Written by: Letty Chen | Senior Tax Writer

On 2 July 2024, the Legislative Instrument titled the Tax Agent Services (Code of Professional Conduct) Determination 2024 (the Instrument) was registered. Registered tax and BAS agents need to pay immediate attention to the Instrument as it introduces new obligations under the TPB’s Code of Professional Conduct (the Code) which comes into effect on 1 August 2024. Registered agents have only a few weeks to ready themselves and their practices to comply with the new obligations.

There is now a requirement to notify current and prospective clients about any matter that could significantly influence their decision to engage the tax agent. It is crucial to note that — despite the 1 August commencement date of the Instrument — registered agents are required to make these disclosures in relation to matters which arose from 1 July 2022. Further, tax agents have 90 days from 1 August to make disclosures relating to matters arising between 1 July 2022 and 31 July 2024.

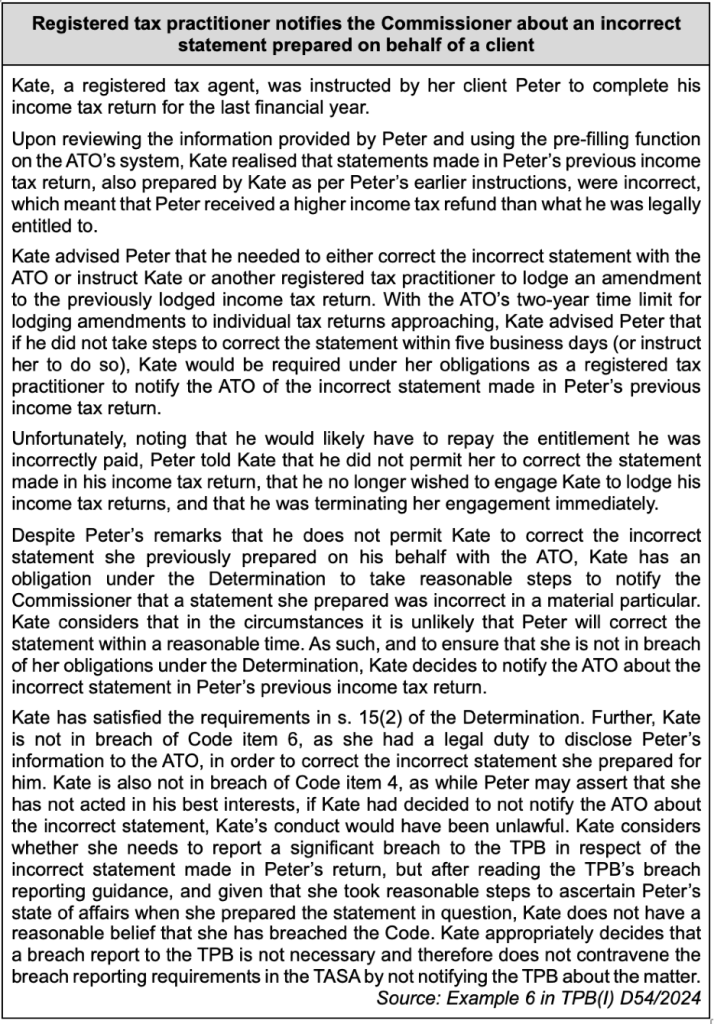

Another new obligation is a requirement to take corrective action in relation to a false, incorrect or misleading statement. Significantly, this obligation covers where the agent prepares and lodges a client’s tax return — the obligation requires the agent to advise the client to take action to correct the statement or to authorise the agent to correct the statement. Where the client refuses to do so, the practitioner is obliged to notify the TPB or Commissioner.

This article will outline these two new notification requirements followed by a summary of the other additional obligations introduced by the Instrument.

The Instrument is accompanied by an Explanatory Statement (the ES).

Note: The ES notes that the Tax Practitioners Board (the TPB) will issue guidance materials to support registered tax practitioners to comply with the new obligations. At time of writing, the TPB has announced that it will be ‘consulting on draft guidance relating to the new Code obligations progressively, starting in the coming weeks’.

