The Albanese Government has released its plans for what it calls the ‘biggest crackdown on tax adviser misconduct in Australian history’, to address tax adviser misconduct and perceived shortcomings in regulatory frameworks in the wake of the PwC tax leaks scandal.

The Government will introduce legislation later this year.

The proposed reforms focus on three priority areas:

The Government proposes to reform elements of the promoter penalty laws.

The promoter penalty laws — found in Div 290 of Schedule 1 to the TAA — provide that an entity must not engage in conduct that results in:

Exclusions and exceptions include:

To increase maximum penalties for advisers and firms who promote tax exploitation schemes from $7.8 million to over $780 million.

Current law

The ATO must apply to the Federal Court of Australia to impose a civil penalty. (The ATO may also consider various forms of corrective action.)

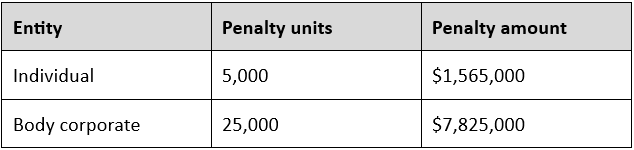

From 1 July 2023, a penalty unit is equal to $313 (previously $275 from 1 January to 30 June 2023).

Currently the maximum penalty is the greater of:

While the media release does not provide details of the proposed new penalty regime, it is clear that the number of penalty units imposed will increase 100-fold for a body corporate, which is $782,300,000 at the current penalty unit value (i.e. the ‘over $780 million’ per the media release). The announcement is silent as to how much — and whether — the maximum penalty for individuals will increase.

To expand their scope so they are easier for the ATO to apply to advisers and firms who promote tax avoidance.

Current law

An entity is a promoter of a tax exploitation scheme if:

An entity is not a promoter of a scheme merely because it provides advice about the scheme.

An employee is not taken to have had a substantial role in respect of the marketing or encouragement merely because they distributed information or material prepared by another entity.

It is currently unclear as to which elements will be amended to expand the scope of the promoter penalty regime.

To increase the time limit for the ATO to bring Federal Court proceedings on promoter penalties from four years to six years after the conduct occurred.

Current law

The Commissioner must apply to the Federal Court no later than four years after the entity last engaged in the relevant conduct. However, there is no time limit where the scheme involves tax evasion.

The below is a summary of the proposed reforms (what we know so far) compared to the current rules:

To remove limitations in the tax secrecy laws that were a barrier to regulators acting in response to PwC’s breach of confidence.

Current law

The tax law secrecy rules in Div 355 of Schedule 1 to the TAA provide that it is an offence for an ATO officer to disclose ‘protected information’. There are existing exceptions for certain disclosures made to a law enforcement agency, court or tribunal for the purposes of law enforcement.

To enable the ATO and Tax Practitioners Board (TPB) to refer ethical misconduct by advisers — including but not limited to confidentiality breaches — to professional associations for disciplinary action.

Current law

Where the TPB finds that a practitioner’s conduct breaches the Tax Agent Services Act 2009 (TASA), the TPB is required to notify any recognised professional association of which the practitioner is a member.

To protect whistleblowers when they provide the TPB with evidence of tax agent misconduct.

Current law

There are existing whistleblower protection laws for eligible disclosures under Part IVD of the TAA. To qualify for protection the disclosure must be made to an eligible recipient, which includes the ATO and certain entities associated with the entity the subject of the disclosure, but does not include the TPB.

To give the TPB more time — up to 24 months — to complete complex investigations.

Current law

The TPB has the power to investigate breaches of the Code of Professional Conduct (which is codified in the TASA) but it must make a decision about the outcome of an investigation within six months after the investigation commences.

To improve the TPB’s public register of practitioners, so that people have more transparency over agent and firm misconduct.

Current law

The register discloses any conditions of registration, period of and reasons for suspension, sanctions imposed, and date of and reason for termination. The TASA requires the TPB to maintain a register. Regulations prescribe the details disclosed.

Treasury will be co-ordinating a whole of Government response to the PwC matter and the systemic issues raised. This work will deliver options to Government progressively over the next two years.

Consultation on the following options will begin in the coming months:

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 14 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

![]() Outsource your L&D

Outsource your L&D

We can also present tax updates or specialty topics at your firm or through a private online session, with content tailored to your client base. Call our friendly staff on 03 9660 3500 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Email us to have a chat >

Join thousands of savvy Australian tax professionals and get our weekly newsletter.