Background

The Federal Election held on 18 May 2019 returned a Coalition Government with a majority in the House of Representatives (although counting continues in some seats). At the time of writing, one seat remains in doubt.

Following the dissolving of the House of Representatives (HoR) and with the calling of the election, all Bills tabled in the HoR lapsed. Many of these Bills contained important proposed tax and superannuation measures. At this election, the Senate was not dissolved (unlike the double dissolution election held on 2 July 2016). The Senate’s agenda is therefore regarded as continuing until the day before the opening of the next session of Parliament. Any Bills tabled before the Senate remain ‘before the Parliament’ and do not lapse until the day before the next session of Parliament.

Some of these measures were proposed to commence on 1 July 2019. Additionally, there are measures due to commence on 1 July 2019 that are still in the form of announcements, subject to a consultation paper or in exposure draft form (and not yet tabled in Parliament). The lack of clarity in relation to these proposed measures continues to leave tax advisers and their clients with a significant level of uncertainty.

Further, the proposed Superannuation Guarantee Amnesty finished on 23 May 2019 without being enacted.

This article examines the current status of the election outcome and what this means for Parliamentary sitting days. It sets out a summary of those tax and superannuation measures that became law and examines the implications of the numerous unenacted measures.

Note

Note

This article does not provide an exhaustive list of all taxation, superannuation and related Acts that have recently passed, Bills tabled in Parliament or in exposure draft form, or announcements and consultation papers.

The 46th Parliament

Who will make up the 46th Parliament?

House of Representatives

As at 26 May 2019, the Australian Electoral Commission (AEC) Tally Room has the Coalition leading in the HoR with 78 seats, which is two more than the 76 needed to form a majority Government. Only five seats in New South Wales have been formally declared at the time of writing.

The HoR may be summarised as follows (noting that there are now 151 seats in the HoR, up from 150):

|

Counted |

Predicted |

Previous |

| In doubt |

1 |

|

|

| Coalition |

77 |

77 |

75 |

| Labor |

67 |

68 |

69 |

| Greens (Adam Bandt) |

1 |

1 |

1 |

Crossbenchers:

- Bob Katter

(Katter’s Australian Party)

- Rebekha Sharkie

(Centre Alliance)

- Helen Haines

(Independent)

- Zali Steggall

(Independent)

- Andrew Wilkie

(Independent)

|

5 |

5 |

5

(not listed) |

Senate

The Senate is made up of 76 Senators and 39 seats are needed to form a majority. The 76 Senators comprise 12 from each of the six States and two for each of the Territories. At this election, 40 of the 76 seats were contested, being half of the 72 State Senators plus the four Senators representing the two Territories.

The Senate result is also still unknown and the AEC has little guidance on which candidates will likely be elected. According to the ABC Federal Election coverage, of the 40 contested seats, the Coalition will likely secure 18; Labor: 13; the Greens: 5; and the Jacqui Lambie Network: 1. The remaining three seats, all in Queensland, are uncertain.

The current election results (as at the time of writing this article) in the Senate may be summarised as follows:

|

Counted |

Predicted |

Previous |

| In doubt |

3 |

|

|

| Coalition |

34 |

35 |

30 |

| Labor |

26 |

26 |

26 |

| Greens (Adam Bandt) |

8 |

9 |

9 |

Crossbenchers:

- Stirling Griff and Rex Patrick

(Centre Alliance, SA)

- Pauline Hanson and Malcolm Roberts

(One Nation, Qld)

- Jacqui Lambie

(Lambie Network, Tas)

- Corey Bernardi

(Australian Conservatives, SA)

|

5

2

1

1

1 |

6

2

2

1

1 |

11

(not listed) |

On these numbers, the Coalition Government will hold at least 34 seats, probably 35, which means that the Coalition will likely require 4 additional votes from the crossbench in circumstances where Labor is not voting with them. History tells us that Labor votes with the Coalition 75 per cent of the time when they are in Federal Government so negotiation with the crossbench is only required for 25 per cent of bills presented.

When will the new Parliament sit?

The final process in all elections is the return of the election writs. For this election, these are due on Friday, 28 June 2019. That is 41 days after polling day and is designed to be in time for the new Senators to commence their terms on Monday 1 July 2019 (hence why the latest date that the half-Senate election could be held was 18 May).

With regards to the Senate, the previous State Senators that were up for re-election retain their position until 30 June 2019. The newly elected or returned State Senators commence their terms on 1 July 2019. The terms of the continuing State Senators expire on 30 June 2022. However, the terms of the previous four Senators from the Territories ceased on the dissolution of the HoR so the terms of the newly elected Territory Senators commence upon issuing of the writ for their particular division; their terms are tied to the term of the HoR and they face election at every HoR election.

This means that if Parliament sits prior to 30 June 2019, it will be all the previous State Senators plus the newly elected Territory Senators. Note, however that:

- Australian Capital Territory (ACT) Senator David Smith (Labor) resigned before the 2019 election and has been succeeded by Katy Gallagher (Labor), so the ACT trend of electing one Labor and one Liberal Senator continues (this has occurred at every election since the first contest in 1975); and

- Northern Territory (NT) Senator Nigel Scullion (Country Liberal) retired at the 2019 election and has been succeeded by Sam McMahon (Country Liberal), so the NT trend of electing one Labor and one Country Liberal Senator also continues (this has occurred at every election since the first contest in 1975), so nothing has changed with regards to the ACT or the NT.

This means that the numbers in the Senate remain effectively unchanged should the Senate sit before 30 June 2019.

