The ATO has released Taxation Ruling TR 2023/3 setting out the Commissioner’s views in relation to the application of s. 26-102 of the ITAA 1997 which limits the deductions available for expenses incurred in relation to holding vacant land. The Ruling was previously issued in draft as TR 2021/D5.

A loss or outgoing relating to holding vacant land, including interest or ongoing borrowing costs, is deductible only to the extent that the land is in use, or available for use, in carrying on a business.

An applicable business is one that is carried on for the purpose of deriving assessable income of one or more of:

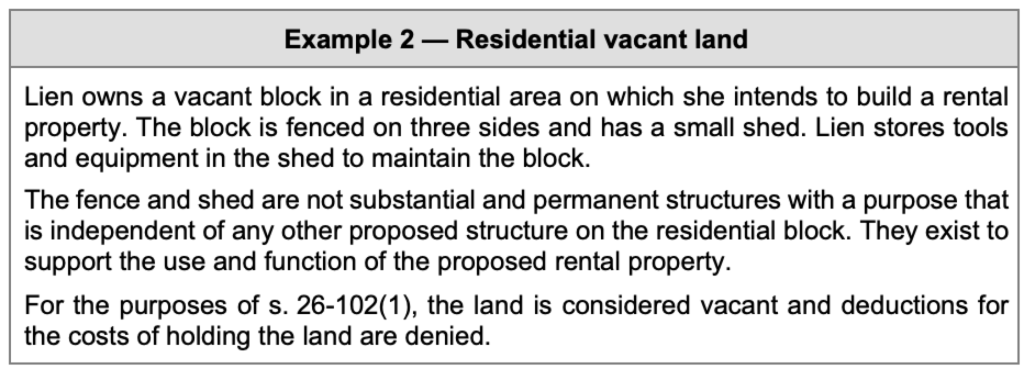

Land subject to s. 26-102 (i.e. vacant land) is where there is no substantial and permanent structure in use or available for use on the land having a purpose that is independent of, and not incidental to, the purpose of any other structure or proposed structure. Residential premises that are being constructed and substantially renovated are not treated as being a substantial and permanent structure unless they are lawfully able to be occupied and are in fact being rented or available to be rented.

The limitation on deductibility does not apply to a taxpayer that is a corporate tax entity, a superannuation fund (other than an SMSF), a managed investment trust, a public unit trust or a unit trust or partnership where each member is one of the aforementioned entities.

There are also exceptions for:

Leaving aside the exclusions, three tests determine whether the section applies:

Is there a substantial and permanent structure on the land?

If there is a structure, is it in use or available for use?

If there is a structure available for use, is it independent of and not incidental to the purpose of any other structure, or proposed structure on the land?

The non-binding Appendix to the Ruling sets out the Commissioner’s practical compliance approach in relation to newly constructed property temporarily unavailable for lease, hire or licence, as well as for determining if a lessee is using land to carry on a business.

A substantial structure is significant in size, value, or some other criteria of importance in the context of the property. To be permanent, a structure needs to be fixed and enduring.

Premises that are capable of being occupied (whether residential or commercial) will be considered available for use unless they have been deemed unsafe to occupy by a council, relevant body or relevantly qualified professional.

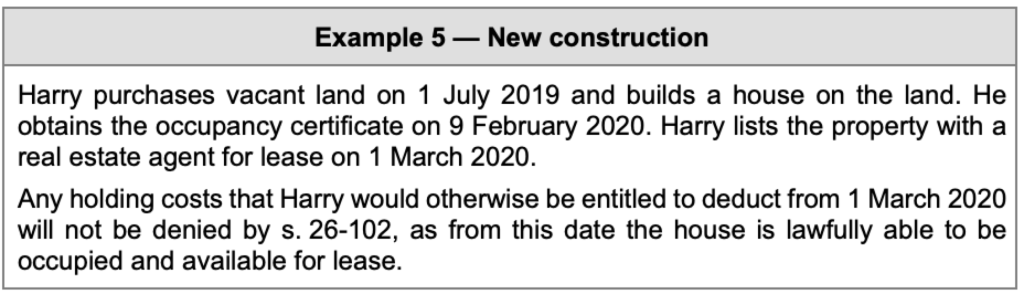

Residential premises constructed or substantially renovated must be ‘lawfully able to be occupied’ and this would occur when the certificate of occupancy (or other local council approval) is received.

