The Government has now confirmed the details of its proposed revisions to the Stage 3 personal tax cuts, which take effect from the 2024–25 financial year.

The currently legislated Stage 3 tax cuts form part of the Personal Income Tax Plan implemented by the Treasury Laws Amendment (Personal Income Tax Plan) Act 2018.

Refer to the following Treasury resources:

Draft legislation has not been released. Parliament resumes on Tuesday 6 February 2024.

This article summarises the proposed changes to the tax brackets and tax rates and illustrates the potential implications for taxpayers with a range of taxable incomes.

![]() Note

Note

The Government will also increase the Medicare levy low-income thresholds for 2023–24. This article will not cover this proposed change.

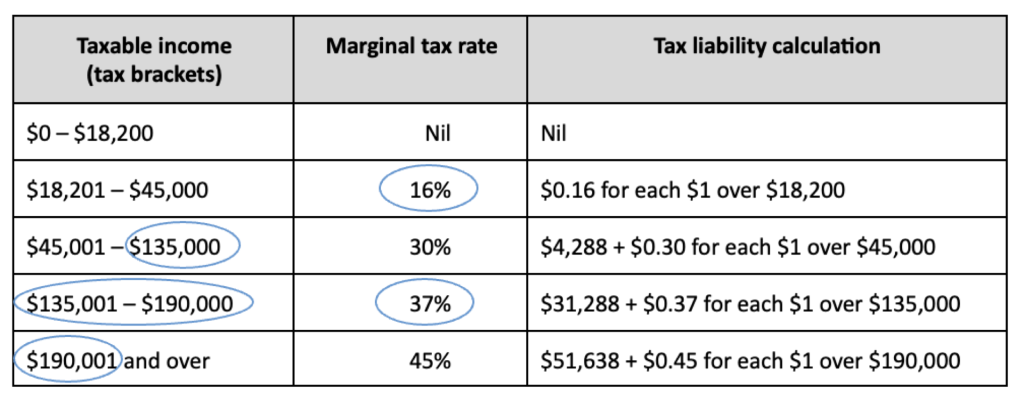

From 1 July 2024, the revised Stage 3 tax cuts will:

There will be no change to the current tax-free threshold of $18,200.

No taxpayer will pay more tax than that which would apply under the 2023–24 rates but higher income taxpayers will receive a lower tax cut than under the existing Stage 3 plan.

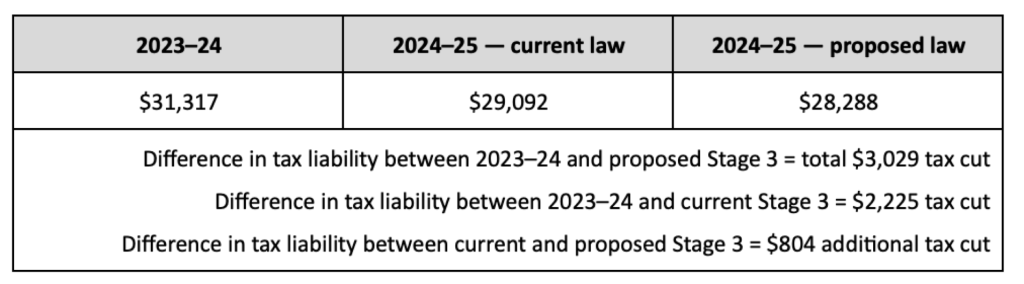

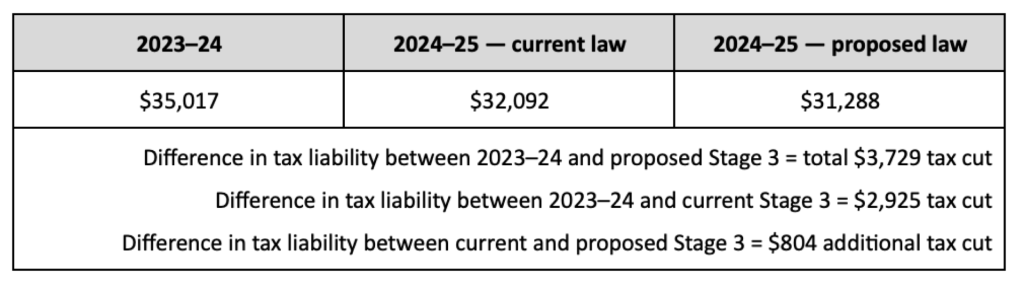

Taxpayers with taxable incomes up to $45,000 will benefit from a proposed reduction of their marginal tax rate from 19 per cent to 16 per cent (maximum tax saving of $804). Under the currently legislated Stage 3 plan, there is no change to the current (2023–24) tax bracket ($18,201 to $45,000) or marginal tax rate (19 per cent).