The writs for the HoR are likely to be returned earlier and, in some cases, before all votes are counted. This can occur where the Returning Officer is satisfied that the votes recorded on the remaining ballot papers to count could not possibly affect the result. However, where the vote is close, the result may not be called until after 31 May 2019. This is because postal votes are still able to be received up until this date, provided that they have been postmarked before 6:00 pm on election day.

With no formal confirmation of any seat in the HoR, it will still be some time before the new 46th Parliament can convene.

Once the election writs are returned on 28 June 2019, the new Parliament must then sit within 30 days of the writs being returned. At the first sitting, all members of the 46th Parliament are sworn in. No other business may be conducted at this sitting.

The 2019 sitting calendar was removed upon the dissolution of the 45th Parliament. This means that there are currently no formally scheduled sitting dates for the remainder of 2019. Prior to that, there were three sitting weeks scheduled in June (but it was expected that they would be cancelled because it is too close after the election for Parliament to resume). Parliament does not generally sit in July and was previously scheduled to then sit on 12 August 2019. It will be up to the new Government, once officially declared, to determine the sitting calendar for the remainder of the year.

In regard to the June 2019 dates, it is very likely that the sitting week previously scheduled for 3–6 June will be cancelled. There is a possibility that the Parliament may sit either on the previously scheduled dates of 17–20 June or 24–27 June as the Coalition will be keen to get their proposed personal tax cuts through before 1 July 2019 (see below).

What does this mean?

For those unenacted Bills and announcements with a scheduled start date of 1 July 2019, there may be an opportunity for them to be enacted prior to this date but this will depend on the priorities of the re-elected Coalition Government.

All Bills will have either lapsed on the dissolution of the 45th Parliament or will lapse before the next sitting of Parliament (see under “Lapsed Bills” below). Therefore the new Government will have to re-table those Bills (if they decide to proceed with the measures contained in them) to have them considered by the new Parliament as a Bill cannot be carried over from one Parliament to the next. As discussed above, if Parliament sits in June 2019, the Senate will be constituted by most of the previously serving Senators, not the newly elected ones (except for the four newly elected Territory Senators but the composition of the Senators won’t change).

Key enacted measures with a 1 July 2019 start date

Taxable Payments Reporting System (TPRS)

The Treasury Laws Amendment (Black Economy Taskforce Measures No. 2) Act 2018 (enacted on 29 November 2018) extended the TPRS to further high risk industries to ensure payments made to contractors in these sectors are reported annually to the ATO. Entities that provide the following services will need to report under the TPRS from 1 July 2019:

- road freight;

- information technology; and

- security, investigation or surveillance.

The Treasury Laws Amendment (Black Economy Taskforce Measures No. 1) Act 2018 had previously extended the operation of the TPRS to cleaning and courier services from 1 July 2018.

Non-compliant payments (employer withholding obligations)

Implementing part of the Black Economy Taskforce package announced in the 2018–19 Federal Budget, the Treasury Laws Amendment (Black Economy Taskforce Measures No. 2) Act 2018 (enacted on 29 November 2018) removes the tax deductibility of certain payments — broadly salaries and wages to employees and payments to contractors — if the entity making the payment fails to comply with its obligations to withhold and report information to the Commissioner, namely a failure to:

- withhold PAYG withholding or non-ABN withholding; or

- report the withheld amounts through activity statements or Single Touch Payroll (see below).

It will apply to payments made, or non-cash benefits provided, on or after 1 July 2019.

A deduction that would otherwise be denied is maintained in the original income year if the taxpayer voluntarily notifies the Commissioner of their mistake before the Commissioner commences audit activity.

New work test exemption for recent retirees

The Treasury Laws Amendment (Work Test Exemption) Regulations 2018 (the Regulations) were registered on 7 December 2018 and provide an exemption from the ‘work test’ for eligible recent retirees (i.e. in their first year of retirement) to allow them to make voluntary contributions to boost their superannuation balances.

The Regulations amend the SIS Regs and the RSA Regs to ensure that an individual aged 65 to 74 years whose total superannuation balance (TSB) at the end of the previous financial year is less than $300,000 can make voluntary contributions — from the 2019–20 financial year — to their superannuation for 12 months from the end of the income year in which they last met the work test.

On 17 December 2018, the Government announced as part of MYEFO (Mid-Year Economic and Fiscal Outlook) 2018–19 that it would allow an individual aged 65 to 74 years who is eligible for the work test exemption to also be eligible for the ‘bring-forward rule’, enabling them to make a non-concessional contribution as much as $300,000. (Ordinarily, the non-concessional contributions cap of an individual aged 65–74 years is $100,000 as they cannot access the ‘bring-forward rule’.)

Single Touch Payroll

The Treasury Laws Amendment (2018 Measures No. 4) Act 2019 (enacted on 1 March 2019) extends Single Touch Payroll (STP) reporting to all employers, regardless of the number of employees, from 1 July 2019.

Website

Website

More information about employers’ obligations to report payroll and superannuation information to the ATO at the time of the payroll, including employer guides and webcasts, is available on the ATO website.

TaxBanter has produced two podcasts on the operation of STP; both of these consist of interviews with senior ATO staff members responsible for the rollout of STP, one titled Single Touch Payroll: A chat with the ATO (Ep 17) and the other titled Single Touch Payroll: Q&A with the ATO (Ep 18).

TaxBanter has also produced a Banter Blog on the ATO’s approach to transitioning small employers, micro employers and employers with closely held payees to STP reporting.

The same Act also includes the Government’s Superannuation Guarantee (SG) integrity package that enables the Commissioner of Taxation to issue directions to employers to pay unpaid amounts of SG and undertake SG education courses. These changes apply from 1 July 2018.

