The ATO has launched its refreshed ATO Charter — previously known as the Taxpayers’ Charter. The ATO Charter explains what people can expect when they interact with the ATO, the ATO’s commitments to them, what the ATO asks of them, and steps people can take if they are not satisfied.

The community consultation leading to the revision of the Charter was ‘inaccessible, dense and did not reference the ATO’s support for people with vulnerabilities or those impacted by difficult times’.

The refreshed Charter has been streamlined but contains links to detailed information on specific topics. The PDF version — as a chapter of the ATO’s ‘Commitments and reporting’ document — is around five pages long.

The new Charter also contains a specific commitment for ‘support and assistance’ in dealing with vulnerabilities and crises, and makes more prominent information about the steps people can take if they are not satisfied.

Note that ATO interactions with tax agents — through which almost two-thirds of individuals lodge — and other professional intermediaries are not comprehensively covered in the Charter, although there is a commitment that the ATO will work with taxpayers’ representatives.

Further, to reflect the ATO’s digital strategy, the Charter commits to providing services digitally except where an alternative approach is more appropriate, and there is a commitment to ensure cyber security over taxpayers’ digital data.

The web-based ATO Charter is available here — at Our Charter. It has been translated into 25 languages and there is also an ‘easier to read’ version. In addition, a downloadable three-page PDF pamphlet is available here.

This article summarises the contents of the new Charter.

Note: the below summary uses the terminology in the Charter — i.e. ‘we’/’us’ refers to the ATO and ‘you’ refers to the taxpayer.

We want to ensure that every time you work with us your experience is ‘easy and professional’.

The Charter:

There are also steps you can take if you disagree with a decision or believe we have not followed the Charter.

Our relationship with you is based on mutual trust and respect. We are committed to being fair, ethical and accountable in everything we do.

We will:

We know your rights and obligations under the law can be complex. We aim to provide you with reliable, accessible and useful information and service to help you understand your rights and meet your obligations.

We will:

We understand people may need help in different ways, at different times. We know it may be harder for you to meet your obligations if you are experiencing vulnerability, difficult times or are impacted by crisis events. While we can’t remove your obligations in most cases, there may be ways we can assist you to meet them.

We will:

We take the responsibility to protect your information and data very seriously. We know how important the privacy and security of your personal information is in the modern digital world.

We will:

We are committed to being transparent and accountable in our interactions with you and the community.

We will:

You will have a range of obligations under the law depending on your circumstances.

If you believe we have made a mistake in our decisions, we will:

As a first step, discuss your concerns with us. You can also request to have many of our decisions reviewed by an independent officer who was not involved in the original decision.

If you disagree with our internal review, you can ask for an external review. In most cases, you need to have requested an internal review with us and be dissatisfied with the outcome before seeking an external review.

Depending on the type of decision you are objecting to, you may have a variety of options for external review such as the courts or tribunals.

There are several steps you can take if we have not met your expectations, or you think we have not followed our Charter:

We treat all complaints seriously and aim to resolve them quickly and fairly.

Making a complaint will not affect your relationship with us.

If you are not satisfied after making a complaint with us, you can contact the Inspector-General of Taxation and Taxation Ombudsman for an independent investigation.

You can also apply for compensation from us if you:

The previous Taxpayers’ Charter was introduced in July 1997 and was one of the first ‘service’ charters introduced by a Commonwealth agency. It set out the way the ATO was to conduct itself when dealing with taxpayers. It consisted of two overview booklet and ten supporting booklets. It explained 13 Charter principles (taxpayer rights) and outlined six taxpayer obligations.

The original Charter gave a commitment to be independently reviewed every three years. The inaugural review was delayed to incorporate the impact of tax reform (A New Tax System). A revised Charter was released in November 2003.

The Charter has undergone a number of internal and external reviews over the years. Interested readers may refer to the Inspector-General of Taxation’s thought-leadership paper A brief history of the Taxpayers’ Charter (released in November 2021) for a detailed account of the history and development of the Charter, including review findings and recommendations.

The most recent ATO review of the Charter commenced in July 2021 with a public consultation period in September-October 2022.

Taxpayers’ rights and obligations as set out in the former Taxpayers’ Charter are below.

You can expect us to:

We expect you to:

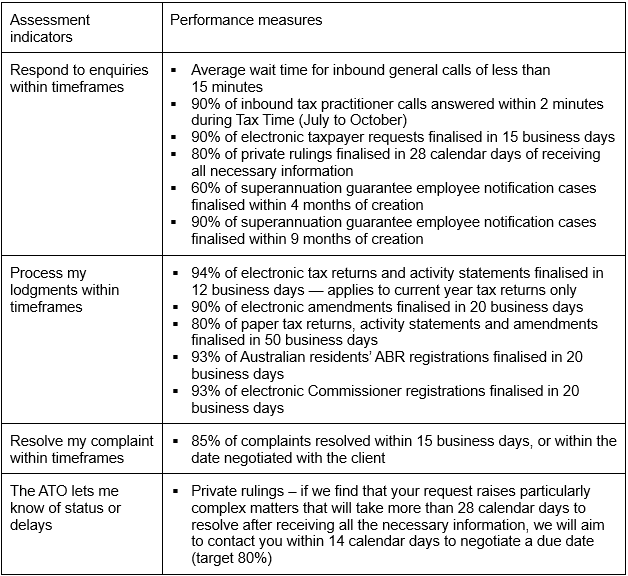

While not forming part of the Charter, the ATO’s service commitments are relevant to this topic and also to the current Tax Time. Detailed information is available here.

The ATO’s 2023–24 service commitments are as follows:

The ATO’s part year performance against its service commitments for 2022–23 is published here.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

We can also present tax updates or specialty topics at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Email us to have a chat >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.