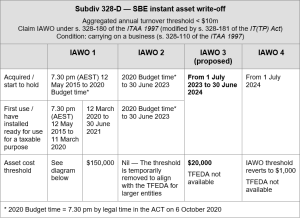

As part of its 2023–24 Federal Budget handed down last Tuesday night, the Government announced that it will temporarily increase the instant asset write-off (IAWO) cost threshold to $20,000. The threshold will apply to eligible small business entity (SBE) taxpayers in respect of eligible assets that are first used or installed ready for use between 1 July 2023 and 30 June 2024.

The outcomes outlined in this article assumes that:

At the time of writing the Government has not released draft legislation.

An entity is an SBE if:

An SBE can choose to use the small business capital allowance rules in Subdiv 328-D of the ITAA 1997. The rules allow:

The prescribed threshold has varied over the past nine years and is currently uncapped as part of the temporary full expensing measures in place since 6 October 2020. Under current law, the threshold is due to revert to $1,000 from 1 July 2023.

The IAWO is available for the income year in which the taxpayer starts to use the asset, or have it installed ready for use, for a taxable purpose. This may not be the same year in which the expenditure is incurred or in which the taxpayer committed to the purchase.

SBEs will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024.

As per the current operation of Subdiv 328-D:

The ‘lockout rule’ that prevents small businesses from re-entering the small business capital allowance regime for five years if they opt out of Subdiv 328-D for a particular year will continue to be suspended until 30 June 2024.

This means that if the taxpayer opts out in 2022–23, they can choose to re-enter for 2023–24 (disregarding the five-year lockout period). This may be beneficial where the taxpayer intends to make capital investments that are eligible for the temporary $20,000 write-off in 2023–24 but they had opted out in any of the five preceding years. However, if a taxpayer chooses not to use Subdiv 328-D in 2023–24, they will not be able to re-enter until 2020–30.

Legislation currently before the Senate proposes amendments to provide eligible businesses with access to a bonus deduction equal to 20 per cent of their eligible expenditure incurred on expenses and depreciating assets for the purposes of their digital operations or digitising their operations between 7.30 pm (AEDT) on 29 March 2022 and 30 June 2023. This is known as the technology investment boost.

An entity is eligible if it meets the definition of an SBE if the reference to $10 million was replaced by a reference to $50 million.

To be eligible for the bonus deduction:

Taxpayers with a 30 June year end must claim the bonus deduction for expenditure incurred in both their 2021–22 and 2022–23 income years in their 2022–23 tax return.

The total eligible expenditure is effectively $100,000 for each of the 2021–22 and 2022–23 income years such that entities can claim a maximum bonus deduction of $20,000 per year, and an overall maximum total bonus deduction of $40,000. Certain expendires are ineligible for the bonus deduction.

![]() Note

Note

The Treasury Laws Amendment (2022 Measures No. 4) Bill 2022 was introduced into Parliament on 23 November 2022 and is before the Senate at the time of writing.

This article proceeds on the assumption that the amendments will be enacted as proposed.

An entity can claim the bonus deduction for expenditure on a depreciating asset only if the asset is first used, or installed ready for use, before 1 July 2023. This rule does not apply to expenses incurred in the development of in-house software allocated to a software development pool, consistent with current pooling rules.

An entity cannot claim the bonus deduction for expenditure on a depreciating asset if any balancing adjustment event occurs to the asset while the entity holds it during the relevant time period, unless the balancing adjustment event is an involuntary disposal. This means, for example, that an entity cannot claim the bonus deduction if it sells the asset within the relevant time period.

The proposed law has no effect on the year in which the expenditure is deductible under another provision of the law. That is, it may be that depreciation on an asset is deductible in 2021–22 under the existing rules while the corresponding bonus deduction is claimable in 2022–23.

