Editor’s note: This article will be updated whenever the Treasurer makes a new declaration that certain grants are non-assessable non-exempt income. This article has been updated as of 24 November 2022.

The State and Territories have provided a range of grants to businesses affected by COVID-19 trading restrictions.

Section 59-97 of the ITAA 1997 provides that such a payment is non-assessable non-exempt income if it meets certain criteria, including that it was announced on or after 13 September 2020. The grant must be received in the 2020–21 or 2021–22 income years.

The most recent declaration of eligible grants was made on 17 November 2022.

The payment must be received under a grant program administered by a State or Territory, or an authority of a State or Territory.

The taxpayer must receive the payment in the 2020–21 and 2021–22 income years. That means any grant paid before 1 July 2020 is assessable.

The concessional tax treatment was originally legislated to only apply for the 2020–21 income year. Schedule 1 to the Treasury Laws Amendment (COVID-19 Economic Response) Act 2021, which received Royal Assent on 30 June 2021 as Act No. 71 of 2021, extended the concessional tax treatment to include qualifying grants received in the 2021–22 income year. The amendments also ensured that eligible taxpayers with a substituted accounting period are also able to take advantage of the NANE income status of grant payments.

A taxpayer is eligible for the NANE tax treatment where:

This is based on the requirements in ss. 59-97(1)(d) and (2) that the taxpayer must be either:

The grant program must be declared — under s. 59-97(3) — to be an eligible program. It does not matter whether the declaration is made before, on or after the day the taxpayer receives the payment.

A grant program is declared — by legislative instrument — to be an eligible program if it satisfies all of the criteria. There is no Ministerial discretion to not declare an eligible program.

The eligibility criteria are that:

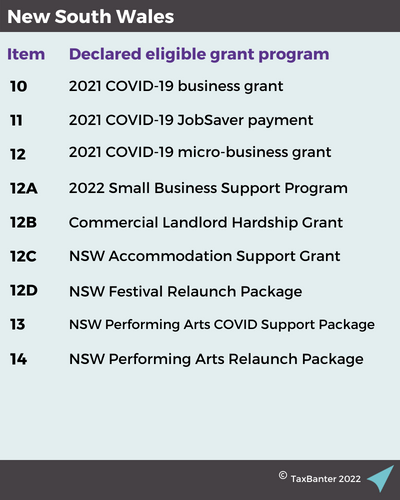

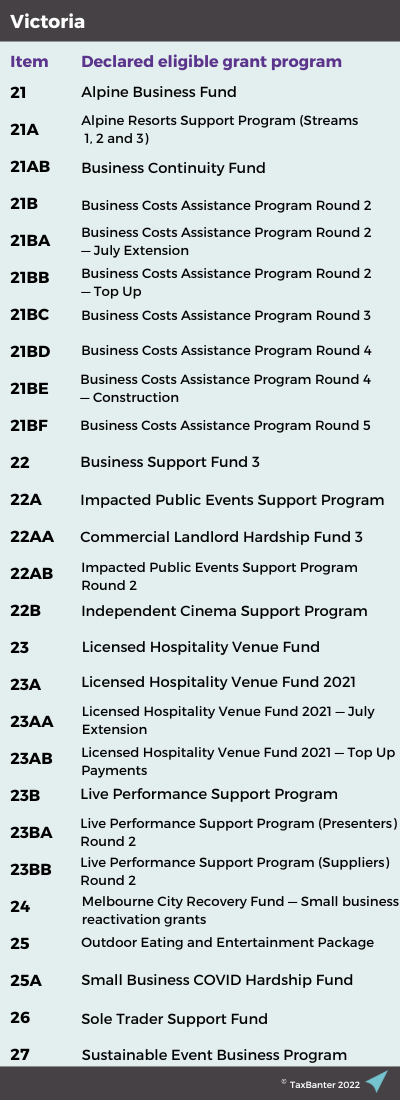

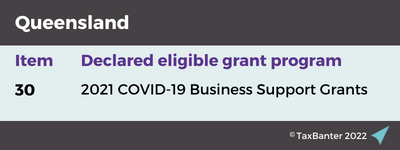

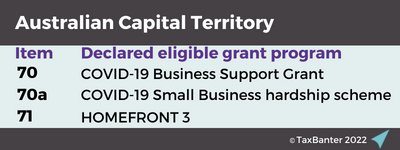

The grants which have been declared eligible for NANE treatment are listed in the following legislative instruments:

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 16 locations across Australia. Click here to find a location near you.

We’ll cover these grants (and other new announcements) in full at our upcoming Public Offer Sessions:

Personalised training options

Personalised training optionsWe can also present these Updates at your firm, or through a private online session, with content tailored to your client base – please contact us here to submit an expression of interest or visit our In-house training page for more information. You can also reach us our BDM Caitlin Bowditch at 0413 955 686 for an in-depth chat of your training needs.

Our mission is to offer flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.