Middle income taxpayers will receive an extra tax cut of $804 (on top of the tax cut they would have received under the currently legislated plan).

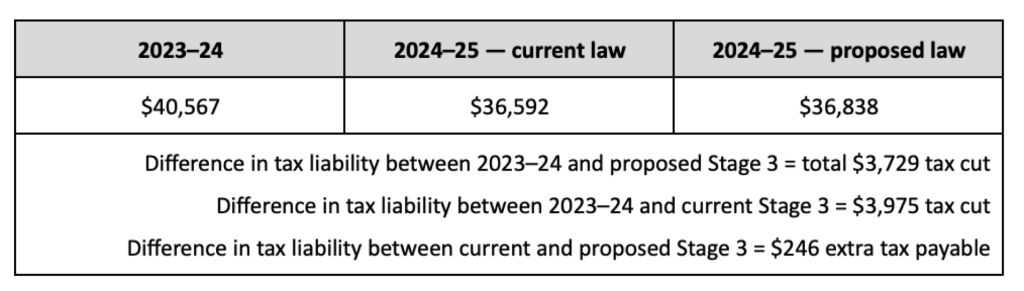

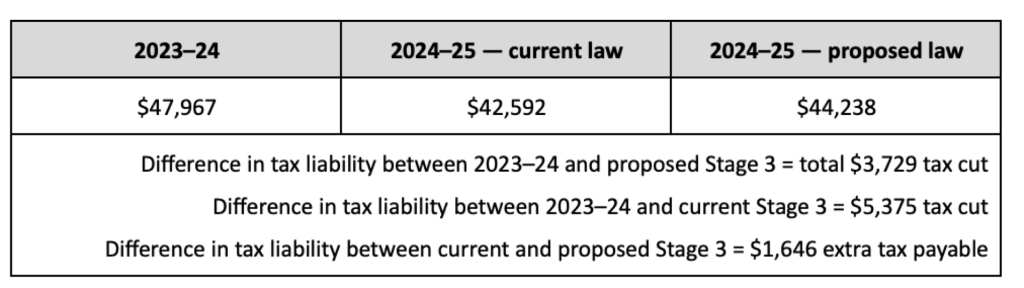

The benefit of the proposed changes cuts out at taxable incomes of approximately $147,000 — taxpayers at this income level will be $36 worse off under the changes (albeit with a saving of $3,729 from 2023–24 rates).

