On 16 November 2023 the House of Representatives agreed to the Senate amendments to the Treasury Laws Amendment (2023 Measures No. 1) Bill 2023. The Bill received Royal Assent on 27 November 2023.

Schedule 3 to the Bill — in particular the Senate amendments — introduces significant changes to the Tax Agent Services Act 2009 (TASA) in relation to the regulation of tax agents.

One of the major changes introduced by the Senate is that — from 1 October 2024 — the leadership of tax practices with more than 100 employees will be ineligible to be appointed to the Tax Practitioners Board (the Board). This new law means that the leadership of mid-tier and large accounting and law firms cannot be appointed while they are in the leadership role or within six months of receiving benefits from the practice after their departure.

In addition the Senate amendments impose new mandatory notification requirements — from 1 July 2024 — for a registered agent who has committed a significant breach of the Code of Professional Conduct (the Code) or who becomes aware of a significant breach of the Code committed by another registered agent.

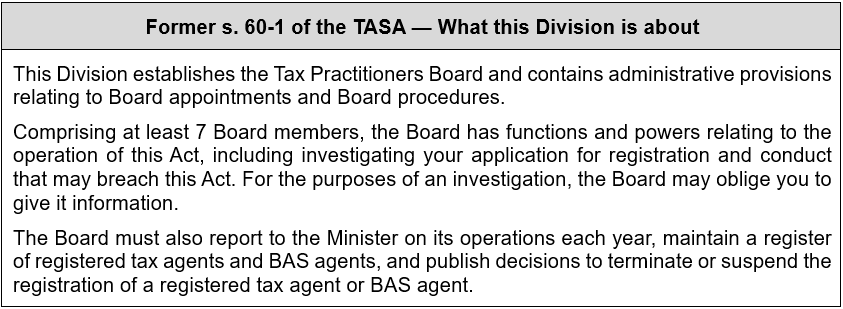

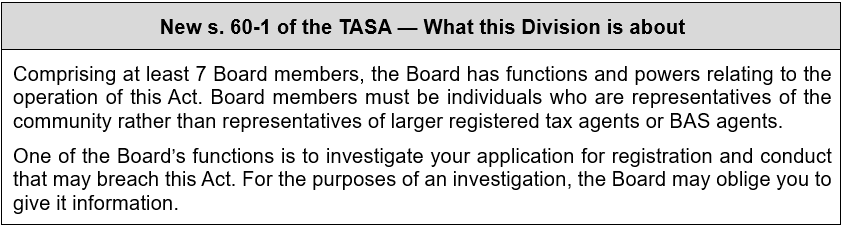

The amendments introduce new restrictions in relation to appointments to the Board.

In appointing an individual as a Board member, the Minister must be satisfied that the individual is a community representative.

An individual is a community representative if they are not any of the following:

A prescribed tax agent is a company or partnership that is a registered tax agent or BAS agent and has more than 100 employees.

An executive officer of a company means a director, secretary or senior manager (within the meaning of the Corporations Act 2001) of the company.

The Senate amendments also introduce new requirements into the Code of Professional Conduct (the Code) for mandatory notification of breaches of the Code. These requirements commence 1 July 2024.

A registered agent will be required to provide written notification to all of their current clients about the findings of the Board’s investigation.

The existing rules require registered agents to notify the Board of certain changes of circumstances relating to the registration of the individual registered agent, or a partner or director in the case of a partnership or company.

The Senate amendments now mandate reporting to the Board where the registered agent has reasonable grounds to believe that they have breached the Code, and the breach is a significant breach.

Registered agents must notify the Board, in writing, if they have reasonable grounds to believe that another registered agent has breached the Code, and the breach is a significant breach.

If the registered agent is aware that the other agent is a member of a professional association accredited by the Board, the agent must also notify the professional association of the breach.

A significant breach of the Code is defined as a breach which:

At time of writing the Board has not provided any guidance in relation to what would constitute a significant breach of the Code.

The new notification requirements form part of the Code in Div 30 of the TASA. The Senate amendments do not introduce new consequences for non-compliance with the Code (including the new notification rules).

Where the Board finds that a registered agent has failed to comply with the TASA it may impose one or more of the following administrative sanctions:

Details of an administrative sanction (other than a written caution) are listed against the agent on the TPB Register.

(Note that civil penalties only apply to specific types of contraventions listed in the TASA, including providing services while unregistered, making a false or misleading statement to the Commissioner, employing or using the services of an entity whose registration has been terminated, or signing a declaration or statement that was prepared by an unregistered entity who was not working under the supervision or control of a registered agent.)

The other changes to the TASA contained in the Bill include amendments which:

NOW is the time to get organised! We offer online sessions, as well as workshops throughout Australia.

Purchase an entire series of training and save 15-25%.

Get our early bird pricing while it lasts.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.