020 (the Rules).

![]() Reference — Treasury fact sheet

Reference — Treasury fact sheet

The Treasury fact sheet (the Fact Sheet) titled Extension of the JobKeeper Payment is available here.

On 21 July 2020, the Treasury also released its findings from its three-month review of the JobKeeper scheme, which it completed in June 2020. The report titled JobKeeper Payment: Three-month review concludes that there is a ‘strong case’ to continue the scheme beyond 27 September 2020 and recommends some changes.

For an overview of the existing JobKeeper scheme rules that were announced on 30 March 2020 and the changes which have taken effect since then, refer to our previous Banter Blog articles:

The following terminology is used in this article for ease of reference as follows:

The proposed amendments to the operation of the JobKeeper scheme are outlined below. Other features of the current scheme will remain the same for the extended scheme.

An individual is an eligible employee of their employer for a fortnight where they satisfy the following requirements:

Similar eligibility requirements exist for business participants, relevantly including that, on 1 March 2020, the individual was:

The eligibility criteria for employees (and business participants) will change from Monday 3 August 2020. For the final four fortnights of the current scheme, and throughout the extended scheme, the reference date for employee eligibility for the extension periods will generally change from 1 March 2020 to 1 July 2020.

The revised eligibility criteria are as follows:

The payment rate — i.e. the minimum amount which an eligible employer must pay an eligible employee, and the amount which the ATO pays the employer per eligible employee — is $1,500 per fortnight. This is a flat rate regardless of the employee’s work hours for the relevant fortnight.

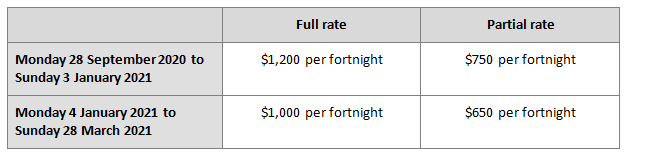

The payment rate will be reduced in two tranches as follows:

The eligibility criteria for the full rate and the partial rate are explained below.

![]() Note

Note

Businesses will be required to nominate which payment rate they are claiming.

There is no distinction between full-time, part-time, fixed term, casual or stood down employees for the purposes of the minimum payment. Every eligible employee is entitled to the minimum payment of $1,500 per fortnight regardless of the number of hours worked in a fortnight.

An employee must have been employed (other than as a casual, excluding a long-term casual) by the business on 1 March 2020.

A business participant must have been actively engaged in the business on 1 March 2020.

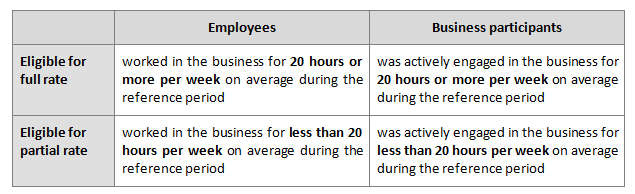

The two-tier payment system will apply to workers based on their average weekly work hours in the relevant reference period.

The reference period is the four weeks of pay periods before either 1 March 2020 or 1 July 2020.

Workers with 1 March 2020 eligibility are able to use the period with the higher number of hours worked.

The payment tiers will apply as follows:

![]() Implications

Implications

Under the current scheme, the requirement for an employee to have been employed on 1 March 2020 and for a business participant to have been actively engaged in the business on 1 March 2020 does not include a minimum number of hours of the employment or active engagement.

Employees whose work hours decreased from at least 20 hours per week (average) to less than 20 hours per week after February/June 2020 due to the COVID-19 crisis — including those who were stood down — will still remain entitled to the full payment rate regardless of the hours they actual work in a fortnight from 28 September 2020.

Business participants who, before March/July 2020, worked in their business for less than 20 hours per week (average) but have since increased their active participation due to the crisis will not qualify for the full payment rate regardless of how many hours they work in their business from 28 September 2020.

The original version of the Fact Sheet released on 21 July 2020 indicated that the payment rate for business participants would be determined based on whether the business participant was actively engaged in the business for less than 20 hours, or for 20 hours or more, on average in the month of February 2020.

The revised version of the Fact Sheet removes the reference to the calendar month of February 2020 (nor does it refer to the calendar month of June 2020). Accordingly it would appear that the test period for business participants has been changed to align with the test period for employees, i.e. the four weeks of pay periods prior to 1 March or 1 July 2020. The question arises as to how the hours of active engagement will be tested if the business does not have any employees, i.e. there are no ‘pay periods’.

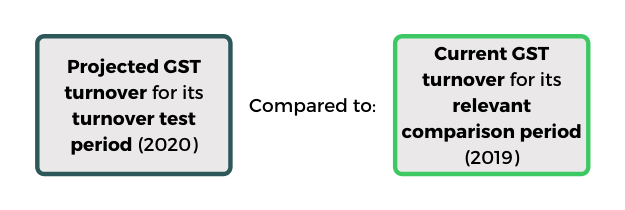

The decline in turnover test operates by comparing the business’:

The turnover test period may be:

The relevant comparison period is the corresponding month or quarter in 2019.

The business’s turnover must have decreased by the requisite percentage — i.e. 15, 30 or 50 per cent — between the comparison period and the turnover test period.

The Commissioner has exercised his discretion to establish an alternative decline in turnover tests where there is not an appropriate relevant comparison period.