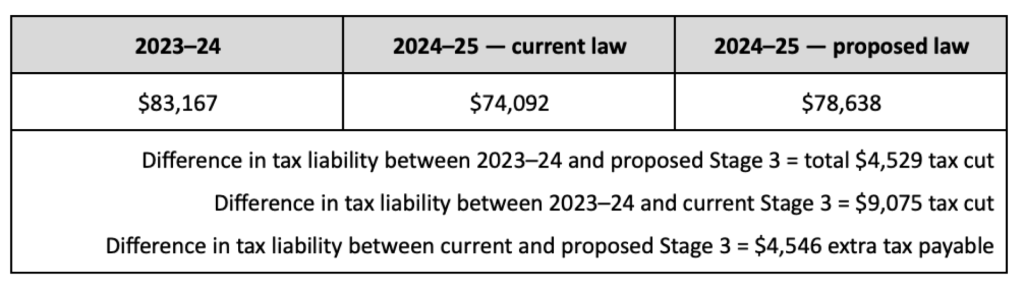

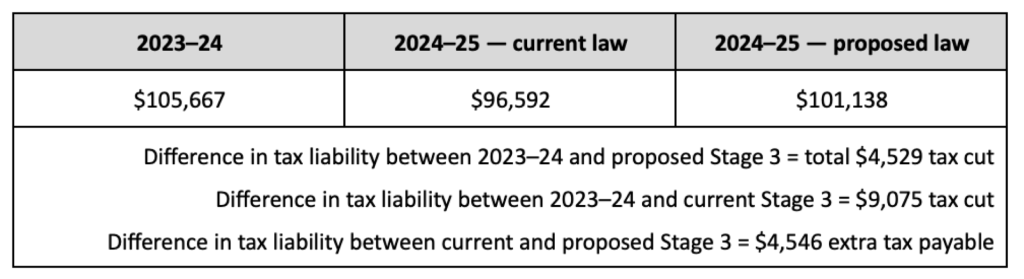

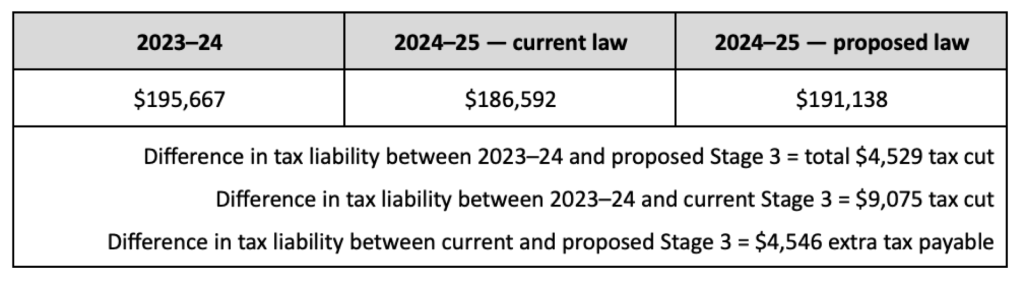

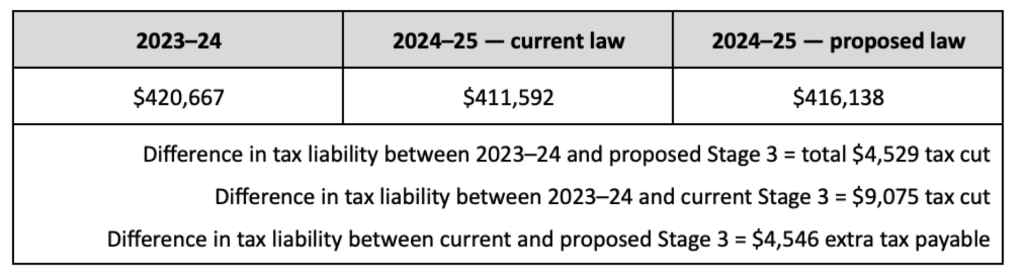

For taxpayers with taxable incomes of $200,000 and above, the tax cut will be worth $4,529 instead of $9,075 — i.e. the Stage 3 benefit will be cut by half.

![]() Note

Note

This article only considers the implications for resident individuals and ignores the effect of Medicare levy, the low income tax offset, and any other income tested levies, offsets and rebates on a taxpayer’s overall tax position.