The same Act also amended s. 307-80(3) of the ITAA 1997 to ensure that a reversionary transition to retirement income stream (TRIS) will always be allowed to automatically transfer to eligible dependants upon the death of the primary recipient.

Enhancing Whistleblower Protections

The Treasury Laws Amendment (Enhancing Whistleblower Protections) Act 2019 (enacted on 12 March 2019).

The Act creates:

- a single whistleblower protection regime in the Corporations Act, to cover the corporate, financial and credit sectors; and

- a new whistleblower protection regime in the taxation law to protect those who expose tax misconduct.

Large companies will be required to have a whistleblower policy to support good corporate governance and culture. Among other things, the reforms broaden the whistleblower definition to include both current and former employees, officers, and contractors, as well as their spouses and dependants, and anonymous disclosures. ASIC’s Office of the Whistleblower will oversee the implementation of the reforms when they commence from 1 July 2019.

Protecting your Superannuation

The Treasury Laws Amendment (Protecting Your Superannuation Package) Act 2019 was enacted on 12 March 2019 with 22 amendments moved by the Greens and agreed to by the Government.

The amendments remove the proposed opt-in rule for insurance within superannuation for individuals aged under 25 years and for individuals with account balances of less than $6,000. The Senate’s changes will see the opt-out rule applied for group insurance for individuals aged under 25 years with default superannuation, and those with account balances of less than $6,000.

The Senate’s amendments also increase the period of ‘inactivity’ to 16 months (instead of 13 months) to prevent it inadvertently capturing employees on parental leave. The definition of ‘inactivity’ has been amended so that it will not be interrupted simply because a member changes their investment options or alters their insurance cover or nominates a beneficiary. The Senate’s amendments will also require the ATO to consolidate and transfer inactive low-balance accounts into an active account of the member within 28 days.

The changes will apply from 1 July 2019.

Note

Note

Having voted for the amendments, the Government then promptly introduced the Treasury Laws Amendment (Putting Members’ Interests First) Bill 2019 on 20 February 2019 which contains all the original policy proposals. This Bill lapsed with the dissolution of the HoR.

