The ATO has released its report for the Next 5,000 tax performance program, which looks at the tax obligations of privately owned and wealthy groups.

The Next 5,000 program began on 1 July 2019. It engages with taxpayers on a one-to-one basis, through streamlined assurance reviews. The findings in the report are based on the outcomes of 1,078 reviews covering 7,198 transactions, activities and events.

The data and findings in the report are current as at 31 August 2023.

Advisers to private groups should take heed of the common errors and tax risks raised in the report when reviewing their clients’ tax affairs – including the observation that poor governance and documentation processes is correlated to compliance errors.

The below is a short summary of key findings. For more detail refer here.

Key observations include that:

There is a correlation between no documented tax governance processes and procedures, and

ATO recommendation

ATO recommendation

Documenting tax return procedures, including a tax return review process, which could also include a lodgment calendar.

The common issues where the ATO was unable to obtain assurance include the following.

The ATO was not able to obtain assurance in relation to tax deductions in certain circumstances due to a lack of governance processes, procedures and poor recording keeping. Certain expenditure could not be substantiated and a nexus between the expense and assessable income could not be evidenced. A high proportion of these expenses are related party transactions where the reported income derived by a related party was less than the deductions claimed by the other related party.

ATO recommendation

ATO recommendation

Having clear processes and procedures setting out record keeping requirements for related party transactions.

The ATO found a correlation between poor record keeping, lack of documented governance processes and procedures and not taking enough steps to satisfy Div 7A rules. In these reviews, the ATO identified no written loan agreements or minimum yearly repayments and a lack of appropriate record keeping.

ATO recommendation

ATO recommendation

The ATO was unable to obtain assurance over a range of property disposals for the following reasons:

ATO recommendation

ATO recommendation

Implementing processes and procedures to identify material transactions and ensure that these transactions are communicated to the tax agent where applicable.

The ATO was unable to obtain assurance over trust distributions where there were concerns over beneficiary entitlement to trust distributions, such as distributions paid to the incorrect beneficiary and s. 100A.

In relation to family trusts the ATO was unable to obtain assurance in the following circumstances:

In some cases a lack of governance processes and procedures resulted in omitted trust distributions for some beneficiaries.

The ATO was unable to obtain assurance over revenue recognition relating to related party transactions. A lack of governance processes and procedures potentially resulted in poor record keeping. Some examples include:

From the GST integrated streamline assurance reviews undertaken to date, ATO observations include:

The most common tax risks flagged to market arising for review as part of streamlined assurance reviews include those related to:

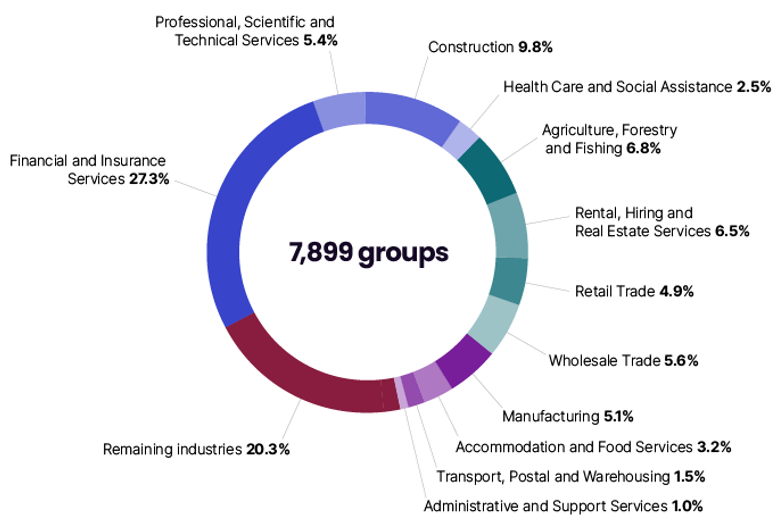

Within the Next 5,000 sub-population there are about 7,899 private groups with net wealth of over $50 million. These groups hold around $1 trillion in net assets. Most are well established, multigenerational businesses.

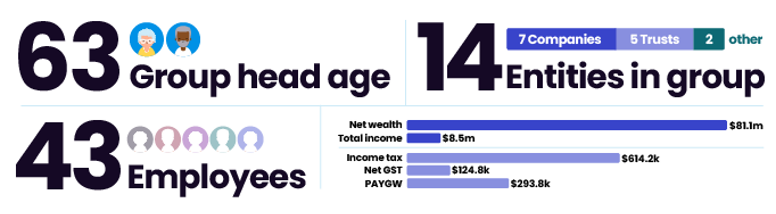

A typical Next 5,000 group:

The industries in which the Next 5,000 groups operate:

For more information about the Next 5,000 demographic, refer here.

NOW is the time to organise next year’s CPD! We offer online sessions, as well as workshops throughout Australia.

Purchase an entire series of training and save 15-25%.

Get our early bird pricing while it lasts!

Join thousands of savvy Australian tax professionals and get our weekly newsletter.