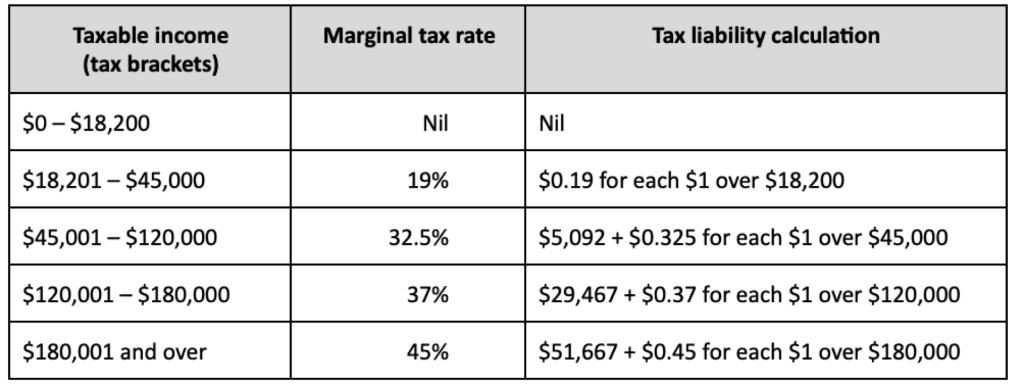

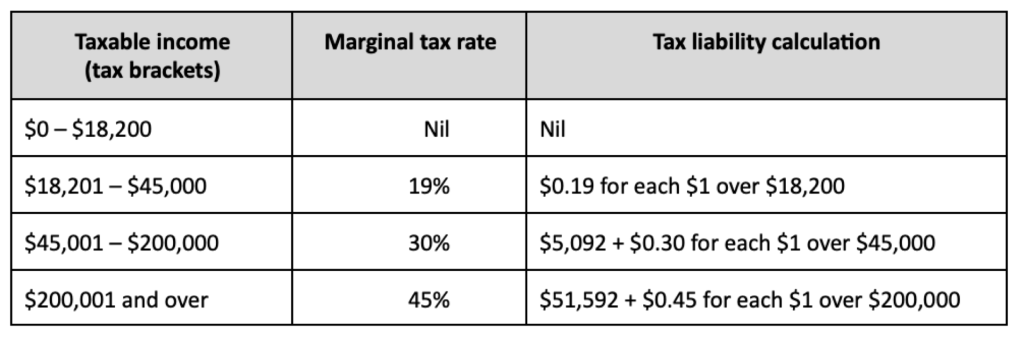

Resident individual tax rates 2020–21 to 2023–24 — Stage 3 not yet implemented

Resident individual tax rates 2024–25 — currently legislated Stage 3 tax plan

Resident individual tax rates 2024–25 — proposed revised Stage 3 tax plan

Some of the key implications of the proposed changes to the legislated Stage 3 tax plan are as follows:

There will be no change to the tax-free threshold of $18,200 or the top marginal tax rate of 45 per cent for taxpayers with taxable incomes over $200,000.

All taxpayers will receive a tax cut compared to 2023–24 but taxpayers with taxable incomes of approximately $147,000 and higher will receive a lower tax cut under the proposed changes as compared to the currently legislated tax rates.

On a taxable income of $146,000, the tax liability under current law is $35,392 vs under proposed changes is $35,358 (a $34 benefit under the proposed change). On $147,000, tax liabilities are $35,692 vs $35,728 (a $36 detriment).