Note: The ES notes that the Tax Practitioners Board (the TPB) will issue guidance materials to support registered tax practitioners to comply with the new obligations. At time of writing, the TPB has announced that it will be ‘consulting on draft guidance relating to the new Code obligations progressively, starting in the coming weeks’.

Keeping your clients informed of all relevant matters

Note: in the Code, this obligation is listed under ‘Other responsibilities’.

Disclosures relating to matters that could significantly influence client’s decision to engage

Tax practitioners are obliged to advise all prospective and current clients of any matters that could significantly influence the client’s decision on whether to engage the agent.

The disclosure must be made in a prominent, clear and unambiguous way.

If a client makes inquiries to engage or re-engage the practitioner and the practitioner is aware of the matter at that time — the disclosure must be made at the time of the inquiry.

Otherwise, the disclosure must be made within 30 days of becoming aware of the matter.

Prospective clients will include individuals and entities that have contacted a tax practitioner in relation to the provision of services, which could include by email, phone or website.

Relevant matters

The Instrument does not prescribe a list of matters which require disclosure.

The ES states that, without limiting the scope of the obligation, relevant matters may include:

- a prior material breach of the TAS Act

- a current investigation by the TPB of a material breach

- any sanctions imposed by the TPB or conditions applying to registration

- any potential use of disqualified entities in relation to that client or potential client

- any charge or conviction relating to an offence relating to fraud or dishonesty or a tax offence

- imposition of a promoter penalty.

Materiality is a breach that a reasonable person would have regard to, as part of their decision-making, to engage or re-engage the tax practitioner.

If an investigation by the TPB ultimately finds a material breach, or no breach, or any breaches found by the investigation are not material, the tax practitioner could provide that update.

Disclosure to prospective and current clients should go beyond any non-compliance of the individual tax practitioner and extend to matters relating to any company or partnership they work under, if the matter could significantly influence the decision to engage or continue to engage a tax practitioner within the company or partnership.

Application and transitional rule

While the Instrument and the other seven additional obligations commence on 1 August 2024, practitioners are required to comply with this client disclosure obligation in relation to matters arising from 1 July 2022.

For matters which arose between 1 July 2022 and 1 August 2024 (inclusive), disclosure to current and prospective clients must be made within 90 days of this Instrument commencing (i.e. by 30 October 2024).

Disclosures relating to TPB register and complaints process

Tax practitioners are also obliged to advise all prospective and current clients:

- that the TPB maintains a register of tax agents and BAS agents and how they can access and search the register

- about how they can make a complaint about a tax agent service the practitioner has provided, including the TPB’s complaints process.

The disclosure must be made in a prominent, clear and unambiguous way.

This information must be disclosed upon engagement or re-engagement of a client or upon receiving a relevant request.

Disclosures on website and in letters of engagement

The Instrument makes clear that a practitioner may be treated as complying with their disclosure obligations — in a prominent, clear and unambiguous way — if they publish the information on a publicly accessible website that they use to promote their tax agent services AND include the information in letters of engagement or re-engagement given to each client.

False or misleading statements

Note: in the Code, this obligation is listed under ‘Honesty and integrity’.

The three limbs of the obligation

A tax practitioner must not make a statement — in writing or orally — to the Commissioner, the TPB or another Australian government agency that they know, or ought reasonably to know, is false, incorrect or misleading.

The practitioner must not omit information that would result in a statement being materially misleading. The obligation applies to statements made in writing or orally.

According to the ES, this obligation covers statements made directly by a tax practitioner (not for or on behalf of another) such as statements made to the Board when applying for registration, in relation to being a fit and proper person or having relevant skills and experience.

The obligation also extends to preparing a statement that is likely to be made to the Commissioner, the TPB or another Australian government agency by an entity.

Per the ES, this covers statements prepared by a tax practitioner, such as where the practitioner prepares a document for a client to provide to the TPB or Commissioner in the client’s name, provided that the practitioner knows, or ought reasonably to know, that the statement will be provided to the TPB or Commissioner.

Further, the obligation extends to permitting or directing someone else to make or prepare such a statement.

This would cover a tax practitioner delegating work to staff who may or may not themselves be tax practitioners, or any other attempt to circumvent the obligation by having someone else prepare or make the statement.

