On 18 November 2022, the Treasury released for consultation exposure draft legislation titled Treasury Laws Amendment (Measures for Consultation) Bill 2022: Tax Practitioners Board Review (the ED) and accompanying explanatory materials.

The ED contains proposed amendments to the Tax Agent Services Act 2009 (TAS Act) to ensure that tax agent services and BAS services provided to the public are of an appropriate ethical and professional standard and to enhance the financial independent of the Tax Practitioners Board (the TPB) from the ATO.

In 2019, the Government announced an independent review into the effectiveness of the TPB and the TAS Act. On 27 November 2020, the Government released the final report of the Tax Practitioners Board Review (the Review) and its response to it.

The Government supports 20 of the Review’s 28 recommendations in full, in part or in principle and seeks to achieve three key objectives:

The ED proposes to implement five recommendations of the Tax Practitioners Board Review (the Review) as outlined below.

Comments and Submissions

Submissions are due 11 December 2022. See the Treasury’s ED webpage for consultation details.

Recommendation 4.6 is anchored in concerns in relation to insufficient internal governance practices leading to tax practitioners employing or using people who are unsuitable to provide tax services on their behalf. In particular, there is an identified gap in the regulation of tax services whereby entities who would not qualify to be registered (e.g. an applicant whose registration application was rejected) are able to provide tax services under the auspices of a registered tax practitioner.

The ED proposes the following three obligations:

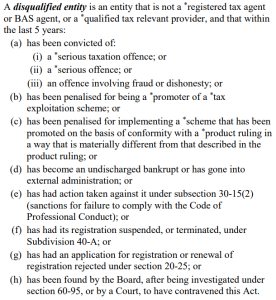

The proposed definition of a ‘disqualified entity’ is partially based on the current ‘fit and proper’ criteria, with some additional factors:

Failure by a registered agent to give a notice to the TPB, or by a disqualified entity to give a notice to the registered agent, may result in a civil penalty.

The TPB must decide an application within 30 days. The TPB may give approval, having regard to:

The proposed amendments will commence from the first 1 January, 1 April, 1 July or 1 October to occur after the day the Act receives Royal Assent. Transitional provisions will apply to appropriately capture existing and new employees or entities who may be disqualified entities, and provide tax practitioners and regulators with implementation time.

The ED proposes to convert the renewal period from at least every three years to at least every year. The change will remove the requirement for registered agents to provide an annual declaration to the TPB, and will align renewal with other requirements including maintaining professional indemnity insurance and undertaking continued professional education.

The maximum time period for the TPB to determine the outcome of an application will be reduced to four months.

These changes are proposed to apply prospectively to any registration or renewal applications submitted on or after 1 July 2023.

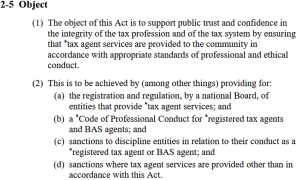

The proposed replacement s. 2-5 updates and modernises the object of the TAS Act, to support public trust and confidence in the integrity of the tax profession and the tax system. This is in addition to the current object which is to ensure that the tax agent services are provided to the community in accordance with appropriate standards of professional and ethical conduct.

The proposed new object will commence from the first 1 January, 1 April, 1 July or 1 October to occur after the day the Act receives Royal Assent.

A Special Account has been established for the TPB, meaning funding will largely be independent from the ATO. This dispenses with the need for yearly discussions with the Commissioner and provides the TPB with greater financial independence and power to manage its funding needs. In practice, the TPB will be primarily funded by the fees received from tax practitioners, and supplemented by amounts appropriated by the Parliament. Currently, the ATO has the final decision regarding the portion of its annual budget allocated to the TPB.

Financial independence aligns with the overall purpose of the Review, to recognise the TPB as having distinct functions and powers form the ATO, and as having responsibility for regulating tax practitioners with consistency and limits undue influence from the ATO.

The TPB and ATO will still be able to continue utilising their existing synergies and shared services which reduces overall costs and allows both bodies to benefit from information sharing.

These changes are proposed to commence 1 July 2023.

The Code of Professional Conduct (the Code) in the TAS Act sets out the professional and ethical standards that registered tax practitioners are required to comply with.

The proposed amendments enable the Minister to specify, in a legislative instrument, additional obligations that registered tax agents and BAS agents must comply with. The power cannot be used to reduce any existing obligations under the Code.

The proposed process also ensures appropriate consultation with key stakeholders and parliamentary oversight.

The proposed amendments will commence from the first 1 January, 1 April, 1 July or 1 October to occur after the day the Act receives Royal Assent.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 16 locations across Australia.

Our 2023 registrations are now open! Save up to 25% by registering for a full series of your choice (tax workshops or online training)

December Tax Update | registrations >

Personalised training options

Personalised training optionsWe can also present these Updates at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.