The Treasurer released the Government’s Mid-Year Economic and Fiscal Outlook (MYEFO) on 13 December 2023.

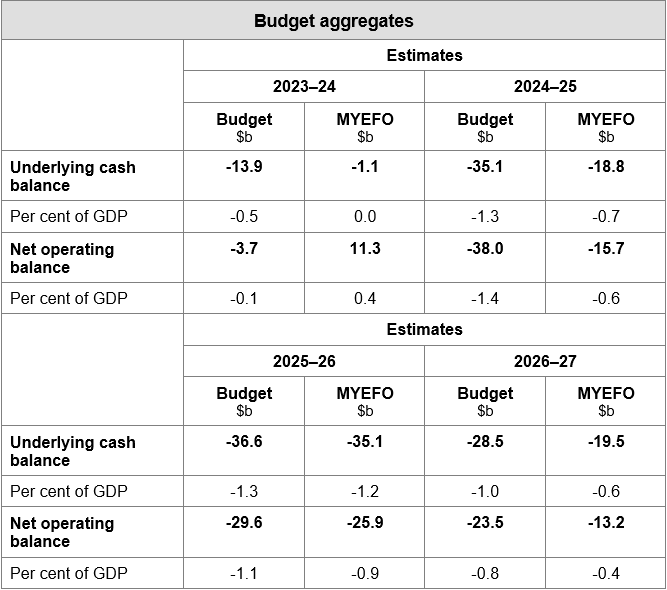

The MYEFO updates the economic and fiscal outlook from the 2023–24 Federal Budget. It takes into account the decisions made since the release of the Federal Budget, and therefore revises the Budget aggregates.

The MYEFO also contains a number of tax, superannuation and related policy announcements, including proposals to:

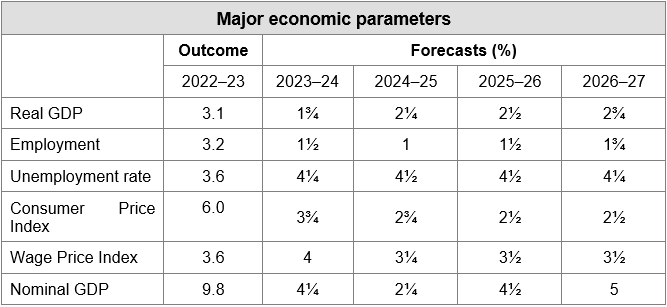

The MYEFO states that:

Real GDP and nominal GDP are percentage change on preceding year. The consumer price index, employment, and the wage price index are through the year growth to the June quarter. The unemployment rate is the rate for the June quarter.

Key tax policy decisions taken since the 2023–24 Federal Budget include the following:

Increasing the integrity of the foreign resident capital gains withholding regime

The Government will increase the foreign resident capital gains withholding tax rate from 12.5 per cent to 15 per cent and reduce the withholding threshold from $750,000 to $0.

The changes will apply to real property disposals with contracts entered into from 1 January 2025.

Denying deductions for ATO interest charges

The Government will deny deductions for ATO interest charges, specifically the GIC and SIC, incurred in income years starting on or after 1 July 2025.

Global Infrastructure Hub — extension of income tax exemption

The Government will extend the existing income tax exemption of the G20 organisation, the Global Infrastructure Hub (the Hub), for an additional year, from 30 June 2023 to 30 June 2024.

The Hub is a company limited by guarantee governed by Australian law, and is funded by contributions provided by G20 members. The current policy approach is to not tax contributions provided to the Hub by other G20 economies.

International Tax — signing of the Australia-Portugal Tax Treaty

The Government signed the Convention between Australia and the Portuguese Republic for the Elimination of Double Taxation with respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance on 30 November 2023.

Luxury Car Tax — modernising the luxury car tax (LCT) for fuel-efficient vehicles

The Government will modernise the LCT by tightening the definition of a fuel-efficient vehicle and updating the indexation rate for the LCT value threshold for all-other luxury vehicles, from 1 July 2025.

This measure will tighten the definition of a fuel-efficient vehicle for the LCT by reducing the maximum fuel consumption from 7 litres per 100 km to 3.5 litres per 100 km and will update the indexation rate of the LCT value threshold for all-other luxury vehicles from headline CPI to the motor vehicle purchase sub-group of the CPI, aligning it with the indexation of the LCT value threshold for fuel-efficient vehicles.

Start date deferrals

The Government has deferred the start date of the following measures:

Key superannuation policy decisions taken since the 2023–24 Federal Budget include the following:

Adviser fees from superannuation

The Government will provide a clear legal basis for superannuation trustees to pay advice fees agreed between a member and their financial adviser from the member’s superannuation account and prescribe that such fees are a tax-deductible expense of the fund retrospectively from 2019–20.

Reforming the treatment of the transfer balance cap for successor fund transfers

The Government will amend legislation to ensure the superannuation transfer balance cap of individuals with a capped defined benefit income stream is not adversely impacted in the event of a merger or successor fund transfer between superannuation funds.

Under current legislation, a member’s transfer balance cap may be impacted due to the original income stream being treated as ceasing and a new one beginning. This means a new valuation of the capped defined benefit income stream is required which can result in a higher valuation for the transfer balance cap and lead to adverse outcomes for some members.

This measure will apply retrospectively from 1 July 2017.

Other key policy decisions which have been taken since the 2023–24 Federal Budget include the following:

Commonwealth penalty unit — increase in value

The Government will increase the amount of the Commonwealth penalty unit by 5.4 per cent from $313 to $330, commencing four weeks after passage of legislation.

The increase will apply to offences committed after the relevant legislative amendment comes into force.

Administrative Appeals Tribunal funding

The Government will provide $21.8 million over two years from 2023–24 for the Administrative Appeals Tribunal to support transition to the new Administrative Review Tribunal.

Ceasing the Modernising Business Registers Program

The Government will transfer responsibility for business registers from the ATO to the ASIC following the decision to cease the Modernising Business Registers program.

Responding to the PricewaterhouseCoopers matter

The Government will provide $22.2 million over four years from 2023–24 (and $1.1 million per year ongoing) to the Treasury, the Department of Finance, the ATO and the Attorney-General’s Department to strengthen the integrity of the tax system, increase the powers of regulators and strengthen regulatory arrangements to ensure they are fit-for-purpose.

Foreign investment — lower fees for Build to Rent projects

The Government will apply the lower commercial foreign investment application fee to foreign investments in Build to Rent projects where investors are proposing to acquire residential land or agricultural land.

The difference in fees will depend on the consideration paid by the investor and the kind of land involved. However, once implemented, investors will be able to make investments of up to $50 million for Build to Rent projects on residential land for a fee of $14,100 (subject to indexation) on the commercial fee schedule. Under current settings that application fee could be as much as $1,119,100.

Foreign investment — raising fees for established dwellings

The Government will, from the day after Royal Assent to the enabling legislation:

The Government will also provide $3.5 million to enhance the ATO’s compliance regime to ensure foreign investor compliance.

Fair Work Commission funding — ‘closing loopholes’ in relation to employees and contractors

The Government will provide $94.6 million over four years from 2023–24 (and $22.7 million per year ongoing) to close loopholes to safeguard workers’ wages and conditions and to provide clarity. Proposed measures include:

NOW is the time to get organised! We offer online sessions, as well as workshops throughout Australia.

Sessions generally include a tax update, along with a specialty topic.

Purchase an entire series of training this December and save 15-25%.

Get our early bird pricing while it lasts.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.