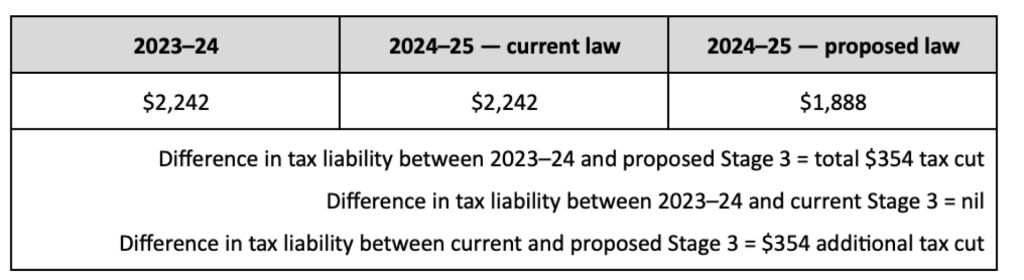

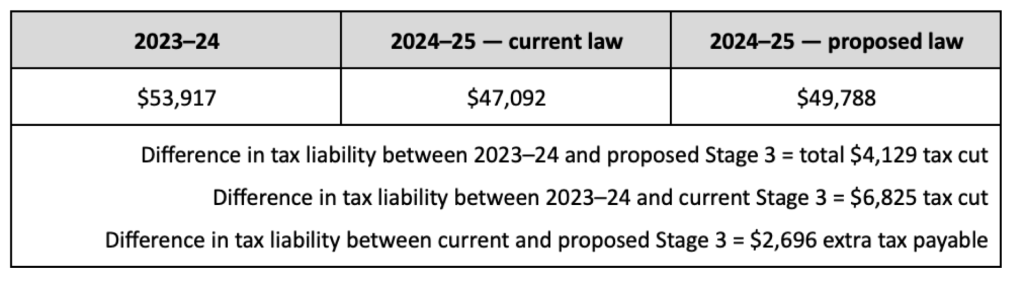

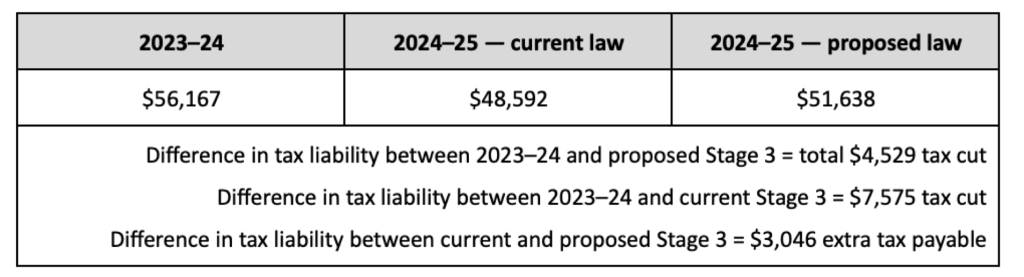

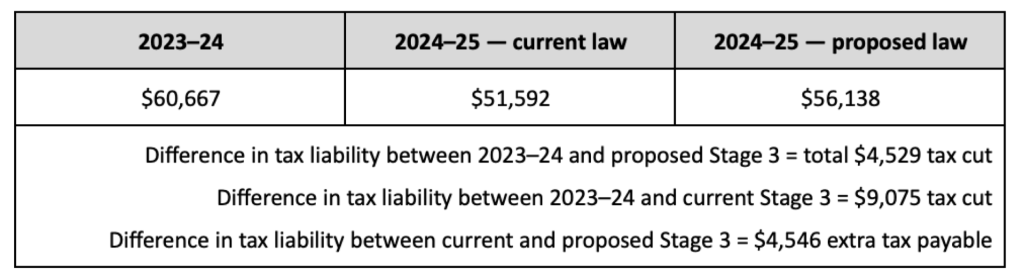

The following examples set out the tax liability that would arise for a given taxable income under the current (2023–24) tax rates, the legislated Stage 3 rates from 2024–25 and the proposed revised Stage 3 rates from 2024–25.

Assume that each taxpayer’s taxable income is the same in 2023–24 and 2024–25.

![]() Note

Note

The Treasury’s tax cut calculator takes into account the basic tax scales, low-income tax offset (as applicable) and the Medicare levy. As mentioned above, the following illustrative examples only take into account the basic tax rates. Therefore the outcomes from the Treasury’s calculator will not be the same as what is represented below.

![]() Reference

Reference

See the Government’s fact sheet for detailed distributional tables setting out the impact of the proposed Stage 3 plan at a multitude of taxable incomes for single and dual income households.

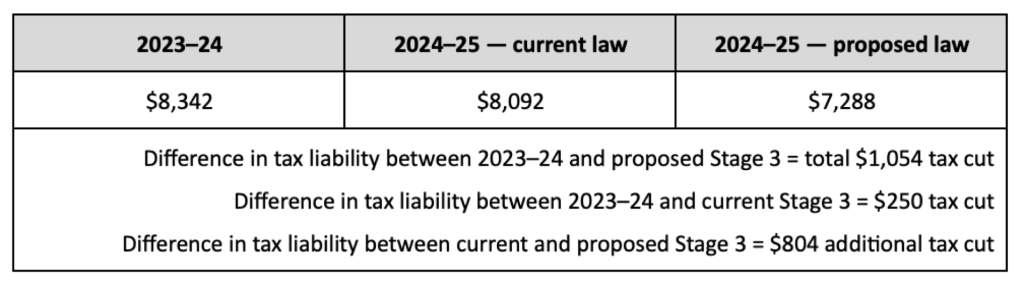

Abbie’s taxable income for 2023–24 and 2024–25 is $30,000.