Key enacted measures with an earlier start date

Personal tax cuts — 1 July 2018

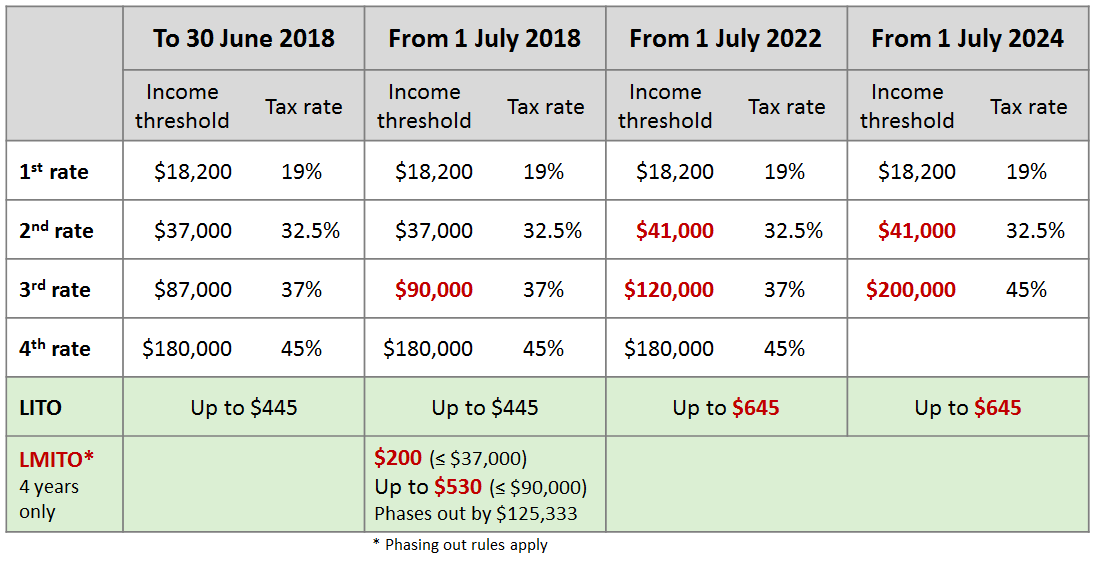

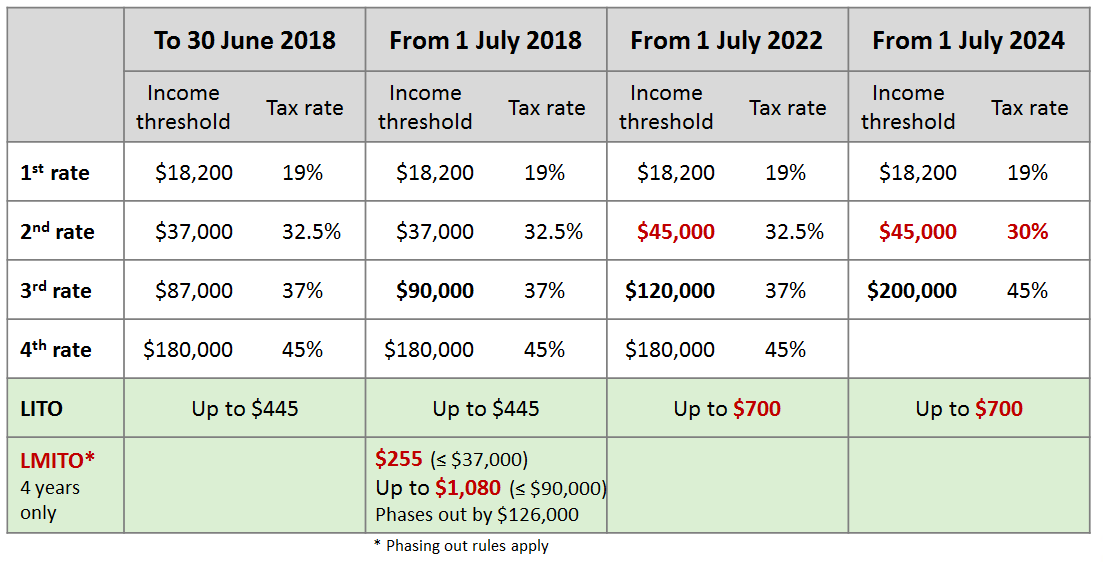

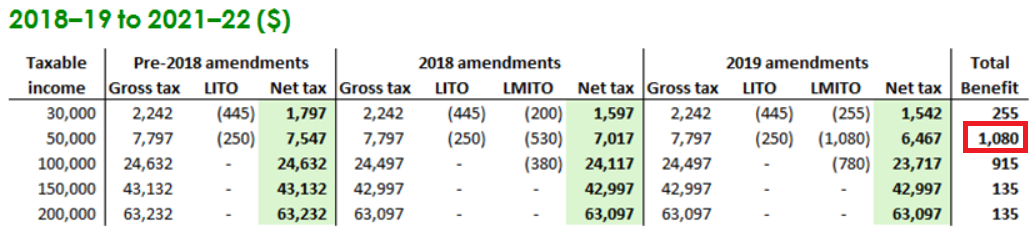

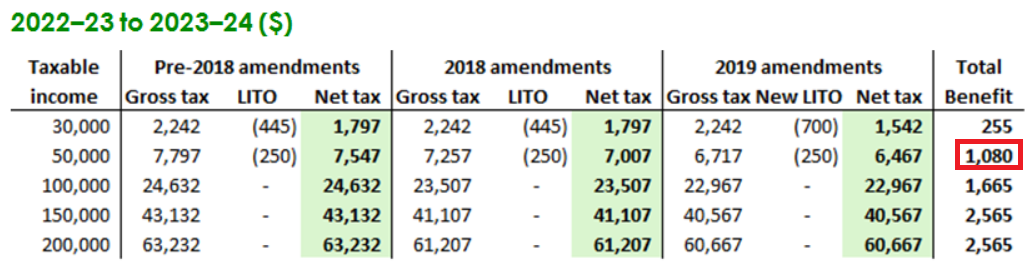

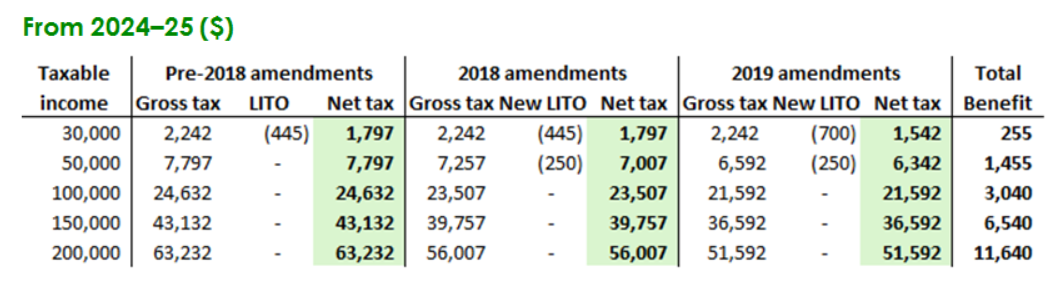

The Treasury Laws Amendment (Personal Income Tax Plan) Act 2018 (enacted on 21 June 2018) introduced a new Low and Middle Income Tax Offset (LMITO) to reduce the tax payable by low and middle income earners who are Australian residents in the 2018–19 to 2021–22 income years. It also merges the LMITO and the current Low Income Tax Offset (LITO) into a new LITO from the 2022–23 income year, and progressively increases the income tax rate thresholds in the 2018–19, 2022–23 and 2024–25 income years.

Note

Note

See below for further discussion on proposed changes announced in the 2019–20 Federal Budget to the LMITO, which has led to a timing problem for the Government, the ATO and taxpayers.

Instant asset write-off for small business entities — up to $30,000 and extended to 30 June 2020 — various dates

The Government announced on 29 January 2019 that it would increase the threshold to $25,000 (from its previous threshold of $20,000) below which amounts can be immediately deducted by small business entities (within the meaning of s. 328-110 of the ITAA 1997) under expanded accelerated depreciation rules. The change to the threshold applies to depreciable assets first used or installed ready for use on or after 29 January 2019 but before 1 July 2020.

The Government also announced that it would extend by 12 months to 30 June 2020 the period during which small business entities can access the instant asset write-off (IAWO). This is the third extension to the IAWO period, following earlier extensions from the initial end date of 30 June 2017 to 30 June 2018, then to 30 June 2019. However, the Government wasn’t finished there …

On Budget night (2 April 2019), the Treasurer announced an additional extension of the IAWO to medium-sized businesses with an aggregated turnover of less than $50 million, as well as a further increase in the threshold to $30,000. Both changes were proposed to commence from 7.30 pm on 2 April 2019 and continue until 30 June 2020.

The Treasury Laws Amendment (Increasing the Instant Asset Write-Off for Small Business Entities) Act 2019 (enacted on 6 April 2019) incorporates the latest changes to the IAWO announced as part of the 2019–20 Federal Budget.

