[lwptoc]

The Coronavirus Economic Response Package (Jobkeeper Payments) Amendment Act 2020 (the Act) received Royal Assent on 3 September 2020.

The Act makes amendments to various legislation to:

This article briefly outlines each of these changes, including how accounting and tax practitioners will play a central role in the new Fair Work rules.

The Act amends the Coronavirus Economic Response Package (Payments and Benefits) Act 2020 (the Payments and Benefits Act) to authorise the Government to make JobKeeper payments in relation to a time between 1 March 2020 to 28 March 2021. Previously, the Government was only authorised to make payments in relation to a time between 1 March 2020 and 31 December 2020, and the scheme had been scheduled to cease on 27 September 2020. This change will extend the scheme to 28 March 2021, as previously announced on 21 July 2020.

The operational JobKeeper rules are contained in the Coronavirus Economic Response Package (Payments and Benefits) Rules 2020 (the JobKeeper Rules). Under the revised Payments and Benefits Act, the Treasurer is now empowered to register a Legislative Instrument to amend the JobKeeper Rules to give effect to the other changes to the scheme — as proposed in the Treasurer’s announcements on 21 July 2020 and 7 August 2020 — for the period 28 September 2020 to 28 March 2021.

The tax secrecy provisions in Subdiv 355-B of Schedule 1 to the TAA makes it an offence for an ATO officer to make a record of, or disclose, protected information. Protected information is generally information that relates to the affairs of an entity and identifies, or is reasonably capable of being used to identify, that entity, where that information was disclosed or obtained under or for the purposes of a taxation law.

There are exceptions to the offence. The Act inserts a new exception, so that an ATO officer is permitted to disclose protected information to an Australian (i.e. Commonwealth, State or Territory) government agency for the purposes of the administration of an Australian law.

The objective of the new exception is to assist other agencies administer programs relating to the Coronavirus. Therefore such disclosures must be for a purpose that relates to the Coronavirus to qualify for the exception. The amendments:

until 28 March 2021.

When JobKeeper was introduced, new Part 6-4C was inserted into the FW Act. The provisions allow an employer who qualifies for the JobKeeper scheme to temporarily vary the working arrangements of employees for whom the employer is receiving the JobKeeper payment, subject to a range of safeguards. Part 6-4C was originally set to be repealed on 28 September 2020.

The Act extends the temporary FW Act provisions — relating to JobKeeper enabling directions and JobKeeper stand down directions — until 28 March 2021, with the exception of the annual leave provisions (see below) which will be repealed on 28 September 2020. The protections and safeguards in the FW Act will also be extended.

The Act creates two categories of employers — which the Explanatory Memorandum describes as ‘qualifying employers’ and ‘legacy employers’ — for the purposes of determining which temporary flexibility provisions can be accessed from 28 September 2020. Employers which fall into neither category cannot access any of the temporary provisions.

Broadly, the FW Act enables employers that qualify for JobKeeper to:

in certain circumstances.

Currently, the Fair Work JobKeeper provisions also allow a qualifying employer to:

![]() Reference

Reference

See the Fair Work Ombudsman website for information about the temporary Fair Work rules.

A ‘qualifying employer’ is an employer that is entitled to a JobKeeper payment for an employee after 27 September 2020.

From 28 September 2020, qualifying employers will retain access to the full range of Fair Work flexibility measures. That is, the employer can give that employee JobKeeper enabling directions and a JobKeeper enabling stand down direction. As noted above, the annual leave provisions will be repealed on 28 September 2020.

A ‘legacy employer’ is an employer that previously received one or more JobKeeper payments for an employee but loses eligibility after 27 September 2020, and has suffered a 10 per cent decline in turnover for the relevant test quarter.

From 28 September 2020, legacy employers will have access to modified Fair Work flexibility measures. The employer can:

Such an agreement or direction cannot result in the employee working less than two hours in a day.

Legacy employers must also give a longer period of notice before giving a JobKeeper enabling direction — seven days rather than three, and have expanded consultation requirements.

The 10 per cent decline in turnover test for legacy employers will mirror the decline in turnover test in the JobKeeper Rules, with the following modifications:

![]() Note:

Note:

The Government has proposed to amend the decline in turnover test for determining JobKeeper eligibility from 28 September 2020. These changes to the JobKeeper Rules have not yet been introduced.

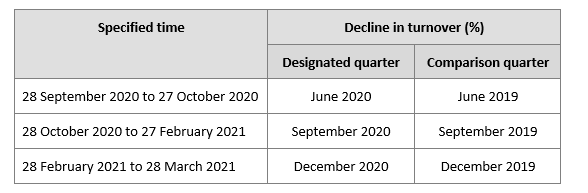

The following table sets out the designated quarter in respect of which the decline in turnover test applies for a specified time:

These dates align with the Business Activity Statement lodgment dates for each quarter, and not with the application of the JobKeeper eligibility decline in turnover test.

It is important to remember that the 10 per cent decline in turnover test must be satisfied each quarter.

In order to qualify as a legacy employer, an employer — other than a small business employer — must obtain a written ’10% decline in turnover certificate’ (a certificate) from an ‘eligible financial service provider’.

An ‘eligible financial service provider’ means:

A certificate can only be issued by a financial service provider that is independent of and external to the employer. An eligible financial service provider cannot issue a certificate in relation to an employer if the provider is:

The certificate must confirm that the employer satisfied the 10 per cent decline in turnover test for the designated quarter applicable to a specified time.

If a legacy employer does not obtain a certificate for the next period, then any directions or agreements in place cease to operate after the current period, and the employer cannot give new directions or reach new agreements with their employees unless they obtain the required certificate.

Importantly the 10 per cent decline in turnover certificate will be required for each quarter to ensure that the direction or agreement continues in effect through the next period.

A small business employer — which broadly means an employer with fewer than 15 employees — may choose to make a statutory declaration to the effect that the employer satisfied the 10 per cent decline in turnover test for the designated quarter applicable to a specified time. The small business employer can still elect to obtain a certificate.

Upcoming webinar

Upcoming webinar

Interested in learning more about the JobKeeper extensions? Join two of our Senior Tax trainers on Wednesday, 16 September. We’ll cover:

You can learn more about JobKeeper Extended here or through the link below.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.