On 19 February 2020, the Tax Practitioners Board (TPB) released a discussion paper titled TPB(DP) D1/2020 Continuing professional education for tax practitioners under the Tax Agent Services Act 2009 (the Discussion Paper) in which it outlines — and seeks feedback about — the core elements of its continuing professional education (CPE) policies.

The TPB is proposing to update two of its CPE policies, as outlined below.

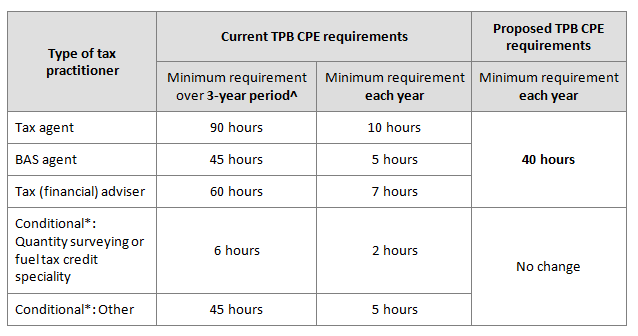

The TPB is proposing to increase the minimum CPE hours requirement to 40 hours per annum for all tax practitioners other than conditional agents, as set out in the following table:

* Conditional relates to those practitioners who only provide tax agent services in a particular or restricted area of the taxation laws.

^ A registered agent’s CPE period begins on the date the agent is registered and ends on the date the agent’s registration expires.

The TPB is seeking feedback in relation to:

Currently, the TPB requires that records be kept for a period of six years, unless the tax practitioner is a member of a recognised professional association in which case records should be kept in accordance with the requirements of the relevant association, provided the association’s requirements meet or exceed the TPB’s requirements.

The TPB employs a pragmatic risk-based compliance approach regarding the provision of evidence by tax practitioners for the purpose of assuring compliance with the TPB’s CPE requirements.

The TPB is proposing to:

The TPB is seeking feedback in relation to:

All registered tax and BAS agents (registered agents) are subject to the Tax Agent Services Act 2009 (TASA). Registered agents are required to comply with the Code of Professional Conduct (the Code) in s. 30-10 which relevantly requires that:

(8) You must maintain knowledge and skills relevant to the *tax agent services that you provide.

(10) You must take reasonable care to ensure that *taxation laws are applied correctly to the circumstances in relation to which you are providing advice to a client.

(12) You must advise your client of the client’s rights and obligations under the *taxation laws that are materially related to the *tax agent services you provide.

Section 20-5(1)(d) requires registered agents to, upon renewal of registration, demonstrate that they have completed CPE that meets the TPB’s requirements. That is, it is a registration requirement for individuals seeking to renew their registration to have met the TPB’s CPE requirements. This ensures that registered individuals maintain their skills and knowledge for the benefit of their clients.

The TPB’s Explanatory Paper TPB 04/2012 sets out the TPB’s CPE policy requirements for registered tax and BAS agents from 30 June 2014.

The TPB considers relevant CPE to be the maintenance of contemporary and relevant knowledge and skills.

CPE completed by registered agents should be relevant to the tax agent services they provide and the development of their relevant personal knowledge and skills. Further, CPE activities should be provided by persons or organisations with suitable qualifications and/or practical experience in the relevant subject area.

The TPB generally does not intend to be prescriptive regarding particular topics for CPE activities which should be completed. Registered agents should exercise their professional judgment in selecting relevant CPE activities to be completed. However, the TPB may, from time to time, recommend specific topics for CPE activities in certain circumstances. For example, the TPB may ask for registered agents to complete CPE activity on the TASA, including the Code, where the registered agent has not completed a course covering this topic as part of their educational qualification requirements used to gain initial registration.

During periods of legislative change or where changes occur to a registered agent’s professional practice, the TPB recommends that registered agents should complete sufficient CPE to meet their knowledge and skill requirements.

Examples of CPE activities for the TPB’s purposes include:

Registered agents should ensure that a contemporaneous record and evidence of their completed CPE activities is maintained. The TPB has developed and made available an appropriate CPE log for registered agents to use.

The TPB intends to request evidence or confirmation of CPE completed upon renewal of registration as a tax agent or BAS agent. In addition, the TPB may from time to time request evidence or confirmation of CPE completed by registered agents during their period of registration.

