The ATO’s new lodgment deferral function is now available in Online services for agents — under the ‘Reports and forms’ menu. The ATO has been working with registered agents and professional associations to co-design the new function and conducted beta testing with a select group of tax and BAS agents over the past month.

There is no longer a need to download and complete different spreadsheets. Now, client information is pre-populated. Agents will receive a response within 48 hours for requests that meet agent-assessed guidelines.

To be ready to use the new function, the ATO advises agents to:

To request a lodgment deferral using the function in Online services:

Up to 40 deferrals can be requested at a time.

The agent will receive a receipt ID when they submit their request and can view the status of any requests submitted in the previous 90 days.

Processing times are as follows:

The outcome of the request will be notified through Practice mail.

If the request is approved, the deferred due date will show in Online services for agents and on the agent’s PLS client report.

If the request is declined or varied, a reason will be provided.

References

References

See the ATO’s Online services for agents user guide for detailed instructions.

See the ATO’s promotional video featuring Assistant Commissioner, Kath Anderson.

A lodgment deferral extends the due date for lodgment of a document. It provides additional time to lodge without incurring a failure to lodge on time penalty.

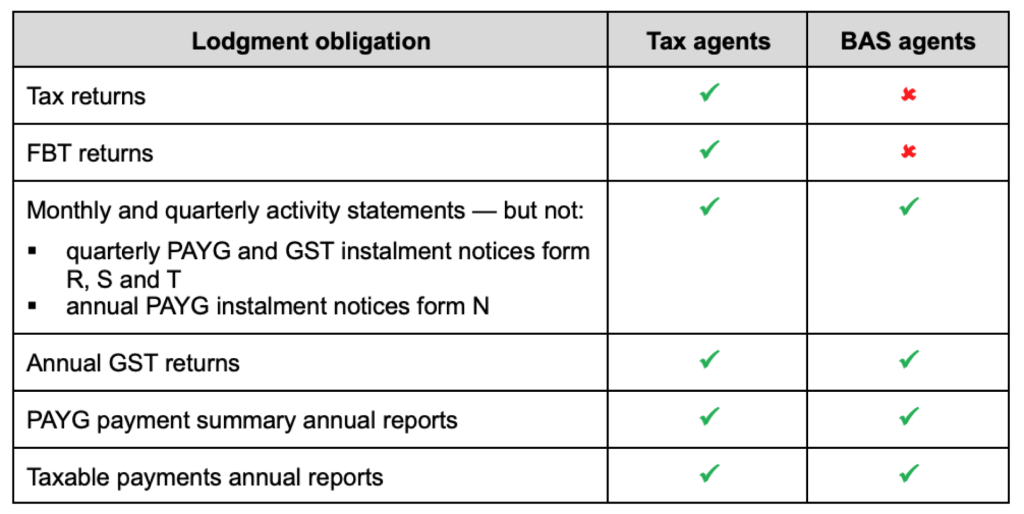

A lodgment deferral may be requested for the following obligations:

A lodgment deferral cannot be requested for an activity statement before the ATO has generated it and made it available online.

It is not necessary to apply for a deferral if:

The ATO considers lodgment deferral requests in accordance with PS LA 2011/15 Lodgment obligations, due dates and deferrals.

The ATO may decline a deferral request if:

The agent can ask the ATO to review a deferral decision within 21 days from the date on the communication varying or declining the request.

The ATO monitors lodgment performance and use of deferrals. It may contact agents who are high user of deferrals to understand the reasons for their requests.

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

We can also present these Updates at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.