[lwptoc]

![]() Note: Check out our accompanying podcasts here (2020 episode) and here (2021 episode)

Note: Check out our accompanying podcasts here (2020 episode) and here (2021 episode)

Expenses associated with the running of an individual’s home are usually private and domestic and nature. However, deductions for ‘home office expenses’ may be available under s. 8-1 and Div 40 of the ITAA 1997 (general deductions and depreciation respectively) where:

![]() References

References

ATO guidance on home office expenses can be found in:

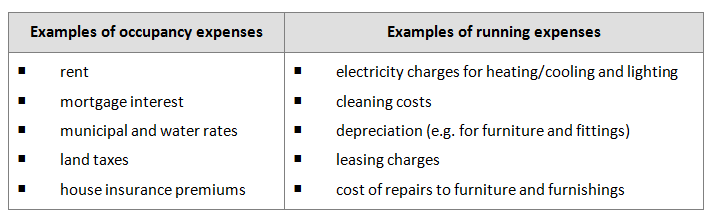

Home office expenses fall into two broad categories:

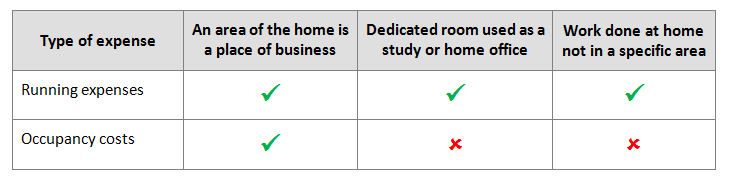

The following table sets out when occupancy costs and running expenses may be deductible:

The legislation does not prescribe specific methods of calculating home office expense deductions.

The amount of occupancy costs which can be claimed is dependent on the taxpayer’s indivdual circumstances. In the Commissioner’s view, in most cases, the apportionment of the total expense incurred on a floor area basis is the most appropriate method. See TR 93/30 for more detail.

The rest of this article outlines the ATO’s alternative methods for calculating a deduction for running expenses.

For calculating a deduction for additional running expenses incurred as a result of working from home from 1 March 2020 to 30 September 2020, the ATO allows a choice of three standard methods:

![]() Note:

Note:

The types of expenses in (b) are to be claimed using the actual method.

![]() Note:

Note:

Unlike the fixed rate method, under the shortcut method, the taxpayer cannot also claim a separate deduction for other running costs, e.g. depreciation.

To claim a deduction under the actual cost method or the fixed rate method, the taxpayer needs to establish the work related portion of expenses incurred. Methods include:

The shortcut method only requires the number of hours that the taxpayer worked from home.

Regardless of the method adopted, taxpayers must still satisfy the deductibility requirements in order to claim the expense:

Source: Example 5 from PCG 2020/3

Ephrem is an employee and as a result of COVID-19 he is working from his home office. In order to work from home, Ephrem purchases a computer on 15 March 2020 for $1,299. He intends to use the shortcut rate to claim his additional running expenses.

During the entire period he is working from home as a result of COVID-19, Ephrem notes in the calendar on his computer, when he starts and finishes each day along with a note about any breaks he has and how long those breaks were.

When it comes to lodging his 2020 tax return, Ephrem works out that during the period he worked from home as a result of COVID-19, he worked a total of 456 hours.

Ephrem calculates his deduction for the 2020 income year for additional running expenses as:

456 hours × 80 cents per hour = $364.80

As Ephrem has claimed his additional running expenses using the shortcut rate, he cannot claim a separate deduction for the decline in value of his computer. Ephrem keeps a record of the calendar entries he has made to demonstrate how he calculated the number of hours he worked from home. Ephrem also keeps the receipts for his computer purchase in case he will need to claim depreciation in future.

When he lodges his 2020 tax return, Ephrem includes the notation ‘COVID-hourly rate’.

Due to COVID-19 many taxpayers started to work from home for the first time during 2019–20. Given the speed of developments and Government restrictions, many taxpayers did not have the time or knowledge to prepare adequate record-keeping systems to establish the work related portion of additional running costs under the actual cost method or the fixed rate method. The shortcut method — set out in PCG 2020/3 — reduces the record-keeping requirements whilst giving taxpayers a reasonable amount to claim for the period that they work from home due to COVID-19 public health concerns.

