[lwptoc]

On 15 September 2020, the Treasurer registered the Coronavirus Economic Response Package (Payments and Benefits) Amendment Rules (No. 8) 2020 which sets out the rules for JobKeeper 2.0 — i.e. the extension of the JobKeeper scheme from 28 September 2020 to 28 March 2021.

These JobKeeper extension rules allow the Commissioner to exercise a discretion to make specific rules in relation to certain aspects of the extended scheme. On 16 September 2020, the Commissioner registered the following Legislative Instruments:

This article summarises each of these Determinations. The Decline in Turnover Test Determination is relevant for working out whether the entity is eligible for JobKeeper during each of the two extension periods, while the Higher Rate Determination and the Alternative Reference Period Determination assist the entity in determining the payment rate that applies to specific classes of eligible individuals.

See our previous Banter Blog article JobKeeper 2.0 is now law for an overview of JobKeeper 2.0. A recording of our JobKeeper Extended webinar, which was presented on 16 September 2020, is available for purchase through this link.

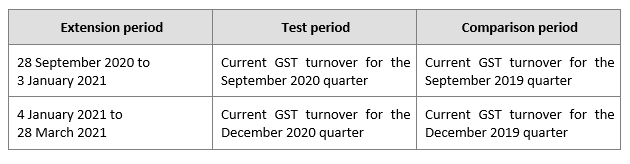

From 28 September businesses will need to apply a new actual decline in turnover test in respect of each quarter — in addition to the existing decline in turnover eligibility test.

The new ‘actual decline in turnover test’ will operate as follows:

To pass the test, the entity’s turnover must have declined by 50 per cent, 30 per cent or 15 per cent (as applicable) between the comparison period and the test period.

The Commissioner has the discretion to determine that certain supplies or classes of supplies are to be treated as being wholly or partly made at a particular time.

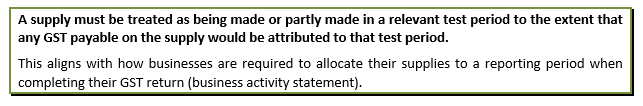

The effect of the Determination is to set out the time or times a supply is treated as being made for the purposes of calculating an entity’s current GST turnover in a test period.

![]() Note:

Note:

The ATO has released website guidance in relation to this Determination. The website also states that the ATO will publish further guidance on the alternative tests for the actual decline in turnover test soon.

In calculating the current GST turnover, a supply is treated as being made at a time in the test period to the extent the GST payable on the supply would be attributable to that test period if:

The effect is that supplies are allocated to a test period to the extent that any GST payable would have been attributable to that test period if the supply was a taxable supply. Once the supply, or part of the supply, is allocated to a test period then the corresponding value of the total supply or of the part of the supply is used to calculate the current GST turnover.

Increasing or decreasing adjustments, and adjustments for bad debts, are excluded from the GST turnover calculation under the Determination.

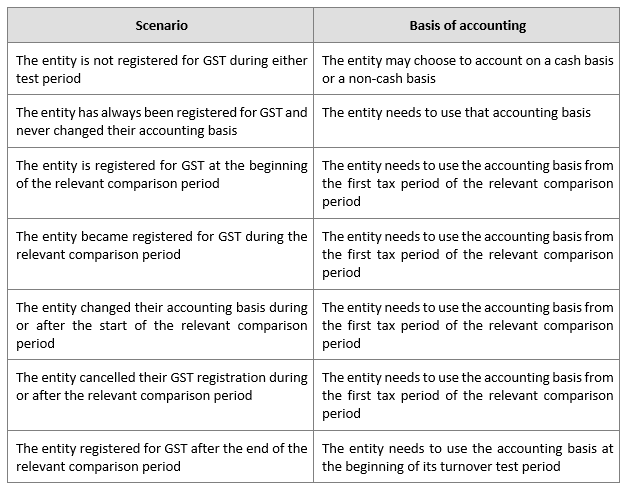

The Determination provides rules regarding the basis of accounting that an entity is required to use — i.e. either a cash or non-cash (accruals) basis.