This means that for the 2018–19 income year, three different thresholds apply to small business entities (i.e. $20,000, $25,000 and $30,000), depending on the date on which the asset was first used or first installed ready for use. In contrast, medium-sized businesses can apply the IAWO using a single threshold of $30,000 which applies to depreciating assets acquired and first used or installed ready for use during the period starting at 7.30 pm on 2 April 2019 and ending on 30 June 2020.

More information about the IAWO is provided in our Banter Blog.

Similar business test for company losses — 1 July 2015

The Treasury Laws Amendment (2017 Enterprise Incentives No. 1) Act 2019 (enacted on 1 March 2019) supplements the ‘same business test’ with a new alternative ‘similar business test’ for the purposes of working out whether a company’s tax losses and net capital losses from previous income years can be used as a tax deduction in a later income year. The new test applies to losses made in income years commencing from 1 July 2015.

The new test requires loss companies to consider the following four factors:

- the extent to which the assets used to generate income were also used formerly;

- the extent to which the activities and operations were also the same as the previous business;

- the identity of the current business and the identity of the former business; and

- the extent to which any changes to the former business resulted from the development or commercialisation of assets, products, processes, services, or marketing or organisational methods, of the former business.

The ATO’s Law Companion Ruling LCR 2019/1 describes how the Commissioner will apply these amendments.

Removal of three-month rule for SGC — 1 July 2018

Currently, a director penalty cannot be remitted if a company is placed into liquidation or voluntary administration where the company has an obligation to pay:

- an SG charge and the company does not report the SG liability to the Commissioner within three months from due date of the liability; or

- an estimate of an SG charge within three months from the day by which the company was obliged to pay the underlying liability to which the estimate relates has passed.

The Treasury Laws Amendment (2018 Measures No. 4) Act 2019 (enacted on 1 March 2019) removed the three-month period from both circumstances in order to prevent directors delaying placing the company in liquidation or voluntary administration by taking advantage of the three-month period before the director penalty is ‘locked down’. This measure does not affect the operation of the three-month rule as it applies to PAYG withholding liabilities (and estimates thereof).

The measures commence:

- for SG charge liabilities that are made on or after 1 July 2018;

- for estimates of SG charge liabilities made on or after 1 July 2018 (whether the underlying liability arose before, on or after that day).

Lapsed Bills

At the time of writing this article, the Parliament House website shows:

- 180 Bills Not Proceeding; and

- 171 Bills Before Parliament.

The description Bills Not Proceeding refers to the 180 bills which were before the HoR when the election writs were issued on 11 April 2019. As the issuing of the writs dissolved the HoR, these bills have lapsed as they cannot be carried over from one Parliament to the next. The returning Coalition Government may re-introduce some of the measures in these bills but that is yet to be determined.

The description Bills Before Parliament refers to the 171 bills which were before the Senate when the HoR was dissolved, and have technically not lapsed yet; they will, however, lapse the day before the first session of the 46th Parliament. This is because, unlike the HoR, the Senate was not dissolved with the calling of the election.

The bills listed as Not Proceeding also include those that have been introduced by non-Government members (referred to as private members’ bills), as well as bills which have been negatived (such as the Treasury Laws Amendment (Enterprise Tax Plan No. 2) Bill 2017 which proposed further corporate cuts to companies with a turnover of $50 million or more).

Listed below are significant tax and superannuation measures which are contained in bills that either have lapsed or will lapse before the next Parliament commences.

SG Amnesty — 24 May 2018–23 May 2019 (Status: Before the Senate; will lapse)

The proposed Superannuation Guarantee (SG) Amnesty was contained in Schedule 1 to the Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2018. It has been before the Senate since 25 June 2018.

The SG Amnesty period was proposed to run from 24 May 2018 to 23 May 2019 being the (inclusive) dates between which the disclosures and payments must be made in order to receive the benefits of the Amnesty.

The benefits for qualifying amounts included:

- the ability of the employer to claim income tax deductions in respect of payments made during the Amnesty period;

- the waiver of the $20 per employee per quarter administrative component in respect of the SG shortfall; and

- no penalties under Part 7 of the Superannuation Guarantee (Administration) Act 1992 (SGA Act) for a failure to lodge an SG statement.

However, unless it was legislated, employers would not be able to claim an income tax deduction and the administrative component would still apply. The reduction of penalties is at the discretion of the Commissioner. As set out in PS LA 2011/28, the Commissioner will remit 100 per cent of the Part 7 penalty where an employer makes a voluntary disclosure to the ATO as part of a genuine attempt to comply.

It was announced in the Government’s MYEFO 2018–19 that employers with SG shortfalls who do not come forward will face the full force of SG penalties, including an additional 100 per cent penalty for employers who could have come forward during the SG Amnesty period, but did not and are subsequently caught.

The ATO has recently advised TaxBanter that:

- the latest ATO estimate of the annual difference between the value of the SG contributions required to be paid under the law and actual SG contributions made by employers (the SG Gap) is $2.79 billion (2015–16 figures);

- over 21,000 employers have voluntarily come forward and lodged SG statements in the past year;

- the ATO has completed 22,883 SG compliance cases raising $634 million in liabilities this financial year (1 July 2018 to 30 April 2019).

Note

Note

With the Coalition being re-elected, there may still be an opportunity for the SG Amnesty to be legislated, notwithstanding that the 12 month period ended on 23 May 2019.

In the absence of legislation, the ATO must administer and apply the current law which means that no deduction is currently available for payments made during the proposed SG Amnesty period. If it becomes law, it may be retrospectively applied to cover those payments.

Our Banter Blogs titled The New Superannuation Guarantee Amnesty from 13 June 2018 and SG Amnesty — Q&A from 14 August 2018 explain the proposed measures.