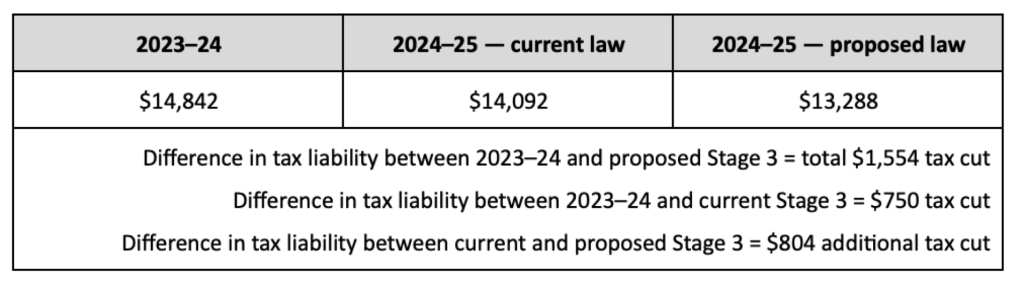

Ben’s taxable income for 2023–24 and 2024–25 is $55,000.

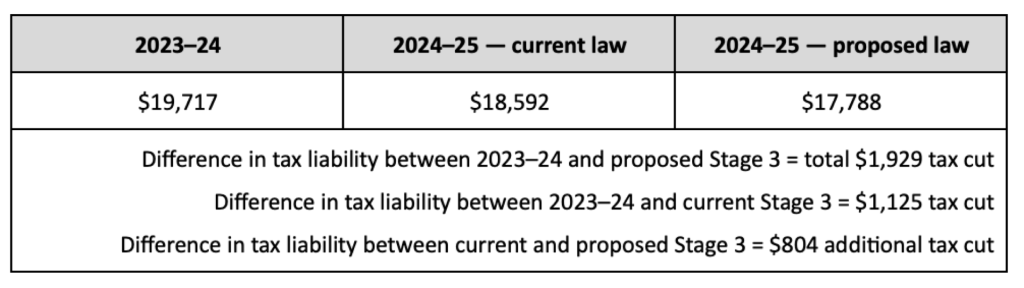

Cameron’s taxable income for 2023–24 and 2024–25 is $75,000.

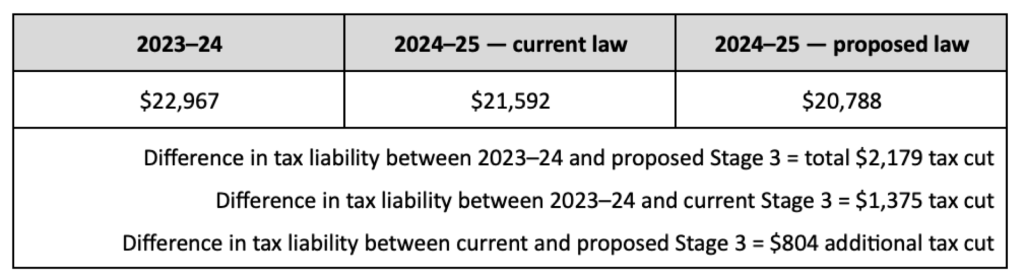

Dana’s taxable income for 2023–24 and 2024–25 is $90,000.

Evie’s taxable income for 2023–24 and 2024–25 is $100,000.

Frank’s taxable income for 2023–24 and 2024–25 is $125,000.

Greg’s taxable income for 2023–24 and 2024–25 is $135,000.

Hannah’s taxable income for 2023–24 and 2024–25 is $150,000.

![]() Note

Note

The benefit of the proposed changes begins to cut out at just under $147,000. Taxables with taxable incomes of $146,000 will benefit under the proposed changes by $34 as compared to the currently legislated Stage 3 rates. However, taxpayers with taxable incomes of $147,000 will receive a tax cut that is $36 less than that which would arise under the legislated Stage 3 plan.

Izzy’s taxable income for 2023–24 and 2024–25 is $170,000.

Jaclyn’s taxable income for 2023–24 and 2024–25 is $185,000.

Ken’s taxable income for 2023–24 and 2024–25 is $190,000.

Leonard’s taxable income for 2023–24 and 2024–25 is $200,000.

Mark’s taxable income for 2023–24 and 2024–25 is $250,000.

Natasha’s taxable income for 2023–24 and 2024–25 is $300,000.

Olivia’s taxable income for 2023–24 and 2024–25 is $500,000.

Pete’s taxable income for 2023–24 and 2024–25 is $1,000,000.

We offer tax training for firms of all sizes:

Our monthly tax updates kick off on 6 February, get the full series for 25% off before the session.

Our early bird pricing is still available for a limited time – we hope to see you in a session soon!

Join thousands of savvy Australian tax professionals and get our weekly newsletter.