As part of the 2023–24 Federal Budget handed down on 9 May 2023, the Government announced a lodgment penalty amnesty program for small businesses to get their tax obligations up to date.

Here are the details of how the amnesty works.

The amnesty applies to overdue income tax returns, business activity statements and FBT returns that were originally due between 1 December 2019 and 28 February 2022.

For many small business taxpayers, these would equate to:

The above assume standard agent-lodged returns. For self-lodgers and small business taxpayers with specific circumstances, the amnesty may apply to obligations for different periods — see the ATO’s full list of due dates here.

The amnesty runs from 1 June 2023 to 31 December 2023. To be eligible for the amnesty, the overdue obligation must be lodged within that timeframe.

To be eligible for the amnesty, the small business must be an entity with an aggregated turnover of less than $10 million at the time the original lodgment was due.

The amnesty does not apply to:

Eligible small business taxpayers that lodge eligible overdue forms within the amnesty period will have any associated failure to lodge (FTL) penalties remitted.

The remission will happen automatically and the taxpayer will not need to separately request a remission.

The amnesty does not apply to any interest charges which may apply to overdue payments or to other administrative penalties such as penalties associated with the Taxpayer Payments Reporting System.

The applicable FTL penalty depends on the size of the entity and the period of time since the due date for lodgment.

Generally, a penalty will not be applied to a late-lodged tax return, FBT return, annual GST return or activity statement if the lodgment results in either a refund or a nil result, with exceptions.

More information about FTL penalties is available here.

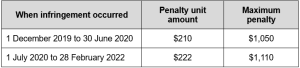

For a small entity, the FTL penalty is applied at the rate of one penalty unit for each period of 28 days (or part thereof) that the obligation is overdue, up to a maximum of five penalty units.

A medium entity either:

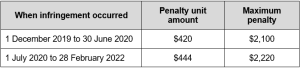

For a medium entity the penalty unit is multiplied by 2.

Where a taxpayer is not eligible for the amnesty because either the taxpayer does not meet the eligibility criteria, or the original due date of the late obligation falls outside of the relevant date range, or the late lodgment occurred before or after the amnesty period, the taxpayer may be able to reudce their FTL penalty under the standard rules.

A taxpayer may request a remission of the penalty in full or in part if there are extenuating circumstances, such as being impacted by a natural disaster or serious illness.

There is also a safe harbour exemption which applies where the taxpayer engaged a registered tax agent or BAS agent to lodge the return or statement and both of the following apply:

Read more about remission and the safe harbour here.

![]() ATO resources:

ATO resources:

Media release — Small businesses given unique opportunity to get back on track with tax

Join us at the beginning of each month as we review the current tax landscape. Our monthly Online Tax Updates and Public Sessions are excellent and cost effective options to stay on top of your CPD requirements. We present these monthly online, and also offer face-to-face Public Sessions at 17 locations across Australia.

![]() Join us online

Join us online

Upcoming webinars >

![]() Register for a workshop

Register for a workshop

Upcoming workshops by state >

We can also present these Updates at your firm or through a private online session, with content tailored to your client base. Call our BDM Caitlin Bowditch at 0413 955 686 to have a chat about your specific needs and how we can assist.

Learn more about in-house training >

Our mission is to provide flexible, practical and modern tax training across Australia – you can view all of our services by clicking here.

Join thousands of savvy Australian tax professionals and get our weekly newsletter.