Based on the ES, the obligations apply whether the tax practitioner made, prepared, permitted or directed a statement to be made in their capacity as a tax practitioner, or in another professional role, such as during consultation on draft legislation, or in relation to the tax practitioner’s personal tax affairs, or in any other capacity.

The provision is concerned with particulars that are material in nature. It is not concerned with particulars that are trivial in the circumstances in which the statement has been made. A statement should not be contrary to fact, nor should it give the wrong impression with regard to a material particular. Expanding this obligation to include statements made in a tax practitioner’s personal and professional activities highlights the importance of a tax practitioner’s role in representing the tax profession and preserving public confidence in the tax system.

Australian government agency is defined in the ITAA 1997 as the Commonwealth, State or Territory, or an authority of the Commonwealth, State or Territory. They include, for example, the Australian Securities and Investments Commission, Department of the Treasury and the Australian Competition and Consumer Commission.

Reasonable steps to correct false, incorrect or misleading statement

If the practitioner becomes aware that a statement given to the TPB or Commissioner was false, incorrect or misleading, they must, as soon as possible, take all necessary steps to (as applicable):

- where they made the statement (or permitted or directed someone else to make the statement) — correct the statement

- where they prepared the statement (or permitted or directed someone else to prepare the statement) — advise the maker of the statement that it should be corrected; or

- where they prepared the statement and the maker does not correct the statement within a reasonable time — notify the TPB or Commissioner.

Note that this requirement does not apply to a statement made to another Australian government agency.

The obligation to correct a statement applies to statements that are false, incorrect or misleading at the time that they are made, regardless of when the tax practitioner becomes aware that the statement was false, incorrect or misleading.

However, there is no obligation under the Code to take action in relation to a statement that was not false, incorrect or misleading at the time it was made, but later becomes false or misleading because of some later event — for examples:

- there was a change to the law that operates on a retrospective basis; or

- a decision of a court or tribunal finds that the law operates differently to what had been the generally understood interpretation and administrative practice; or

- the TPB or Commissioner withdraws guidance and advice relied upon in the preparation of the statement.

While the obligation does not extend to a statement that was not false, incorrect or misleading at the time it was made, to mitigate the potentially burdensome compliance costs for a tax practitioner that would otherwise follow from such an event, it may nonetheless be appropriate for the tax practitioner to take action in relation to such a false or misleading statement where they are advising on the matter or on a related matter.

Other obligations under the TAS Act or Code may apply to past statements that become false, incorrect or misleading after they are made, such as the obligation to lawfully act in the client’s best interests or to notify the TPB of a change in circumstances.

In relation to the obligation to advise the maker of a false, incorrect or misleading statement that they need to take action to correct the statement, this covers, for example, where a tax practitioner prepares a client’s tax return and then submits the return to the Commissioner on the client’s behalf. As the tax practitioner would require the client’s consent to request an amendment, the obligation instead requires the tax practitioner to advise the client to take action to correct the statement themselves, or authorise the tax practitioner to take the necessary action to correct the statement on their behalf.

Other implications

The ES notes that correcting or notifying in relation to false, incorrect or misleading information will be factored into consideration of any potential sanction in relation to the original false or misleading statement where the tax practitioner’s involvement in that statement was a breach of the Code.

If a tax practitioner discloses confidential information, or notifies the TPB or Commissioner, as permitted by this obligation, that will not be a breach of the general confidentiality obligations in the Code. Those requirements do not apply to the extent there is a legal duty to disclose.

The other additional obligations

Honesty and integrity

Upholding and promoting the ethical standards of the tax profession

Tax practitioners, both independently and in cooperation with other tax practitioners, are required to uphold and promote the Code and not engage in conduct that may undermine public trust and confidence in the integrity of the tax profession and tax system.