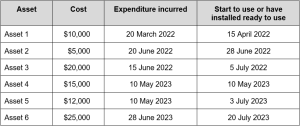

An SBE, T Co, has opted into Subdiv 328-D for 2021–22, 2022–23 and 2023–24. T Co has purchased the following depreciating assets in the digitalisation of its business:

Assume that all of the depreciating assets are eligible assets for the technology investment boost and that the taxable use proportion of each asset is 100 per cent.

What are the IAWO and technology investment boost consequences for T Co?

Asset 1 — $10,000

T Co can deduct the entire $10,000 in 2021–22 under the uncapped IAWO as it started to use the asset, or had it installed ready for use, for a taxable purpose during that year.

T Co cannot claim the technology investment boost as it incurred the expenditure before 7.30 pm (by legal time in the ACT) on 29 March 2022. It does not matter than it started to use, or had it installed ready for use, for a taxable purpose during the qualifying period of time.

Asset 2 — $5,000

T Co can deduct the entire $5,000 in 2021–22 under the uncapped IAWO as it started to use the asset, or had it installed ready for use, for a taxable purpose during that year.

T Co can claim the technology investment boost in 2022–23 in respect of the asset. The amount of the bonus deduction is $5,000 × 0.2 = $1,000. Even though T Co started to use the asset, or had it installed ready for use, for a taxable purpose in 2021–22, it can only claim the boost deduction in 2022–23.

Asset 3 — $20,000

T Co can deduct the entire $20,000 in 2022–23 under the uncapped IAWO as it started to use the asset, or had it installed ready for use, for a taxable purpose during that year. This is the case even though T Co incurred the expenditure in 2021–22.

T Co can claim the technology investment boost in 2022–23 in respect of the asset. The amount of the bonus deduction is $20,000 × 0.2 = $4,000.

Therefore in 2022–23 T Co can deduct $20,000 (IAWO) + $4,000 (boost) = $24,000 in respect of Asset 4, which costed $20,000.

Asset 4 — $15,000

T Co can deduct the entire $15,000 in 2022–23 under the uncapped IAWO as it started to use the asset, or had it installed ready for use, for a taxable purpose during that year.

T Co can claim the technology investment boost in 2022–23 in respect of the asset. The amount of the bonus deduction is $15,000 × 0.2 = $3,000.

Therefore in 2022–23 T Co can deduct $15,000 (IAWO) + $3,000 (boost) = $18,000 in respect of Asset 4, which costed $15,000.

Asset 5 — $12,000

T Co can deduct the entire $12,000 in 2022–23 under the uncapped IAWO as it started to use the asset, or had it installed ready for use, for a taxable purpose during that year.

T Co cannot claim the technology investment boost as it started to use, or had it installed ready for use, for a taxable purpose after 30 June 2023. It does not matter that it had incurred the expenditure during the qualifying period of time.

Asset 6 — $25,000

T Co cannot deduct the $25,000 cost of the asset in 2022–23 under the uncapped IAWO as it started to use the asset, or had it installed ready for use, for a taxable purpose after 30 June 2023, when the threshold reduced to $20,000. This is the case even though T Co incurred the expenditure during 2022–23 when the threshold was uncapped.

T Co also cannot deduct any part of the cost in 2023–24 under the IAWO as it exceeds the $20,000 threshold. Therefore it will add the asset into the small business general pool. It will be able to claim $25,000 × 0.15 = $3,750 in 2023–24 as part of the total pool deduction. In subsequent years the depreciation deduction for Asset 6 will form part of the 30 per cent of the opening balance of the pool.

T Co cannot claim the technology investment boost as it started to use, or had it installed ready for use, for a taxable purpose after 30 June 2023. It does not matter that it had incurred the expenditure during the qualifying period of time.

