[lwptoc]

The small business CGT concessions contained in Div 152 of the ITAA 1997 are arguably some of the most concessional provisions in the Tax Acts. For example, the 15-year exemption in Subdiv 152-B results in eligible capital gains being completely tax-free.

Accessing the concessions involves satisfying a set of basic criteria, with each specific concession having its own additional eligibility requirements. Choosing which concession gives the taxpayer the best outcome involves an understating of how the small business CGT concessions fit within the basic CGT method statement in s 102-5 of the ITAA 1997.

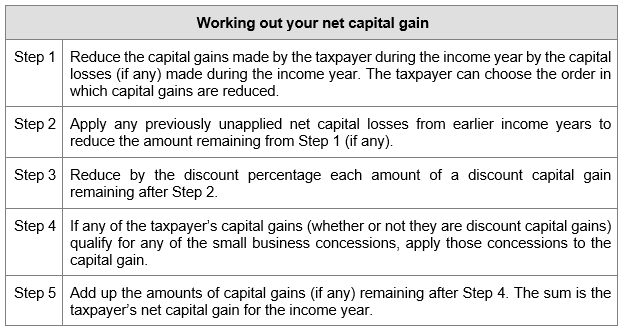

The method statement in s. 102-5 of the ITAA 1997 sets out how to calculate the net capital gain that a taxpayer includes in their assessable income.

There are four small business CGT concessions:

Each concession operates differently. For example the 15-year exemption and the retirement exemption disregard a capital gain — in some instances completely. On the other hand, the 50 per cent reduction and the small business roll-over are not exemptions and they respectively reduce the gain by 50 per cent and defer any gain to a later point in time. As each concession delivers their beneficial treatment differently, they come into the net capital gain method statement at different points in time.

![]() Important

Important

The ‘basic conditions’ in Subdiv 152-A are common to all of the small business CGT concessions and must be satisfied as well as the specific conditions for each concession.

If the taxpayer qualifies for the 15-year exemption under Subdiv 152-B, they can entirely disregard the gain, and no other concessions need to be applied. Accordingly the taxpayer will not have any capital gains during the year to include at Step 1.

Practically this also means that a taxpayer will not be required to offset any capital losses against the gain.

Both Step 1 and Step 2 require a taxpayer to reduce the capital gain by:

As the 50 per cent reduction, the retirement exemption and the small business roll-over are dealt with at Step 4, gains eligible for these concessions will firstly need to be offset against any capital losses.

If the taxpayer is eligible for the CGT discount under Div 115, the taxable amount of the capital gain is reduced by the relevant discount percentage (generally, 50 per cent).

It is important to note that this is not a choice and where a taxpayer is eligible for the CGT discount they must utilise it.

![]() Tip

Tip

A taxpayer wishing to maximise the retirement exemption (and therefore the amount that they can contribute into their superannuation fund outside the contribution caps) could — if eligible — use the indexation method to calculate their cost base and therefore their capital gain included at Step 1. Using the indexation method means the CGT discount is unavailable at Step 3 (s. 115-20).

If the taxpayer satisfies the basic conditions in Subdiv 152-A, they may choose to apply the 50 per cent reduction under Subdiv 152-C.

Alternatively, the taxpayer may choose not to apply this concession in order to maximise use of the retirement exemption.

The 50 per cent reduction applies at Step 4 of the method statement, i.e. after offsetting any capital losses and applying any discount.

If the taxpayer qualifies for the retirement exemption under Subdiv 152-D or the small business roll-over under Subdiv 152-E, these concessions may be applied in either order to the capital gain.

These concessions apply at Step 4 of the method statement.

The remaining capital gain is included in the taxpayer’s assessable income for the income year.

Where a taxpayer chooses the small business roll-over in respect of a capital gain, CGT events J2, J5 or J6 can happen, broadly speaking, if:

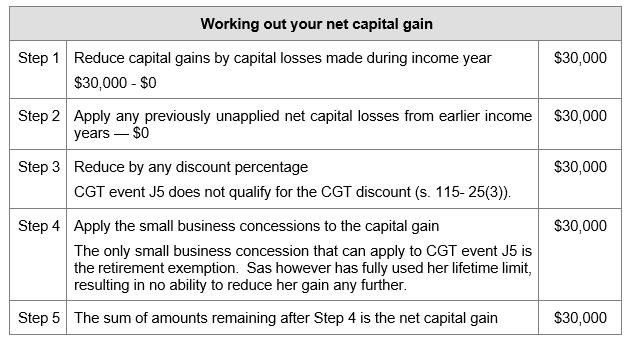

A capital gain that arises from CGT event J2, J5 or J6 is not a discount capital gain and is not eligible for the 50 per cent reduction. In addition, the small business roll-over does not apply to CGT events J5 and J6.