The rules are as follows:

See the Explanatory Statement to the Determination for a detailed practical example.

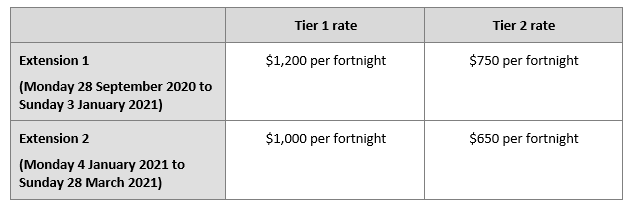

The two-tier payment system will apply to each employee based on their total working hours in the applicable ‘reference period’ (see the Alternative Reference Period Determination section below).

The higher rate applies to eligible employees if the total hours of work, paid leave and paid absence on public holidays for their employer in any reference period was 80 hours or more. Otherwise, the lower rate applies.

Where the hours in a reference period for a class of individuals are not readily ascertainable, the Commissioner has the power to determine specified circumstances in which the higher rate is taken to apply to individuals in that class. In the Higher Rate Determination, the Commissioner has determined specified circumstances in which the higher rate will be taken to apply.

![]() Note:

Note:

The ATO has released website guidance in relation to this Determination.

The Determination applies in respect of individuals for whom their employer:

This class includes individuals paid salary, wages, commission, bonus or allowances that are not tied to an hourly rate or contracted rate, where there are no (or incomplete) records of the relevant hours. It is expected that employers would be less likely to have records of the hours worked by these types of employees and as such the Determination may apply to determine if the higher rate applies.

The Determination does not apply to an employee if their employer can readily ascertain the employee’s total hours of work, paid leave and paid absence on public holidays in a reference period.

If an employer determines that an employee satisfies any of the following three tests, the higher rate will apply.

See the Explanatory Statement to the Determination for five practical examples.

The higher rate applies to employees where, in a reference period, the sum of the following amounts totalled $1,500 or more:

![]() Note: Consistent with the Superannuation Guarantee rules, any amount paid to ‘top-up’ an employee salary to satisfy the wage condition is excluded from this calculation.

Note: Consistent with the Superannuation Guarantee rules, any amount paid to ‘top-up’ an employee salary to satisfy the wage condition is excluded from this calculation.

The higher rate applies to employees if a written industrial award, employment contract or similar instrument governs their employment relationship and under that agreement an employee was required to work 80 hours or more in a reference period (including paid leave and paid absence on public holidays).

The higher rate applies to employees if it can be determined, based on reasonable assumptions, that an employee’s hours in a reference period were 80 hours or more (including paid leave and paid absence on public holidays).

This test also requires that the hours are not readily ascertainable. While this is satisfied where the hours are not readily ascertainable, it is also satisfied where, while the hours could be readily ascertainable (albeit in the absence of complete records of the hours worked), the steps necessary to determine the hours are not reasonable having regard to the burden it would place on the employer.

In either circumstance, employers must make reasonable assumptions to estimate whether the employee’s hours in a reference period were 80 hours or more. For assumptions to be reasonable, they must be based on verifiable information. This could include information on how an employer’s business usually operates, such as the ordinary business hours, average staffing level in any given week, common shift lengths for certain types of employees and the average number of shifts of employees.

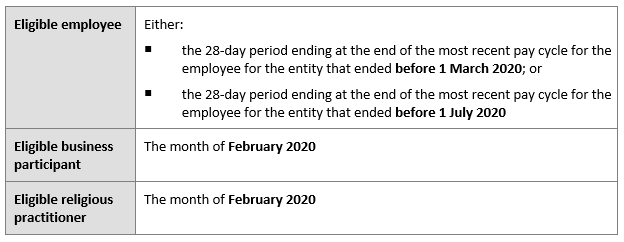

The payment rate that is applicable to each eligible individual is determined based on their total working hours in the applicable ‘reference period’. Broadly, the individual is entitled to the higher payment rate where they performed relevant work for at least 80 hours during their reference period.

