The ATO recently released its Taxation statistics 2020–21. This annual publication shows statistics from lodged tax returns and schedules for the relevant income year.

The publication covers:

The publication also covers the 2021–22 year relating to GST, FBT and excise and fuel schemes.

This article presents a selection of the statistics available in relation to individuals.

Lodgment trends

For 2020–21, 63.7 per cent of individual tax returns were lodged by an agent, 35.8 per cent were lodged through myTax and 0.6 per cent were by other means of self-lodgment.

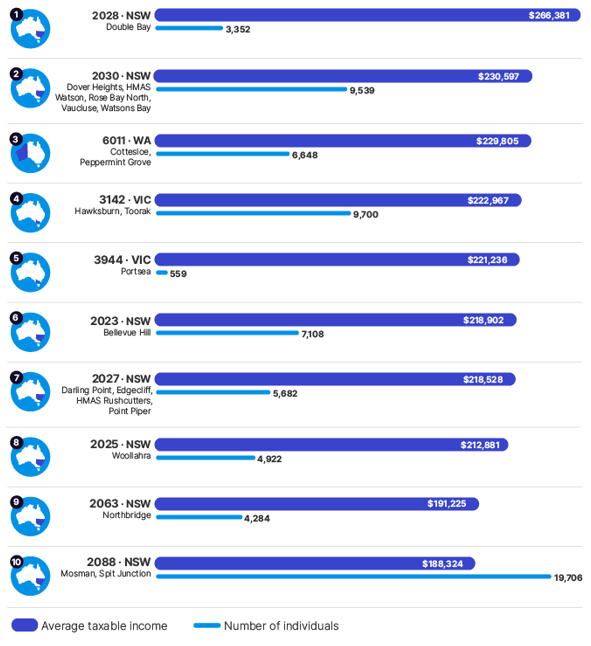

Chart 4: Individuals — top 10 postcodes, by average taxable income

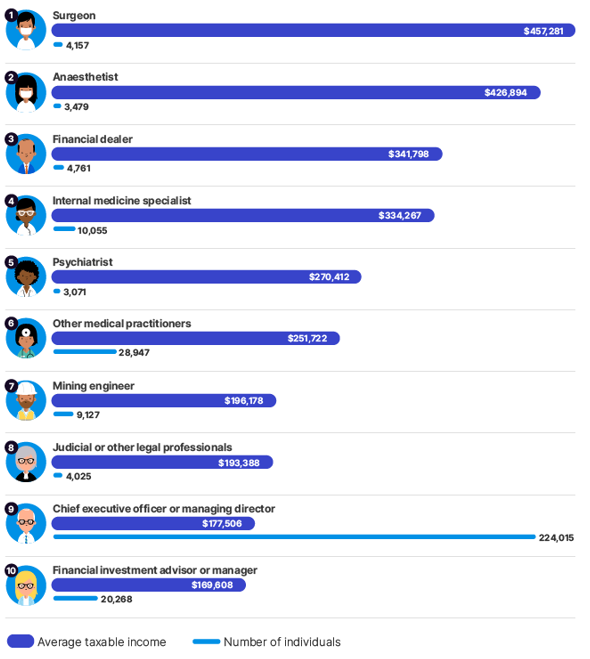

Chart 5: individuals — top 10 occupations, by average taxable income

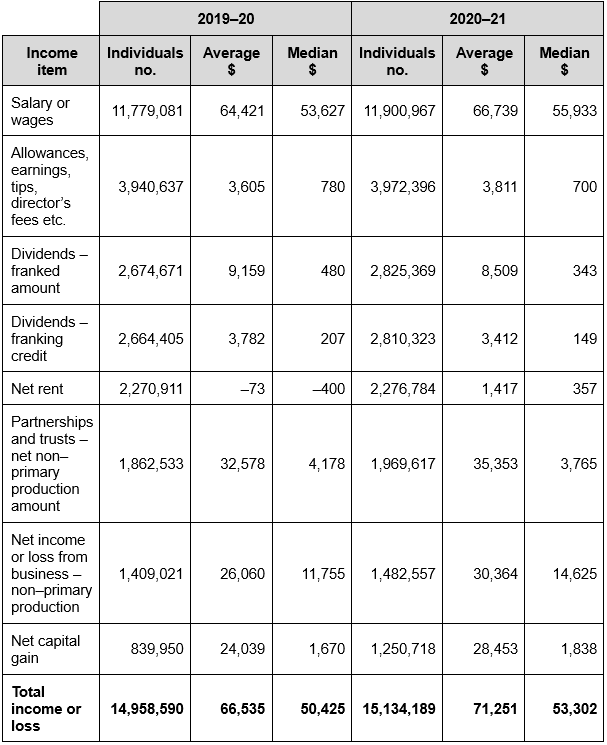

Table 5: Individuals — Selected income items, 2019–20 to 2020–21 income years

(A selection of items only — refer to ATO statistics for the full list of income items)

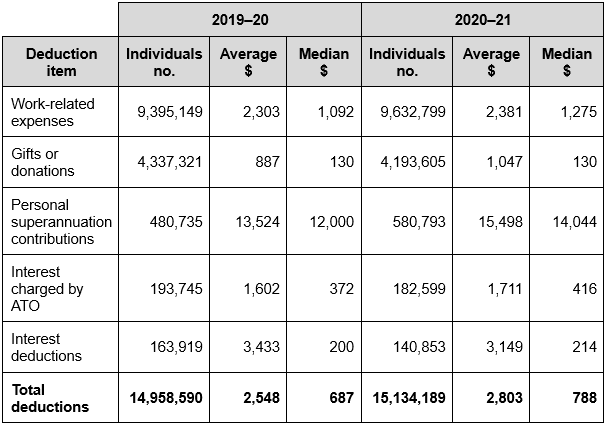

Table 6: Individuals — Selected deductions, 2019–20 to 2020–21 income years

(A selection of items only — refer to ATO statistics for the full list of deduction items)

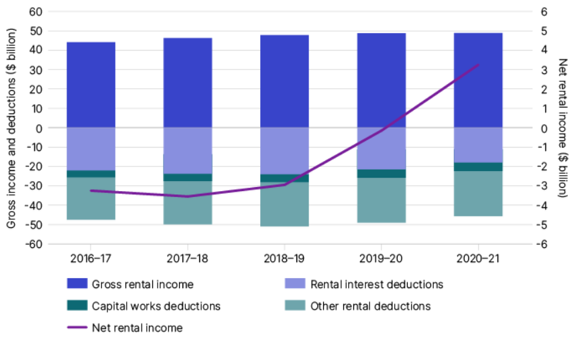

Chart 10: Individuals — rental income and deductions, 2016–17 to 2020–21 income years

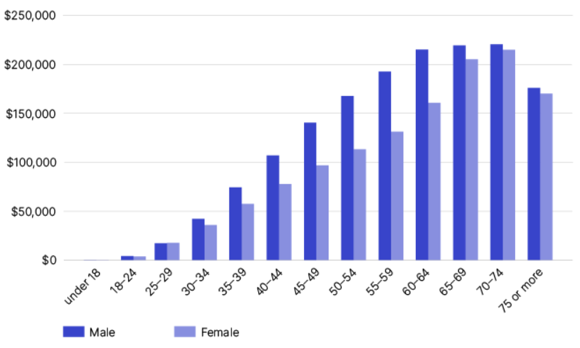

Chart 12: Individuals — median superannuation balance, by age and sex, 2020–21 financial year

Other 2020–21 statistics can be found at the following links:

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

We can also present tax updates or specialty topics at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.