Independence

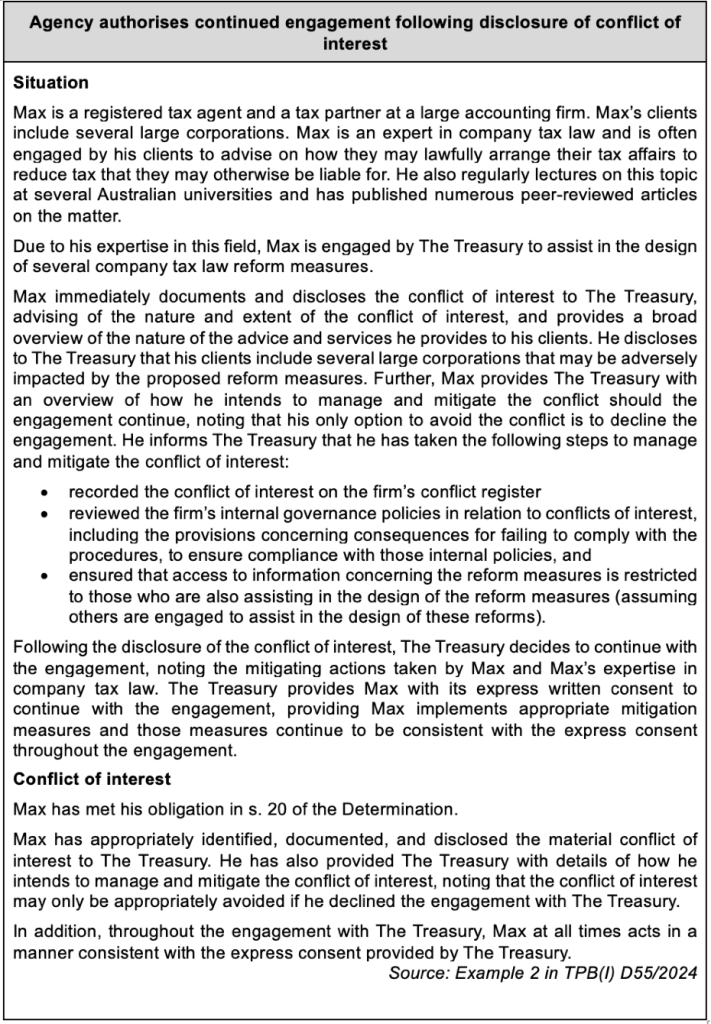

Conflicts of interest in dealings with government

Tax practitioners are required to take reasonable steps to identify, document, manage, mitigate and avoid any material conflicts of interest related to an activity undertaken for an Australian government agency.

They must disclose details of a material conflict — whether real or potential — to the government agency as soon as they become aware of the conflict.

According to the ES:

- An example of a material conflict would be where a tax practitioner is advising government on loopholes that exist in taxation law at the same time as advising their clients on how that same area of law operates in respect of that client’s tax affairs and how the client can rearrange their affairs to minimise taxes payable.

- An example of a conflict of interest that would probably not be material would be advising government on a proposed change that applies across the board to the management of all superannuation funds while being a passive member of a superannuation fund.