In other words, the retirement exemption can apply to any capital gain arising under CGT event J2, J5 or J6, but only CGT event J2 can access the small business roll-over.

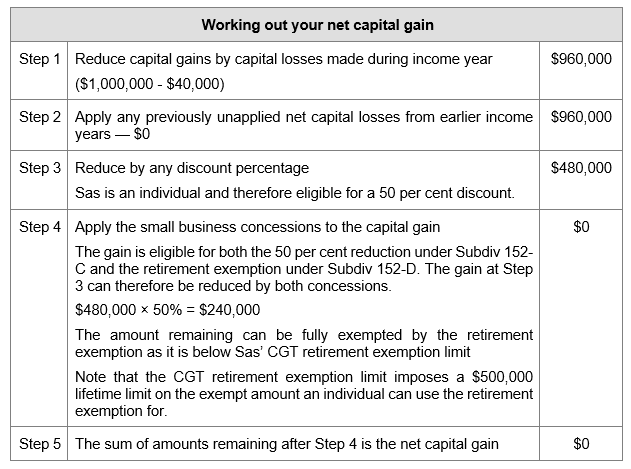

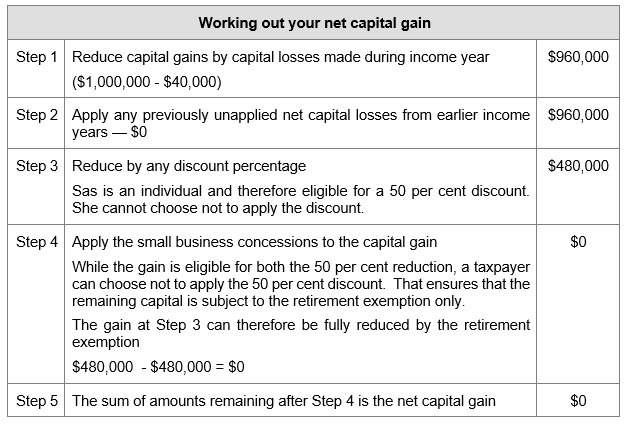

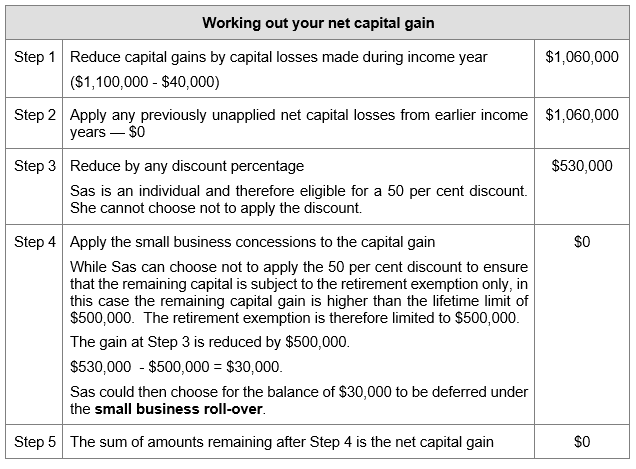

Sas is a graphic designer operating a business as a sole trader. Sas sold her business premises and made a capital gain of $1 million. Sas satisfies the basic conditions in Subdiv 152-A and has an unutilised prior year capital loss of $40,000.

Assume Sas satisfies the criteria for the 15-year exemption.

As the gain qualifies for the 15-year exemption, the gain is disregard and the capital losses are not impacted. Sas’ net capital gain is therefore $0.

Assume that:

After calculating the above gain, Sas realises she can only contribute $240,000 into her SMSF using the retirement exemption.

As Sas wants to fully maximize the amount that can be contributed to her SMSF, advise on an alternative option.

Assume the gain is now $1.1 million. Sas still has carry forward losses of $40,000 and wants to maximise the retirement exemption, so she can maximise the contribution made to her SMSF.

Sas chose the roll-over in Variation Four. At the end of the replacement asset period a replacement asset was not found. CGT even J5 was therefore triggered.

The small business CGT concessions are arguably some of the most generous provisions in the ITAA. The concessions are targeted to small business and consist of:

Depending on which concession (or concessions) applies, a taxpayer can defer, reduce or even disregard a capital gain.

In our upcoming two-part webinar series, we will go through the core rules and then dive deeper into each of the concessions. Click here or the button below to learn more or register. Register before the first session on 16 September and get 10% off the package.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.