Examples of situations where it might not be possible for a registered agent to complete the minimum CPE requirement include: illness and/or disability, financial or other hardship, or a natural disaster. The TPB will consider appropriate relief, provided the registered agent can demonstrate that they have attempted to use the flexibility of their CPE period (three years) to manage any extenuating circumstances to comply with the CPE requirements.

![]() Note

Note

The TPB’s proposal to change its CPE requirements will remove the current three-year flexibility.

CPE requirements are imposed on members of recognised tax and BAS agent associations as a condition of their membership.

The TPB will accept a registered agent’s compliance with their association’s CPE requirements, subject to the following:

Where a record is already maintained to satisfy the registered agent’s membership requirements of a recognised tax or BAS agent association, the TPB does not require an additional CPE record to be kept.

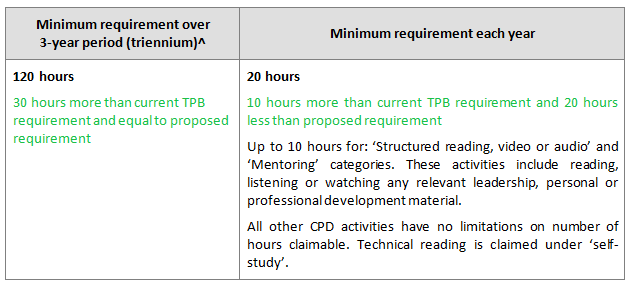

This section summarises the general CPE requirements of CPA Australia, Chartered Accountants Australia and New Zealand (CA ANZ), the Institute of Public Accountants (IPA) and The Tax Institute, as well as a brief overview of requirements for financial advisers. The comparison of hours is to the TPB’s requirements for registered tax agents with no conditions attached to their registration.

Different requirements may apply to particular categories of members, specialists or in certain circumstances — check your specific requirements on your association’s website.

![]() Note

Note

All of the following associations refer to CPE as Continuing Professional Development (CPD).

^ If the member joined CPA Australia before 30 June of a given year, their triennium starts on 1 January that year. If they joined after 30 June, their triennium starts on 1 January the following year.

Any activity that increases the member’s knowledge, skills and ability to do their job can be included in their CPD records.

The member needs to be able to demonstrate that the activity increased their ability to do their job. The activity does not need to be about accounting or finance, be a CPA Australia activity or take place in Australia.

CPA Australia members can access their online CPD diary through their member portal. A member is required to keep CPD records for 12 months after the end of their three-year CPD period.

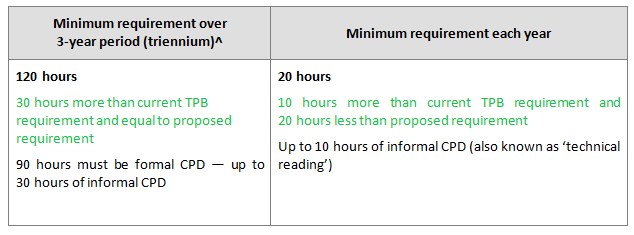

^ A member’s first triennium commences on 1 July following the date of admission.

CPD activities can relate to any competency that is relevant to the member’s current or future professional activities. A member can only claim hours that can be attributed to genuine learning — not breaks and entertainment sessions.

Formal CPD should maintain and/or expand the member’s capacity to discharge their professional obligations and should have the following characteristics: (i) an organised, orderly framework developed from a clear set of objectives; (ii) a structure for imparting knowledge of an educational or technical nature; and (iii) a requirement for involvement by the participant.

Formal CPD would normally include the following activities:

Training activities provided by employers are acceptable CPD provided they relate to the development, maintenance or expansion of professional competence. Training involving purely administrative tasks of a non-professional nature (e.g. completing employer time sheets) would not count as CPD.

Informal CPD is considered to be an activity such as reading technical or professional articles, and mentoring discussions.

Members are obliged to keep CPD records. There is no specified retention period.

Members can:

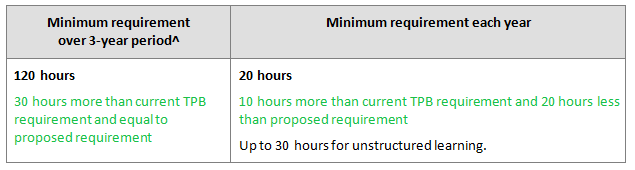

^ CPD requirements are based on a financial year and on a period of three years. The first three-year period commenced on 1 July 2018 and will finish on 30 June 2021. New members are permitted to meet the requirements on a pro-rata basis until a new three-year period commences.