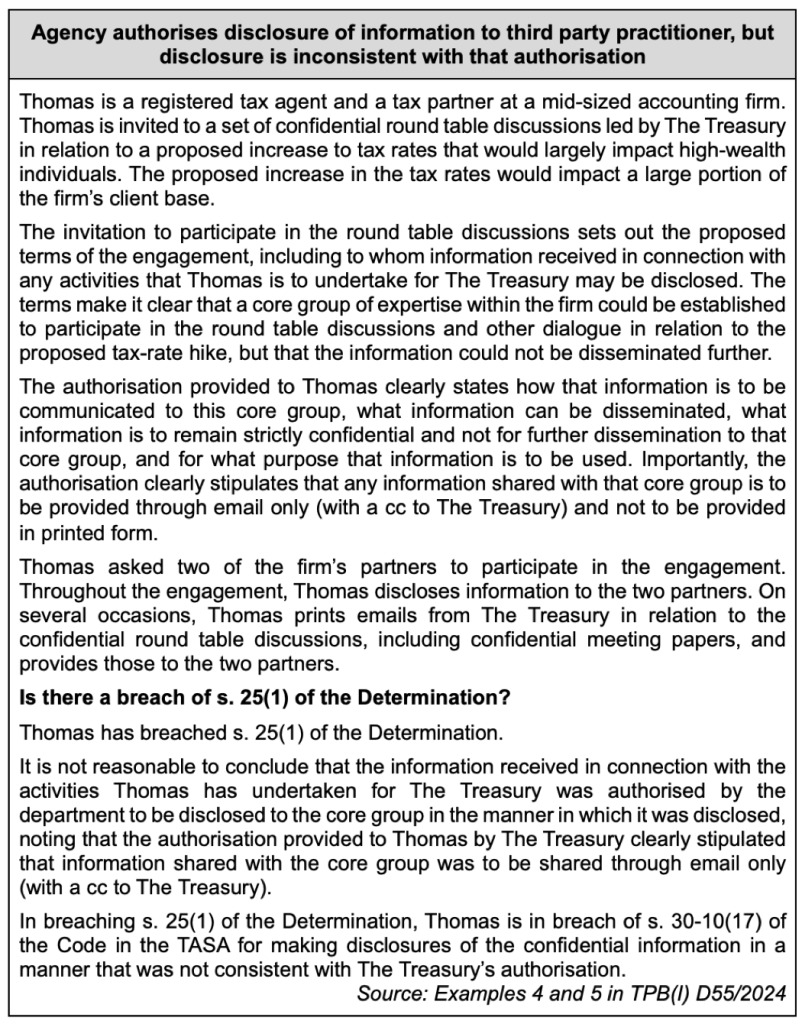

Confidentiality

Maintaining confidentiality in dealings with government

Tax practitioners are prohibited from disclosing information from an Australian government agency that was obtained directly or indirectly in connection with activities they undertake for the government agency. The exceptions are where there is a legal duty or disclose or where the agency authorised such disclosure.

The information cannot be used for the advantage of the practitioner, or their associate, employee, employer or client, other than where authorised by the agency.

There is no requirement for information to be marked as confidential for this rule to apply. It is not necessary that the use was likely or guaranteed to result in an advantage — a potential advantage is sufficient.

Competence

Keeping of proper client records

Tax practitioners are required to keep records that correctly record the tax agent services provided, or that are provided on the practitioner’s behalf, to each of their clients, including former clients.

Records must be in English or easily convertible to English and must be retained for at least five years after the service was provided.

Records must show the nature, scope and outcome of the tax agent service provided, and for complex matters may include the relevant facts, assumptions and reasoning underpinning advice provided to the client.

This obligation applies to tax agent services provided on or after 1 August 2024.

Ensuring tax agent services provided on your behalf are provided competently

Tax practitioners must ensure that adequate supervision is offered to each entity providing tax agent services on their behalf, and these entities have the relevant skills to provide services competently.

This will require tax practitioners to ensure that unregistered staff providing tax agent services on their behalf are provided with adequate training, and substantive review and sign-off of work is conducted.

Other responsibilities

Quality management systems

Tax practitioners must establish a system of quality management which is designed to provide reasonable confidence of compliance with the Code.

They must also document and enforce the policies and procedures of the system.

A system of quality management includes policies and procedures relating to governance and leadership, performance monitoring, adherence to the Code, client engagement, proper keeping of records, protecting confidentiality of information, managing conflicts of interest, and the recruitment, training and management of employees.

According to the EM, the government expects that the extent of internal controls in place will differ significantly depending on the size of the practice.

A large firm would be expected to employ extensive internal controls.

Individuals with clientele from the local community may employ less sophisticated internal controls such as physical controls over filing cabinets, conducting and document a conflict of interest, know-your-client checks, and regularly updating software.

Tax practitioners are expected to keep the system documentation up-to-date and to be made available to the TPB upon request.

Note:

Note:

Note: The ES notes that the Tax Practitioners Board (the TPB) will issue guidance materials to support registered tax practitioners to comply with the new obligations. At time of writing, the TPB has announced that it will be ‘consulting on draft guidance relating to the new Code obligations progressively, starting in the coming weeks’.

Note: The ES notes that the Tax Practitioners Board (the TPB) will issue guidance materials to support registered tax practitioners to comply with the new obligations. At time of writing, the TPB has announced that it will be ‘consulting on draft guidance relating to the new Code obligations progressively, starting in the coming weeks’.