Our Banter Blog The SG Amnesty: What should employers do? from 14 September 2018 looks at the considerations facing employers who are contemplating or hesitating coming forward.

Illegal Phoenix activity (Status: Lapsed)

The Treasury Laws Amendment (Combating Illegal Phoenixing) Bill 2019 was introduced into the HoR on 13 February 2019. The Bill proposed to expand the application of the Director Penalty Notice (DPN) regime to include company liabilities for unpaid GST, LCT and WET. This change was proposed to commence on the first day of the quarter starting after the Bill receives Royal Assent.

The Bill also proposed to:

- make amendments to ensure directors are held accountable for misconduct by preventing directors from improperly backdating resignations or ceasing to be a director when this would leave the company with no directors;

- authorise the Commissioner to retain tax refunds where a taxpayer has failed to lodge a return or provide other information to the Commissioner that may affect the amount the Commissioner refunds;

- introduce new phoenixing offences to prohibit creditor-defeating dispositions of company property.

R&D reforms — 1 July 2018 (Status: Lapsed)

The Treasury Laws Amendment (Making Sure Multinationals Pay Their Fair Share of Tax in Australia and Other Measures) Bill 2018 was introduced into the HoR on 20 September 2018 and remained before the House, even though the measures were proposed to commence on 1 July 2018.

Schedules 1 to 3 of the Bill proposed to implement the reforms to the research and development (R&D) tax incentive announced by the Government as part of the 2018–19 Federal Budget in response to the 2016 review of the tax treatment of R&D.

Given the passage of time, it is hoped that any future Bill containing this measure would have a prospective or later start date than the original proposed start date of 1 July 2018.

MRE changes for foreign residents — 9 May 2017 (1 July 2019) (Status: Before the Senate; will lapse)

The proposed changes to the main residence exemption (MRE) contained in the Treasury Laws Amendment (Reducing Pressure on Housing Affordability Measures No. 2) Bill 2018 were announced on 9 May 2017; the Bill was introduced into Parliament on 8 February 2018. The Bill proposes to deny individual taxpayers access to the MRE who are foreign residents at the time of the CGT event.

Perhaps due to a lack of support in the Parliament and the extensive lobbying efforts of a number of advocates seeking a fairer outcome for Australian expatriates living and working overseas, this Bill has not progressed in its current form to become enacted law. Nonetheless, it is creating significant ongoing uncertainty for affected taxpayers.

The amendments to the MRE were proposed to apply to CGT events that happened on or after 7.30 pm (AEST) on 9 May 2017. However, under a proposed two-year transitional rule, the amendments would not apply in relation to a capital gain or loss from a CGT event that happened on or before 30 June 2019, if the individual held an ownership interest in the dwelling to which the CGT event relates at all times from immediately before 7.30 pm (AEST) on 9 May 2017 until immediately before the CGT event happens.

Our Banter Blog Draconian and retrospective CGT main residence exemption amendments hit Parliament from 28 March 2018 explains the impact of the amendments on Australian expatriates and deceased estates. There are also concerns regarding the interaction of the proposed changes with the marriage breakdown CGT roll-over where a taxpayer’s former spouse or partner is a non-resident at the time that the CGT event happens to the taxpayer, when they sell the former family home, perhaps many years after the family law settlement was reached.

The measures propose to effectively remove the MRE retrospectively for Australian expatriates, as if they had never lived in a property which may have been their home for decades before they moved to live and work overseas.

While the (more than) two-year transitional rule was intended to be available for individuals who owned the property at the time of the 2017 announcement, the end of this proposed transitional period — 30 June 2019 — is rapidly approaching. The Bill has been before the Senate since 19 March 2018; its failure to be passed, the uncertainty of post-election Parliamentary sitting days, a softening property market and tighter lending conditions for borrowers (in the wake of the release of the Final Report of the Banking Royal Commission) continue to make it difficult for affected owners to make decisions about their properties.

On 15 March 2019, at The Tax Institute’s National Convention in Hobart, the then Assistant Treasurer Stuart Robert responded to a question posed about the status of the MRE measures still before the Senate. In answering an unrelated question about changes to the tax treatment of income from testamentary trusts, the Minister replied:

Sometimes things get announced and don’t get progressed and it’s just best to leave it that way.

When asked about the MRE measures, the Minister replied:

Go back to my previous comment.

Unfortunately, with no clear statement from the Coalition, this significant uncertainty for taxpayers who are living and working abroad as non-residents will continue. The ATO will also need to provide taxpayers with guidance as the prolonged uncertainty impacts on the preparation of 2018 and 2019 tax returns.

Increase maximum number of SMSF members from 4 ⇒ 6 — 1 July 2019 (Status: removed from Bill which passed)

The Treasury Laws Amendment (2019 Measures No. 1) Act 2019 (enacted on 5 April 2019) was amended to remove Schedule 1 prior to putting the Bill to a vote which resulted in its subsequent passage through Parliament. Schedule 1, if passed, would have increased the maximum number of allowable members in a self managed superannuation fund (SMSF) from four to six with effect from 1 July 2019.

Employees with multiple employers — 1 July 2018 (Status: Before the Senate; will lapse)

Contained in the same Bill as the SG Amnesty (above) is a proposal to amend the SGA Act to allow individuals to ‘opt-out’ of the SG regime to avoid unintentionally breaching their concessional contributions cap when they receive superannuation contributions from multiple employers. Instead, individuals would be able to apply to the ATO for a ‘employer shortfall exemption certificate’ which will relieve the employer that is the subject of the certificate from any SGC liability if they don’t make SG contributions on behalf of the individual. The individual can then negotiate with their employer to receive additional cash or non-cash remuneration.