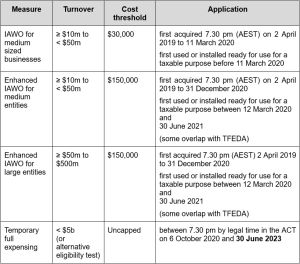

As part of its economic stimulus strategy, the previous Government also temporarily extended the ability to immediately write-off the full cost of an eligible asset to larger businesses over the past few years:

In addition, the backing business investment incentive accelerated depreciation measure allowed eligible businesses with aggregated turnover of less than $500 million to deduct an additional 50 per cent of the asset cost in an income year where the taxpayer started to hold the asset and started to use it, or have it installed ready for use, for a taxable purpose in the period from 12 March 2020 to 30 June 2021. There was no cost limit other than the car limit.

From 1 July 2023, businesses with aggregated turnover of $10 million or more will not be able to access an immediate write-off for the cost of new assets. Such businesses will need to consider whether they should move forward any planned asset investments to make use of the TFEDA by 30 June 2023. To claim an immediate write-off in 2022–23, the taxpayer must start to use the asset, or have it installed ready for use, for a taxable purpose, on or before 30 June 2023 — it is not sufficient to only hold the asset at year end.

These larger entities are also ineligible for the technology investment boost.

While there were no measures for fundamental tax reform, there was a range of announcements which will affect the tax liabilities and compliance obligations of small businesses. Proposed changes include the following:

Businesses with annual turnover of less than $50 million will be able to access a bonus 20 per cent deduction on up to $100,000 of eligible expenditure that supports electrification and more efficient use of energy, for eligible assets or upgrades first used or installed ready for use between 1 July 2023 and 30 June 2024.

The Government announced several initiatives to increase the supply of rental housing, including an increase in the capital works deduction rate from 2.5 per cent to 4 per cent per year for eligible new build-to rent projects where construction commences after 7.30 pm (AEST) on 9 May 2023.

The GDP uplift factor will be set at six per cent — rather than the statutory 12 per cent — for 2023–24 for PAYG and GST instalments. The uplift rate will apply to eligible SMEs which have aggregated turnover of up to $10 million for GST purposes and $50 million for PAYG purposes.

![]() Note

Note

The Treasury Laws Amendment (2023 Measures No. 2) Bill 2023 was introduced into the House of Representatives on 10 May 2023.

From 1 July 2026, employers will be required to pay their employees’ superannuation guarantee (SG) on the same day that they pay salary and wages.

The general anti-avoidance rule in Part IVA of the ITAA 1936 will be expanded so that it can apply to schemes that:

The Government will provide $21.8 million over four years from 2023–24, and $1.4 million per year ongoing, to the ATO to lower the tax administration burden for small businesses. The intiatives include:

From 1 July 2014

An 18-month trial of an expansion of the ATO independent process to small business, with aggregated turnover between $10 million and $50 million, subject to an ATO audit.

Small businesses will be permitted to authorise their tax agent to lodge multiple Single Touch Payroll forms.

Faster, safer and cheaper tax refunds by reducing the use of cheques.

From 1 January 2025

Five new tax clinics to improve access to tax advice and assistance for small businesses.

From 1 July 2025

Small businesses will be permitted up to four years to amend their income tax returns.

The Government has committed to providing extra funding to the ATO for a range of compliance programs:

Four-year extension for the GST compliance program

The Government will provide $588.8 million over four years from 1 July 2023 for the ATO to:

Extending and expanding the Personal Income Tax Compliance program

The Government will provide $89.6 million to the ATO and $1.2 million to Treasury to extend the Personal Income Tax Compliance Program for two years from 1 July 2025. The scope of the program will also be expanded from 1 July 2023 to address emerging areas of risk, e.g. deductions relating to short-term rental properties to ensure they are genuinely available for rent.

SG non-compliance

The ATO will receive additional resourcing to help it detect unpaid SG.

A lodgment penalty amnesty is being provided for small businesses with aggregated turnover of less than $10 million. Under the amnesty, failure-to-lodge penalties will be remitted for outstanding tax statements lodged in the period from 1 June 2023 to 31 December 2023 that were originally due during the period from 1 December 2019 to 29 February 2022.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

We can also present these Updates at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.