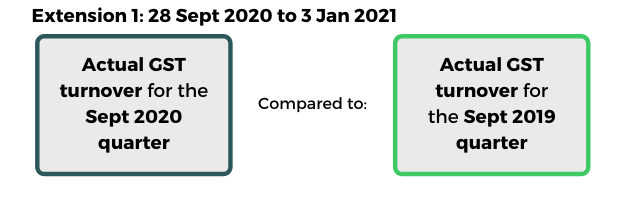

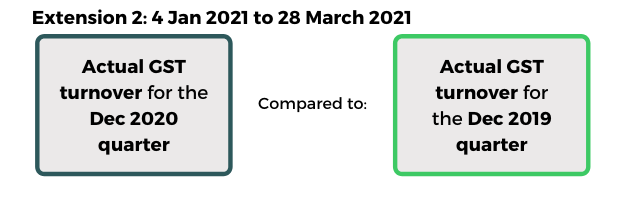

The proposed new decline in turnover test will operate as follows:

![]() Implications

Implications

From 28 September 2020, businesses will no longer be able to test for eligibility using projected (i.e. estimated) GST turnover or to choose a calendar month as a test period.

Businesses will generally be able to assess eligibility based on details reported in their Business Activity Statement (BAS).

The deadline to lodge the September BAS is in late October, and the December BAS is in late January (monthly) or late February (quarterly). Therefore businesses will need to assess their JobKeeper eligibility in advance of the BAS deadline in order to meet the wage condition.

There are a number of matters in relation to which the Commissioner will have discretion in relation to the ATO’s administration of the extended scheme:

At time of writing the ATO has not released any guidance on how it will administer the proposed extended scheme.

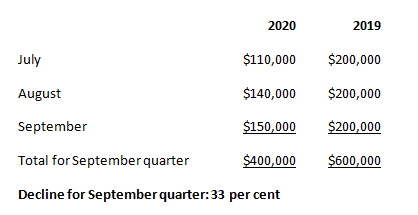

This example has been extracted from the Fact Sheet.

Carmen owns and runs the City Café. Carmen started claiming the JobKeeper Payment for her eligible staff and herself as a business participant when the JobKeeper Payment commenced on 30 March 2020. At the time, Carmen estimated that the projected GST turnover for City Café in April 2020 would be 70 per cent below its actual GST turnover in April 2019. To be eligible for the JobKeeper Payment from 30 March 2020 to 27 September 2020, Carmen needed to show the turnover for the City Café was estimated to decline by at least 30 per cent.

As a monthly BAS lodger, Carmen submitted her BAS for the City Café in July, August and September. For each of these, her actual turnover was as follows:

The actual turnover decline for the September 2020 quarter is greater than 30 per cent, so City Café is eligible for the JobKeeper Payment for the period of 28 September 2020 to 3 January 2021.

Business continued to improve for the City Café, and actual turnover for the December 2020 quarter was 20 per cent less than the December quarter 2019, so the City Café was no longer eligible to claim the JobKeeper for the second extension period starting from 4 January 2021.

Carmen also needs to calculate how much to claim for each of her staff, and for herself as a business participant.

As Carmen was working full-time at the café herself throughout February 2020, she is entitled to claim $1,200 per fortnight from 28 September 2020 to 3 January 2021, as an eligible business participant.

She has three full-time employees who are also eligible to be paid $1,200 per fortnight because they each worked 20 hours or more per week throughout February 2020.

Carmen has an employee, Chris, who works part-time with different hours every other week: 14 hours one week; and 22 hours the next week. During the two pay fortnights (i.e. the four weeks of pay periods) prior to 1 March 2020, Chris was employed for 36 hours in each fortnight. On average, Chris worked less than 20 hours per week for City Café. Carmen is eligible to claim $750 per fortnight for Chris, from 28 September 2020 to 3 January 2021.

Cathy is an eligible employee who worked on a long-term casual basis during February 2020 and June 2020. To determine what rate of JobKeeper Payment to claim for Cathy, Carmen looks at pay records for the two fortnightly pay periods before 1 March 2020 and 1 July 2020. She sees that Cathy was employed on average less than 20 hours per week, so Carmen claims $750 per fortnight for Cathy, from 28 September 2020 to 3 January 2021.

Carmen also started employing Charles, who works part-time, from June 2020 when business started picking up again. Because Charles was employed at City Café before 1 July 2020, Carmen looks at pay records for the two fortnightly pay periods before 1 July 2020 to determine the rate of JobKeeper Payment to claim for Charles. Charles was employed on average less than 20 hours per week for this period, so Carmen claims $750 per fortnight for Charles, from 28 September 2020 to 3 January 2021.

Still have questions relating to JobKeeper 2.0? Check out our recent JobKeeper presentation that will cover key information to prepare yourself and your clients for the new changes.

This webinar — recorded on 31 July 2020 — addresses the changes proposed by the Government on 21 July 2020. However, it does not incorporate the further Government announcements of 7 August 2020.

Further information

For more on the latest legislation changes, join us for our monthly tax updates, hosted by some of Australia’s leading tax experts.

We facilitate these online and in locations across Australia (in line with current COVID-19 restrictions).

Join thousands of savvy Australian tax professionals and get our weekly newsletter.