The amendments were proposed to apply in relation to SG quarters starting on or after 1 July 2018.

Applications for the certificates have to be made with the ATO at least 60 days before the start of the relevant quarter. Given that this deadline has now passed for all quarters of the 2018–19 income year and for the first quarter of the 2019–20 income year, either the start date of the measure will need to be delayed if it becomes law or the ATO will need to advise its administrative approach.

Include new LRBAs in TSB — 1 July 2018 (Status: Before the Senate; will lapse)

This same Bill also proposes to introduce an integrity measure requiring outstanding balances of limited recourse borrowing arrangements (LRBAs) entered into from 1 July 2018 to be included in a member’s total superannuation balance from 1 July 2017.

Introduce Director Identification Numbers (Status: Lapsed)

The Commonwealth Registers Bill 2019 and the Treasury Laws Amendment (Registries Modernisation and Other Measures) Bill 2019 proposed to create a modern business registry regime and introduce a director identification number (DIN) requirement to assist in deterring and penalising phoenix activity in order to protect those who are negatively affected by such fraudulent behaviour.

What’s going on with…

Below we list the significant tax and superannuation measures which were announced with a start date of 1 July 2019 that have not been tabled as a Bill before Parliament. As a result of this delay, even if they become law the start date may change.

LMITO changes

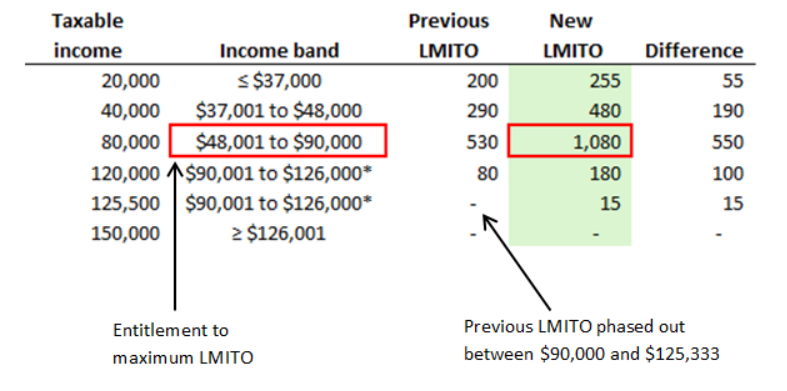

As discussed above, the introduction of the Low and Middle Income Tax Offset (LMITO) from 1 July 2018 has been enacted as part of the Coalition’s personal tax cuts policy. However, they announced further changes to the LMITO on Budget night (2 April 2019), with those changes proposed to apply from 1 July 2018 (i.e. they would apply to the lodgment of 2019 Income Tax Returns).

The changes are proposed to increase the lowest amount of the LMITO from $200 to $255 and the maximum LMITO amount from $530 to $1,080. A further minor amendment would mean access to the LMITO would cut out once an individual’s taxable income was $126,000 rather than the currently legislated amount of $125,333. Labor announced in their 2019 Budget-in-Reply speech on 4 April 2019 that they would also introduce the same changes; however the lowest amount of the LMITO would increase to $350 (rather than to $255).

What happens if the proposed changes are not law by 30 June 2019?

Despite having the opportunity to do so, the Government decided not to pass these further changes to the LMITO prior to the dissolution of the HoR. The Prime Minister stated that the ATO could administratively deliver the changes in time for the 2019 tax season, however the ATO advised in a statement dated 9 April 2019 that they ‘could not issue assessments based on the tax cuts until these are passed into law’.

This issue has received media attention (for example, see this ABC article) and the Prime Minister has confirmed that they will apply to the 2018–19 income year even if Parliament does not sit and pass these changes prior to 30 June 2019. The ATO’s position is that if the legislation passes:

- before 1 July 2019, the increase in the LMITO can be administered in the normal way through assessments;

- after 1 July 2019, the ATO will automatically amend assessments, with no requirement for the taxpayer to lodge another tax return or seek an amendment.

The ATO could therefore be processing large numbers of amended assessments given the likelihood of retrospectively passed law!

Division 7A changes

On 22 October 2018, the Government released a consultation paper on the proposed implementation of the amendments to Div 7A of Part III of the ITAA 1936. The measures arose from a Board of Taxation review that was commissioned by the then Labor Government in 2012 and completed in November 2014.

The Government announced the proposed changes in the 2016–17 Federal Budget and advised that they would commence on 1 July 2018, but in the 2018–19 Federal Budget the Government announced that they would instead commence on 1 July 2019. A further delay to the start date until 1 July 2020 was announced by the Government as part of the 2019–20 Federal Budget.

The profession would welcome certainty on the changes, particularly regarding whether previously quarantined loans (pre-4 December 1997) and Unpaid Present Entitlements (UPEs (pre-16 December 2009) will remain quarantined or instead need to be placed on Div 7A-compliant terms (proposed to be no more than 10 years).

Deductions for the cost of holding vacant land

On 15 October 2018, the Government released exposure draft legislation and explanatory material containing measures which propose to deny certain deductions for expenses associated with holding vacant land from 1 July 2019. Certain exemptions will apply however there was widespread concern that, as drafted, the changes would impact on owners of primary production land where the owners or their associates were not carrying on a business on that land (for example, retired farmers or land used for agistment).

3-year audit cycle for SMSFs

On 6 July 2018, the Government released a consultation paper on the proposed implementation of a measure announced in the 2018–19 Federal Budget to change the annual audit requirement to a three-yearly requirement for SMSFs with a history of good record-keeping and compliance.