The reference period (the standard reference period) for an individual is as follows:

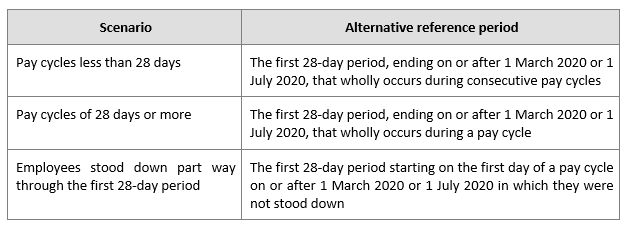

The Commissioner has the power to determine that an alternative reference period applies to a specified class of individuals where he considers that the standard reference period may not be suitable. The Determination sets out these circumstances and the alternative reference periods that apply in those circumstances.

![]() Note:

Note:

The ATO has released website guidance in relation to this Determination.

The Determination sets out the alternative reference period for four classes of eligible employees. Where more than one alternative reference period applies to an employee, the employee can meet the 80 hours threshold to qualify for the higher payment rate under any applicable alternative reference period.

This class includes an eligible employee in respect of which:

A comparison must be made to earlier 28-day periods, being:

Employers can look back to earlier 28-day periods in which any circumstances that affected the number of hours in the standard reference period did not exist to identify a typical 28-day period.

Common reasons the total number of hours in the standard reference period are not representative of typical hours include:

The alternative reference period that applies to an eligible employee is the 28-day period ending at the end of the most recent pay cycle for the employee before 1 March 2020 or 1 July 2020 in which the employee’s total number of hours of work, of paid leave and of paid absence on public holidays was representative of a typical 28-day period.

The alternative reference period is the same as for Class 2 above.

This class of employees comprise employees of a business which changed hands or who were transferred within the same wholly-owned group after 1 March or 1 July 2020, where the JobKeeper Rules allow them to be treated as having been employed by their current employer at the earlier time.

The hours worked for the previous employer cannot count towards the 80 hour threshold.

The alternative reference period is the same as for Class 2 above.

The Determination sets out the alternative reference period for three classes of eligible business participants. Where more than one alternative reference period applies, the business participant can meet the 80 hours threshold to qualify for the higher payment rate under any applicable alternative reference period.

This class of individuals includes an eligible business participant where the total number of hours the eligible business participant was actively engaged in the business in February 2020:

To determine the alternative reference period, the following must be identified:

That most recent period will be the alternative reference period.

For example, if the eligible business participant was absent through sickness in February 2020, causing that month not to be representative of a typical month, the alternative reference period would be the most recent 29-day period (wholly within a calendar month) in which they were not sick.

The alternative reference period is the 29-day period starting on the day the individual first began to satisfy the business participation requirement for the entity.

This class comprises eligible business participants where the entity conducted some or all of its business in a declared drought zone, or declared natural disaster zone, during February 2020.

The alternative reference period would be the most recent 29-day period within a calendar month ending before 1 March 2020, during which the entity did not conduct business or some of its business in a declared drought zone or declared natural disaster zone.

The Determination sets out the alternative reference period for two classes of eligible religious practitioners.

This class of individuals includes an eligible religious practitioner where the total number of hours they spent doing relevant activities in February 2020:

Relevant activities are activities done:

The alternative reference period is the most recent 29-day period wholly within a calendar month ending before 1 March 2020 during which the eligible religious practitioner’s total number of hours spent doing relevant activities was representative of the eligible religious practitioner’s total number of those hours in a typical 29-day period.

The alternative reference period is the 29-day period starting on the day the eligible religious practitioner first commenced doing those activities.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.