The shortcut rate does not cover occupancy costs. Occupancy expenses are not deductible where the taxpayer is being required to work from home temporarily as a consequence of COVID-19 and where no part of the home is a place of business. However where the taxpayer has created a place of business within their home as a result of COVID-19, they may claim occupancy costs under established rules.

The shortcut method is available to all taxpayers working from home during this period, whether as a result of COVID-19 or not, including any business owners who now carry on their business from their home or continue to carry on their business at home. However the ATO introduced the method as a direct response to taxpayer’s changed work arrangements arising from COVID-19 and this is reflected in the limited applicable period of 1 March 2020 to 30 September 2020.

![]() Note:

Note:

The end date of the shortcut method was originally 30 June 2020 — it has now been extended to 30 September 2020. PCG 2020/3 states that the ATO will give further consideration to whether the date may be extended further.

Eligible taxpayers are employees and business owners who:

The Taxpayer does not have to have a separate or dedicated work space or if they do multiple people can be using the space.

Taxpayers using the shortcut rate must keep a record of the hours they have worked at home in order to calculate their additional running expenses. This could be in the form of timesheets, rosters, a diary or similar document that sets out the hours they have worked.

Taxpayers who use the shortcut rate to calculate their additional home office expenses and lodge their tax return through myGov or through a tax agent must include the notation ‘COVID-hourly rate’ next to their deduction for home office expenses — at label D5 Other work-related expenses — in their 2020 tax return and/or 2021 tax return.

Many taxpayers already had work from home arrangements in place before the COVID-19 crisis. They may have increased their work from home hours due to COVID-19 or there may have been no change to previous arrangements. Running expenses incurred prior to 1 March 2020 should be calculated using the actual cost method or the fixed rate method.

![]() Implications

Implications

This means that affected taxpayers will have to perform two separate calculations to work out their total 2020 deduction — one for the period 1 July 2019 to 29 February 2020 and one for the period 1 March 2020 to 30 June 2020. This is likely to also be the case for their 2021 claim.

Source: Example 3 from PCG 2020/3

Duyen is an employee of an online trading business. Up until the end of February, Duyen spent two days working from home and three days working at the office of her employer. As a result of COVID-19, she starts working from home five days per week from 1 March 2020. For the period from 1 July 2019 to 29 February 2020, Duyen uses the current fixed rate of 52 cents per hour to calculate her additional running expenses including electricity expenses, cleaning expenses and the decline in value and repair of her office furniture. She also calculates her work-related phone and internet expenses using the itemised phone bill for one month on which she has marked her work-related phone calls and the four-week representative diary of internet usage that she kept.

As Duyen is working from home she can rely on PCG 2020/3 to claim her additional running expenses for the period from 1 March 2020.

Duyen ends up working from home for five days per week until 30 June 2020 as a result of COVID-19. Rather than continuing to use the current fixed rate and working out the actual expenses she incurred on her phone and internet expenses from 1 March 2020 to 30 June 2020, Duyen decides, for simplicity, to calculate all of her running expenses using the shortcut rate. Duyen uses the timesheets she is required to provide to her employer to calculate the number of hours she works from home in the period from 1 March 2020 to 30 June 2020 and keeps those timesheets as evidence of her claim.

![]() Note:

Note:

The ATO has recently advised that one of the top three lodgment issues for tax time 2020 is taxpayers claiming multiple working from home methods for the same period. Specifically, for the period 1 March to 30 June 2020, some taxpayers have deliberately or accidentally claimed a deduction under the shortcut method as well as depreciation on assets such as laptops or desks. The ATO is reminding taxpayers that the 80 cents per hour rate is an all-inclusive rate.

Further information

For more on the latest legislation changes and to stay up-to-date on the latest in tax, join us for our monthly tax updates, hosted by some of Australia’s leading tax experts.

We facilitate these online and in locations across Australia (in line with current COVID-19 restrictions).

Join thousands of savvy Australian tax professionals and get our weekly newsletter.