These changes were proposed to commence from 1 July 2019 but, given that this proposal was universally unpopular, it is unlikely that this measure will proceed.

Income for individual’s image or fame

On 13 December 2018, the Government released a consultation paper on its proposed 2018–19 Federal Budget measure to ensure that all remuneration (including payments and non-cash benefits) provided for the commercial exploitation of a person’s fame or image is included in the assessable income of that individual from 1 July 2019.

This proposal has not progressed beyond the consultation paper stage.

Circular trust distributions

On 12 October 2018, the Government released exposure draft legislation and explanatory material containing the proposed measures which will extend a specific anti-avoidance rule for closely held trusts engaging in circular trust distributions to family trusts.

The changes would have effect from 1 July 2019 but have not progressed beyond the exposure draft.

Further measures still in draft/announcements

| Measure |

More information |

| Proposed $10,000 economy-wide cash payment limit — from 1 January 2020 |

On 25 May 2018, the Government released a consultation paper which proposes to introduce a cash payment limit that removes the ability of any individual or business to make a single transaction in cash in excess of $10,000 to businesses for goods and services.

Transactions in excess of this amount would need to be made through the electronic payment system or by cheque. |

| ABN reforms |

On 20 July 2018, the Government released a consultation paper which considers ways to strengthen and modernise the Australian Business Number (ABN) system.

Action to reform the ABN system responds to findings of the Black Economy Taskforce that participants in the Black Economy are using the ABN system to facilitate their fraudulent activity. This will also provide an opportunity to consider improvements to the ABN system which will better support ABN data for end users and underpin the growing use of ABNs across a wide range of purposes.

The Treasurer announced two measures in the 2019–20 Federal Budget:

- from 1 July 2021 — where an ABN holder has an income tax return obligation, they will be required to lodge their tax return. There are more questions about this announcement than answers, such as what would be implications of non-lodgment, i.e. would their ABN be cancelled?

- from 1 July 2022 — ABN holders will have to confirm their details on the ABR.

|

| Everett assignments and small business CGT concessions — from 8 May 2018 |

On 15 October 2018, the Government released exposure draft legislation and explanatory material containing the proposed measures which will ensure partners who alienate their income by creating, assigning or otherwise dealing in rights to the future income of a partnership will no longer be able to access the small business CGT concessions in relation to these rights. |

| Reporting tax debts ≥ $100,000 overdue > 90 days |

As part of the MYEFO 2016–17 released on 19 December 2016, the Government announced that it would improve the transparency of taxation debts by allowing the Commissioner to disclose business tax debt information to credit reporting bureaus where the business:

- has not engaged with the ATO to manage their debt; and

- has a tax debt, of which at least $10,000 is overdue and has been owing for more than 90 days.

The Government announced in the MYEFO 2018–19 that it will amend the proposed measure by increasing the threshold of business tax debts that can be disclosed to credit reporting bureaus from $10,000 to $100,000. |

| Board of Tax review — Residency rules |

The Board of Taxation is currently reviewing the income tax residency rules to determine how they could be reformed and modernised, including a possible ‘bright-line’ test to determine tax residency supported by a secondary test. The Board’s earlier report sets out the background and initial proposals. |

| Board of Tax review — Small business tax concessions |

The Board’s review of the small business tax concessions involves assessing the effectiveness of existing concessions and, where appropriate, recommending new concessionary approaches to the Government. |

| Board of Tax review — Tax and the sharing economy |

The Board of Taxation conducted a self-initiated review to consider issues surrounding tax related to the sharing economy.

This report makes recommendations to the Government on modifications that can be made to simplify and improve tax compliance within the sharing economy.

On 23 January 2019, the Government released a consultation paper on how to implement the Black Economy Taskforce recommendation for a sharing economy reporting regime. |

| Proposed Board of Tax review — ‘Granny flats’ |

On 29 November 2018, the Government announced that it has requested the Board of Taxation to undertake a review of the tax treatment of ‘granny flat’ arrangements and recommend any potential changes.

This review is in response to the 2017 Australian Law Reform Commission’s Report: Elder Abuse – a National Legal Response, which identified the development of formal and legally enforceable family agreements as a measure to prevent elder abuse. |

What happens to Labor’s tax and superannuation policies?

TaxBanter published a Banter Blog prior to the election setting out Labor’s proposed tax and superannuation policies. The realisation of these policies was always subject to Labor both winning the election and being able to pass them through both houses of Parliament.

Labor’s recent election loss may not spell the end of these key policies or ensure that that some of the policies won’t be implemented in some other form. Since the election result, there has been some media commentary in regard to the difficulties that the Coalition Government faces in balancing the Budget and delivering the promised surplus.

For example, the Coalition campaigned heavily against Labor’s proposal to deny refundable franking credits but, as reported by The Australian, it will have to find savings in other areas to continue to afford the ever-increasing cost of refunding excess franking credits.

The Coalition could cherry pick from Labor’s policies, which could see the resurrection of debate on Labor’s proposals to reinstate the Temporary Budget Repair Levy or prospective changes to negative gearing or the CGT discount.

Final observations

There is widespread commentary that the Coalition’s policy offering seems to contain no significant measures other than the proposed further personal tax cuts. However, it is clear that they still have a full agenda as they determine whether to reintroduce lapsed bills, and advance previous exposure drafts, consultation papers and announcements, comprising more than 80 proposed measures that remain unenacted.

As TaxBanter told Accountants Daily immediately following the election result:

As a profession, we are waiting for the government to clarify its position on the unenacted measures so that we know whether or not clients are going to be subject to measures that were previously announced …

There is an imperative for the government in the weeks and months ahead to prioritise where they stand on each of these measures.