At all times, newly-constructed or substantially renovated residential premises must be lawfully able to be occupied, and either leased, hired, or licensed, or available for lease, hire or licence.

There may be short periods of time when residential premises are unavailable for lease for reasons other than an exceptional circumstance or natural disaster, e.g. for minor maintenance and repairs. The ATO will not apply resources to review compliance provided that the taxpayer continues to meet the requirements for deductibility under another provision of the law.

While s. 260-102 specifies that interest or ongoing borrowing costs to acquire land are included as a cost of holding land, the ATO clarifies that other costs include council rates, land tax and maintenance.

The ATO does not consider the costs of repairing, renovating or constructing a structure, or any related interest or borrowing costs, to be a loss or outgoing related to holding land.

Where a deduction is prohibited, the expenses may form part of the third element costs of owning the asset.

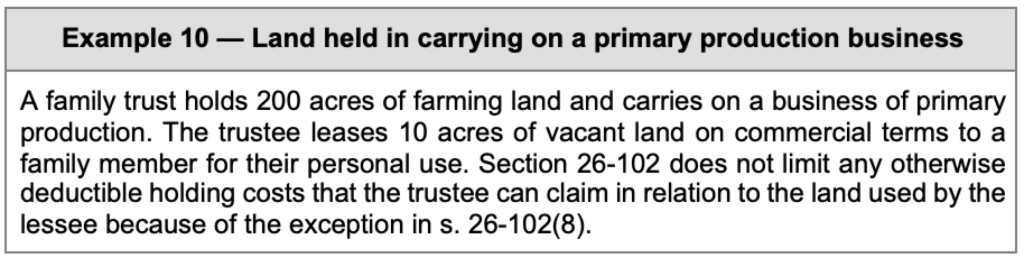

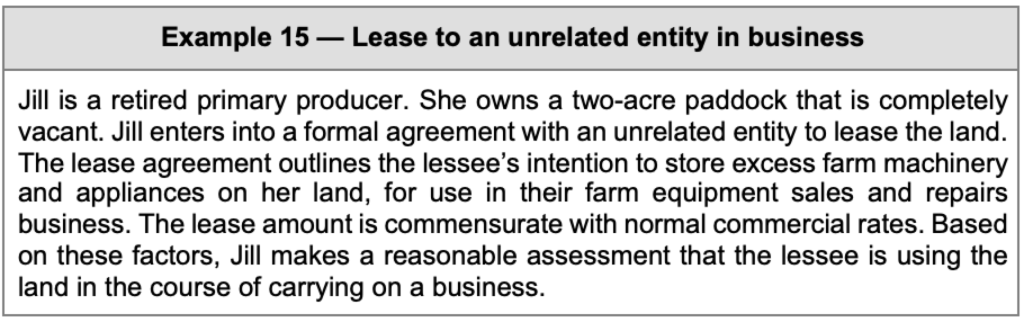

Whether the activities on the land amount to ‘carrying on a business’ is a question of fact determined by reference to the indicia of carrying on a business as set out in the case law. If only part of the land is used or available for use in carrying on a business, the taxpayer will need to apportion the holding costs on a fair and reasonable basis.

There is no requirement for the land to be in active use in the business. Land held by a developer for future development would be considered ‘available for use’.

Under the ATO’s compliance approach,, the taxpayer should make a reasonable assessment of the lessee’s use of the land. Considerations include:

This compliance approach is designed to give the taxpayer confidence that, if they make a reasonable assessment that the lessee — being an unrelated entity — is carrying on a business having regard to these factors, the ATO will not allocate additional compliance resources to determine whether a lessee is carrying on a business, except to confirm that the taxpayer’s assessment is reasonable.

For the primary production exception to apply, the land must not contain residential premises (including residential premises that are under construction).

If a loss or outgoing relates to only part of the land under a property title then for the purposes of determining if there is a substantial and permanent structure on the land, it is sufficient that such a structure exists somewhere on that part of the land.

Similarly, if a loss or outgoing relates to land held under multiple titles, the taxpayer needs to determine whether that land contains a substantial and permanent structure. Again, it will be sufficient that such a structure exists somewhere on the area of land to which the loss or outgoing relates.

The Ruling contains 15 practical examples:

We can also present tax updates or specialty topics at your firm or through a private online session, with content tailored to your client base. Call our support team at 0434 067 133 to have a chat about your specific needs and how we can assist.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.