On 20 September 2023 the Government released for consultation a package of exposure draft legislation (the EDs) in relation to the tax adviser misconduct reforms initially announced on 6 August.

The four EDs can be accessed here:

Consultation closes on 4 October 2023.

The proposed maximum penalty is the greater of:

(i) three times the benefits received or receivable by the entity or its associates — directly or indirectly — in respect of the scheme, or

(ii) for a body corporate or significant global entity (SGE) — 10 per cent of its aggregated turnover for the most recent income year to end before the entity engaged in the relevant conduct — capped at 5 million penalty units (currently equal to $782,500,000), or

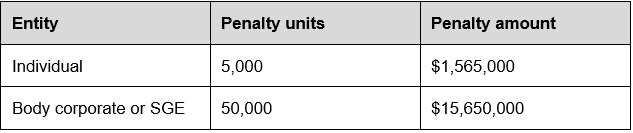

(iii) per the following table:

* Based on the current value of a penalty unit ($313 from 1 July 2023).

Key differences to current law:

An entity will be a ‘promoter’ of a tax exploitation scheme if it, or an associate, receives a benefit in respect of the scheme — currently the rules look at whether the entity or an associate receives consideration. A benefit will be more broadly defined than consideration, and includes less obvious, intangible or disguised benefits, such as increasing client base.

The meaning of a ‘tax exploitation scheme’ will be expanded to cover schemes that would breach, or would breach, the multinational anti-avoidance law or diverted profit tax laws.

The limb of the promoter penalty rules that currently covers the misrepresentation of a scheme’s conformance with a product ruling will be expanded to cover all types of rulings — private, public and oral rulings.

The time limit for the ATO to bring Federal Court proceedings on promoter penalties will be increased from four years to six years after the conduct occurred.

There is no time limit where the scheme involves tax evasion.

The later of:

The tax law secrecy rules in Div 355 of Schedule 1 to the TAA provide that it is an offence for an ATO offcer to disclose ‘protected information’. There are exceptions for certain disclosures made to eligible recipients, which currently include:

The Government proposes to include in the list of disclosures qualifying for protection a disclosure made to the Commissioner or to the Tax Practitioners Board (TPB) to assist the TPB to perform its functions or duties under the Tax Agent Services Act 2009 (TASA).

A disclosure will also qualify for protection if made to certain entities (e.g. professional associations and unions) for the purposes of obtaining assistance in relation to a disclosure, or to a medical practitioner or psychologist.

The later of:

The final report of the independent Review of the Tax Practitioners Board was released on 27 November 2020. The ED proposes to implement three of the recommendations in the report by amending the TASA and introducing the Tax Agent Services Amendment (Register Information) Regulations 2023 (Regulations).

The proposed amendments to the Regulations to ensure:

The Government proposes to extend the period of time that the TPB has in which to conclude investigations into potential breaches of the TASA from six months to 24 months. The timeframe can be extended if the TPB is satisfied that for reasons beyond its control, a decision cannot be made in 24 months.

The proposed amendment also creates a new option for the TPB following the conclusion of an investigation, by allowing it not to pursue administrative sanctions or civil penalties, and instead to publish the findings of the investigation on the Register.

The amendments propose to permit delegation by the TPB and enables the decision to terminate registration due to death or surrender to be delegated widely to ensure more timely decision-making and better use of resources.

The later of:

In some cases the proposed changes will apply to investigations commenced on or after 1 July 2022.

It is proposed that the ATO and TPB will be able to share protected information with Treasury about misconduct arising out of suspected breaches of confidence by intermediaries engaging with the Commonwealth.

Currently, the ATO and TPB can share protected information with a professional association in relation to suspected misconduct by members where the disclosure relates to the administration of the tax law. It is proposed that the ATO and TPB will be able to share protected information with prescribed disciplinary bodies where they reasonably believe a person’s actions may constitute a breach of the body’s code of conduct or professional standards.

Further, the Treasury will be able to on-disclose protected information to the Treasurer or Finance Minister.

In relation to disclosures of information made on or after the day after Royal Assent.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 14 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

![]() Outsource your L&D

Outsource your L&D

We can also present tax updates or specialty topics at your firm or through a private online session, with content tailored to your client base. Call our support team at 0434 067 133 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Email us to have a chat >

Join thousands of savvy Australian tax professionals and get our weekly newsletter.