![]() IPA reference

IPA reference

Pronouncement 7

CPD activities are classified into:

Examples of structured CPD activities are:

Examples of unstructured CPD activities (maximum hours apply) are:

Members are obliged to keep CPD records for a minimum of five years.

Members can record CPD online through the member portal.

The Tax Institute’s minimum yearly CPD requirements are:

This is 20 hours more than the current TPB requirement and 10 hours less than the proposed requirement.

The membership year runs over the financial year. The Tax Institute does not impose a three-yearly requirement.

![]() The Tax Institute reference

The Tax Institute reference

CPD requirements

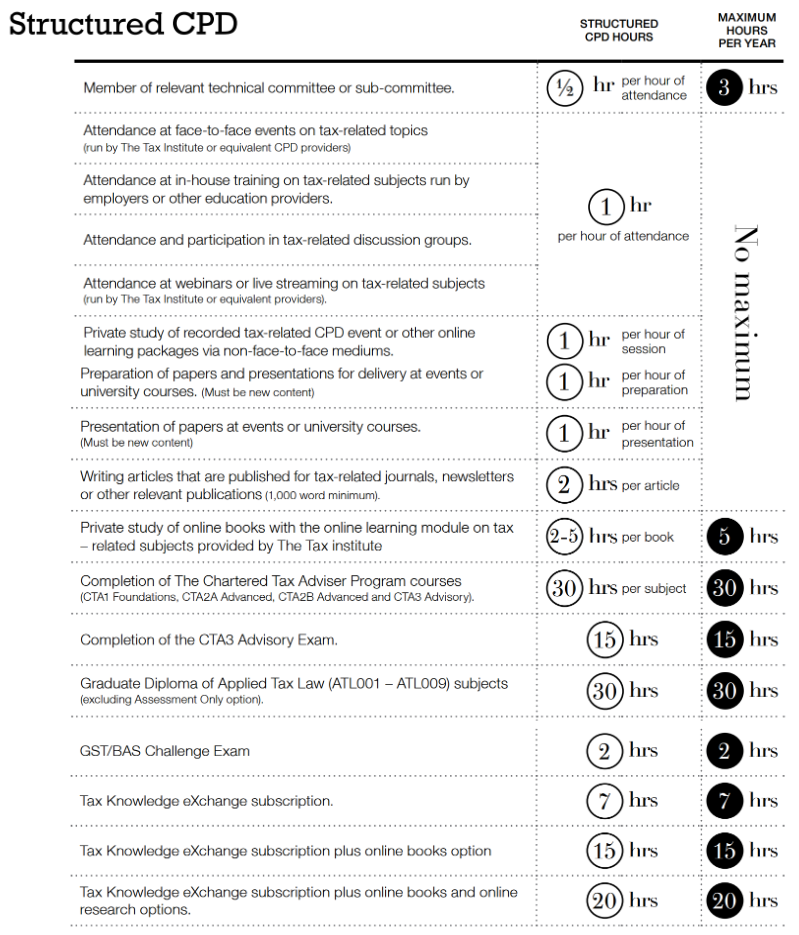

Structured CPD is delivered face-to-face or through a variety of technology based formats. Structured CPD has a defined outline, purpose or objective, aim or learning outcome and the ideal audience will be described in terms of levels, assumed knowledge, sectors or client base. The attendee may be already working in a role or aspiring to a role for it to be considered relevant and structured professional development.

Source: The Tax Institute fact sheet ‘CPD Requirements’

Unstructured CPD is defined as an activity which does necessarily define the types of attendees. Unstructured can include reading The Tax Institute journals, networking, social or tax community-building activity.

Members are obliged to keep structured CPD records for a minimum of 12 months. It is not necessary to record unstructured CPD.

Members can download the Structured CPD Form.

FASEA was established in April 2017 to set the education, training and ethical standards of licensed financial advisers.

From 1 January 2019, registered advisers must undertake 40 hours CPD per year, of which 70 per cent must be approved by their licensee (including a maximum 4 hours of professional reading).

The minimum hours for CPD across the mandatory categories are:

![]() FASEA reference

FASEA reference

Continuing Professional Development

Join thousands of savvy Australian tax professionals and get our weekly newsletter.