Written by: Tiffany Douglas | Tax Training Team Leader

On 19 February 2025, the Full Federal Court (FFC) handed down its eagerly awaited decision in Commissioner of Taxation v Bendel [2025] FCAFC 15 (the Bendel case) where it concluded that an unpaid present entitlement (UPE) is not a loan under s.109D(3) of Division 7A of the Income Tax Assessment Act 1936.

While the case is potentially significant, we will have to wait and see whether anything actually changes in the longer run.

Background

The scenario we are dealing with is not uncommon and has been problematic for practitioners for many years now.

A discretionary trust makes a corporate beneficiary presently entitled to trust income which remains unpaid. Prior to 16 December 2009, the ATO held the view that a UPE was not a loan unless the parties actually converted it into an ordinary loan. This meant that the trust could retain the use of the distributed trust income (e.g. for working capital) without attracting any implications under Division 7A.

However, with effect from that date, the ATO formed the view in TR 2010/3 (now withdrawn) that if the present entitlement remained unpaid by the lodgment day for the trusts tax return for the income year in which it arose, it became the provision of financial accommodation (by the company to the trust) and a loan for Division 7A purposes.

Our options for avoiding a deemed unfranked dividend, were to either pay out the UPE, hold it on ‘sub-trust’ in accordance with PS LA 2010/4 (now withdrawn) or put in place a complying Division 7A loan agreement within specified timeframes.

The ATO updated its view with effect from 1 July 2022 bringing forward the point where financial accommodation arises to when the corporate beneficiary knows that it is entitled to an amount, can demand immediate payment of it but doesn’t do so. This is likely to be earlier than the lodgment day, however the ATO accepts this most likely does not occur until after year end – i.e., at some point in the next income year.

What happened in Bendel?

The facts in the case are straightforward. A discretionary trust had made a corporate beneficiary presently entitled to trust income for the 2013 to 2017 income years which remained unpaid.

Following an audit of the taxpayer’s affairs, amended assessments were issued, and penalties imposed, on the basis that the corporate beneficiary’s UPEs were deemed to be dividends under Division 7A (with each beneficiary being proportionally assessed on their share).

The taxpayers unsuccessfully objected to the amended assessments and the dispute proceeded at first instance to the Administrative Appeals Tribunal (the Tribunal) which primarily considered whether a UPE is a loan for the purposes of s.109D(3).

The Tribunal found that it was not, which of course was completely at odds with the ATO’s long standing view.

The ATO appealed the decision of the Tribunal to the Full Federal Court which unanimously dismissed its appeal.

At the crux of its finding that a UPE is not a loan under s.109D(3) is that the provision encapsulates an obligation to repay an amount, not merely an obligation to pay an amount. This includes paragraphs (b) and (d) which brings into the definition of a loan respectively, ‘the provision of credit or any other form of financial accommodation’ and ‘a transaction (whatever its terms or form) which in substance effects a loan of money’ which provide the basis for the ATO’s view that a corporate beneficiary UPE is a loan for Division 7A purposes.

On March 18, the Commissioner lodged its special leave application with the High Court. It now remains to be seen whether leave will be granted.

What happens now?

The question on the mind of tax practitioners is ‘what do we do now?’. Unfortunately, the way forward is currently unclear.

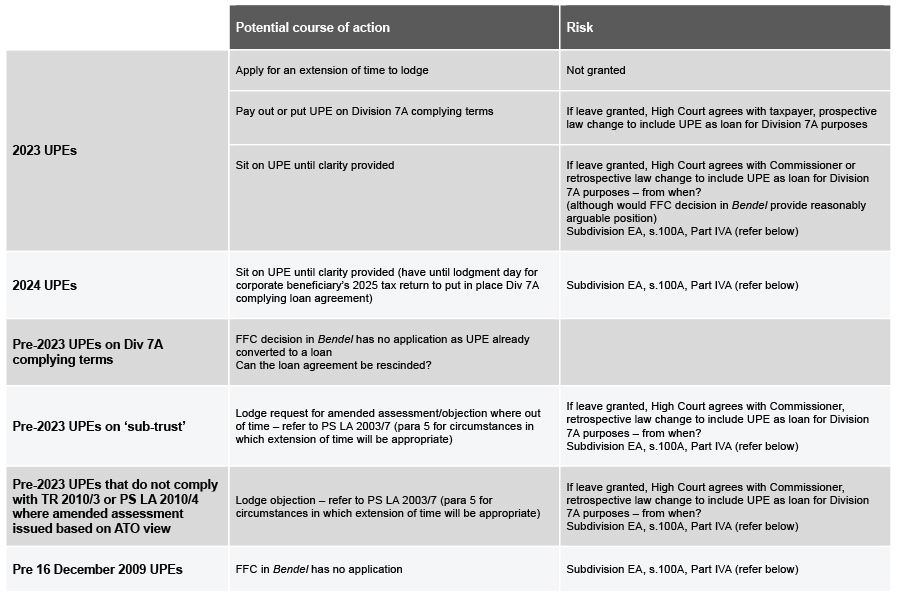

In this regard, the table below proposes some alternative courses of action, as well as the associated risks. It is not meant to be prescriptive – only to raise issues that may form the basis for discussions by tax practitioners both internally and with their clients.

Any proposed course of action will depend on the risk profile of tax practitioners and their clients alike. It may also be prudent to seek legal advice.

On 19 March, the ATO issued its Interim Decision Impact Statement in response to the decision of the FFC in which it confirms that pending the outcome of the appeal process, it will continue to administer the law in accordance with the published views in TD 2022/11.

Beware Subdivision EA and other legislative provisions

One of the reasons why the Tribunal (and indeed the FFC) reached the decision that it did in the Bendel case was because Subdivision EA of Div 7A already deals with the application of Div 7A where a trust has a UPE with a corporate beneficiary.

While the ATO’s view renders this set of provisions somewhat redundant (other than with respect to pre-16 Dec 2009 UPEs and those held on sub-trust), it is nonetheless important to be aware of their existence and when they can be triggered.

Effectively, Subdivision EA comes into play if a trust makes a payment, a loan or forgives a debt to a shareholder of a corporate beneficiary (or their associate) during an income year and the company becomes presently entitled to an amount of income from the trust that remains unpaid by the lodgment day for the trust’s tax return for that income year.

Again, we have options for managing our Div 7A exposure (i.e., putting a complying loan agreement in place between the trust and the beneficiary, paying out the UPE, extinguishing the loan or putting the UPE on Div 7A complying terms).

However, if Subdivision EA applies, the corporate beneficiary is taken to have paid an unfranked dividend to the beneficiary equal to the lower of either the value of the benefit provided, the UPE or the distributable surplus of the company.

Other legislative provisions that may also be available to the Commissioner in this context are s.100A (where the funds representing the corporate beneficiary UPE are loaned by the trust to a shareholder (or associate) of the corporate beneficiary and used for private purposes) as well as Part IVA.

Importantly, in its interim decision impact statement, the ATO has put taxpayers on notice that it has s.100A at its disposal.

Next steps

Join us at the beginning of each month as we review the current tax landscape.

We cover legislative updates, proposed changes to the tax law, topical matters that affect your clients and more.

Each interactive session also includes a Q&A (e.g. on hot issues – ‘The Bendel case’) and a supporting technical paper.

Join us live or watch the recording at a time convenient to you.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.